FISCAL REFORM

WIDESPREAD REFORMS FOR THE NEW TAX ERA

Prashanthi Cooray assesses the tax and administrative implications of the budget alongside macro economic targets

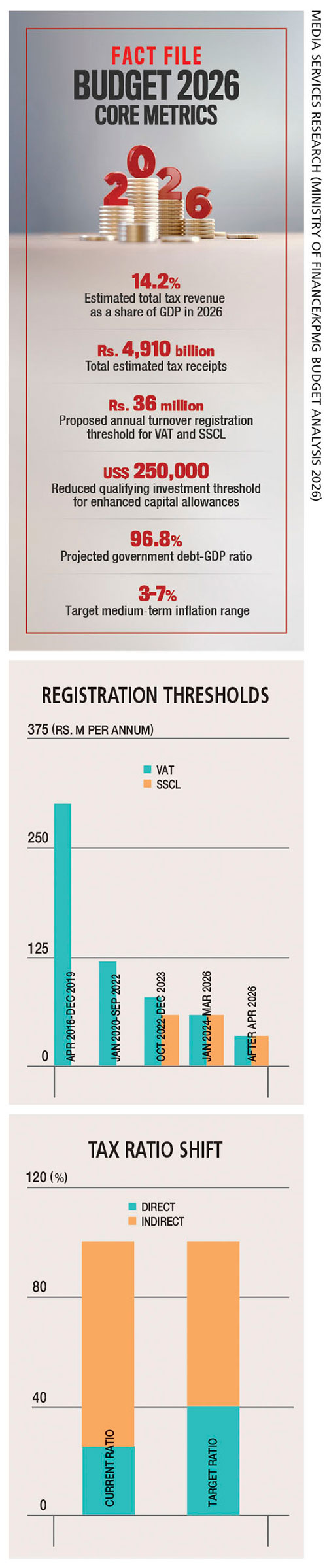

Budget 2026 outlined a series of taxation and tariff reforms aimed at broadening the tax base, modernising compliance and supporting strategic sectors. These form part of a wider fiscal reset aimed at strengthening revenue performance and improving the tax system.

A key proposal is the reduction of the annual value added tax (VAT) and social security contribution levy (SSCL) registration threshold from Rs. 60 million to 36 million rupees. This brings previously exempt businesses into the tax net and discourages practices such as splitting operations to avoid compliance.

While this will increase administrative work for many SMEs, it is intended to align Sri Lanka’s value added tax system with international practices and ensure that smaller businesses contribute to national development.

In line with this amendment, the qualifying investment threshold for enhanced capital allowances has been reduced from US$ 3 million to 250,000 dollars to further incentivise SME expansion.

Underlying these reforms is the goal of moving the direct to indirect tax ratio from 25:75 to 40:60 – a shift intended to create a fairer and more efficient tax structure.

Import duties are also set for an overhaul. The maximum customs duty rises from 20 to 30 percent, and the National Tariff Policy establishes bands at zero, 10, 20 and 30 percent from April 2026.

Alongside this, the government plans a gradual phase-out of para-tariffs, which currently include CESS and the ports and airports levy (PAL). These levies – which have historically increased input costs and limited export diversification – will be replaced by VAT or SSCL based systems, to simplify taxation and support competitiveness.

Sector specific adjustments include the removal of the Rs. 100 per kilogram CESS on imported fabric (with VAT applied instead) aligning the tax treatment of imported and local fabric.

Similarly, the special commodity levy (SCL) on coconut and palm oils will be replaced by VAT and SSCL while a new SSCL on vehicles will be levied at the point of import or manufacture but exempt on any subsequent resale.

For import heavy firms, these changes could increase costs and prompt a review of pricing, supply chain planning and product mix.

Beyond rates and thresholds, Budget 2026 emphasises modernising tax administration. This includes a risk based tax audit framework for returns filed after January, amendments to the Telecommunications Tax Act and stronger legal powers to prosecute tax offences.

Furthermore, the telecommunications levy on internet data charges is to be reduced from 15 to 10 percent to support digitalisation.

A national electronic invoicing system will connect taxpayers’ enterprise resource planning (ERP) systems directly with the revenue administration management information system (RAMIS) platform, starting a phased rollout alongside upgrades to RAMIS 3.0.

Consumers may see price adjustments for textiles, edible oils and vehicles, as taxes shift from CESS and SCL to VAT or SSCL, depending on how businesses pass the changes.

Alongside these tax and duty reforms, the budget projects total revenue of around Rs. 5,300 billion against estimated expenditure of 7,057 billion rupees. The resulting fiscal gap is expected to be partly offset by a primary surplus of Rs. 860 billion with debt projected to decline to 96.8 percent of gross domestic product, underscoring the government’s efforts to maintain macroeconomic stability while advancing its broader policy measures.

The budget seeks to empower small businesses, nurture local industries and explore new opportunities in exports, while also modernising public services and embracing digital innovation.

At the same time, it hopes to strengthen social safety nets and invest in the blue economy and logistics, with targeted initiatives such as housing loans for migrant workers and programmes to reduce rural poverty.

During the final week of parliament, discussions focused on urgent relief following Cyclone Ditwah, putting budget debates on the backburner.

Even so, the budget’s revenue and structural reforms are designed to enhance efficiency, equity and competitiveness, with practical implications for businesses and consumers as the economy shifts gears to a post-cyclone recovery.