GROWING PAINS

Shiran Fernando analyses the performance of the nation’s main sectors and industries

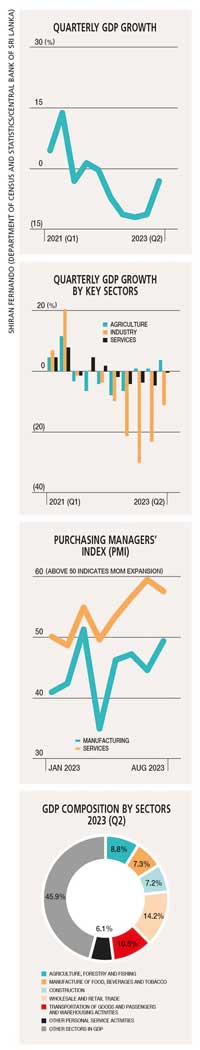

Sri Lanka’s economy contracted by 3.1 percent in the second quarter of this year as most forecasters expected. This was partly due to the base effect and weak recovery of the industry sector.

The contraction took place at a slower pace than the 11.5 percent decline in the first quarter of the year. As a result, the economy contracted by 7.9 percent in the first half of 2023.

It’s necessary to understand the economy’s movements and what they mean as we close in on ending the year and commencing 2024.

AGRICULTURE The agriculture sector saw positive growth (3.6%) once again – for the third consecutive quarter. This was driven by an improvement in the production of rice, cereals, vegetables and fruits, as well as an uptick in fishing, marine products and aquaculture.

While the sector displayed growth two years after the chemical fertiliser ban, it is now facing new challenges with the drier weather conditions – save the incessant rains of late – since the beginning of the second half of 2023.

This could derail the positive contribution of agriculture to economic growth.

INDUSTRY The industry sector contracted by 11.5 percent in the second quarter of the year although the pace of deceleration eased compared to the three most recent quarters.

Only the food and beverage (F&B) sector recorded substantial growth in the quarter while construction, and textile and rubber manufacturing dipped.

Though construction activity contracted, the downtrend was much less than in the previous three quarters. Textiles continued to be impacted by the weak demand for apparel in key markets such as the US and EU.

High interest rates and the fiscal adjustments imposed by higher taxes also weighed on new investments and an expansion of activity in the industry sector.

SERVICES The services sector absorbed a marginal contraction of 0.8 percent, showing signs that it will register growth from the second half of 2023.

Wholesale and retail trade, as well as transport – which account for around 23 percent of GDP and 45 percent of services – recorded a notable uptick in the second quarter. A rebound in tourism also helped sub-sectors such as accommodation record substantial growth during this period. However, financial services and other personal activities continued to remain weak.

EXPECTATIONS Given the lag in the release of GDP data (for instance, information on growth from April to June is released only in mid-September), it’s important for businesses and the public to understand trends in growth from key indicators.

The Purchasing Managers’ Index (PMI) is an ideal indicator to understand trends in manufacturing and services. It surveys over 100 entities in each sector – largely from the Western Province – to assess their sentiments regarding the likes of new orders, production, employment and supply side delivery.

If the overall index reading is above 50, it indicates there’s month on month expansion.

The Manufacturing PMI has been below 50 for most months for over 12 months, mainly due to a slowdown in construction activity. And the survey indicates that the F&B sector is likely to continue its positive momentum while the demand for apparel is most likely to remain weak.

And the new Construction PMI provides more industry data and suggests that although activity is picking up, it is still below the 50 level. Businesses are surviving by undercutting prices to secure construction projects while new ventures are hard to come by due to limited local and foreign funded construction projects.

The industry sector is dominated by three sub-categories – namely construction, F&B, and textile and apparel manufacturing – that comprise about 18 percent of GDP and two-thirds of industry.

Given the expected slowdown in construction and apparel, we are likely to see the industry sector contracting in the second half – albeit at a slower pace – with a full recovery expected in 2024.

The Services PMI has been in positive territory for most months this year and expanded consistently since April. This augurs well for services to record growth in the third quarter of this year.

Financial services, which had been contracting, will likely do better with the completion of the domestic debt restructuring process.

Lower market interest rates compared to the beginning of the year will also help financial services activity with an improvement in the demand for credit as well. An improvement in consumption towards the last quarter of 2023 will boost retail trade too.

REFORMS While the economy is likely to normalise eventually, the focus will have to be on structural reforms that will unlock sustained economic growth at around five percent.

The IMF, in its staff visit assessment in late September, highlighted the need to establish the reforms process as growth has been subdued. So the government must promote organic growth through these much delayed reforms relating to energy, state owned enterprises, labour and trade to name a few.

This content is available for subscribers only.