ECONOMIC REVIEW

Looking ahead to 2026, Sri Lanka finds itself featured prominently and positively in the World Bank’s South Asia Development Update released in October. In 2025, the global economy was dominated by talks of sluggish growth, trade fragmentation and geopolitical uncertainty.

SRI LANKA’S GROWTH STORY

Shiran Fernando analyses the World Bank’s South Asia Development Update

But Sri Lanka stands out as a story of gradual recovery and renewed confidence, which can continue into 2026 although this assessment preceded the recent devastation following Cyclone Ditwah.

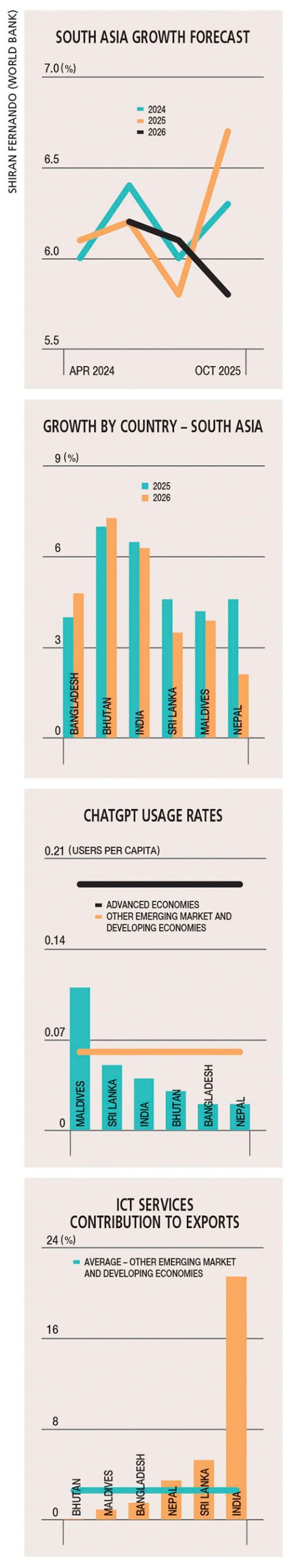

Among the South Asian economies that were reviewed, Sri Lanka and Bangladesh were the only two that received upward revisions to their 2026 growth forecasts while large economies such as India faced downgrades.

The World Bank now expects South Asia’s growth to moderate from 6.6 percent in 2025 to 5.8 percent in the new year, as high interest rates and slower global demand begin to weigh on the region.

Yet for Sri Lanka, the message is unmistakably more upbeat – stabilisation is giving way to a recovery.

RECOVERY The report notes that Sri Lanka’s recovery is underway, following the 2022/23 economic crisis. The World Bank has revised its growth projections upward to 4.6 percent in 2025 and 3.5 percent in 2026, reflecting stronger services exports, resilient remittances and a steady revival in tourism.

Perhaps the most encouraging milestone is that Sri Lanka’s real output is expected to regain its 2018 level in the next 12 months, two years earlier than previously forecast. This marks an important psychological turning point where the economy, long defined by crisis narratives, is moving back into expansionary territory – subject of course, to the economic trajectory in the aftermath of the cyclone.

The document also warns that structural weaknesses remain. Medium-term growth will be constrained by labour shortages, subdued industrial investment and the ongoing fiscal consolidation that’s needed to maintain debt sustainability.

These issues show that while stabilisation has been achieved, transformation is still a work in progress.

TARIFF RISKS A notable feature of this year’s update is the World Bank’s attention to rising global protectionism.

The escalation of reciprocal tariffs, most visibly the 20 percent US tariff on Sri Lankan goods introduced in August, has so far had only limited macroeconomic impact. But it serves as a clear warning of the vulnerabilities facing export oriented industries – particularly apparel and manufacturing.

The World Bank urges South Asian economies to respond to this uncertainty not with retaliation but greater trade openness through tariff rationalisation, regional integration and bilateral FTAs.

For Sri Lanka, this means deepening engagement with India, ASEAN and potentially through the Regional Cooperation Economic Partnership (RCEP), while also expanding export diversification beyond traditional markets such as the US and EU.

The lesson is simple: an open economy must stay open, even in an era of protectionism.

DOUBLE-EDGED SWORD Perhaps the most forward-looking part of the bank’s latest report is its special chapter titled ‘Artificial Intelligence, Real Impact.’

Here too Sri Lanka stands out with one of the highest AI exposure scores in South Asia. This reflects a relatively educated service oriented labour force that’s concentrated in ICT, finance and professional services.

But this exposure is a double-edged sword.

On the one hand, AI offers significant productivity gains for skilled professionals such as doctors, lawyers, teachers and managers whose work can be complemented rather than replaced by technology.

And on the other, it threatens entry-level and mid-skilled service jobs in sectors such as ICT-BPM and back office processing.

The World Bank’s analysis shows that while AI related job postings surged in India and Sri Lanka after the advent of ChatGPT in late 2022, entry-level demand fell by about 20 percent. This suggests that automation is already reshaping labour demand faster than most policy frameworks can adapt.

For Sri Lanka, the imperative is clear: upskill and reposition the workforce towards higher value digital services such as AI model testing, prompt engineering, data annotation and algorithmic auditing rather than traditional outsourcing.

Otherwise, the country risks losing competitiveness in its flagship services sector.

AI READY ECONOMY The World Bank stresses that South Asia’s artificial intelligence readiness is held back by unreliable electricity, weak broadband and skills shortages.

For Sri Lanka, the priorities are urgent but achievable by guaranteeing reliable power supplies to support data centres and AI enabled industries, expanding high-speed broadband and 5G coverage nationwide, and investing heavily in science, technology, engineering, and mathematics (STEM), and AI focussed tertiary education, alongside reskilling programmes for mid-career professionals.

Strengthening these foundations will retain digital talent and curb brain drain.

SUSTAINED GROWTH The South Asia Development Update paints a picture of a Sri Lankan economy that’s emerging from crises but not yet immune to external shocks.

Tariff risks, fiscal pressures and technological disruptions are real. Yet, the broader message is one of cautious optimism. Sri Lanka has stabilised and regained credibility, and possesses the human capital to compete in the new digital era.

If policy makers can convert this stabilisation into reform momentum by strengthening trade competitiveness, fostering innovation and investing in people, Sri Lanka can move beyond recovery to become South Asia’s agile, digitally driven growth story of the decade ahead.