LIFE AFTER THE IMF REVIEW

Shiran Fernando writes about what comes next for Sri Lanka

Sri Lanka and the IMF reached their first staff level agreement (SLA) after an initial review was completed in October. And although there was a delay of a month following the review in September, it was a welcome sign that there’s been progress under the bailout package inked in March.

As the year winds up, it’s necessary to explore the implications of the SLA and what further steps Sri Lanka needs to take in the months ahead.

PROGRESS REPORT The International Monetary Fund acknowledged the progress made by Sri Lanka in meeting its programme targets at end-June. Barring prescribed targets as regards tax revenue, the global lender feels the review is quite positive.

PROGRESS REPORT The International Monetary Fund acknowledged the progress made by Sri Lanka in meeting its programme targets at end-June. Barring prescribed targets as regards tax revenue, the global lender feels the review is quite positive.

Sri Lanka also implemented key structural reforms such as a new Monetary Law Act for the Central Bank and an Anti-Corruption Act. The administration was also able to publish its Governance Diagnostic Assessment report; and it became the first country in Asia to do so under the IMF.

This report highlights corruption and governance vulnerabilities, which the country needs to address.

On the macro scheme of things, 2023 was a year of stabilisation.

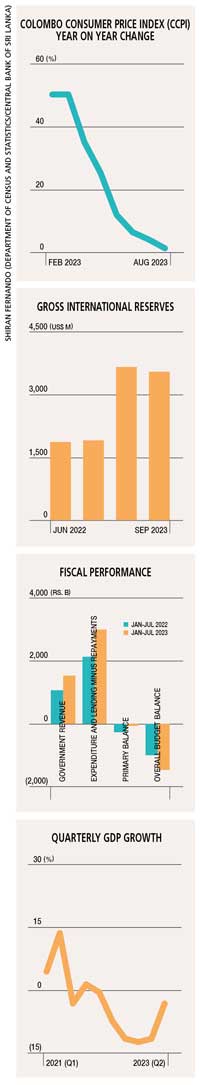

Headline inflation as reflected by the Colombo Consumer Price Index (CCPI), which was 70 percent in September 2022, fell to 1.3 percent in the same month this year. Reserves have improved from less than US$ 2 billion in 2022 to over 3.5 billion dollars.

Though revenue collection through taxes has not met the set targets, Sri Lanka managed to record a minor primary surplus on the fiscal account relative to a primary deficit in 2022.

Macro stabilisation efforts have resulted in a retardation of economic growth alongside a slowdown in exportations owing to weak external demand in key export markets.

SECOND TRANCHE The SLA will have to obtain approval from the board of the IMF for Sri Lanka for the country to receive the second tranche under the International Monetary Fund programme, which will be the equivalent of US$ 330 million.

Before seeking IMF board approval however, Sri Lanka has to implement a few ‘prior actions’ and also have its creditors provide financial assurances in the context of debt repayments. Even at the end of October however, the country had not met these conditions nor gained board approval – although this is likely to transpire in November or December.

The reference to ‘prior actions’ is unclear but these would most likely revolve around the national budget for 2024 – and the budget would have to continue the path of fiscal consolidation, which means ensuring further revenue growth and bridging the gap.

The IMF also emphasised that the government would have to continue demonstrating how it would “mitigate fiscal risks, ensure strong governance reforms and safeguard financial stability.”

With regard to obtaining financial assurances on debts, Sri Lanka needs assurances from its creditors to create a clearer path to restoring debt sustainability.

Recently, the Export-Import Bank of China provided an assurance that would address the outstanding debt of about four billion dollars. This assurance – and others from the Paris Club and international bondholders – will have to be in line with the debt parameters set out by the IMF.

During this complex process, Sri Lanka has to uphold the principles of parity and transparency.

Essentially, the country only needs to receive an assurance that there is a commitment to the key parameters and doesn’t need to conclude its restructuring process with external creditors immediately.

We saw this in the case of Zambia in its first review as well whereby the assurances provided by creditors unlocked the financing for disbursement while discussions on finalising the debt restructuring process were ongoing.

REFORM MOMENTUM As highlighted by the IMF and other institutions, Sri Lanka must continue to drive its reform agenda to put the economy back on a growth path.

These can include non-IMF measures related to trade facilitation and unlocking the digital economy.

Meanwhile, numerous challenges and barriers that exist at the institutional level are stifling the competitiveness of the private sector. While a focus of the IMF with state owned enterprises (SOEs) has been on cost reflective tariffs, there could be a limit to how this can be sustained.

Reforms related to the power and energy sector will need to be fast tracked in the light of recent electricity tariff hikes not long after the previous increase in June since this will certainly put pressure on the public and slow down consumption even further.

The Governance Diagnostic Assessment report provides an opportunity for the country to reflect on issues of corruption and institutional failure or mismanagement.

This type of report needs further discussion in the public domain as it will put pressure on the government for better delivery of its services.

A targeted action plan to reduce vulnerabilities is important for the country to avoid a repetition of defaulting on external debt repayments – and subsequent bankruptcy – in the future.