COVER STORY | SRI LANKAN OF THE YEAR 2024

POLICY ARCHITECT

Dr. Nandalal Weerasinghe is LMD’s Sri Lankan Of The Year for 2024

Year 2024 was a pivotal period for Sri Lanka as the call for change resonated throughout the nation. While public frustration seemed to subside, or at least appear less intense, the demand for relief and transformation remained steadfast.

Thankfully, a sense of optimism began to emerge with Sri Lanka displaying an unwavering spirit of perseverance; it felt as though the nation was nearing the end of a long and unyielding storm, as it held onto hope for a brighter future.

However, the road to 2024 was anything but smooth.

Hardships paved the way for a complete overhaul in political leadership, which led to a change in both the presidency and people’s representatives in parliament, following an overwhelming mandate from the voting public.

FORERUNNERS Sri Lanka’s story is far from over, let it be said; it is instead, work in progress of a nation still healing from its wounds but moving forward with determination.

The scars of the past are still visible but they’re now accompanied by some signs of growth, renewal and transformation.

Among those who inspired the nation with their achievements and sparking widespread celebration, LMD’s 2024 Sri Lankan Of The Year (SLOTY) shortlist stands as a symbol of national pride and joy amid the hardships it has endured.

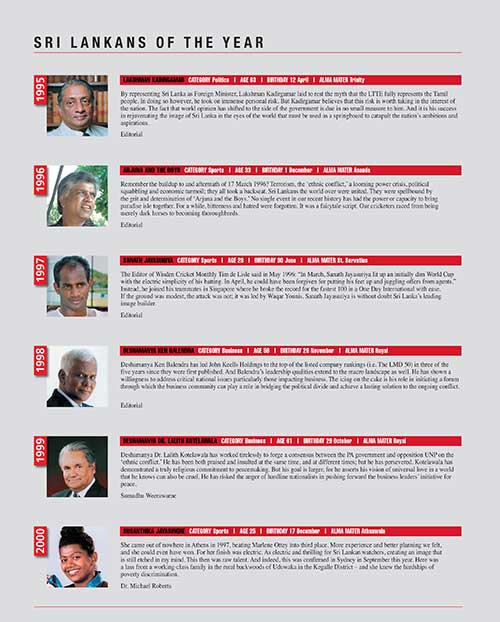

VANGUARDS Back in 1994, LMD debuted its first edition of SLOTY in celebration of individuals from a diverse array of fields including politics, sports, business, entertainment and advocacy.

In most years since then, the selection process has been challenging and 2024 was no exception since each of the individuals on our shortlist has played a role in shaping the country’s future.

This time around, LMD’s Sri Lankan Of The Year is the Governor of the Central Bank of Sri Lanka Dr. Nandalal Weerasinghe. He was selected for the role he’s played in stabilising the economy, particularly during a period of untold challenges.

Weerasinghe is only the second Central Bank governor to win LMD’s annual accolade and he follows in the footsteps of the highly respected Deshamanya Dr. Indrajit Coomaraswamy, who was the magazine’s SLOTY in 2016.

With years of experience under his belt, Weerasinghe has led the Central Bank with strategic policies that are focussed on economic recovery, monetary policy and fiscal discipline. As the head of the monetary authority, his initiatives have been crucial in navigating Sri Lanka through economic turbulence by implementing reforms and restoring financial stability.

Under his leadership, we have seen the Sri Lankan Rupee stabilise and negotiations with the IMF bearing fruit. His strategies – which are aimed at debt restructuring, improving foreign reserves and fostering investor confidence – have been crucial to revitalising the economy.

With years of experience under his belt, Weerasinghe has led the Central Bank with strategic policies that are focussed on economic recovery, monetary policy and fiscal discipline

South Asia’s fastest man and 2022 Birmingham Commonwealth Games bronze medallist Yupun Abeykoon made it to LMD’s SLOTY shortlist for the second time. Abeykoon won the 150m race at the Florence Sprint Festival in Italy early last year by crossing the finish line in 15.19 seconds.

Another repeat standout on our shortlist is national women’s cricket captain Chamari Athapaththu, who led Sri Lanka to qualify for the ICC Women’s T20 World Cup 2024. She topped the batting charts with 151 runs and capped her performance with a spectacular 102 off 63 balls against Scotland, which took Sri Lanka to the qualifier trophy.

Athapaththu helmed the ICC Women’s ODI batting rankings twice and by November, she stood at No. 3. She also led Sri Lanka to its first Women’s Asia Cup title last year. Under her leadership, the Sri Lankans secured T20I series victories over Bangladesh, England and South Africa, culminating in their qualification for the 2024 ICC Women’s T20 World Cup.

Chairman of John Keells Holdings (JKH) Krishan Balendra is also on our SLOTY shortlist this year, for leading the conglomerate to impressive heights – including topping LMD’s Most Respected rankings once again.

A key highlight under his leadership is the recent launch of Cinnamon Life City of Dreams Sri Lanka, a landmark project that has transformed Colombo’s skyline and promises to be a game changer in the region.

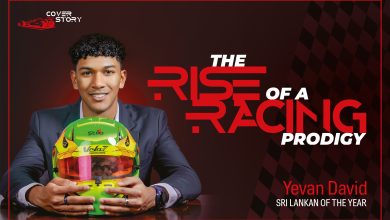

As a rising star in motorsport, 17-year-old Yevan David has earned himself a reputation as one of Sri Lanka’s brightest racing talents – and a place among the honourable mentions in the 2024 SLOTY shortlist.

David made history as the first Sri Lankan to compete in the Euroformula category and clinch victory in his debut race at Monza in Italy.

LMD’s 1997 Sri Lankan Of The Year Sanath Jayasuriya also earns an honourable mention in 2024 for his impactful leadership of the national men’s cricket team. He was appointed full-time head coach until the 2026 ICC Men’s T20 World Cup and under his guidance, Sri Lanka has achieved historic milestones.

These include a first bilateral ODI series win against India in 27 years, a landmark Test away victory against England after a decade and a 2-0 Test series whitewash of New Zealand at home.

Activist, academic and adventurer Jayanthi Kuru-Utumpala was the first Sri Lankan to summit Mount Everest in 2016. She has also makes it to the LMD SLOTY shortlist this year for her pioneering efforts in gender inclusivity.

Kuru-Utumpala received the IOC Gender Equality, Diversity and Inclusion Champions Award for Asia at the 43rd General Assembly of the Olympic Council of Asia in Bangkok.

Chairman and CEO of Hayleys Mohan Pandithage has been the driving force behind the group’s remarkable success over many years. Under his leadership, Hayleys clinched pole position in the LMD 100 rankings for financial year 2023/24 – the eighth time it has secured this prestigious spot since the rankings were launched back in 1994.

Beyond this accolade, Pandithage also holds the distinction of having the highest number of male directorates among listed companies in Sri Lanka, which bears testimony to his influence and leadership in the corporate landscape of this country.

Multi-talented actress and filmmaker Dinara Punchihewa also earns a spot on LMD’s SLOTY shortlist for her recognition on the prestigious Forbes 30 Under 30 – Asia 2024 list.

Balancing a thriving career while being a daughter, wife and mother, Punchihewa has seamlessly woven her love for the arts into a diverse portfolio.

Distinguished leader in the global mobile industry and former SLOTY, Dr. Hans Wijayasuriya was honoured with the prestigious GSMA Chairman’s Award in recognition of his outstanding contribution to the sector.

He completes our list of laudable SLOTY nominees for year 2024.

After careful consideration of the shortlisted nominees, LMD has chosen Dr. Nandalal Weerasinghe as its Sri Lankan Of The Year for 2024 – for inspiring confidence in Sri Lanka’s path to economic recovery and growth.

– LMD

THE MACRO MAESTRO

Tamara Rebeira chronicles the journey of Dr. Nandalal Weerasinghe

“Weerasinghe’s achievements are far reaching and he is one of the few central bank governors to be awarded the prestigious ‘A’ grade in Global Finance’s 2024 Central Banker Report Cards”

As Sri Lanka spiralled into chaos and those that governed all but lost control, the nation found itself sinking deeper into financial instability with each passing day. Amid this turmoil, a new figure emerged to help steer the country’s economy – Dr. Nandalal Weerasinghe.

A highly regarded and experienced banker, Weerasinghe was appointed to lead the Central Bank of Sri Lanka. Upon returning from Australia where he was domiciled at the time, Weerasinghe immediately stepped into this role during a time of profound crisis – and he was tasked with helping to navigate Sri Lanka through one of its most turbulent economic periods.

He assumed duties as the 17th Governor of the Central Bank on 7 April 2022 – by then, a series of poor decisions had plunged the country into an unprecedented economic crisis, leaving Weerasinghe with the monumental task of steering the nation’s financial system out of the abyss.

The road ahead was bound to be fraught with challenges and the path to recovery was undoubtedly difficult, requiring swift and strategic action to restore stability and confidence in Sri Lanka’s economy.

This was a period that marked the height of the aragalaya movement, which was characterised by extreme fuel and supply shortages, a foreign exchange crisis and soaring inflation.

Since taking office, Weerasinghe has served under three heads of state – former presidents Gotabaya Rajapaksa and Ranil Wickremesinghe, and now under Anura Kumara Dissanayake.

From his early days, Weerasinghe set a tone of consistency and confidence. Drawing on his deep-rooted connections within the Central Bank, he reiterated the institution’s independence, which gained support from all political parties.

Weerasinghe has stated clearly that he is leading the Central Bank, which is not a government controlled entity. And he has firmly asserted his authority over monetary policy and the Central Bank’s core ресурс.

SOFT DEFAULT Almost immediately after his appointment, Weerasinghe was thrust into the deep end and expected to work miracles in the midst of an unprecedented financial crisis. Within a week of his appointment, a media briefing revealed that Sri Lanka was technically bankrupt.

He announced the temporary suspension of all external debt repayments while acknowledging that the country could no longer meet its financial obligations due to the dire fiscal position, which was exacerbated by both external shocks and internal mismanagement.

This stark admission underscored the severity of the crisis and the immense challenges he was to face in his new role.

The decision to suspend external debt repayments ended Sri Lanka’s longstanding record of honouring its financial commitments – ever since the nation gained independence in 1948, in fact. This move was framed as a ‘soft default,’ which would enable restructuring and negotiations with creditors. And it offered a path to manage the country’s debt crisis without the severe repercussions of an outright default that would have isolated Sri Lanka from global financial markets.

Meanwhile, the arduous task of resurrecting an economy that was teetering on the brink of collapse began in earnest with Weerasinghe playing a prominent role in proceedings. He noted at the time that “our position is very clear; we have stated that until a debt restructuring process is in place, we will not be able to make payments. This is what is called a pre-emptive default…”

On 4 July 2022, he was reappointed as the Governor of the Central Bank for a six-year term, following an initial three month tenure. Weerasinghe expressed a commitment to remain at the helm of the bank for the long haul and signalled his determination to steer the country towards a recovery.

In recognition of his leadership, several former Central Bank staff penned an open letter to then president Gotabaya Rajapaksa, urging him to retain Weerasinghe as the Governor of the Central Bank. This support was crucial, as it was clear that he was willing to take on such a herculean task. His reappointment was thus viewed as being vital to stabilising the economy.

“Weerasinghe was thrust into the deep end and expected to work miracles in the midst of an unprecedented financial crisis”

ROOT CAUSES ‘Taking the bull by the horns’ best describes Weerasinghe’s approach to the challenges facing the national economy.

He was forthright in discussing the root causes of the economic crisis, and cited the substantial tax cuts in 2019 and excessive printing of money to cover debts as the primary contributors to the country’s unprecedented financial turmoil.

When he took office, the nation’s reserves had plummeted from US$ 7.6 billion to a mere US$ 20 million in usable funds.

He focussed on stabilising the economy by sharing the burden between high and low income groups with the goal of minimising the impact on the most vulnerable. His strategy emphasised the need to increase state revenue while reducing the dependence on borrowing. Key priorities in his plan included controlling inflation, boosting export income, and managing state revenue and expenditure.

On the other hand, he was also realistic about the challenges ahead and acknowledged that the crisis would not be resolved in the short run.

Weerasinghe didn’t sugarcoat the situation and candidly noted that hardships would likely persist until at least December of that year. To prevent future economic crises, he stressed that state revenue must rise to 14-15 percent of GDP, as he and others laid the groundwork for long-term economic stability.

IMF’S ROLE Taking a decisive stand, he urged the government to seek assistance from the International Monetary Fund to help restore the economy, despite strong resistance from the ruling party at the time.

He emphasised that tax reforms, debt restructuring and other crucial adjustments were integral to the stabilisation plan.

Subsequently in August 2022, an IMF mission visited Colombo to discuss potential support for Sri Lanka and the government’s comprehensive economic reform programme. At the conclusion of the discussions, the IMF team announced that a staff level agreement had been reached to support Sri Lanka’s economic adjustment and reform efforts through a new 48 month Extended Fund Facility (EFF) with an access request of US$ 2.9 billion.

This arrangement was a significant achievement for the Central Bank governor, who demonstrated his value in a short period by working towards ensuring macroeconomic and financial stability, and debt sustainability. The IMF programme was designed to stabilise the economy, protect the livelihoods of Sri Lankans and lay the foundation for a long-term economic recovery.

Along with the International Monetary Fund’s programme came certain strict guidelines that had to be stringently adhered to. Since then, the IMF team has reached multiple staff level agreements with local authorities – most recently following the third review under the four year EFF arrangement. The reform programme under the arrangement is based on robust policy measures that focus on five key pillars.

The first is ambitious revenue based fiscal consolidation that’s strengthened by wider social safety nets, fiscal institutional reforms and cost recovery energy pricing to ensure that the state is able to cover essential expenditure.

And the second is the restoration of public debt sustainability. This includes debt restructuring to secure stable financing for the government’s operations.

The third pillar refers to the programme that includes a multi-pronged strategy to restore price stability and rebuild foreign reserves with a flexible exchange rate that aims to reduce the burden of inflation – especially on the poor.

As for the fourth pillar, it encompasses policies to safeguard financial sector stability by ensuring that it can support economic growth effectively.

The fifth pillar focusses on structural reforms to address corruption vulnerabilities and increase economic growth.

Recently, Senior IMF Mission Chief for Sri Lanka Peter Breuer observed that “Sri Lanka’s ambitious reform agenda supported by the EFF is delivering commendable outcomes.”

FISCAL POLICY During Weerasinghe’s leadership of the monetary authority, the economy expanded on average by four percent year on year in the four quarters ended June 2024. And the IMF noted that high frequency indicators pointed to continued expansion across all sectors.

When Weerasinghe was appointed Governor of the Central Bank in April 2022, inflation stood at nearly 30 percent. It then peaked at 61 percent in November that same year before gradually trending down. Thanks to stringent policy measures, inflation fell to single digits by July 2023, marking a significant improvement over the course of a year.

Gross official reserves increased to US$ 6.4 billion by October 2024 with sizeable foreign exchange purchases by the Central Bank and public finances strengthened following substantial fiscal reforms.

Meanwhile, the Monetary Policy Board of the Central Bank has resorted to reducing interest rates gradually. In September, the board decided to maintain the Standing Deposit Facility Rate (SDFR) at 8.25 percent and the Standing Lending Facility Rate (SLFR) at 9.25 percent – figures that represent a notable decrease from the same time a year ago.

FISCAL REFORMS One of Weerasinghe’s critical challenges was managing Sri Lanka’s unsustainable debt levels. He ensured the successful negotiation of agreements with both bilateral and private creditors; and in 2024, Sri Lanka reached a landmark agreement with bondholders, which was essential for putting the country’s debt on a sustainable trajectory.

The negotiations were complex and required Weerasinghe’s adept handling of stakeholder interests. He had to assure them that economic stability would follow and ensure that the debt restructuring aligned with the IMF’s guidelines.

Eventually, Sri Lanka reached a draft agreement with creditors to restructure US$ 12.5 billion in international bonds in September. This development follows the country’s third round of formal debt restructuring negotiations with bondholders.

Additionally, the country completed a preliminary agreement to restructure a debt of US$ 3.3 billion with the China Development Bank.

Weerasinghe stated that the country’s Official Creditor Committee (OCC) and its secretariat would continue to ensure compliance with the Agreement in Principle and the Local Option, and be in line with the Comparability of Treatment principle.

Under his leadership, the Central Bank has also introduced policies to strengthen public finances, including enhanced revenue collection and lower fiscal deficits. Fiscal reforms such as streamlining tax administration and minimising exemptions have played a pivotal role in increasing state revenue.

“Taking the bull by the horns’ best describes Weerasinghe’s approach to the challenges facing the national economy”

THE LONG VIEW Weerasinghe took a decisive step ahead of the recent elections when he warned that reversing existing economic policies would lead to a repeat of the financial and social crises that Sri Lanka experienced nearly two years ago.

He emphasised that ongoing reforms are crucial for economic recovery and long-term growth. While acknowledging the challenges posed by these short-term adjustments, he stressed the need for all parties to commit to implementing overdue changes for sustainable and inclusive development.

Weerasinghe also cautioned that any political or social instability, or backtracking on the progress made in the last 18 months or so, could jeopardise the debt restructuring process and cause lasting harm to the national economy.

He asserted that due to the nation’s debt obligations, the government no longer has the resources to stimulate growth through increased spending or tax cuts as it had done in the past. Re-establishing fiscal and credit stability is the most pressing priority for both the present and future.

Despite these challenges, Governor Weerasinghe remains optimistic that Sri Lanka will achieve economic growth in 2024 – for the first time since the onset of the crisis. He is confident that the country is nearing the final phase of external debt restructuring and is close to achieving short-term economic stability.

Looking ahead, he emphasises the need to target a growth rate of between four and five percent in the years ahead. And he underscores the importance of safeguarding the short-term gains made under the current restructuring programme to ensure sustained long-term development.

BANKING MERIT Weerasinghe’s achievements are far reaching and he is one of the few central bank governors to be awarded the prestigious ‘A’ grade in Global Finance’s 2024 Central Banker Report Cards.

The accolade places him among the world’s elite central bank governors, and recognises his exceptional leadership in navigating Sri Lanka’s economy through challenging times.

He shares this honour with other top performing governors from countries such as Denmark, India, Switzerland, Brazil, Chile, Mauritius, Morocco, South Africa and Vietnam, and places him in the company of some of the best central bankers in the world.

Meanwhile, at the 34th Anniversary Convention of the Association of Professional Bankers – Sri Lanka, Governor Weerasinghe received the Lifetime Achievement Award for The Most Outstanding Contribution to the Banking Industry.

“Taking a decisive stand, he urged the government to seek assistance from the International Monetary Fund to help restore the economy”

LMD’S AWARD Weerasinghe’s remarkable leadership during one of Sri Lanka’s most challenging economic periods demonstrates his profound commitment to the country’s economic future.

By taking difficult but necessary action, he has not only guided Sri Lanka towards a recovery but also restored a sense of confidence in the Central Bank’s leadership.

His efforts to implement sound fiscal policies, secure debt restructuring agreements and navigate the complexities of international negotiations reflect a relentless drive to create economic stability.

Weerasinghe’s recognition, both locally and globally, underscores the transformative impact he has had in a short period. The governor’s steady and strategic approach in the face of adversity has earned him recognition as LMD’s 2024 Sri Lankan Of The Year – a testament to his determination, vision and unwavering dedication to build a more resilient Sri Lanka.

As the country advances in its rebuilding efforts, his achievements serve as a powerful reminder that steadfast leadership coupled with clear strategies can turn the tide.