BEYOND FINANCING

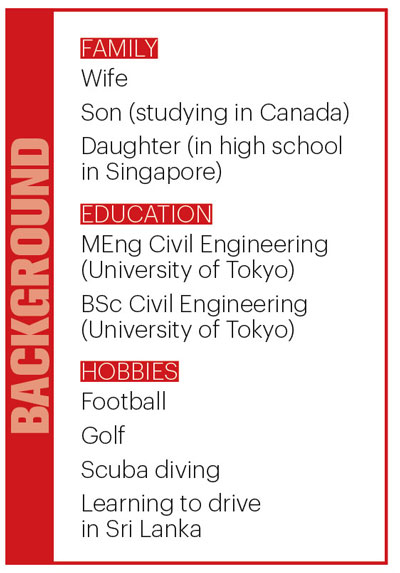

Takafumi Kadono

In a strategic move that is expected to bring a wave of positive change to Sri Lanka, the Asian Development Bank (ADB) welcomed Takafumi Kadono as its new Country Director in July last year.

A seasoned development professional with 24 years of expertise, the Japanese national steps into the vibrant setting of Colombo to steer the ADB’s initiatives in the island.

With a stellar background in civil engineering and a penchant for impactful projects across Asia and Latin America, Kadono’s appointment promises an exciting chapter for Sri Lanka’s economic recovery.

“With a desire to contribute to economic development through infrastructure development, I started my career in 1999 as an engineering consultant in Japan where I gained extensive field experience in developing countries preparing master plans, feasibility studies and detailed designs, while also supervising project construction,” Kadono says.

He continues: “While I worked on water, urban, and post-disaster reconstruction, the main sector was energy. Geographical coverage was mostly Southeast Asia and Latin America.”

Turning the clock back, he muses: “In 2006, I was selected as a Fulbright Scholar to enrol in a master’s degree in public administration with a focus on international development but was offered a position at the ADB as a ‘young professional.’ I opted to continue working so I can make a difference on the ground.”

“At the ADB, I first worked one year in the agriculture and environment sectors in China, and then in the energy sector in Central and West Asia (four years) and then Southeast Asia (three years), where I was stationed in Vietnam as the energy sector lead promoting renewable energy and power sector reform,” he adds.

In 2015, Kadono switched to the World Bank where he worked more than five years based in the Singapore Hub for urban, infrastructure and PPP.

Taking the reins from his predecessor Chen Chen – who completed his term on 30 June – Kadono entered the fray with a vision aligned with ADB’s commitment to a prosperous, inclusive and sustainable Asia.

His enthusiasm shines through as he pledges ADB’s continued support for Sri Lanka, especially during these challenging times marked by an economic crisis. Kadono aims to chart a course to strengthen Sri Lanka’s resilience and usher in a new era of development with a focus not only on funding but also as a knowledge partner.

– Compiled by Tamara Rebeira

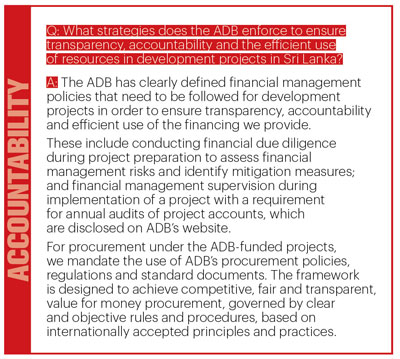

Q: Upon your appointment as the Asian Development Bank’s (ADB) Country Director for Sri Lanka, what were your initial thoughts and impressions of the country?

A: The best word to describe my initial thought when I was appointed as the ADB’s Country Director for Sri Lanka is ‘thrilled.’

I had never set foot on this magnificent island – but I had worked from Tokyo when I was younger on projects in the country, and always wanted to work here with its kind and talented people.

The worst of the economic crisis had passed at the time of my appointment but I knew that these are trying times for everyone; so I strived to prepare as much as possible to make myself useful to the government and citizens as the country works on pulling itself out of the crisis.

Since my arrival, I’ve witnessed the unwavering commitment to change and strong resilience of the people; and I’m privileged to be given the opportunity to serve such a wonderful country.

Q: How do you view Sri Lanka’s international image and potential to achieve economic prosperity?

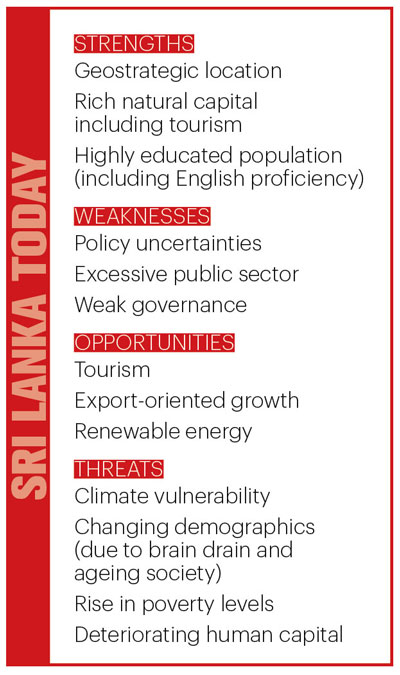

A: Sri Lanka is known for its natural beauty and rich heritage – the country has been a shining example of advanced human development. Historically it’s been an important node in maritime trade routes.

Decades of conflict and the more recent crises, including COVID-19 and the economic crisis, have held the country back from achieving its potential. I view this as an opportunity for the country to capitalise on its strengths, address structural and governance weaknesses, and demonstrate to the world its true potential.

Sri Lanka has a good opportunity to achieve strong sustainable growth that is both green and inclusive, if the right policies are introduced and maintained. I’m confident of this and believe that many who know Sri Lanka feel the same.

Q: What are the priorities and projects that the ADB is currently focussing on here in Sri Lanka? And what development challenges do you foresee?

A: The ADB has historically supported Sri Lanka in infrastructure development and other critical sectors, such as education and skills, finance and agriculture.

Since the unprecedented crisis in 2022, the government has planned an ambitious reform agenda to address structural weaknesses in the economy.

The ADB, in consultation with the government and in coordination with other development partners including the IMF and World Bank, is providing policy advisory and budget support for the reform agenda.

In May last year, we provided a US$ 350 million special policy based loan (PBL) to Sri Lanka for economic stabilisation, aligned with the IMF’s Extended Fund Facility (EFF) programme. And more recently in December, the ADB approved a US$ 200 million concessional loan to help Sri Lanka’s financial stabilisation endeavours.

The reform programme that the government has undertaken is critical to move the country to a sustainable growth path and fast track development. Persistent macroeconomic vulnerabilities that led the country to the International Monetary Fund several times before the ongoing programme must be tackled in order to provide certainty and confidence, to both investors and the public.

Staying the course of the reforms is a significant challenge and will require a political consensus to continue with reform agenda beyond electoral cycles. This will also require social acceptance for difficult reforms that will impact the public.

Sri Lanka is faced with significant governance challenges as highlighted in the recently released IMF governance diagnostic assessment report. It’s critical that the gaps identified are addressed to improve public sector efficiency and effectiveness, to set itself on a strong positive growth trajectory.

Other constraints that need to be tackled include the regulatory environment. These include high degree of protection (tariffs, para tariffs and non-tariff barriers); barriers to entry and exit (i.e. restrictive licensing-permit and insolvency regimes); delays in contract enforcement; and rigidities in land and labour market regulations.

Skills mismatches – particularly in STEM fields, and technical and vocational skills – pose a constraint to become competitive. This mismatch is likely to be exacerbated due to the outmigration over the past two years. In addition to governance, policy induced inconsistencies and multiplicity of institutions with overlapping mandates also create uncertainties.

This can be a serious deterrent for investors. Access to finance – especially for SMEs – and the quality of infrastructure for trade logistics pose challenges.

Q: The Asian Development Bank has supported Sri Lanka throughout the multiple crises it has faced in recent years. How does the bank prioritise such assistance – and how will the scope of development funding evolve in the future?

A: The ADB has been privileged to be a part of Sri Lanka’s development journey. Through the years, the organisation has responded to various challenges that the country faced.

We align assistance to the country’s needs, and adjust responses in close consultation with the government and international partners.

Then there are global priorities and commitments that countries have made, such as the climate and Sustainable Development Goals (SDGs), that require coordinated support from all development partners. We utilise different tools and modalities to suit the context, and ensure that the best response is provided according to the situation.

During the conflict, we provided several multi-sector loans to support rehabilitation and reconstruction of affected areas. More recently, we provided multi-tranche financing facilities (MFF) which allow us to stay engaged in sectors over a longer period to maximise benefits.

Readers may have heard of the ’iRoad programme’; these are MFFs that we’ve been supporting since 2014. We also provided results-based lending (RBLs) – for example, for secondary education and skills development – to ensure that critical sector results were achieved.

The ADB is preparing a new country partnership strategy for Sri Lanka that will provide the overarching framework for the bank’s assistance over the medium term. Going forward, to support the country’s efforts to address the crisis, we are changing track. The ADB will support efforts to address the crisis with technical assistance and budget support.

We will also support critical development expenditure needs of the country on a selective basis. Our assistance goes beyond financing – we provide, and will continue to provide, policy advisory and knowledge support to the country.

The ADB is already fulfilling this role through the serendipity knowledge programme for Sri Lanka, which covered the economic outlook, nature-based solutions, state-owned enterprise (SOE) reform, and flexible pathways to education and skills development in 2023.

We will continue to cover timely topics and invite internationally renowned experts.

Q: ADB President Masatsugu Asakawa recently expressed optimism over steps taken by Sri Lanka towards economic recovery against the backdrop of the IMF’s four-year Extended Fund Facility (EFF) programme. Could you elaborate on this?

A: It’s encouraging to see early signs of stabilisation and improvement in the economic situation compared to a year ago, and the efforts taken by the government are commendable.

The Central Bank of Sri Lanka ended its monetary tightening policy stance and reduced key policy rates by 650 basis points in 2023.

These measures were undertaken as inflation tapered down faster than anticipated while growth indicators remain muted. Owing to the ongoing macroeconomic adjustments, inflation as measured by the Colombo Consumer Price Index edged down to low single digits from close to 70 percent in September 2022.

Official reserves reached US$ 4 billion at the end of December 2023, from 1.9 billion dollars at the end of 2022. This increase comes mainly from the Central Bank’s net purchasing of foreign currency combined with budget support from international financial institutions like the ADB.

Q: To date, the ADB has committed 482 public sector loans, grants and technical assistance to Sri Lanka. Would the bank sustain this level of assistance in the medium term – and if so, under what conditions?

A: Sri Lanka is a founding member of the ADB. We’ve stood by the country and its people through good and challenging times. I take this opportunity to reaffirm our support for Sri Lanka. The ADB is reorienting its support to the country situation.

With the current economic situation, a greater emphasis will be placed on policy advisory and technical assistance, as well as budget support. We’re also aware that the country still has critical development expenditure needs. The ADB will work with the government to identify high priority projects, and the timing and sequencing of such support.

Q: In June last year, the ADB approved a request by Sri Lanka for concessional assistance amid the economic crisis. What was the bank’s rationale for granting this assistance?

A: Indeed, the ADB approved reclassification of Sri Lanka to ’Group B’ to make it eligible for concessional lending. For any new lending from June 2023, we are tapping into concessional resources first. However, this is a scarce resource as other eligible countries are vying for the same pot of money.

The ADB looks at different criteria to determine the country classification. Two such criteria being the nation’s gross national income measured by the so-called atlas method of the World Bank and a country’s credit worthiness.

On both these counts, Sri Lanka’s situation deteriorated dramatically in 2022 and provided grounds for reclassification. We hope this reclassification will help reduce debt service costs on some of ADB’s new financing.

Q: The ADB has expressed hope of actively engaging and collaborating with the private sector in this country. How will this complement development and economic growth, in your assessment?

A: Enhanced private sector participation in key sectors of the economy will, apart from bringing financing, introduce efficiency and drive innovation, which is essential for Sri Lanka’s economic growth. However, a conducive investment climate must prevail for the private sector to invest and attract foreign direct investment (FDI).

To facilitate private sector development, the ADB will provide support to develop an enabling environment including facilitating public-private partnership (PPP). Improving the investment climate, strengthening public financial management (PFM), enabling PPPs, SOE reforms and capacity building will help create a foundation for enhanced private sector participation.

The ADB is supporting reforms in the power sector to encourage private sector participation in the renewable energy sector. Financing for private investment will be considered for sectors where reforms have resulted in creating a conducive and enabling environment.

Q: In your view, what are the key opportunities and potential growth sectors for Sri Lanka in the coming years?

A: An engine of strong growth could be the tourism industry as it can bring in foreign exchange, support SMEs and create employment. Sri Lanka is blessed with rich natural and cultural resources that are of interest to a wide range of clientele but more needs to be done.

The country needs to market itself better, better manage over-tourism and enhance the quality of services so tourists enjoy memorable experiences.

Renewable energy is another area that will not only reduce carbon emissions but bring down electricity tariffs if tendered competitively to achieve a low cost of production. Such a reduction can make it attractive for FDIs and emerging sectors like green hydrogen.

I’m interested in seeing the growth in the agriculture sector, which employs over a quarter of the population. The sector needs to be modernised through commercialisation and by integrating it into the global value chain.

The ADB will support these areas to help the country become more competitive. The right policies need to be introduced and maintained, to offer confidence to investors and farmers alike.

Q: Sustainability efforts, given the heightened concern over climate change, are crucial. How does the ADB incorporate environmental considerations into the projects that it helps fund?

A: While addressing climate change and environmental considerations are interrelated, it may be better to explain this separately.

First on climate change, we’re a strong supporter of the government’s green growth agenda. Sri Lanka is highly vulnerable to the effects of climate change and projects supported by the ADB incorporate adaptation measures to ensure climate resilience.

We’re also interested in promoting nature-based solutions that recognise nature’s potential to make the economy and society more resilient. On the mitigation side, the government has ambitious targets such as 70 percent renewable energy generation by 2030 and net zero by 2050.

The ADB is supporting power sector reforms to accelerate renewable energy development particularly by the private sector and will consider non-sovereign lending when the timing is right.

Secondly on environmental considerations, environmental safeguards for ADB-financed projects are part of the organisation’s safeguard policy, which also covers involuntary resettlement and indigenous people. The objectives are to avoid or minimise any adverse impacts of projects.

Our policy requires executing and/or implementing agencies to carry out measures to mitigate and/or compensate for adverse project impacts, and to help borrowers strengthen their own safeguards.

Q: Many Asian countries continue to struggle to contain the widening gap between the rich and the poor – and as we have seen, this has the potential to spark social unrest. What more must be done to bridge this gap and reduce poverty levels in the region?

A: Economic shocks brought about by the likes of the pandemic and economic crises have disproportionately impacted the poor and vulnerable as they have limited coping mechanisms.

The same can be said about the impact of climate change. Social protection such as ‘Aswesuma’ is important but policies must be implemented to pull such people out of poverty and vulnerability.

More effort is also needed to strengthen human capital through improved education, skills development and healthcare systems. Bridging the digital divide will also be important to give equal opportunities to everyone to thrive in a fast-changing and sophisticated world.

Alongside a well-targeted social protection system, income redistribution through a progressive tax system can help contain the gap between the rich and poor.

The main vehicle for addressing equity via the tax system is personal income taxes (PIT). Widespread PIT systems with a broad base and progressive rate structure – and with few tax expenditures and exclusions – are the necessary first step for equity via the tax system.

Wealth and property taxes – to the extent that they’re stringently administered and bring in large sums of money – can obviously supplement this effort. Strengthening tax administration to utilise information on high-net-worth individuals and deploying effective base erosion and profit shifting (BEPS) measures can help safeguard revenues from the very rich, and from multinationals.

Other broad based and preferably single rate taxes like the value added tax (VAT) and corporate income tax (CIT), and selective excises, can be used to raise revenue without harming the business climate. Sri Lanka’s tax revenue collection is dependent on indirect taxes such as VAT, excise and customs, which are generally regressive.

Over time it’s necessary to shift this composition toward direct taxes like personal income tax (PIT) – and to this end, improving tax administration will play a critical role.

From international experience, particularly in Asia and the Pacific, we know that growth is good for poverty reduction. Addressing structural constraints and reinvigorating growth, and employing people in high productivity jobs, will be crucial to poverty reduction efforts.

Q: Could you elaborate on some of the success stories in poverty reduction and alleviation programmes from among the countries that you have worked in or with? And from what you know, where does Sri Lanka stand vis-à-vis poverty reduction?

A: My background is engineering but I decided to devote myself to poverty reduction when I attended a training on participatory rural appraisal while in university.

As a professional, I’ve worked mostly in the power sector, so I like to believe that the infrastructure and reforms we supported have directly or indirectly contributed to economic development and improved the quality of life.

For example, in Vietnam where I was based for four years from 2012 to 2016, we helped bridge the infrastructure gap, enhance service quality and attract private sector investment into the sector. Such support, complemented by other developments and a conducive policy environment that boosts investor confidence, boosted Vietnam’s GDP per capita.

The change was happening before my eyes.

The same can be said for Sri Lanka: it has tremendous potential. If the government can maintain good policies and transparency, the private sector will flourish, thereby creating jobs and opportunities.

Q: Is there an ADB initiative or project in Sri Lanka that you are particularly excited about or believe will have a transformative impact – and if so, what is it?

A: Having spent many years in the power sector, I’m excited about power sector reforms. I recognise that it’s not an easy task but if successful, electricity tariffs can be reduced through renewable energy.

If the renewable energy potential can be harnessed economically, particularly through private investment, there may be new opportunities such as regional power trade or for Sri Lanka to become a regional powerhouse for green hydrogen.

I’m equally excited about our proposed support for the tourism industry, which is important for economic growth, foreign currency earnings, SME development, environmental protection, gender equality and social inclusion.

I am also interested in how we can support the government’s efforts to revamp the education system as well as agriculture modernisation.

Q: Finally, what is your vision for future ADB engagements in Sri Lanka? And what outcomes do you hope to achieve during your tenure here?

A: The ADB sees economic stabilisation through strengthening public financial management and governance as the priority for our assistance to Sri Lanka, as well as promoting private sector development while ensuring inclusive growth.

Our modus operandi will shift from financing projects to supporting relevant reforms through problem-based learning (PBL).

This requires the ADB to change the way it works. I want to be able to mobilise the best specialists we have internally and tap into our extensive professional network to provide world-class advice to the government.

The outcomes I hope to achieve are the successful and irreversible execution of reforms, and for the government to view the ADB not merely as a bank that provides financing, but also a knowledge partner who provides tailored solutions to strengthen the fundamentals of the economy and society.