COMMERCIAL BANK

THE MARKET

Sri Lanka’s banking sector is highly competitive, comprising licenced commercial and specialised banks serving the retail, SME, corporate and trade segments. Large state owned banks such as Bank of Ceylon and People’s Bank dominate on scale, while private and foreign banks compete on rates, digital innovation and convenience.

Amid this competition, Commercial Bank has maintained its leadership as the largest private sector bank by assets, deposits and loans, driven by customer trust, operational excellence and disciplined risk management.

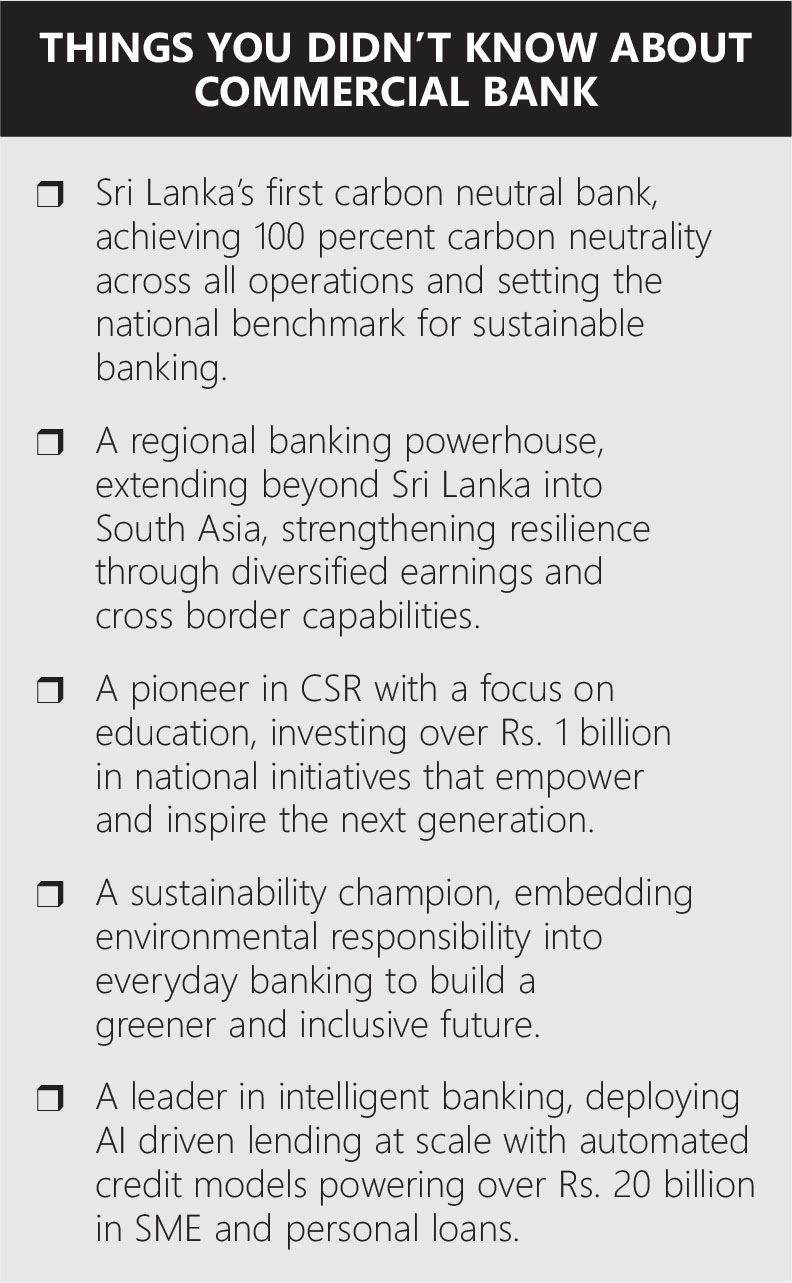

Its regional presence across Asia – including Bangladesh, the Maldives, Dubai and Myanmar– enhances resilience, diversifies earnings and strengthens its position as Sri Lanka’s most influential private banking institution.

ACHIEVEMENTS

Commercial Bank translates scale into unmatched reach and convenience. It has the largest private sector branch and ATM network in Sri Lanka, robust card issuance and acceptance, and sustained investment in digital and physical infrastructure. It became the first Sri Lankan bank to surpass US$ 1 billion in market capitalisation, demonstrating strong investor confidence.

Its focus on SMEs has made it the largest lender to small and medium enterprises for five consecutive years, while its retail and corporate offerings continue to expand. Digital adoption is a key strength with ComBank Digital, QR based payments and global payment partnerships delivering secure, multi-channel banking.

Recognitions include Best Bank in Sri Lanka, and Best SME Bank by Global Finance and Euromoney, FinanceAsia Best Bank of the Year for 14 consecutive years, and accolades from LMD as a Most Loved, Most Respected and Most Awarded corporate entity.

These achievements reflect the bank’s leadership, customer trust and sector dominance.

HISTORY

Commercial Bank traces its roots to 1920, when Eastern Bank opened a branch on Chatham Street in Colombo, marking the beginning of a century long banking legacy.

In 1969, Commercial Bank of Ceylon was incorporated with Eastern Bank as a stakeholder, followed by local expansion with its first branches in Galewela and Matale in 1972. Strategic acquisitions and the establishment of an Offshore Banking Centre in 1979 strengthened capabilities.

The 1980s and ’90s focussed on institutional growth and technology adoption, including the formation of the Commercial Development Company (1980), relocation of its head office to Sir Razik Fareed Mawatha (1984), ATM introduction (1990) and implementation of core banking software (1993).

Service innovation continued with the launch of internet banking in 2000, the 100th branch in 2001 and the 200th branch in 2011. Regional expansion began with the acquisition of Crédit Agricole Indosuez’s Bangladesh operations in 2003, later extending to subsidiaries in the Maldives and Myanmar.

Approaching its centenary in 2020, Commercial Bank became Sri Lanka’s first carbon neutral bank, launched ComBank Digital, and introduced innovations such as the ComBank Q+ app and Flash – the first multilingual digital banking app.

In 2024, the brand evolved its logo to reflect commitments to sustainability, inclusivity, governance and eco-friendly banking, alongside launching its first DigiZone experience centre to showcase the bank’s digital ecosystem.

THE PRODUCT

The bank offers a comprehensive banking ecosystem built around security, convenience and financial progress. For retail customers, it provides savings and deposit solutions for financial stability, personal lending for milestones, card based payments for daily convenience, and digital platforms for fast and secure self-service.

For SMEs and corporates, services include trade finance, working capital solutions, cash management and merchant services, enabling growth with confidence. Its digital first approach, combined with extensive physical reach, ensures accessibility and reliability.

The defining feature of the bank’s offerings is balance: merging the stability of a trusted institution with the innovation of modern banking. Commercial Bank delivers end-to-end solutions tailored to individuals, families, entrepreneurs and exporters, creating secure, convenient and progressive banking experiences across all customer segments.

RECENT DEVELOPMENTS

Commercial Bank continues to lead Sri Lanka’s digital banking transformation. It became the first local bank to enable Google Pay for Visa cardholders, providing secure tap and pay convenience globally. ComBank Digital has expanded capabilities, offering bill payments, multi-channel account servicing and seamless day-to-day banking via secure self-service journeys.

The bank introduced Sri Lanka’s first AI powered SME Credit Underwriting Solution, improving credit assessment efficiency, turnaround times, and access to finance for small and medium enterprises. QR based payments and growth of the merchant ecosystem have also strengthened cashless adoption and card usage.

Other innovations include ComBank Q+, Flash (Sri Lanka’s first multilingual banking app), and enhancements to card and payment services. These developments demonstrate the bank’s commitment to scalable convenience, technology driven inclusion and customer empowerment, while maintaining trust, stability and reliability that underpin its leadership.

PROMOTION

Commercial Bank’s promotion strategy extends beyond the traditional above the line (ATL) and below the line (BTL) model to a more data driven, MarTech enabled approach. While high impact mass media continues to reinforce trust, leadership and credibility, communication is increasingly shaped by customer insights, behavioural data and performance analytics, to ensure relevance, efficiency and measurable impact across segments.

A strong digital and MarTech foundation anchors engagement with modern consumers, particularly younger and digitally active audiences. Social and digital platforms are leveraged for education, product storytelling, personalised messaging, interactive campaigns and real-time engagement.

Content strategies are informed by data and customer journeys, enabling more meaningful conversations and stronger conversion. This narrative is further supported by brand ambassadors cricketer Matheesha Pathirana and athlete Tharushi Karunarathna, who embody progress, aspiration and confidence – they help humanise the brand while keeping data and insight at the core of decision making.

At the ground level, Commercial Bank complements its digital strength with a robust physical presence through branch led activations, merchant partnerships, POS visibility and participation in national events. Long-standing involvement in national sports such as cricket and rugby strengthens emotional connection, unites communities and nurtures national pride.

This integrated insight led promotional approach ensures the brand remains visible, relevant and inclusive across all socioeconomic strata, positioning Commercial Bank as a trusted, accessible and future ready financial partner.

BRAND VALUES

Trust sits at the core of Commercial Bank’s brand values, earned through honesty, integrity, and a long-standing record of stability, transparency and dependable service. The bank strives to earn and retain stakeholder trust through transparent actions that align with their values.

Customers choose a bank to safeguard their finances and support their ambitions, and Commercial Bank positions itself as a reliable partner that fulfils this responsibility with fairness and accountability in every interaction.

Customer centric service is another defining pillar: the bank focusses on reducing friction, enhancing responsiveness, and delivering meaningful experiences across branches, digital platforms and self-service channels. Integrity and strong governance guide all decisions, reinforcing credibility with regulators, investors and customers alike.

Sustainability is at the core of everything Commercial Bank does. It drives the bank’s business model, strategy and operations, linking growth to long-term social, economic and environmental value. Innovation is applied with purpose, making banking simpler, safer and more accessible while supporting sustainable outcomes.

Performance and professionalism underpin leadership, ensuring efficiency, consistency and quality. Responsible citizenship connects growth to community development, national progress and inclusive access to financial services, ensuring that Commercial Bank delivers responsible, equitable and enduring impact.