Biz confidence has nosedived. And we may have to tighten our seatbelts and prepare for a hard landing when businesspeople take cognisance of the budget proposals presented in parliament on 13 November.

BUSINESS CONFIDENCE IN A TAILSPIN

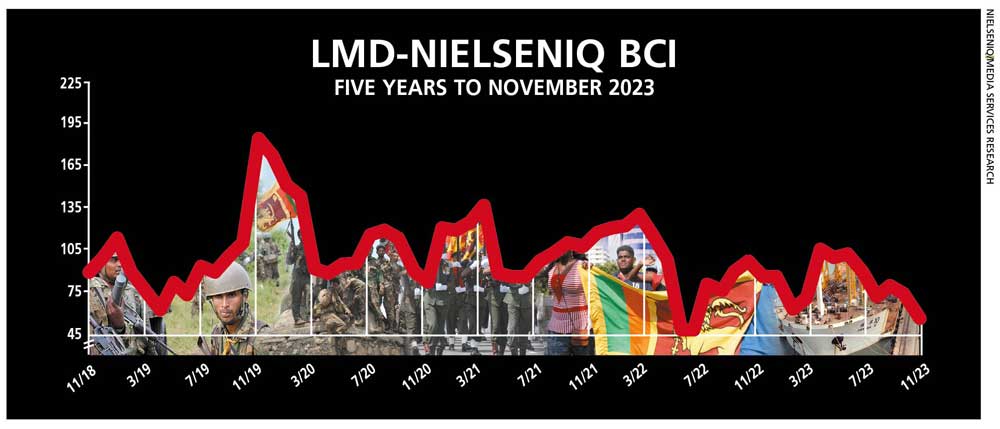

Sri Lanka’s one and only barometer of biz sentiment plummets to a 15 month low

For the time being, we note that Fitch Ratings has raised concerns about the proposals, asserting that the targets outlined in the budget – particularly the revenue projections and fiscal deficit – may prove challenging to achieve even if the anticipated economic recovery in the coming year materialises.

Additionally, Fitch forecasts modest economic growth of 3.3 percent for 2024, which suggests that an economic recovery might be more restrained than initially anticipated.

Meanwhile, the Executive Director of Verité Research Dr. Nishan de Mel has characterised the budget as another fairy tale, emphasising that the revenue promises lack a solid foundation. He urged private sector associations to take the lead in professionalising tax compliance, budgeting and planning.

In contrast however, the Ceylon Chamber of Commerce views Budget 2024 as a pivotal step in sustaining the macroeconomic stabilisation measures initiated in late 2022.

THE INDEX Amid such developments, the LMD-NielsenIQ Business Confidence Index (BCI) plummeted by 17 basis points in November to register 58 – from the preceding month’s 75.

THE INDEX Amid such developments, the LMD-NielsenIQ Business Confidence Index (BCI) plummeted by 17 basis points in November to register 58 – from the preceding month’s 75.

While the biz barometer has exhibited a degree of volatility in its trajectory, the sudden free fall in its fortunes tells a story of a nation on edge. This marks the first instance since July last year that the index has fallen below the 60 basis points threshold.

So the BCI is now at a 15 month low – and it is heading back to where it was in the dark days and months at the height of the national crisis amid the aragalaya mid last year.

SENSITIVITIES The looming increase in value added tax (VAT) by an additional three percent (to 18%) from 1 January is at the top of the pile of sensitivities that could drive business confidence in the near term.

In addition, Sri Lanka’s fiscal goals present a challenging landscape as the projected primary account deficit of 0.6 percent of GDP contrasts with the IMF’s requirement to achieve a primary surplus of 2.3 percent by 2025 – with a mandate to reduce the debt to GDP ratio to 95 percent by 2032.

On the external front, the ongoing wars in Ukraine and Gaza continue to undermine any prospect of a global economic revival; and this in turn is affecting our exports – particularly the crucial apparel industry.

PROJECTIONS The fact that the business community’s verdict on Budget 2024 is pending (as the November survey was conducted in the first week of the month – i.e. ahead of the budget presentation), next month’s outcome could paint an even darker picture of how corporates perceive the outlook for 2024.

And as we prepare to ring in the New Year, the doom and gloom that surrounds elections in this country may reappear on the horizon together with a resurgence of political instability – and potentially, uncertainty about the outcome of the polls.

We are bracing ourselves for a year of turbulence.

– LMD

This content is available for subscribers only.