BUSINESS SENTIMENT

Sri Lanka’s manufacturing Purchasing Managers’ Index (PMI) improved to 67.3 in June, reflecting a month on month increase of 18 index points with the Central Bank of Sri Lanka attributing this to a “normalising of economic activities in the country following the complete relaxation of restrictions for mobility.”

SILVER LINING AMID THE GLOOM

Business confidence seems to have regained its footing despite the challenges

The Central Bank notes: “This increase in manufacturing PMI is underpinned by the significant improvement in production, new orders and employment, especially in the manufacturing of food and beverages, and textiles and wearing apparels subcategories, where many respondents highlighted that their factories were operated throughout the month of June, receiving more new orders than in the previous month mainly supported by the local demand.”

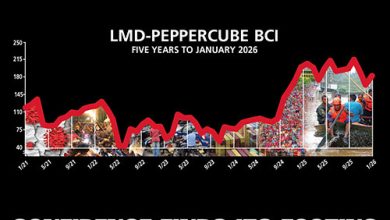

As for the latest LMD-Nielsen Business Confidence Index (BCI), there are emerging signs of stability – albeit changeable, should there be further spikes in the count of COVID-19 cases here in Sri Lanka.

THE INDEX The BCI has remained more or less the same, recording an increase of one base point from the previous month to 97 in July.

This marks an improvement compared to the corresponding month of last year when the index stood at 74. But the BCI remains well below its 12 month and all-time averages of 119 and 127 respectively.

Nielsen’s Director – Consumer Insights Therica Miyanadeniya comments: “Sentiment seems to be stabilising as civilians and businesses slowly begin to operate as ‘near normal’ as possible. Although businesses are not fully operational and some continue to run at a lower capacity than usual, civilian lives have more or less adjusted to ‘life with COVID’.”

Furthermore, she observes that “as big businesses count their losses and make plans to mitigate their losses, many smaller companies and SMEs are on the verge of closing down. Amidst this turbulence, election fever is also hotting up, and people have to grapple with sustaining their lives and listening to all the propaganda by politicians.”

SENSITIVITIES Much like last month, the impact of the coronavirus is deemed to be the most pressing issue for business today. Meanwhile, political instability is also cited as a major corporate concern – which is brought to the forefront with an election on the horizon – as are high taxes and inflation.

COVID-19 remains the most pressing national issue as well with biz executives also voicing concern over the economy and insufficient per capita income.

PROJECTIONS Miyanadeniya points out that “with an election around the corner and the fear of a second wave of coronavirus looming like the Sword of Damocles over our heads, the future of the index is very unpredictable.”

She adds: “If a second wave does materialise and the country is plunged into despair once again, it is likely that the index will plummet. On the other hand, if the country is able to effectively curtail the virus, the BCI may continue to rise.”

We’re inclined to add that no matter what the election outcome turns out to be, the mere fact that there will be political continuity for the next five years may well see the BCI heading north – subject to ‘what’s next’ on the COVID-19 front, of course.