BUSINESS SENTIMENT

BIZ CONFIDENCE INCHES UP AT END 2017

The business confidence gauge remains intact for the time being ahead of more elections

In early December, Sri Lanka formally handed over the Hambantota Port to China on a 99 year lease despite criticism that the move could lead to an erosion of the country’s standing as a sovereign state.

The southern port has incurred heavy losses in the past, and the joint venture between Chinese state controlled entities and Sri Lanka Ports Authority (SLPA) is part of the government’s efforts to pay down the nation’s massive debt.

Speaking at the handing over ceremony, Prime Minister Ranil Wickremesinghe asserted that following the agreement, “Hambantota will be converted to a major port in the Indian Ocean … There will be an economic zone and industrialisation in the area, which will lead to economic development and promote tourism.”

A few days prior, the IMF agreed to release a fourth tranche of US$ 251.4 million under its Extended Fund Facility (EFF) to Sri Lanka.

While maintaining that monetary policy must focus on easing inflationary pressures and high credit growth, the IMF commended the authorities’ moves to implement economic reforms, undertake fiscal measures to increase government revenue, extend the foreign exchange market, build up reserves, realise greater exchange rate flexibility and achieve quantitative performance criteria set under the EFF.

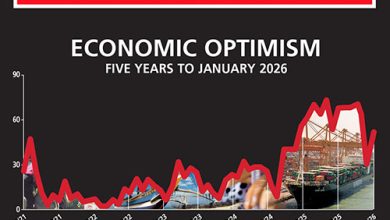

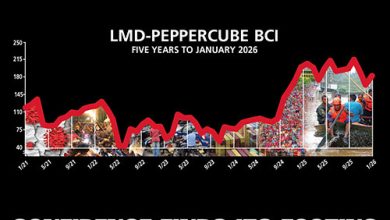

This sense of optimism is reflected in the latest LMD-Nielsen Business Confidence Index (BCI) with the barometer continuing to head upwards following the 13 point increase in November – that was in the immediate aftermath of the budget presentation.

THE INDEX The BCI inched up to 122 in December from 119 in the previous month. This means that from a level of 99 in September 2017, the index has climbed up by more than 20 points over the course of three months.

Accordingly, biz confidence is now slightly higher than its average over the last 12 months (118) and also where it was a year ago (117).

“A mixed response to the budget continues amongst business leaders and citizens in general. While some stakeholders have called for a reversal of specific taxes, others including the IMF have appreciated the changes,” observes Nielsen’s Managing Director Sharang Pant.

He continues: “While macro indicators continue to come under pressure, communications by the government on its intentions for Vision 2025 and the budget engagement have pushed sentiment up. It remains to be seen how this sentiment translates into investment and growth, pushing up growth early in 2018.”

THE ECONOMY The outlook for the economy sees a marginal improvement with one in five (up from 18% in November) respondents stating that the economy will advance in the coming 12 months.

A corporate executive reveals: “We speak to a lot of customers, and many of them are displaying positive sentiments towards the economy and looking forward to further progress in the coming year.”

Meanwhile, close to a third of those surveyed expect economic conditions to worsen while the majority (50%) continue to believe that the status quo will remain.

BIZ PROSPECTS Sentiment regarding business prospects however, indicates a minor drop compared to the previous month – 28 percent of respondents feel that their business prospects will improve in the next 12 months compared to 33 percent in November.

Moreover, only 22 percent (versus more than a third in the prior month) of those consulted feel that the first quarter of 2018 will deliver an uptick in sales volumes. This could be attributed to corporate anxiety regarding inflationary trends and how the new taxes are likely to impact profitability.

One survey respondent laments: “Taxes on our products are very high due to which we have seen a decline in our sales as consumers cannot bear the additional cost. We do not expect this situation to improve in the coming months.”

INVESTMENT The investment climate appears to be improving gradually going by the one in four respondents who call it in the positive range as against 19 percent in the previous month.

To this end, a businessperson points out that “things seem to have opened up a bit and the economy is now more conducive to investment as there are certain tax concessions for investors.” But another respondent disagrees: “Although certain investment projects are taking place in the country… government policies are still not too favourable for local businesses and investors.”

WORKFORCE Slightly under a third (versus 35% in November) of those spoken to by the pollsters say they will look to increase their workforce in the coming six months. Meanwhile, the majority (61%) of corporates say they have plans to maintain existing employee numbers over this period.

SENSITIVITIES As has been the case in recent months, interest rates, inflation and the value of the rupee are among the chief concerns in the corridors of business.

“There are no proper incentives for businesses to invest in the economy. The government needs to start focussing on these issues in the coming year,” cautions a member of the business community.

PROJECTIONS The latest BCI achieves further gains amid a largely warm reception to the government’s fiscal policy brief for 2018.

But as we’ve seen in the past, the state of business in Sri Lanka is intertwined with the political economy. So any developments on this front (the local government elections, for example) could determine the fate of the index in the short term.

In addition, as the recently released LMD 100 special edition notes, Sri Lanka’s corporates could be facing a “profit squeeze” and there’s evidence of this in the listed company results for the July-September quarter.

We’re betting on a downturn so to speak in the face of dirty politics raising its ugly head – yes, again!