BUSINESS SENTIMENT

Sri Lanka’s internal affairs are heating up with critical agreements pending regarding debt restructuring. The government however, is confident that the process will be completed in time for the release of the third IMF tranche in June.

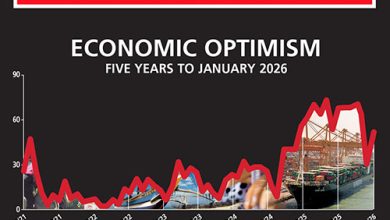

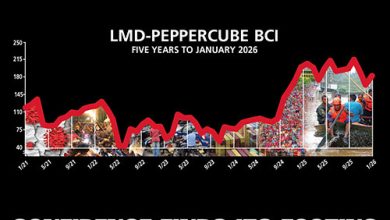

INDEX CLIMBS TO AN 11 MONTH HIGH

Business confidence spikes for a third consecutive month to nearly three digits

President Ranil Wickremesinghe announced that the country has initiated formal economic stabilisation and recovery programmes, and says he expects to conclude all negotiations by mid-year, emphasising the ultimate objective of debt restructuring to reduce our borrowings to 95 percent of GDP by 2032.

There are also some positives to savour: the Central Bank of Sri Lanka reported that official reserve assets surged by 9.6 percent to US$ 5.4 billion in April; and the Sri Lankan Rupee continues to gain ground against other currencies.

Against this backdrop, the National Election Commission announced that the presidential election will be held between 17 September and 16 October.

THE INDEX For the third consecutive month, the LMD-PEPPERCUBE Business Confidence Index (BCI) has shown steady but tepid growth, reaching the 99 point threshold in May (vs. 96 in April).

Despite this improvement, the index still falls short of its all-time average of 123. However, it’s only three points below its marker from a year ago – when ironically, the IMF instigated domestic debt optimisation (DDO) plan was mooted.

PepperCube Consultants attributes the ongoing positivity to cautious optimism regarding the economy, resulting in a slight inclination towards maintaining sales volumes over the next 12 months.

It says this shift indicates a sense of stability with the corporate sector adopting a cautious yet positive attitude towards economic and business prospects.

SENSITIVITIES The ground reality however, is that the business community is still wrestling with critical indicators such as the cost of doing business (despite inflation being in the low single digits), and the tax and interest rate regimes.

Amid such difficulties, the IMF maintains that the global economy exhibits remarkable resilience with steady growth and a notable deceleration in inflation.

It characterises the global economic journey as eventful, beginning with supply chain disruptions in the pandemic’s aftermath, followed by an energy and food crisis stemming from Russia’s war in Ukraine – and subsequently, a surge in inflation, leading to a globally synchronised tightening of monetary policy.

PROJECTIONS It is an undeniable fact that following the announcement of a time frame for the presidential election, the turbulence that uncertainty creates is set to become even rockier.

And while many key indicators point towards a smooth landing for the world economy, the local equivalent is perched on a cliff edge with a heady mix of the good (pre-election relief for the people perhaps), the bad (should the debt restructuring process not be finalised in time for the release of IMF funds) and the ugly (an election outcome that threatens to undo the progress made since the economic crisis infolded in early 2022).

So the index, like the economy, could rise or fall!