As with each year, the national budget for the next fiscal term comes into focus on 12 November when the proposals are presented in parliament. This year, Budget 2022 will be in focus even more so given the nation’s debt and fiscal situation.

POLICY

CONTINUITY

THE NEED OF THE HOUR

Shiran Fernando discusses the priorities for the forthcoming budget in the context of the prevailing economic landscape

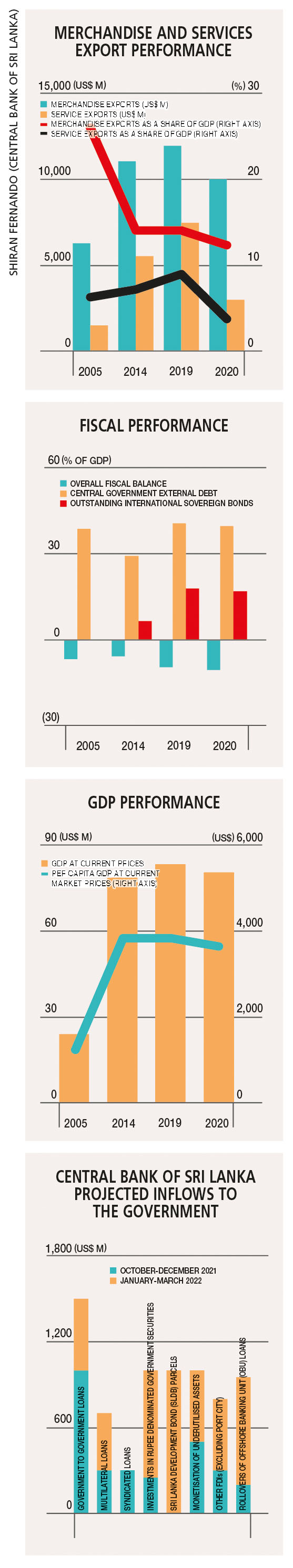

The growing trade and fiscal deficits, depleted reserves and lack of dollars in the market are some of the issues the government faces.

In such a scenario, the finance minister will have to present a budget that is practical but also realistic and can solve some short-term challenges while setting the foundation for the country’s medium to long-term development needs.

FINANCIAL ROAD MAP Against the backdrop of the budget is the six month road map presented by the new governor of the Central Bank of Sri Lanka (CBSL) on 1 October.

FINANCIAL ROAD MAP Against the backdrop of the budget is the six month road map presented by the new governor of the Central Bank of Sri Lanka (CBSL) on 1 October.

The governor began by explaining that there is an economic challenge at hand, which has undermined sentiment vis-à-vis the economy’s future trajectory. As a panacea to this challenge, CBSL presented a to-do list of critical steps that it will carry out along with the state banking sector in addressing debt and forex, financial services industry and macroeconomic stability concerns.

While there are several tasks for the policy makers, the road map identified the role of the private sector – particularly the banking sector and exporters – in playing its part in addressing the challenges.

CBSL reversed significant regulations such as the cash margin deposit placed on several consumer goods imposed in September while lifting the ceiling on outward investment and migration allowances. These moves signal a shift in not imposing more capital and current account restrictions but enabling market forces.

However, there was a sharp focus on meeting the dollar shortage by persuading exporters to convert their inflows to meet the shortfall. The road map notes that if exporters do not repatriate and convert dollars, the government would be requested to tax their profits at 28 percent rather than the present 14 percent.

We may see some of these regulations announced in the national budget as well if the shortfall continues.

PROJECTED INFLOWS The government and Central Bank are targeting US$ 4.5 billion in inflows during the fourth quarter of this year and an additional 5.7 billion dollars in the first quarter of 2022.

These are optimistic forecasts but they underscore the level of inflows required to meet the debt outflows. In January for example, Sri Lanka will need to refinance US$ 500 million while in July, one billion dollars will mature. In between, there will be both bilateral and multilateral debts to service.

The inflows expected in the last quarter of this year revolve around US$ 1 billion in government to government loans, one billion dollars in swaps with other central banks and 500 million dollars in inflows from the sale of underutilised assets.

As for the remainder, they comprise smaller parcels of inflows from multilateral agencies (US$ 300 million), syndicated loans (300 million dollars) and foreign direct investments (US$ 300 million).

Additionally, CBSL is expecting to see foreign inflows of 250 million dollars to the local Treasury bill and bond market.

To incentivise such flows, the monetary authority is looking to provide a depreciation hedge to foreign bondholders so that they’re not adversely impacted should the Sri Lankan Rupee depreciate against the US Dollar when they repatriate their investments.

BIZ FRIENDLY BUDGET The road map mentions that the government is expected to announce a business friendly budget and also that it will be investor friendly.

While this remains the CBSL’s objective, the government will need to identify avenues to raise fresh tax revenues to meet the budget deficit shortfall.

It is difficult to see more relief being provided given the reduction in corporate tax rates and VAT prior to the pandemic. As such, there could be some changes in terms of rates, the threshold of existing tax mechanisms and improvements in tax administration to boost government revenue.

Moreover, the budget will have to provide details on how the deficit will be financed, and the role of both domestic and foreign financing in doing so. There will also need to be an emphasis on how the government’s expenditure will make way for a swifter post-pandemic recovery but keep overall expenses in check.

The space to provide additional incentives to bolster exports and FDIs may be limited but should be prioritised where possible given that this is the more medium to long-term solution in terms of mitigating our debt concerns.

POLICY CONTINUITY The finance minister is aware of the challenges at hand as he prepares for his maiden budget speech. In parliament in September, he conceded that “our country is facing a severe foreign exchange crisis,” as well as a domestic one with falling revenue and rising expenses.

Against this backdrop as well as that of the monetary road map announcement, the budget will need to ensure policy continuity with a sharp focus on implementation.

This content is available for subscribers only.