BANKING SECTOR

The local banking sector has endured one of the most turbulent chapters in its history. The 2022 financial crisis forced banks into survival mode as liquidity shortages, a sovereign default and inflationary pressures dominated the landscape.

CAPITAL ADEQUACY

Compiled by Yamini Sequeira

THE NEXT BANKING CHAPTER

Dr. Harsha Cabral believes that banks will drive post-economic crisis growth

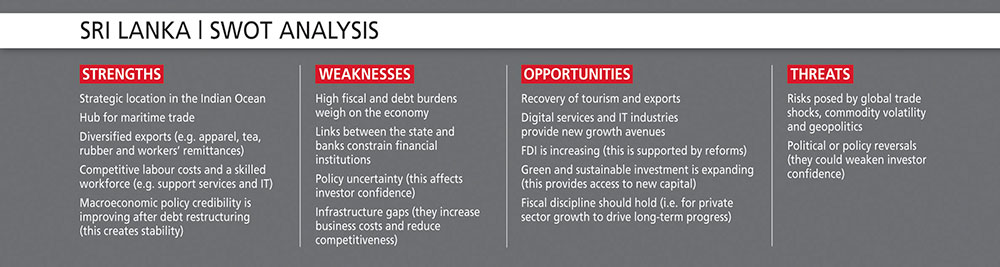

Today, with the economy beginning to stabilise, the role of banks is shifting rapidly from being crisis managers to catalysts of recovery and long-term growth. With the immediate shock of the crisis behind them, these institutions are repositioning themselves to actively support the economic recovery.

Dr. Harsha Cabral explains: “Since late 2023, lending portfolios have been recalibrated towards export oriented firms, the SME sector and industries such as tourism that demonstrate strong potential for a quick rebound.”

He continues: “Institutions are also optimising costs by streamlining branch networks while investing heavily in digital channels to ensure uninterrupted customer service delivery.”

REGULATORY FOUNDATIONS “The crisis underscored the urgency of regulatory reform and the Central Bank of Sri Lanka has responded decisively. New rules on prudential norms, governance and digital security have pushed the banking sector closer to global standards,” he asserts.

Cabral notes that “revised capital and liquidity guidelines now require banks to maintain higher Tier 1 ratios, and improve risk weighted asset calculations. These measures are designed to ensure that buffers can withstand future shocks.”

This year, the Central Bank introduced a landmark directive on IT and cyber incident reporting, recognising the systemic risks posed by digital threats.

Cabral elaborates: “Banks have since invested in security operations centres, expanded internal capacity and established rapid incident response mechanisms. This focus on resilience is already bearing fruit, as capital adequacy and liquidity coverage ratios now stand comfortably above minimum thresholds.”

On the part of banks, reforms have also been market driven, he avers. “Loan underwriting standards have tightened, provisioning for non-performing loans has improved and best practices such as the International Financial Reporting Standards (IFRS) are being applied more rigorously.”

Yet, challenges remain for smaller institutions that may struggle with the cost of compliance and technological investments.

MANAGING RISKS “Capital adequacy and risk management are now central to the banking sector’s future. To preserve capital, many banks have retained earnings instead of distributing dividends while others have strengthened their buffers through rights issues or subordinated debt,” he reveals.

Stress testing has moved beyond regulatory mandates to become part of everyday decision making. “Scenario analyses now extend beyond macro shocks to sector specific risks such as climate related events, commodity price volatility and cyberattacks,” Cabral explains.

He also reveals that credit underwriting models have become more conservative while treasury operations are governed by stricter limits on foreign exchange positions. Meanwhile, operational risk management has been enhanced through digitised workflows and more robust business continuity planning.

In his opinion, the shift is as much cultural as it is procedural: “Risk awareness now permeates boardroom discussions and strategic planning in a way that was less visible before the crisis.”

CONSOLIDATION Another major shift is the Central Bank’s road map for consolidation aimed at creating stronger, more competitive banks capable of supporting national growth priorities.

“While valuation challenges and lingering debt restructuring complexities have delayed transactions, the trend is clear. Over the next three to five years, Sri Lanka is expected to move towards a more concentrated banking landscape with fewer but stronger institutions,” Cabral asserts.

He adds that international investors are cautiously reengaging with Sri Lanka, though a sustained appetite for bank equity will depend on macroeconomic stability and regulatory consistency.

“Consolidation however, is widely recognised as inevitable if the sector is to achieve economies of scale and improve competitiveness,” he states.

RESTRUCTURING The sovereign bank nexus remains one of the most notable risks for the sector, he cautions, adding that “banks hold large volumes of government securities – meaning fiscal stress directly impacts their balance sheets. Debt restructuring initially created uncertainty but its successful conclusion has restored clarity and confidence.”

He notes that “this shift has enabled banks to gradually rebuild foreign credit lines and strengthen liquidity. Fiscal consolidation has also reduced the government’s reliance on domestic borrowing, freeing up capacity for private sector credit.”

“Although businesses are still deleveraging and credit demand remains cautious, falling inflation and declining interest rates are creating space for lending to recover,” Cabral adds.

The focus is on financing sectors with strong repayment capacities and growth potential – such as exporters and SMEs – while avoiding a repeat of pre-crisis vulnerabilities.

Meanwhile, digital transformation has accelerated across the sector. With cost rationalisation a pressing concern, banks have embraced online channels to maintain customer service at lower costs.

In addition, the Central Bank’s emphasis on cyber resilience has encouraged institutions to invest in digital security.

ECONOMIC REFORMS The IMF’s Extended Fund Facility (EFF) has been a critical anchor for the banking sector. Its conditions – i.e. fiscal consolidation, structural reforms and macroeconomic stability – have created a safer banking environment.

“The programme’s monitoring and technical assistance have encouraged stronger disclosure, and improved public finance management and supervisory practices, which benefits governance,” Cabral emphasises.

What’s more, he says that “crucially, the IMF’s backing has lent credibility to the reform agenda, boosting investor confidence and reducing tail risks. Foreign direct investment (FDI) is beginning to return with the Board of Investment (BOI) reporting commitments in manufacturing, services and IT enabled activities.”

Although global capital flows remain mixed, Sri Lanka is positioned to benefit from its economic reopening, competitive wages and policy clarity, he maintains: “For banks, this presents an opportunity to channel financing into sectors that can generate sustainable foreign exchange and drive growth.”

Sustainability is also climbing higher on the agenda.

To this end, Cabral opines that “as global environmental, social and governance (ESG) trends reshape investor expectations, banks are expected to play a leading role in green lending and sustainable finance initiatives. This will not only align the sector with international benchmarks but also contribute to a broader transformation of the economy.”

“Looking ahead, the sector’s strategic priorities are clear. Strengthening capital and liquidity buffers remains non-negotiable as resilience to systemic shocks underpins stability. Equally critical are digital transformation and cyber resilience, requiring continuous investment and innovation,” he muses.

Supporting SMEs and export oriented sectors will also define the banking sector’s role in the real economy, alongside the promotion of sustainable and inclusive finance.

“Governance, transparency and risk awareness must remain embedded across all levels of decision making. At the same time, banks will need to manage profitability through cost optimisation and selective consolidation,” he emphasises.

Cabral concludes: “Banks will increasingly act as facilitators of reallocation – i.e. funding viable businesses, financing trade and exports, and supporting digital financial inclusion. This path will define the sector’s evolution in a post-crisis economy.”