APPAREL INDUSTRY

GLOBAL OUTLOOK

COMPILED BY Yamini Sequeira

SHIFTING THREADS OF TRADE

Hasitha Premaratne calls for visionary policies to navigate export challenges

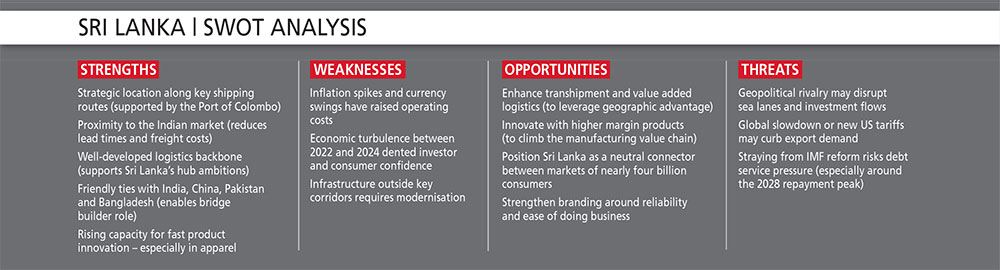

Sri Lanka’s apparel industry stands at a critical juncture shaped by global trade dynamics, tariff uncertainties and intensifying geopolitical challenges. Traditionally anchored in the US and European markets, the industry is being forced to chart new pathways to remain competitive and pursue growth.

“Recent geopolitical shifts and tariff uncertainties have underscored the imperative to diversify export destinations. Europe remains a promising avenue, supported by Sri Lanka’s Generalised Scheme of Preferences Plus (GSP+) status – a crucial duty-free concession that currently extends until 2027 with hopes of an extension,” notes Hasitha Premaratne.

He adds: “Beyond Europe, Asia’s growing economies – particularly India and China – represent significant potential.”

However, he avers that penetrating the Chinese market remains complex: “Sri Lanka faces stiff competition from numerous peripheral suppliers to China, limiting easy access. Conversely, India emerges as a more accessible alternative – especially for segments such as lingerie and sportswear – where demand is rising.”

While efforts over recent years have increased engagement with Indian customers, the prevailing annual duty-free quota of a mere eight million pieces poses a severe bottleneck, constraining export volumes despite strong demand.

“This quota limitation necessitates accelerated government-to-government negotiations to raise the threshold and unlock the full potential of the Indian domestic market. The private sector remains actively involved, engaging through joint apparel associations and industry bodies, to advance proposals and influence policy dialogue,” he reveals.

Premaratne adds: “While progress has been steady, finalising agreements remains a work in progress, underscoring the importance of sustained political will and diplomatic momentum.”

UNCERTAINTY REIGNS The US remains Sri Lanka’s largest apparel export market; however, uncertainty surrounding tariff regimes and preferential access has led to notable operational risks.

“As of June, delays and ongoing negotiations have created a fragile environment where neither buyers nor manufacturers are willing to commit to new investments or relocations,” Premaratne laments.

The lack of clarity and permanence regarding tariff rates continues to deter international apparel supply chains from reconfiguring.

On the other hand, he acknowledges that this status quo has “paradoxically benefited Sri Lanka, particularly as political upheaval and instability in competitor countries such as Bangladesh have redirected some brand investments and orders towards Sri Lanka and India.”

This dynamic underscores a strategic opportunity for Sri Lanka to capitalise on regional shifts – provided that policy and infrastructural support is forthcoming.

STRATEGIC PRIORITIES Looking beyond immediate trade disputes, the apparel industry recognises the importance of long-term strategies focussed on productivity and competitiveness.

Premaratne explains: “Reducing the cost per unit through enhanced operational efficiencies is paramount. This includes minimising wastage across supply chains, streamlining organisational structures and reducing cycle times – i.e. measures that collectively improve price competitiveness. Moreover, logistical infrastructure also plays a vital role.”

Port efficiency, especially at the Port of Colombo, is a key differentiator. Improvements in this area can reduce shipping times and costs, enabling Sri Lankan manufacturers to offer more agile and customer centric solutions that outpace competitors lacking such advantages.

“Three areas are especially critical to mitigating the impact on the industry. Resolving US tariff issues swiftly remains the foremost priority to restore confidence and facilitate investment. The next imperative is accelerating FTAs, particularly with India, by lifting quota restrictions and ensuring meaningful duty-free access, which is essential for market diversification,” he recommends.

In Premaratne’s view, energy cost stability is also crucial: “Predictable and stable energy pricing underpins operational planning and cost management, thereby boosting competitiveness.”

He notes that “encouraging innovation through R&D is gaining traction,” adding: “Tax incentives or relief to spur investments in research and development could position Sri Lanka as a hub for product and process innovation within the apparel industry.”

The apparel industry has faced challenges with talent migration, particularly between 2022 and 2024. However, recent foreign visa restrictions and improving domestic economic conditions have considerably slowed this trend.

As a result, migration pressures have eased to some degree, enabling companies to focus on optimising internal structures rather than constantly recruiting new staff.

He observes: “In response, many firms have adopted transformational plans that streamline organisational hierarchies, enhance productivity and foster output driven cultures, compensating for reduced workforce availability.”

OPTIMISING CAPACITY “As for industry infrastructure, there is cautious optimism about new export oriented zones under development in areas such as Eravur,” Premaratne notes.

“However, the importance of optimising existing zones in Biyagama, Katunayake and Avissawella is essential – particularly by enhancing water supply and effluent management systems critical for fabric manufacturing,” he adds.

Premaratne also says that increasing resource availability and efficiently utilising vacant industrial plots could expand production capacity. While the proliferation of zones is not seen as necessary everywhere, a focus on maximising existing assets aligns better with sustainable growth.

On the industry’s reputation for sustainability he opines: “Sri Lanka’s apparel industry is widely regarded as a leader in sustainability relative to regional competitors. Yet challenges remain, particularly in water management infrastructure. Enhancing water treatment and reuse capabilities within industrial zones will be critical to maintaining the country’s green credentials and meeting international buyer expectations.”

The apparel industry remains acutely aware of the broader geopolitical landscape. Tensions across Asia – from India-China relations to regional instability involving Bangladesh and Pakistan, as well as Sino-US trade frictions – have led to unpredictable backdrop.

“These factors add layers of complexity to supply chains and trade flows, requiring constant vigilance,” he cautions.

Economic outlooks in key markets also present risks. There’s growing concern about a potential economic slowdown or recession in the Untied States next year, which would impact export volumes. And Europe, including the UK, continues to grapple with economic headwinds that may lead to volatility.

Such external risks compound internal challenges but also reinforce the imperative for Sri Lanka’s apparel industry to build resilience through diversification, efficiency and innovation.

“Sri Lanka’s apparel industry is navigating a uniquely complex era of trade uncertainty, geopolitical shifts and evolving buyer demands. While challenges – from tariff disputes and quota limitations, to talent migration and infrastructure constraints – abound, there are clear avenues for growth and resilience,” he muses.

Premaratne explains: “Success will depend on proactive government and industry collaboration, to resolve trade and tariff access issues, investments in productivity and infrastructure, and a sustained commitment to innovation and sustainability.”