ACL CABLES

RANK 49

“We have fared exceptionally well, leveraging the favourable shift in key economic indicators to deliver our strongest financial performance to date”

Q: As Sri Lanka continues to pursue economic and political stability, how is the corporate sector driving growth while overcoming challenges that persist on many fronts?

A: The corporate sector has demonstrated remarkable resilience and adaptability in navigating the complexities of the past year. At ACL Cables, we witnessed firsthand how stability in the macroeconomic environment directly fuels corporate growth.

2024 marked a significant turnaround, characterised by sustained stability and renewed investor confidence, which allowed businesses to pivot from survival to expansion. ACL has driven growth by capitalising on the revitalised economic landscape, particularly the resurgence of the construction sector, which rebounded notably after a period of contraction.

By aligning our strategies with national infrastructure development and renewable energy initiatives, we have not only solidified our market leadership but also recorded a robust top line revenue of Rs. 17.3 billion for the company.

Overcoming challenges required a focus on operational excellence. We achieved significant efficiencies across our manufacturing and supply chains, optimising processes to deliver superior quality while maintaining cost discipline. Ultimately, the sector is driving growth by embracing innovation, maintaining fiscal discipline and leveraging improved access to financing to restart stalled projects.

Q: How is your group faring against the backdrop of the prevailing macroeconomic milieu?

A: We have fared exceptionally well, leveraging the favourable shift in key economic indicators to deliver our strongest financial performance to date. The stabilisation of the Sri Lankan Rupee, which appreciated modestly against the US Dollar to average 297 rupees in 2024/25, provided crucial predictability in raw material procurement costs, aiding our margin management.

Furthermore, the reduction in benchmark interest rates by the Central Bank of Sri Lanka – amounting to a cumulative 200 basis points – notably lowered our finance costs, directly boosting profitability. Headline inflation remained well within single digits, averaging 2.6 percent, which stimulated credit growth and revived demand for construction and infrastructure activities.

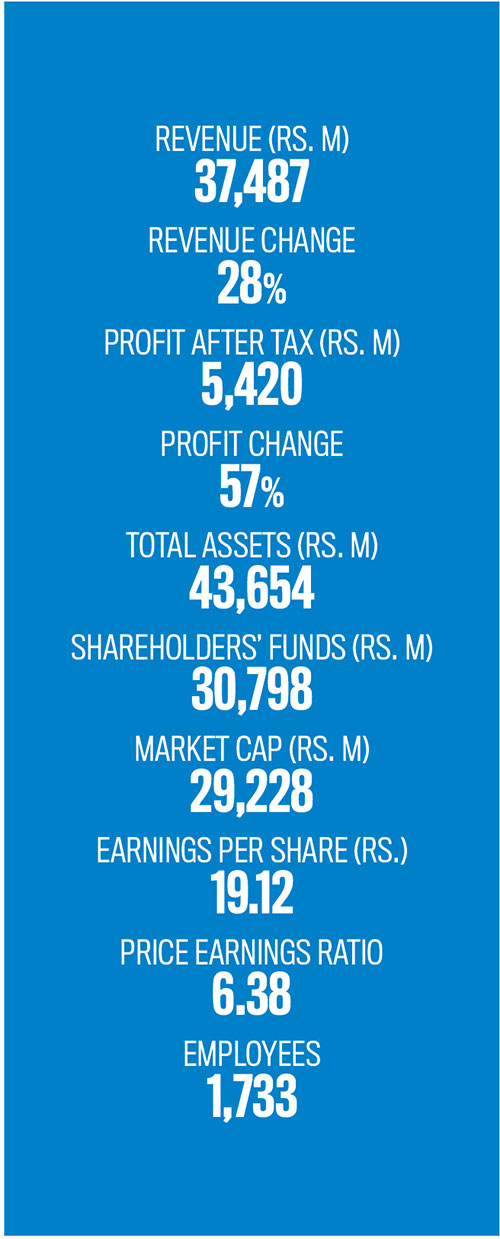

Against this backdrop, the group recorded a revenue of Rs. 37.5 billion, a 28 percent increase over the previous year and a profit after tax of 5.4 billion rupees. This performance underscores our ability to capitalise on macroeconomic stability to generate sustainable returns for our shareholders.

Q: What trends do you observe in your sector – and what have you done as a business to optimise on some of them?

A: Two key trends defining our sector are the accelerated shift toward renewable energy and the global diversification of supply chains. In the renewable energy sector, we observed increased demand for transmission and distribution lines driven by the government’s solar power generation programme.

To optimise this, we strategically invested in Resus Energy, solidifying our presence in the renewable energy value chain, and expanded our own rooftop solar capacity to 4.5 MW across the group.

Additionally, we see a growing trend of foreign clients diversifying their supplier bases. We have primed ourselves to seize this opportunity by expanding our export footprint to markets such as the UK, Sweden and the Maldives.

Our diversified portfolio and adherence to global quality standards have allowed us to substantially grow our export business this year, positioning ACL as a trusted global supplier.

Q: And what are the challenges facing the sector that your organisation is part of?

A: Despite the recovery, the sector faces structural challenges. A primary concern is our heavy dependency on the construction industry, which makes our revenue vulnerable to fluctuations in construction activity and government infrastructure spending.

While the sector has revived, it remains sensitive to policy changes. Additionally, the brain drain poses a threat, leading to a loss of tacit knowledge and expertise essential for productivity and innovation. We also contend with the volatility of global commodity prices, particularly for imported raw materials such as copper and aluminium.

Although the exchange rate has stabilised, the sector remains susceptible to global trade dynamics and tariff structures that can create uneven playing fields. Mitigating these risks requires constant vigilance and agile strategic planning.

Q: How is your group embracing environmental, social and corporate governance (ESG) standards?

A: Sustainability is integrated into our core business strategy. On the environmental front, we are proactively preparing for the adoption of the Sri Lanka Financial Reporting Standards (SLFRS) S1 and S2 standards to enhance our sustainability reporting.

We implemented robust waste management practices, ensuring that plastic scrap is recycled under national standards and that no hazardous solid waste is generated from our cable manufacturing processes. Our commitment to green energy is evident in our solar power initiatives, which help reduce our carbon footprint.

Telephone 7608300 | Email info@acl.lk | Website www.acl.lk