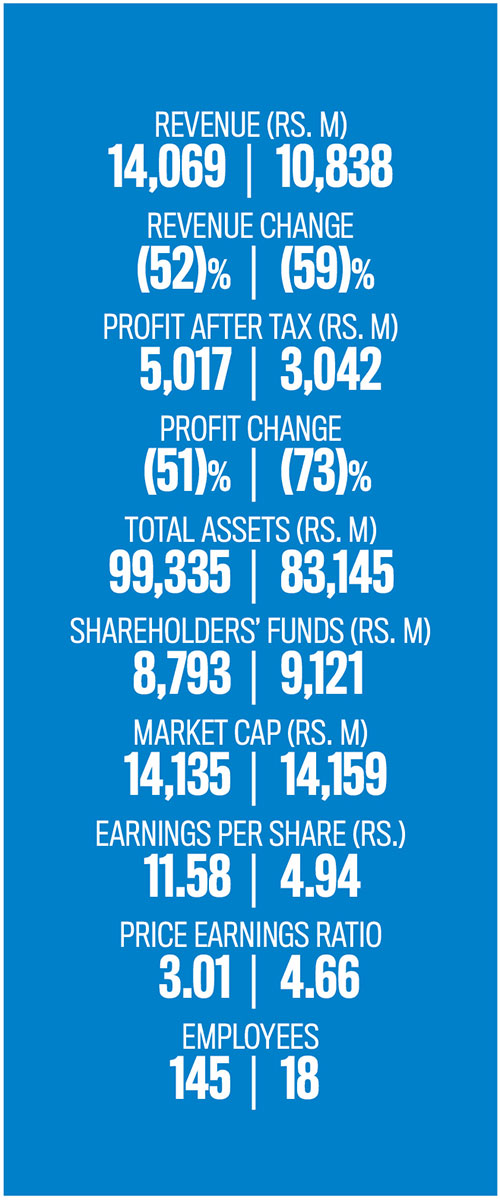

FIRST CAPITAL HOLDINGS | FIRST CAPITAL TREASURIES

RANK 78 | 94

“Sri Lankans are moving from a savings mindset to an investment orientation, driven by stability and lower interest rates”

Managing Director

CEO

First Capital Holdings |

Sachith Perera

CEO

First Capital Treasuries

Q: As Sri Lanka continues to pursue economic and political stability, how is the corporate sector driving growth while overcoming challenges?

Dilshan Wirasekara (DW): With greater political and policy consistency, Sri Lanka has entered a strong growth phase. We’ve now seen six consecutive quarters of growth, averaging five percent, indicating economic recovery.

Corporates are once again ready to invest, as reflected in the quarter on quarter increases in profitability and turnover of companies listed on the Colombo Stock exchange (CSE). Consumer disposable income has also improved and consumption patterns normalised.

Take vehicle imports, for instance – after five years of restrictions, reopening the market released pent-up demand, resulting in a surge of imports that contributed to government revenue.

Overall, policy and political stability have supported economic growth, and corporates are expanding to meet rising consumer demand.

Sachith Perera (SP): From a macro perspective, credit growth in the first nine months of this year exceeded a trillion rupees. A considerable part of this was linked to vehicle imports but we are also seeing strong momentum in the corporate segment.

SMEs – the largest contributor to economic activity – are showing recovery, which is evident from improved non-performing loans in commercial banks. This suggests SMEs are cleaning up their balance sheets and re-accelerating operations. There is positive traction, although more needs to be done to unlock the country’s full economic potential.

Q: What are your company’s goals and objectives for financial year 2025/26?

DW: Our purpose as an organisation is to improve the lives of all Sri Lankans through financial solutions.

For 2025/26, our goal is to create wealth and broaden access to the capital markets nationwide. First Capital is focussed on disrupting the notion that capital markets are a niche segment benefiting a limited audience.

A key element is our digital strategy – we are expanding our digital footprint to increase reach and accessibility. Our aim is for anyone to access investment products seamlessly without visiting a physical branch, offering the same digital convenience that banks provide but within the capital markets ecosystem.

Q: How does your company harness technological advancements – especially in the context of AI?

DW: We are currently developing artificial intelligence enabled models, particularly for client onboarding. The lack of a human presence in digital journeys often causes customers to drop off when they encounter a stumbling block. So we’re building AI into the onboarding process to guide and assist clients.

We’re also exploring AI driven analytics. Much of our work is grounded in data, analysis and research and we’re looking at how artificial intelligence can handle these processes faster and more accurately. AI is gradually being integrated into several areas that are currently carried out manually.

Q: What is your assessment of Sri Lanka’s image risk profile at this juncture?

SP: Sri Lanka has undergone a remarkable recovery since 2022 – arguably, one of the sharpest globally. Consistent political commitment to recovery efforts across administrations has strengthened investor confidence.

Having engaged with several foreign investors recently, I have seen strong interest in Sri Lanka’s opportunities and appreciation for the progress made. Policy continuity has reinforced trust in the system and strengthened the country’s positioning.

While fiscal conditions under the IMF programme remain challenging, the government has stayed on course. The seven percent growth target is ambitious and will require considerable public investment – but even if it is not fully met, the growth trajectory is still positive. Both the government and private sector must leverage this confidence to attract capital and create new opportunities.

Q: What trends do you observe in your sector and how is your business optimising for these developments?

DW: A major trend is the shift in risk appetite. Sri Lankans are moving from a savings mindset to an investment orientation, driven by stability and lower interest rates. With rates now in single digits, investors can no longer rely solely on deposits for attractive returns.

As a result, people are exploring alternative instruments such as unit trust funds, government securities, debentures, securitisations and commercial papers that offer premiums over fixed deposits. Equities have also become attractive – the CSE’s market capitalisation has doubled over the past year, reflecting this move towards higher risk, higher return assets.

Banks have now recognised this trend and set up private wealth management units to cater to capital market products. This represents opportunity and increased competition as new players enter the space. At First Capital, we’re positioning ourselves to capitalise on this trend and capture a larger market share.

Q: How is your company embracing environmental, social and corporate governance (ESG) standards?

A: We are passionate about sustainability – it receives the highest attention at board level and is implemented through the management committee.

We recently appointed a dedicated Head of Sustainability and have embraced 12 of the 17 UN Sustainable Development Goals (SDGs) that align with our business.

We’ve also pursued global certifications and were accepted by the European Organisation for Sustainability Development (EOSD) under the Sustainability Standards and Certification Initiative (SSCI). We are the third company in Sri Lanka – and the only investment bank worldwide – to achieve this certification.

Sustainability isn’t a box ticking exercise or a PR initiative – it’s embedded across everything we do. From supporting local initiatives such as building forest corridors to protecting Sri Lanka’s endemic flora and fauna, we are committed to making a real difference.

Telephone 2639898/2651651 | Email info@firstcapital.lk | Website www.firstcapital.lk