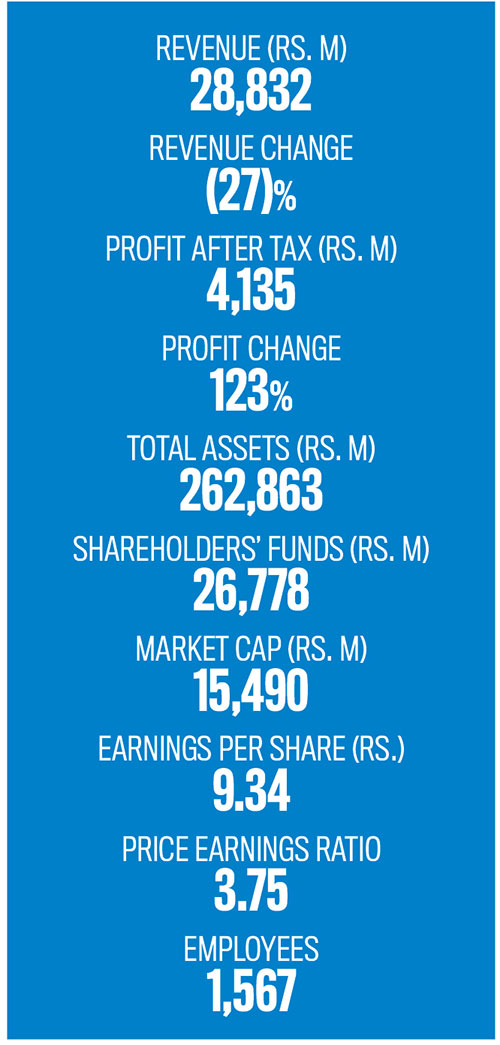

PAN ASIA BANKING CORPORATION

RANK 56

“I believe the renewed confidence and smarter decision making within the business community will turn this recovery into real, lasting success”

Q: As Sri Lanka continues to pursue economic and political stability, how is the corporate sector driving growth while overcoming challenges that persist on many fronts?

A: It’s encouraging to see the corporate sector leading the charge. The sheer strength and determination of local businesses are among the key factors keeping the economy growing. We have moved past a period of simply trying to survive; the focus now is on smart, planned growth.

Although we still face high taxes and the need for companies to reduce debt, businesses are still finding ways to grow. We are witnessing a major shift with companies moving towards export led strategies, increasing local production to reduce import dependency and improving operational efficiencies.

This renewed confidence, reflected in a rise in new investments, is one of the most important drivers – alongside the government’s stabilisation efforts – of economic recovery and job creation.

At Pan Asia Bank, our priority is to act as an engine for credit market growth. Our focus is firmly on SMEs, the real backbone of the economy. They were among the hardest hit and require the most support.

Beyond providing loans, we help them reschedule existing facilities, secure fresh investments and strengthen their financial management capabilities to run businesses effectively.

We are managing this carefully to ensure our growth remains high quality and sustainable. I believe the renewed confidence and smarter decision making within the business community will turn this recovery into real, lasting success.

It’s an exciting time where we as a bank must ensure that the money we lend wisely helps our customers achieve their ambitions.

Q: How is your organisation faring against the backdrop of the prevailing macroeconomic milieu?

A: We are performing well and navigating the economic environment with a clear strategy and plan. Pan Asia Bank is stronger today because we acted early. The landscape has now shifted. Strong policy decisions by the Central Bank of Sri Lanka have created a more stable monetary climate with inflation and interest rates at prudent levels. This is a major advantage for us.

Our funding costs have reduced, enabling us to reset rates on our products; and most importantly, customers are starting to seek new opportunities again. We are taking advantage of this by focussing on safe, quality lending – particularly through secured lending, trade financing and facilities for growth oriented businesses. This balanced approach allows us to benefit from the lower interest rates while avoiding unnecessary risks.

At the same time, we remain vigilant. Our plan is simple and strict: first, maintain rigorous credit assessments for all new lending; second, work closely with customers. I view helping businesses restructure their loans not as a failure but a strategic move that enables good customers to recover and protects our assets in the long run.

With the Sri Lankan Rupee remaining stable, we are also more confident in expanding international business. By managing our finances prudently and leveraging the current low interest rates, we are well positioned to deliver value to shareholders while strengthening the financial security of our customers.

“Our goal is clear: to be the most efficient, technology first, relationship bank of our size”

Q: What trends do you observe in your sector and what have you done as a business to optimise some of them?

A: The banking world is changing rapidly, driven by three major forces: the accelerated shift towards digitalisation; regulatory pressure for larger and stronger banks; and the growing importance of environmental, social, and corporate governance (ESG) factors. Digitalisation is the greatest transformation.

It’s no longer merely about having a mobile app; it is about end-to-end automation that makes our work faster and the customer experience seamless. AI will drive the next wave of disruption – much of which is already in motion.

At the same time, rules about capital requirements and the push for greater efficiency are creating a tougher operating environment for banks. Every bank must either become extremely efficient or specialise in a clearly defined profitable focus area.

Pan Asia Bank’s strategy is designed to succeed in this new environment. We focus on providing personalised, friendly service powered by smart technology.

We have invested extensively in new technologies and integrating artificial intelligence into our business processes to deliver a superior customer experience. By offering special tailored services, we are attracting customers who previously did not bank with us – largely because we are faster and more relationship focussed. Our goal is clear: to be the most efficient, technology first, relationship bank of our size.

Q: What are your company’s goals and objectives for the financial year ahead?

A: Our goals for 2026 are summed up by our focus on high quality smart growth, being technology first while keeping sustainability at the heart of everything we do. Our main financial goal is to grow our asset base at a faster but safer pace – especially in target sectors such as profitable SME lending and export oriented trade financing.

This growth must be complemented by a strong push to significantly reduce our non-performing loan (NPL) ratio. A clean, healthy loan book is best for us, our customers and shareholders.

Operational efficiency is another priority. Our goal is to noticeably lower our cost to income ratio (CIR). We will achieve this by completing major automation projects and ensuring our branches are optimally structured for customers who increasingly prefer digital banking.

Crucially, we are also preparing for the future by planning to strengthen our capital base. This ensures the bank is ready for future expansion and any potential mergers that may arise. In the market, we plan to launch specialised products targeting younger demographics to diversify our deposit base and secure future income.

Ultimately, our ambition is to be recognised as an agile, high performing, customer focussed bank and the most efficient in the sector.

Telephone 4667222 | Email customerservice@pabcbank.com | Website www.pabcbank.com