BALANCING REFORM AND GROWTH

It is essential to sustain reform efforts to mitigate debt vulnerability in the medium term – ADB

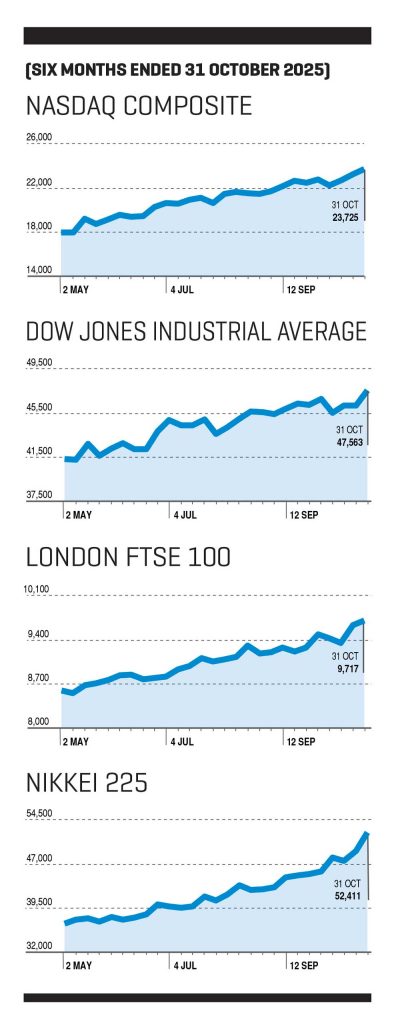

As the Central Bank of Sri Lanka notes, the continued improvement of domestic macro financial conditions has supported overall financial system stability despite heightened global uncertainties.

Maintaining macroeconomic stability remains essential for sustained growth and investor confidence. And while positive momentum has been observed, challenges persist – including limited foreign investor participation in the stock and government securities markets, low transaction volumes in the secondary market, and ongoing trade and geopolitical risks.

The economy grew by 4.8 percent in the first quarter of 2025 with leading indicators at the time of going to press reflecting a continuation of this momentum into the third quarter. The Central Bank reports a notable broad based expansion of private sector credit, supported by a low interest rate environment and the revival of economic activity.

According to the 2024 national accounts estimate compiled by the Department of Census and Statistics, Sri Lanka’s economy demonstrated a strong recovery following years of crises, recording real GDP growth of around five percent. This improvement was driven by gains in tourism, exports and industrial activities.

And the Central Bank’s Annual Economic Review 2024 affirms that the economy continued to recover steadily following its deepest economic downturn two years ago.

It notes that although the road to recovery was difficult, progress has been faster than in most debt distressed countries. Post-crisis reforms have begun to yield tangible outcomes with signs of improved economic activity, partial restoration of purchasing power and reduced uncertainty becoming visible.

In terms of economic growth, Sri Lanka exceeded expectations in 2024. Inflation eased, even recording deflation from September 2024 mainly due to energy price reductions – a development that caused inflation to deviate below the target. Supported by low interest rates, credit to households and businesses expanded throughout the year.

This economic momentum, as highlighted in the Annual Economic Review, has been reinforced by the ongoing IMF’s Extended Fund Facility (EFF) programme, near completion of external debt restructuring and renewed investor confidence. The positive impact of these corrective measures is evident across major sectors of the economy.

Growth momentum was sustained in the first quarter of 2025 as consumption recovered on stronger remittances and credit

Asian Development Outlook

Meanwhile, fiscal performance in 2024 played a critical role in strengthening economic stability with improved revenue collections leading to a positive primary balance for the year.

SERVICES The services sector gradually normalised in 2024, recording 2.4 percent growth compared to a 0.2 percent contraction in the prior year. The surge in tourism created a ripple effect across the accommodation, food and beverage, transport and trade sectors. Recovery in IT and telecommunications also added to this momentum.

INDUSTRY Supported by the revival of domestic and external demand, industry activity recorded a robust 11 percent growth in 2024. Manufacturing was a key driver, fuelled by sustained production in food, beverages and tobacco, alongside a rebound in textiles, apparel, leather and related products.

AGRICULTURE Agricultural activity grew moderately by 1.2 percent, led by animal production and fruit cultivation. However, a prolonged contraction in coconut and extreme weather conditions – particularly in the fourth quarter – disrupted rice, cereal and fishing activities, thereby limiting overall expansion.

INFLATION Following an uptick, inflation trended down in 2024, reaching deflationary levels by September. Factors such as VAT hikes, the removal of exemptions on several consumer items and food initially spurred inflation.

By March however, headline inflation stabilised at low single digits, below the five percent target. Accordingly, year-on-year headline inflation stood at -1.7 percent compared to four percent at the end of 2023.

VIEWPOINTS The Asian Development Outlook (ADO) update released in September 2025 maintains Sri Lanka’s GDP growth forecast for the year at 3.9 percent while revising projections for next year downward.

“Growth momentum was sustained in the first quarter of 2025 as consumption recovered on stronger remittances and credit. Leading indicators suggest continued strength in key sectors, as rising private credit buoys growth throughout the year,” the ADO notes.

However, it revised the 2026 forecast to 3.3 percent, citing external risks – notably higher US tariffs – that could weigh on Sri Lanka’s exports of garments and rubber, and affect employment in export oriented industries.

The report also observes that with deflation easing since early 2025, inflation has returned and is expected to gradually accelerate through 2026 as food prices rise, energy tariffs adjust upwards and the deflationary effects of 2024 wane.

In the meantime, the Asian Development Bank (ADB) cautions that despite recent progress in fiscal discipline and debt restructuring, debt vulnerability remains high.

It believes that public debt to GDP will fall below 95 percent only by 2032, emphasising the need for continued efforts to build external buffers and advance structural reforms to foster private sector led growth without increasing debt.

The financial institution notes that as election and debt restructuring uncertainties fade, investor confidence is expected to strengthen, supporting private investment. However, consumer demand may remain sluggish amid anticipated inflationary pressures. The ADB also warns of downside risks – including trade uncertainty, loss of reform momentum and macroeconomic policy slippages.

“We are pleased to observe that Sri Lanka’s economy has stabilised and is progressing toward debt sustainability. It is essential to sustain reform efforts to mitigate debt vulnerability in the medium term and to establish a foundation for sustainable recovery, resilience building and growth revival,” ADB Country Director for Sri Lanka Takafumi Kadono remarks.

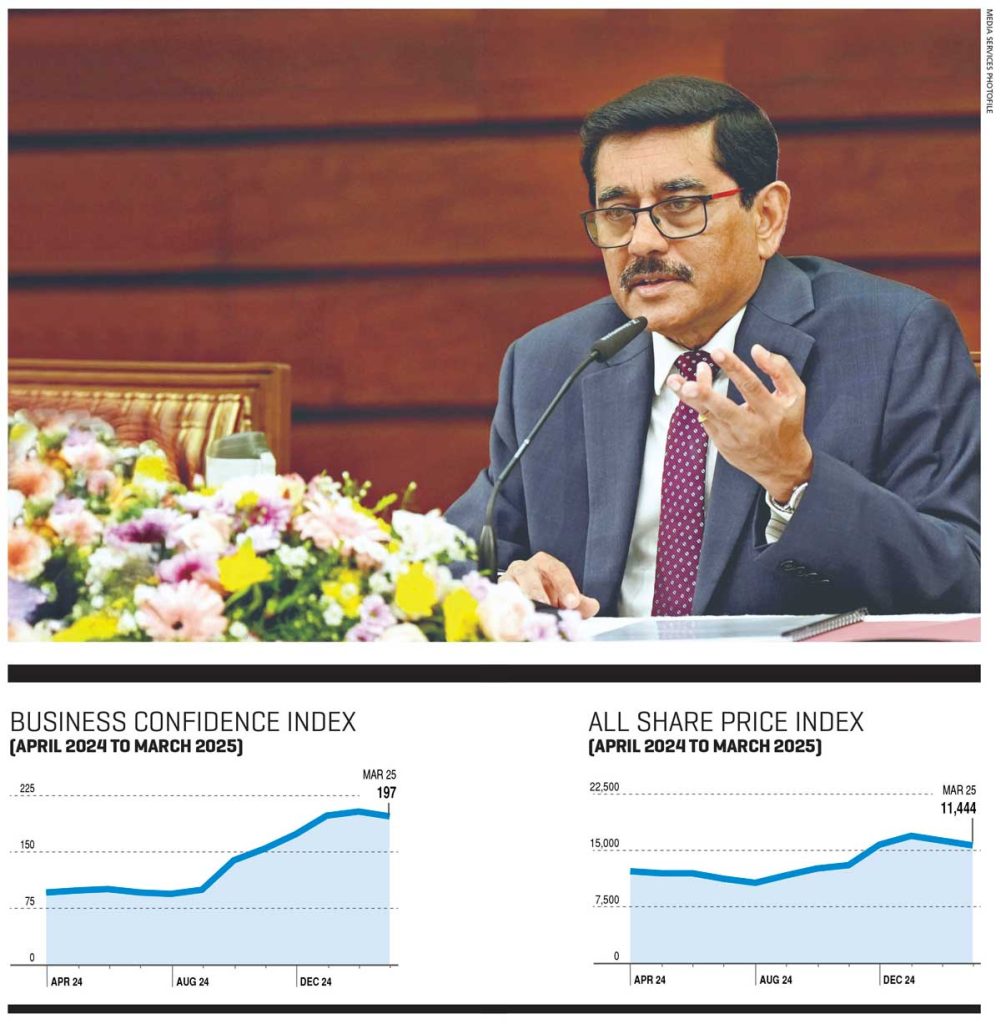

Meanwhile, Governor of the Central Bank Dr. Nandalal Weerasinghe asserts that “Sri Lanka is on course to meet its inflation and financial stability targets by 2026 with economic growth projected to remain healthy and sustainable.”

He adds that the Central Bank’s inflation target of five percent is expected to be achieved in the coming year, noting that financial stability has improved compared to the crisis years of 2022 and 2023.

Weerasinghe stresses that in terms of the recovery, “the economy is continuously growing around five percent. I think that is a healthy economic growth rate after the crisis occurred in 2022 and 2023.”

He reveals that Sri Lanka is likely to surpass key fiscal targets including the primary surplus and revenue goals, which will positively impact debt sustainability. “Lower than expected fiscal deficits mean reduced borrowing needs, leading to improved debt dynamics and a more favourable outlook for long-term economic stability,” the governor explains.

Sri Lanka is on course to meet its inflation and financial stability targets by 2026

Governor of the Central Bank of Sri Lanka

Dr. Nandalal Weerasinghe

The IMF’s continued engagement has been instrumental in Sri Lanka’s progress. The global lender and local authorities reached a staff level agreement to conclude the fifth review of the reform programme supported under the EFF, granting Sri Lanka access to US$ 347 million in October.

The International Monetary Fund says programme performance remains strong, underpinned by good fiscal revenue and improved external resilience. It also stresses that reform momentum must be sustained to safeguard macroeconomic stability and strengthen Sri Lanka’s ability to withstand future shocks.

FISCAL AFFAIRS The Mid-Year Fiscal Position Report 2025 released by the Ministry of Finance affirms that reflecting post-election stability, the country has officially emerged from default.

The economy expanded by 4.8 percent in the first half of 2025 compared to the expansion of 4.6 percent in the first half of the preceding year, benefiting from growth across agriculture, industry and services.

And the report states that gross official reserves stood at 6.2 billion dollars by end August and the Sri Lankan Rupee remained broadly stable – although as this edition of the LMD 100 goes into print, the currency’s value continues to erode as it has done in recent months.

The tax to gross domestic product ratio increased by 2.5 percentage points to 12.4 percent in 2024 from 9.9 percent in the previous year – evidence of successful revenue based fiscal consolidation.

Export performance also improved, driven by growth in both industrial and agricultural exports, reflecting the economy’s continued recovery and resilience amid global uncertainties.

Meanwhile, import expenditure rose by 12.4 percent to US$ 9,762 million in the first half of 2025 compared to 8,684 million dollars in the same period of the preceding 12 months.

It is essential to sustain reform efforts to mitigate debt vulnerability in the medium term and to establish a foundation for sustainable recovery, resilience building and growth revival

ADB Country Director for Sri Lanka

Takafumi Kadono

This increase was largely due to higher imports of consumer and investment goods, supported by the revival of economic activities and lifting of import restrictions – particularly on motor vehicles.

The external sector demonstrated resilience during the period from January to August 2025, supported by improved inflows from tourism and workers’ remittances despite a widening trade deficit.

Workers’ remittances grew by 18.9 percent to US$ 3.7 million in the first half of 2025 compared to 3.1 million dollars in the corresponding period of 2024. Similarly, earnings from tourism rose by 10 percent to US$ 1.7 million in the first half of 2025 – up from 1.55 million dollars a year earlier.

Meanwhile, the services sector grew by 3.3 percent in the first half of 2025, reflecting increased activity across wholesale and retail trade, transport and financial services.

And by the end of August 2025, despite ongoing debt service payments, gross official reserves stood at US$ 6.2 billion, inclusive of the swap facility with the People’s Bank of China. This stability in reserves highlights the gradual strengthening of Sri Lanka’s external buffers as the economy recovers.

In his column titled Boom and Bust Cycles in the July edition of LMD, columnist Shiran Fernando asserted that “recent reforms, most notably under the IMF supported programme, have emphasised raising revenue through increases in VAT and income taxes. These measures have helped Sri Lanka achieve a primary budget surplus for the first time in years and marked a significant step forward.”

He cautioned however, that “the real challenge lies in sustaining progress without undermining growth or worsening the already heavy burden on formal businesses. The answer lies in structural reforms and fixing the architecture of our tax system.”

Fernando reiterated the need to “improve tax administration especially through inland revenue and customs reforms, broadening the tax base by formalising the informal sector and simplifying compliance for existing taxpayers.”

BIZ CONFIDENCE The LMD-PEPPERCUBE Business Confidence Index (BCI) painted a mixed picture at the close of 2025 compared to the previous year. The barometer reached an all-time high during the year before settling at 189 in December. By March 2025 – the end of the financial year under review – the index had climbed to 197, signalling a renewed sense of optimism in business circles.

Despite lingering concerns surrounding inflation, the cost of living and taxation, business sentiment has continued to reflected cautious confidence. The interim budget in March by the then newly elected government contributed to this shift, as corporate leaders anticipated continuity, stability and reform during a period of political transition.

It is left to be seen whether Budget 2026, presented in November, will reflect a similar level of confidence.

POLICY REVIEW The Institute of Policy Studies (IPS) released its State of the Economy 2025 publication in October, themed ‘Technology for Change: Driving the Digital Economy.’

The report notes that Sri Lanka’s GDP grew by 4.9 percent in the first half of 2025, supported by stronger macroeconomic fundamentals and steady recovery across sectors.

And it emphasises that sustaining this growth trajectory will depend on enhancing productivity and efficiency, implementing structural reforms in land and labour markets, expanding openness to trade and investment, prioritising education and skills development, and tax and regulatory simplification.

IPS’ Executive Director Dr. Dushni Weerakoon asserts: “Sri Lanka’s economy is in a cyclical recovery phase, driven by renewed investor and consumer confidence.”