THE RACE TO A REVIVAL

Our corporate giants are rising to the challenge amid global headwinds and local pressures

In a sobering update on the state of the world economy, the World Bank sharply downgraded its global growth forecast for 2025, citing escalating trade tensions and rising policy uncertainty.

This revision came on the heels of sweeping tariffs imposed by the US, dampening economic prospects worldwide.

In its latest Global Economic Prospects report, the bank cut its projection for world gross domestic product growth to 2.3 percent, down from the 2.7 percent projected in January.

The World Bank also lowered its growth outlook for nearly 70 percent of global economies – compared to projections made just six months prior, before President Donald Trump assumed office.

“Global growth and inflation prospects, for this year and next, have worsened because of high levels of policy uncertainty and the growing fragmentation of trade relations,” World Bank Group Chief Economist Indermit Gill asserts.

Amid these challenging global indicators, Sri Lanka has made hard-earned progress in stabilising its economy and laying the groundwork for a more resilient future. While the recovery has been far from easy, domestic efforts to steer the economy towards greater balance and reform have been navigated with a degree of responsibility.

A key structural shift came in November 2025, when the Monetary Policy Board of the Central Bank of Sri Lanka replaced its dual policy rate framework with a single policy interest rate mechanism – the Overnight Policy Rate (OPR).

This change aims to enhance clarity, efficiency and transmission of monetary policy, across financial markets and the broader economy.

While the Standing Deposit Facility Rate (SDF) and Standing Lending Facility Rate (SLF) remain in place as liquidity tools, the Central Bank now targets the Average Weighted Call Money Rate (AWCMR) to align with the newly introduced OPR under its flexible inflation targeting framework.

In its August 2025 Monetary Policy Report, the Central Bank projected GDP growth of 4.5 percent for the year, which is slightly below its earlier forecast tied to a five percent inflation target. Though inflation moderation has been slower than anticipated, the bank affirmed that reflation is on the horizon, supported by Sri Lanka’s ongoing US$ 2.9 billion IMF Extended Fund Facility (EFF).

The report adds that growth for the second quarter of 2025 is expected to remain robust, continuing the positive trajectory seen throughout 2024 and early 2025. It anticipates a modest but steady expansion over the medium term, though the Monetary Policy Report caution that external demand conditions and global geopolitical shifts continue to pose uncertainty.

Maintaining an accommodative monetary policy stance, the Central Bank notes that demand driven inflationary pressures remain subdued, helping to push market interest rates lower and encourage a broad based expansion in private sector credit.

The report also highlights Sri Lanka’s external sector resilience through 2025, despite global volatility.

Meanwhile, gross official reserves remained above US$ 6 billion with the country continuing to meet its debt servicing obligations.

Looking ahead, the financial authority expressed confidence that near-term growth will likely continue along its current trajectory, driven by favourable credit conditions, recovering domestic demand and a stable policy environment. It also emphasised the importance of continued structural reforms to reinforce and sustain long-term recovery.

However, it warns that “the rapidly evolving global trade landscape, global policy uncertainties and recurring geopolitical tensions may have an impact on the economic outlook in the coming months.”

The International Monetary Fund echoes similar sentiments, emphasising the importance of data driven monetary policy and preservation of the Central Bank’s independence, particularly avoiding monetary financing of the fiscal deficit.

“Efforts should continue to rebuild external buffers through reserve accumulation to adequate levels while allowing for exchange rate flexibility. Resolving non-performing loans, strengthening governance and oversight of state owned banks, and improving the insolvency and resolution frameworks, are important to foster credit growth and safeguard financial sector stability,” the global lender adds.

Meanwhile, the Ceylon Chamber of Commerce (in its 2025 Outlook Report) adds that while early signs of recovery are encouraging, long-term growth depends on sustained fiscal discipline, improved governance and greater investment in digital infrastructure.

With the post-crisis consumption rebound tapering off, the chamber stresses the need for a shift from consolidation to strategic investment. It identifies targeted capital expenditure in infrastructure, energy, tourism and digital services as being critical next wave growth drivers capable of propelling the economy forward.

Against this backdrop, although some leading listed companies improved their bottom lines despite high operating costs, several others didn’t experience the same upward trajectory.

In this context, we turn our attention to the 10 leading listed companies, highlighting their performance as they secure prime positions on the coveted LMD 100 Leaderboard for financial year 2024/25.

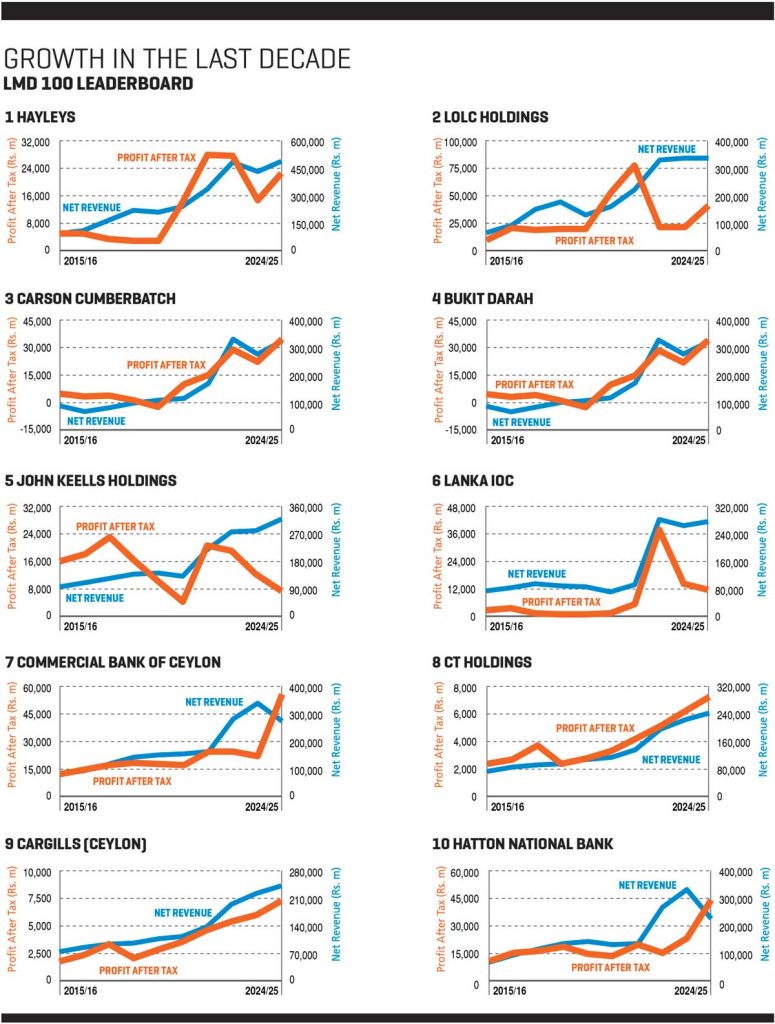

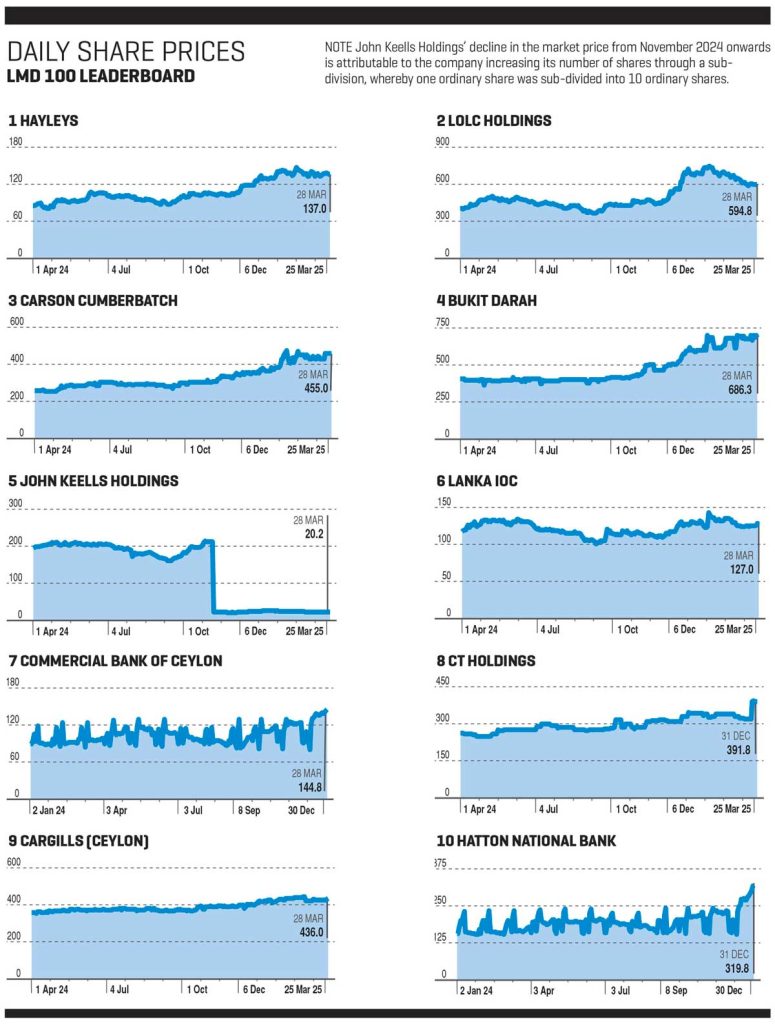

Capital goods conglomerate Hayleys tops the Leaderboard once again, reporting a higher turnover compared to the previous financial year. This marks the continuation of its reign since financial year 2023/24 and the 10th time the esteemed corporate has garnered a place on the podium since the inception of the LMD’s rankings.

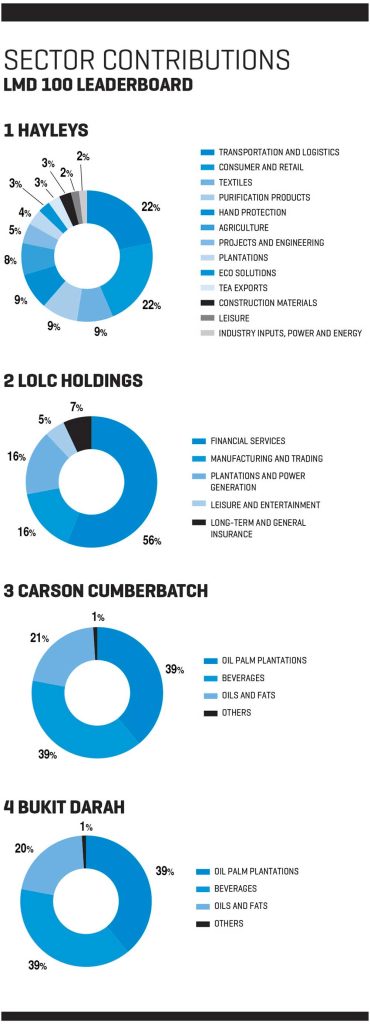

As highlighted in the group’s integrated annual report for 2024/25, Hayleys delivered a 52 percent year-on-year surge in profit after tax (PAT) to Rs. 22.5 billion supported by a 13 percent top line growth – transportation and logistics, and consumer and retail, emerged as the top contributors to profitability during the year.

The report notes that performance was upheld by strategic interventions in regional and international expansion, and a focus on value added products and segments – supported by the stabilisation of macroeconomic fundamentals and improved customer sentiment. The group also recorded an appreciation of total assets (by 16%) during the year, driven primarily by capital investments across key verticals.

Chairman and Chief Executive Mohan Pandithage reflects on the year with a sense of conviction and purposes: “The hope and optimism that shaped our outlook for the year ran deeper than simple sentiment; they were beliefs that we held close, inspiring our resilience and guiding every decision and direction we pursued.”

He continues: “Today, it is deeply fulfilling to reflect on how that optimism has begun to take shape in reality, as Sri Lanka slowly but definitively regains its footing after years of economic hardship. For us as a group, witnessing this national resurgence has been both humbling and invigorating, reaffirming our belief that even in the hardest times, there is always room for renewal and progress.”

“The complexity of the challenges does not mean that they are insurmountable; and as always, I reiterate my belief that optimism is critical for resilient and adaptable leadership and better outcomes, particularly in times of rapid change,” Pandithage adds, noting that amid a turbulent global climate, Sri Lanka’s gradual return to stability signalled a meaningful turning point after prolonged economic strain.

And indeed, the group’s performance underscores this shift.

Revenue grew by 13 percent during the year, notably outpacing national GDP growth of five percent. And despite a one percent contraction of its labour force, the Hayleys team expanded by five percent, reflecting continued job creation driven by its wider operational footprint and sustained growth momentum.

Securing second position in the LMD 100 rankings, LOLC Holdings posted a consolidated top line of over 339 billion rupees for its financial year ended 31 March 2025, marking a climb from third place in the prior year.

This reflects an increase from last year’s Rs. 337 billion as the diversified financial conglomerate saw profit after tax, which soared from 21 billion rupees in 2023/24 to Rs. 41 billion in its most recent financial year.

In LOLC’s annual report, Executive Chairman Ishara Nanayakkara states that amid macroeconomic stabilisation, currency appreciation and easing inflationary pressures, the organisation demonstrated one of the most exceptional financial performances in its history.

He elaborated: “The year under review also witnessed significant growth in our non-financial businesses, which continue to serve as critical pillars of diversification and long-term value creation.”

Moving up to third place in the listed company rankings from financial year 2023/24 is Carson Cumberbatch, reporting a top line of 323 billion rupees. The conglomerate maintained its profit after tax at over Rs. 34 billion, notably higher than its 22 billion rupees in the previous year.

Chairman Ravi Dias affirms in Carsons’ 2024/25 annual report that the group is “guided by a clear and focussed strategic vision for each of our business segments, we successfully maintained momentum towards achieving our growth and profitability objectives.”

“The future presents both challenges and opportunities as we navigate a dynamic global economic landscape. Continued success of our operations will require vigilant management of geopolitical risks, close coordination of monetary and fiscal policies, and the preservation of open international trade channels,” he adds.

Advancing to No. 4 on the coveted Leaderboard from seventh place in the prior year, Bukit Darah reportedan income exceeding Rs. 323 billion for the financial year ended 31 March 2025 – that’s a robust 17 percent increase compared to 2023/24.

Additionally, the diversified conglomerate also delivered a post-tax profit of over 34 billion rupees, marking an impressive 54 percent surge from the prior year.

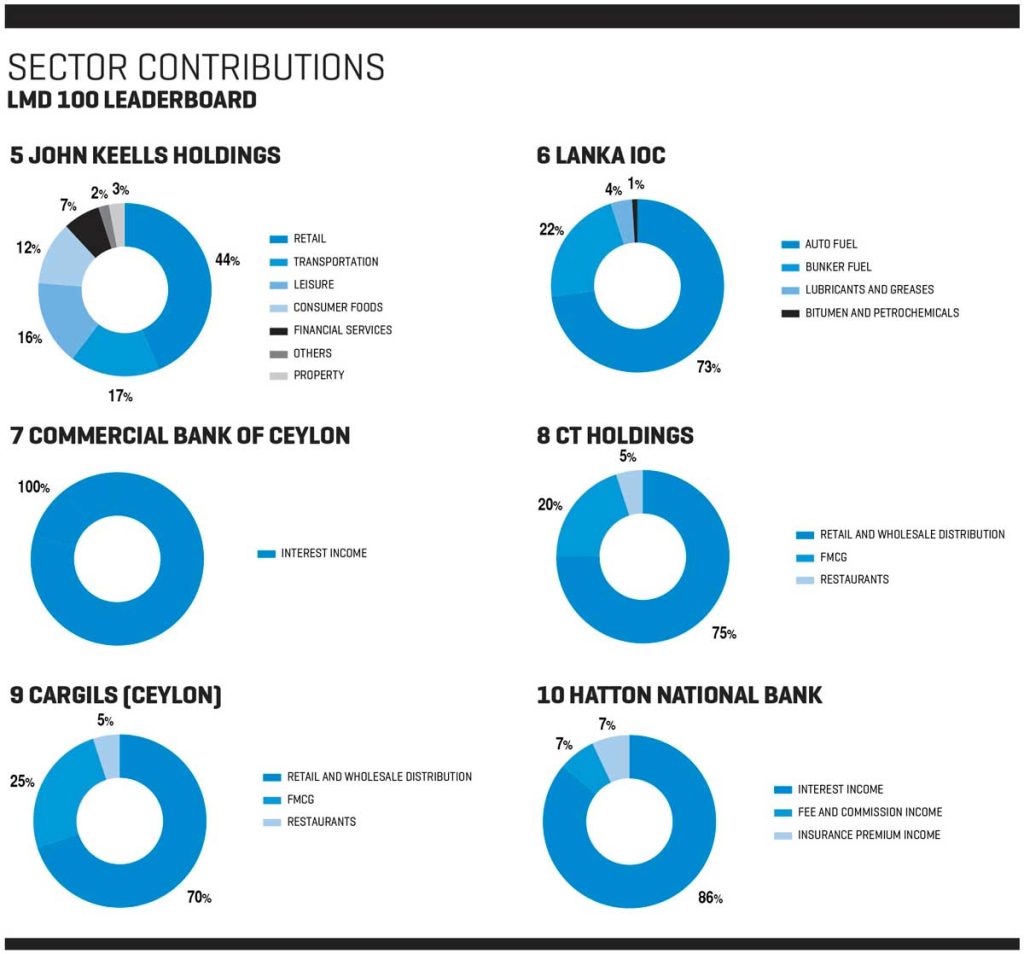

Retaining fifth place in the 2024/25 LMD 100, John Keells Holdings (JKH) recorded an after-tax profit of more than Rs. 6.9 billion – a sharp decline from the 12 billion rupees reported in 2023/24. However, the group’s consolidated turnover grew by 13 percent, to reach Rs. 317 billion.

Lanka IOC climbs tosixth place (from No. 8 in the prior year), posting a turnover of Rs. 276 billion for 2024/25 – which represents a five percent decrease – while the diversified conglomerate absorbed a 20 percent decline in profit after tax, falling to 11 billion rupees from the previous year’s Rs. 13 billion.

And Commercial Bank of Ceylon slips to seventh place from second, recording a 19 percent decline in turnover with an income of Rs. 274 billion for the year ended 31 December 2024 – down from 341 billion rupees in 2023. Despite the drop in income, the bank posted a remarkable profit after tax exceeding Rs. 55 billion – a 154 percent jump from the 21 billion rupees recorded previously.

CT Holdings moves up in the rankings from 10th to eighth place in the 2024/25 LMD 100 rankings. For the year ended 31 March 2025, CT reported a consolidated revenue of Rs. 242 billion (an 8% increase from 2023/24). Its PAT also grew by 17 percent to seven billion rupees.

The LMD 100’s 9th and 10th positions are held by Cargills (Ceylon) and Hatton National Bank (HNB) respectively.

Cargills climbs two spots from its previous 11th place, reporting a profit after tax of over Rs. 7 billion – a 22 percent increase – alongside a top line of 241 billion rupees, reflecting an eight percent growth in the period under review.

Meanwhile, HNBslips from fourth place to claim the No. 10 spot in financial year 2024/25. And although the bank’s aggregate income declined by 32 percent to Rs. 228 billion, it registered a strong PAT surpassing 44 billion rupees for the period under review.