ECONOMIC OUTLOOK

POST-DITWAH ECONOMY

Shiran Fernando reflects on the economic impact of Cyclone Ditwah

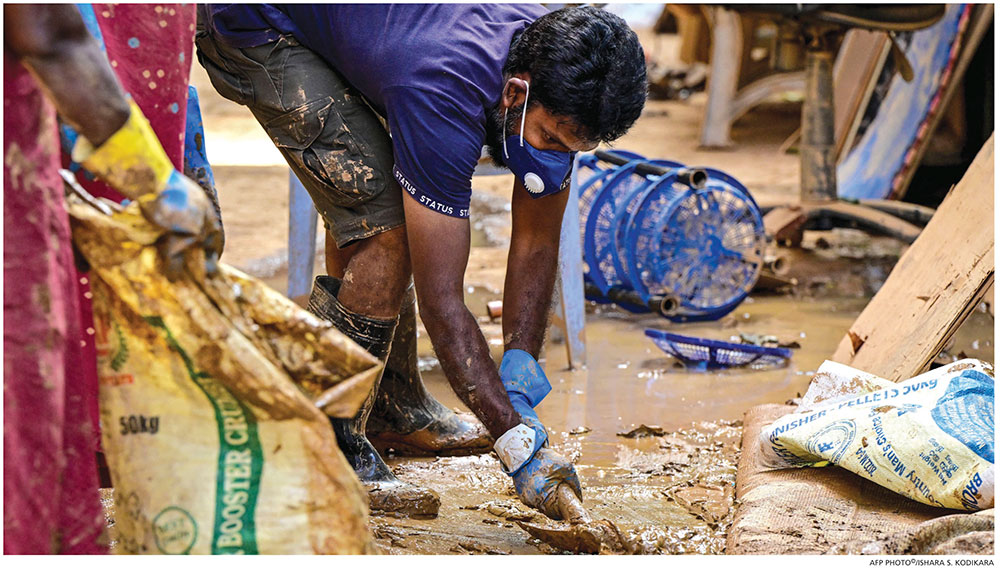

Cyclone Ditwah delivered a sharp shock to Sri Lanka’s economy at a time when the country was emerging strongly after a succession of crises since 2018. With over 600 fatalities, nearly 180 people missing and close to eight percent of the population affected, it represents not only a notable economic setback but also a profound humanitarian and social challenge.

According to the World Bank, Ditwah has caused an estimated US$ 4.1 billion in physical damage across housing, agriculture and critical infrastructure – equivalent to around four percent of Sri Lanka’s GDP, even before accounting for indirect losses, income disruptions and long-term economic scarring.

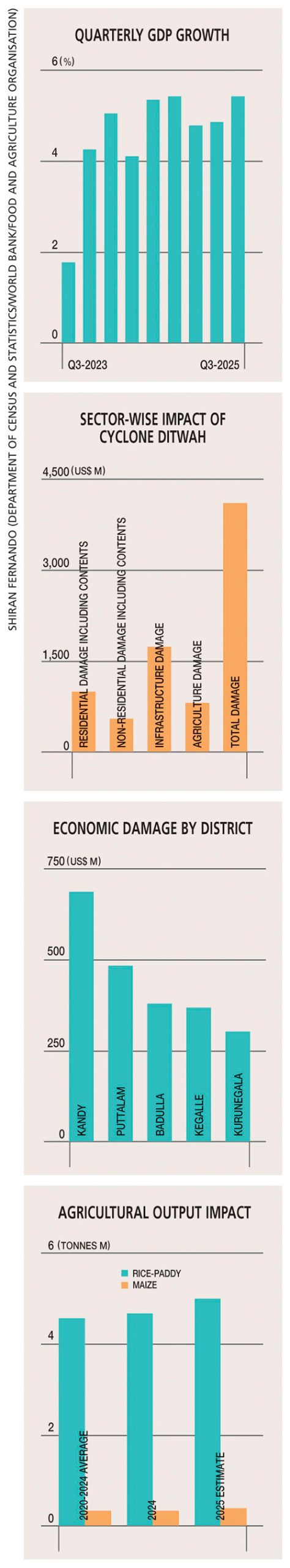

GROWTH IMPACT Prior to Ditwah, Sri Lanka’s economic recovery had gained notable momentum. Between January and September last year, the economy expanded by five percent year-on-year while the July to September quarter recorded a robust 5.4 percent spike, marking the ninth consecutive quarter of positive expansion.

This performance reflected broad-based improvements across services, industry and domestic demand.

However, this momentum – which is anchored at around the four to five percent growth range – is likely to weaken in the last quarter of 2025 and first three months of this year, driven primarily by disruptions to agriculture.

According to the FAO’s mid-December assessment, nearly 20 percent of Maha season paddy sowings have been partially damaged or lost, alongside losses in maize, vegetables and some pulses. These disruptions affect the livelihoods of approximately 227,000 farmers. As agricultural GDP largely captures output rather than welfare impacts, the sector is likely to contract in the short term and exert a drag on overall growth.

The World Bank says the Kandy District is the most severely affected in terms of physical damage. Given its importance as a tourism hub, early concerns pointed to a potential decline in arrivals. However, these fears haven’t yet materialised. More than 245,000 tourist arrivals were recorded in December, suggesting that immediate impacts on tourism have been contained.

A key risk to monitor is whether future bookings reduce due to lingering perceptions of disruption. If arrivals remain resilient, tourism will continue to provide crucial support to the broader services sector during the recovery phase.

Infrastructure damage alone is estimated at 1.7 billion dollars, implying a substantial reconstruction effort over the coming years. This presents an opportunity for the construction industry, which has yet to fully recover to pre-crisis levels.

Public and private reconstruction activity is likely to generate employment, stimulate domestic demand and partially offset the short-term contraction in agriculture. If sequenced effectively, rebuilding could act as a stabiliser of growth during 2026 and beyond.

ECONOMIC BUFFER A critical difference between Ditwah and past shocks such as the pandemic or 2022 economic crisis is the government’s ability to respond swiftly. Relief measures and disbursements to affected households and businesses commenced rapidly, supported by improved fiscal conditions.

Sri Lanka’s primary fiscal surplus has resulted in over Rs. 1.3 trillion in cash balances held with state banks. This fiscal space enabled the government to absorb the shock without immediate destabilisation. The hard lessons of the recent crisis have yielded an important dividend: greater economic resilience in the face of climate related disasters.

This buffer can now be deployed to support income losses, protect vulnerable households and expand capital expenditure linked to reconstruction.

EXTERNAL FUNDING Despite improved domestic mechanisms, Sri Lanka will continue to rely on multilateral and bilateral financing to support its recovery. Encouragingly, institutions such as the World Bank and Asian Development Bank (ADB) have already committed to reorienting and accelerating funding for reconstruction.

Last year, delays in external disbursements contributed to foreign reserves stagnating at around US$ 6.1 billion. However, inflows – including 200 million dollars under the IMF’s Rapid Financing Instrument and expected bilateral support, particularly from India and China – should help ease short-term balance of payments pressures and support reserve adequacy during the recovery phase.

FAST TRACK REFORMS The opportunity that comes with responding to a shock is not only to build back better but review fundamental structures that are impeding growth and accelerating economic buffers as well.

There is a chance to focus more on climate adaption, and source funding from global and local partners with feasible projects; it’s an opening for the private sector to rethink its business continuity planning and conduct climate risk assessments to see how vulnerable they are to future shocks.

Beyond this is an opportunity to fast track the process of reforms related to labour, trade facilitation and land, which if implemented well can recreate an image that Sri Lanka is not only resilient to climate and economic shocks, but also ready for business and connecting with the global supply chains.

Cyclone Ditwah will undoubtedly weigh on short-term growth, particularly through its impact on agriculture, but is unlikely to derail Sri Lanka’s recovery trajectory altogether.

Stronger fiscal buffers, improving external support and the potential boost from reconstruction will provide important offsets.