THE ECONOMY

MOTHER NATURE HAS HER SAY

Economic confidence plummets as the cyclone takes its toll on biz mindsets

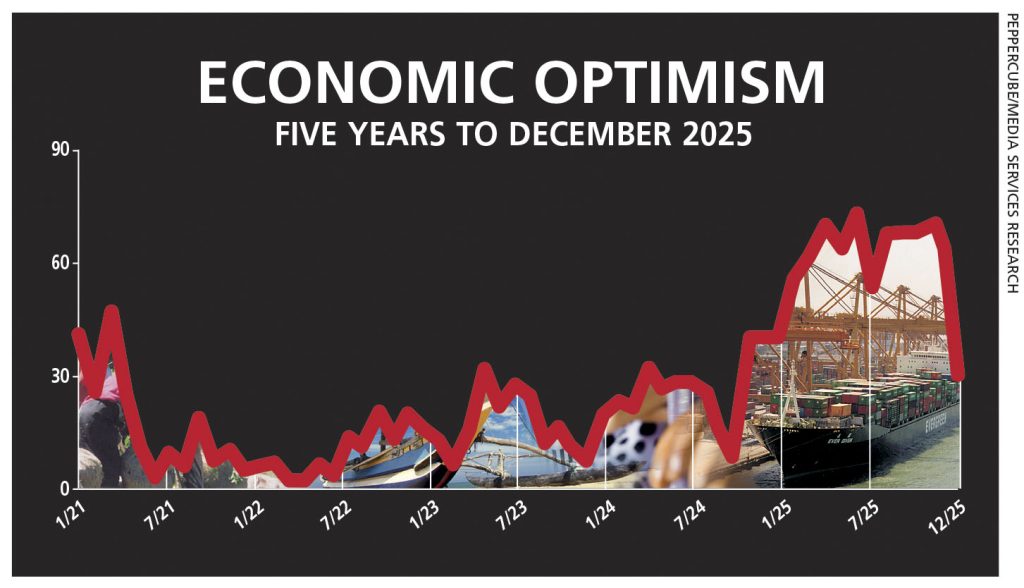

Economic sentiment fell sharply in December with several pressing concerns weighing heavily on the corporate community – there is no doubt that the stormy weather at the end of November has taken its toll on how businesspeople view the economic outlook.

THE ECONOMY The latest LMD-PEPPERCUBE Business Confidence Index (BCI) survey, conducted in the first week of December, produced a sharp decline in economic optimism, reversing the largely positive outlook of recent months.

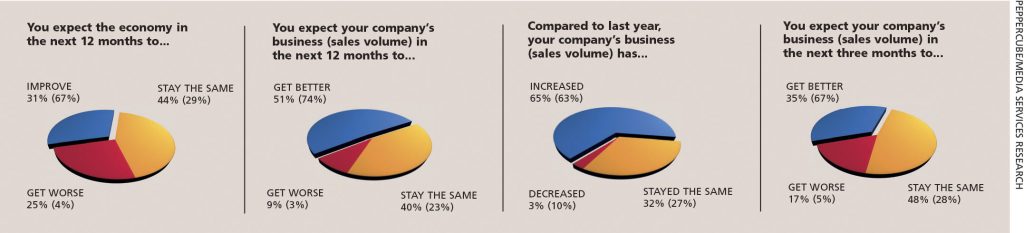

Less than a third (31%) of respondents now believe the economy will ‘improve’ over the next 12 months – a steep 36 point drop from November. And over four in 10 (44%) expect it to ‘stay the same’ – that’s a 15 point increase from the previous month.

In the meantime, only a quarter (25%) anticipate that the economy will ‘get worse’ (this too is a notable 21% increase from November).

SALES VOLUMES Expectations surrounding sales volumes have weakened considerably as well: while more than half (51%) expect an improvement over the next 12 months, this outcome reflects a 23 point free fall from November.

And 40 percent of executives expect their sales numbers will ‘stay the same,’ marking a 17 point rise from the previous month. Only nine of the 100 respondents surveyed believe their sales volumes will ‘get worse,’ up six points from November.

Sixty-five percent of poll participants report an ‘increase’ in sales volumes – a marginal two point rise from the previous month.

Additionally, 32 percent reveal that their volumes ‘stayed the same’ (up five points from November’s 27%). Only three percent report a decline, marking a seven point drop from the 10 percent recorded a month ago.

Looking ahead to the next three months, expectations of higher sales volumes softened further with slightly over a third (35%) of respondents projecting an increase – that’s a massive 32 point fall from November’s 67 percent.

And almost half (48%) of the sample population believe their sales volumes will ‘stay the same’ (up 20% from the previous month) while 17 percent say their numbers will ‘get worse’ over the next three months, representing a 12 percentage point increase from the month prior.

INVESTMENT CLIMATE In contrast, confidence in the investment climate continues to improve with 14 percent viewing the outlook as ‘very good’ – compared to November’s 12 percent.

Those who say the future looks ‘good’ fell by 13 percentage points to a quarter (25%) while 42 percent view the investment outlook as ‘fair’ – a slight one percentage point decline from the previous month.

Meanwhile, 19 percent perceive the investment climate as being ‘poor’ or ‘very poor’ – that’s a notable increase from seven percent in the preceding month.

EMPLOYMENT PROSPECTS Only 34 percent of respondents say they intend to ‘increase’ their staff numbers, which is a steep 16 point decline from November.

Meanwhile, 61 percent plan to maintain the status quo (up 16%) and only five percent expect to downsize in the next six months – unchanged from the previous month.