LMDtv 5

With the private sector poised to bear the brunt of the work required to help Sri Lanka transition from a recovery to sustainable growth, there is a pressing need for organisations to adopt corporate governance as a fundamental pillar of their operations.

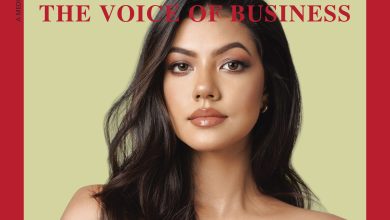

During a recent LMDtv interview, Thamali Rodrigo – who is a Partner of KPMG – discussed how companies perceive corporate governance.

She explained: “Some entities only comply with corporate governance regulations to avoid being penalised. Others apply those principles because they understand the advantages of compliance – such as creating accountability within the organisation, and facilitating effective decision making and implementation. Some entities implement the rules simply because they need to tick the box.”

Among the many types of entities, family businesses are a special kind, she noted. “They are the backbone of our economy and have excellent strengths. For instance, they’re extremely resilient and have successfully withstood multiple crises due to their unique nature.”

Yet, these companies face challenges when it comes to applying the principles of corporate governance.

Rodrigo asserted that “many family businesses become stagnant at some stage. One of the reasons is that these businesses have been founded and led by exceptionally strong and capable entrepreneurs who have grown their enterprises rapidly. And because they do an excellent job, they’re often blinded to the fact that their businesses eventually outgrow their capacity.”

Resistance to change is a key challenge, she pointed out: “Family businesses resist change for many reasons.”

And Rodrigo emphasised that these businesses have been built with a lot of effort and hard work, adding that “there is an emotional attachment as well, which creates fear and mistrust of any other system that may take over what’s been achieved so far.”

Rodrigo continued: “Many family entrepreneurs also don’t realise the point at which their businesses outgrew how they’re usually managed. That’s why it’s crucial to implement new ways of management that are ideally backed by corporate governance principles, to help facilitate the next phase.”

The first step is to understand the concept of compliance, she explained: “Many entrepreneurs shy away from corporate governance, believing that it’s limited to listed or regulated entities. But in truth, corporate governance principles help facilitate growth.”

Corporate governance is also about leadership, she added: “It’s about facilitating transparency, accountability and responsibility within the organisation.” And after creating awareness, it’s necessary to establish practices such as holding board meetings.

Rodrigo noted that “there are family businesses that haven’t held board meetings – despite having boards on paper. You shouldn’t confuse a board meeting with a management meeting. Many family businesses have weekly management meetings to discuss what’s happening in their firms but they don’t hold board meetings.”

“A board meeting is where you discuss the future of the business; and a good starting point would be to have structured regular meetings that are driven by an agenda. At these meetings, you will dedicate 60 percent of the time to discuss plans for the next one, three or five years. You ask management to present their views on the future, and also discuss risk management and contingency plans,” she elaborated.

Rodrigo also recommended that family businesses recruit independent parties to attend these meetings either as board members or observers: “When you have a third party sitting in at your meetings, you’ll naturally introduce discipline to your discussions and not let them be governed by emotions.”

In conclusion she posited: “If family businesses don’t practise the principles of corporate governance, they will become stagnant. Start small and you will understand the advantages of corporate governance – and improve.”