THE ECONOMY

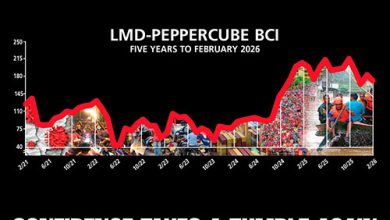

The corporate strain shows no signs of easing as businesses navigate an uncertain and hostile economic environment. The latest findings from the LMD-PEPPERCUBE Business Confidence Index (BCI) poll highlight widespread apprehension about the economic outlook.

PERSISTENT ECONOMIC BLUES

Businesses navigate uncertain waters with caution amid multiple hostilities

THE ECONOMY In July, 27 percent of survey participants expressed optimism about the economy ‘improving’ over the next 12 months, marking a three percentage point decrease from the month prior.

And a third (33%) believe the economy will ‘stay the same’ – a seven point increase from June. Furthermore, 40 percent of respondents feel the economy will ‘get worse,’ which is a four percentage point drop from June’s reported opinion.

SALES VOLUMES Salespeople are cautious about the outlook as the optimism witnessed in June appears to have faded a month later. According to the poll, only 30 percent of executives believe that sales volumes will ‘get better’ over the next 12 months, marking a four percentage point decline from June’s projections.

Nearly three in 10 (29%) of survey participants anticipate their sales numbers will ‘stay the same,’ which represents a marginal increase from June’s 25 percent. Meanwhile, 41 percent expect their sales volumes to ‘get worse’ – this has remained steady over the past four months.

Twenty-four percent of respondents report an ‘increase’ in sales volumes over the past 12 months, marking a nine point fall from June’s 33 percent.

In addition, 28 percent report that their sales numbers ‘stayed the same,’ which is a five point increase from the previous month. And 48 percent report low sales volumes, a slight hike from 44 percent in June.

Looking ahead, expectations for higher sales volumes in the next three months remain positive with nearly a third (32%) expressing optimism about their numbers ‘getting better,’ as in the previous month.

And a quarter or so (26%) expect their sales numbers to ‘stay the same,’ reflecting a two percent increase.

However, a sizeable percentage (42%) of survey respondents expect their sales volumes to ‘get worse’ over the next three months – a sentiment that is two points lower than in the preceding month.

INVESTMENT CLIMATE In July, the notable shift observed a month ago persisted with eight percent rating our investment prospects as ‘very good.’

Moreover, the proportion of participants that view the outlook as ‘good’ increased by seven percentage points to 28 percent.

Meanwhile, 43 percent perceive the investment climate as ‘fair’ (compared to 33% in June) while slightly over a fifth (21%) consider the outlook to be ‘poor’ or ‘very poor’ (June – 38%).

EMPLOYMENT PROSPECTS A quarter (25%) of businesses intend to ‘increase’ their staff numbers, which reflects a four percentage point decrease from the previous month (29%).

However, a clear majority (70%) plan to maintain the status quo (June – 61%) while five percent of respondents reveal that they may resort to downsizing over the next six months, which nevertheless is five percent less than the month before.