FDI PROSPECTS

As Sri Lanka enters a phase of cautious optimism following the economic crisis, the time is opportune to reimagine our role in the region, not only as a recovering economy but also as a strategic partner and investment gateway.

LEVERAGING SRI LANKA’S LOCATION

Shiran Fernando asserts that India’s rise can help raise FDI for Sri Lanka

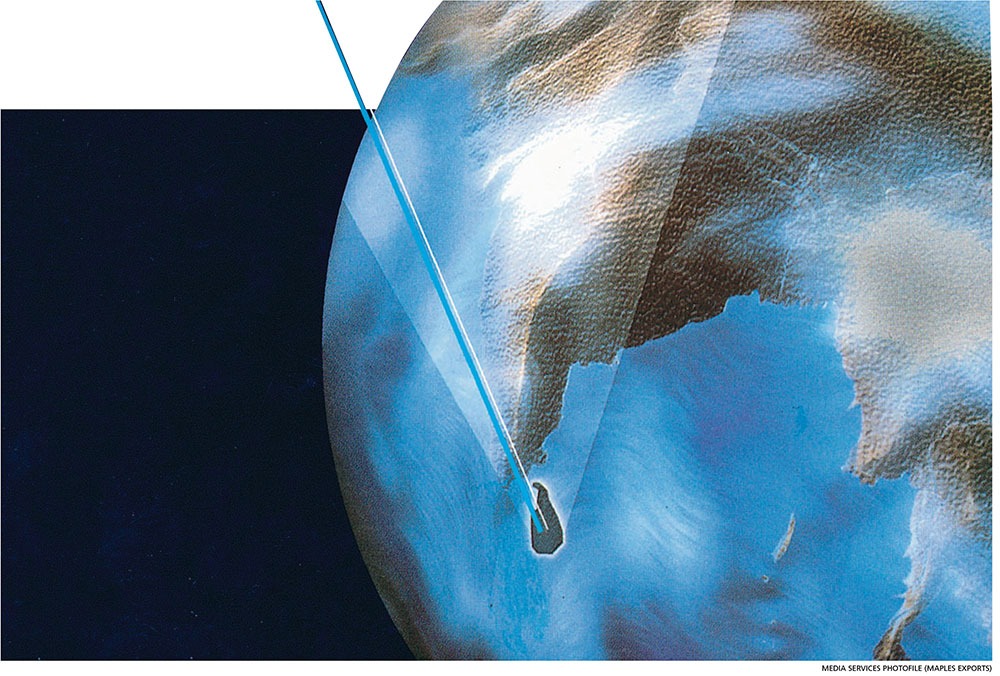

Central to this repositioning is strategic location, which is one of our most underutilised assets. Perhaps no partner offers more potential at this time than India, given Sri Lanka’s proximity to the fastest growing economy in the world.

Some insights were gathered during a recent roundtable discussion with investors from India.

PROXIMITY VALUE Sri Lanka sits at the southern tip of India and less than an hour’s flight from major South Indian cities. Reports indicate that fast pace growth in South India compares to states in the north.

This location, long seen as symbolic or touristic, must now be redefined in the language of logistics, regional manufacturing, digital trade and supply chains.

Proximity matters in a world of shifting trade routes, the China Plus One strategy and nearshoring. And Sri Lanka is ideally placed as a complementary node to India’s vast and expanding economic machine.

MACRO OUTLOOK The post-crisis stabilisation of Sri Lanka’s economy has created momentum for structural reform. Inflation has cooled, interest rates are falling and a new phase post-debt restructuring is opening up fiscal space.

The government has embarked on targeted regulatory and institutional reforms that directly encourage investor confidence, and range from tax clarity and digital systems to public-private partnership frameworks and state-owned enterprise (SOE) restructuring.

Across sectors, this is translating into opportunities.

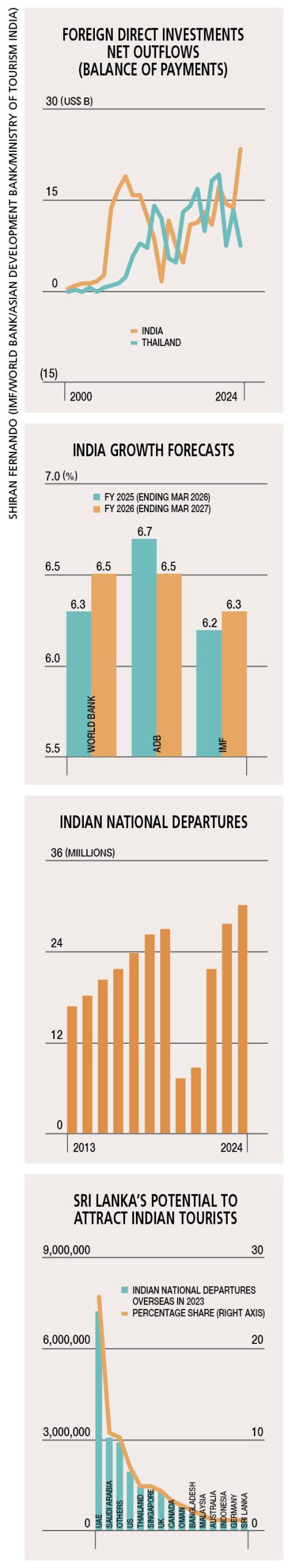

Tourism is rebounding with a focus on high value experiential offerings and new infrastructure. However, Sri Lanka is only attracting 1.2 percent of Indian tourists. In 2024, India was home to 30 million outbound tourists

Apparel and IT-BPM remain competitive with cost and talent advantages offering niche export platforms for Indian firms. And energy is opening up around solar, wind and green hydrogen.

The Port of Colombo is one of the best in the region, among the top 20 in the world and caters to transshipment cargo heading to India.

Agribusiness and food processing are ripe for value added investment, particularly in the north and east.

VALUE CHAINS India is becoming a manufacturing and technology powerhouse, and international firms are seeking integration with its ecosystems. But supply chains don’t stop at national borders and radiate outwards. India signed an FTA with the UK in July for greater market access and investment.

Sri Lanka’s potential lies in plugging into India’s value chains, not only as a final assembly point but also as a partner in component manufacturing, B2B services and logistics support.

Whether it is in textiles, vehicle components, packaging, FMCG inputs or specialty chemicals, there’s space for India-Sri Lanka co-production platforms. Indian firms obtain a nearby stable and English speaking hub, while Sri Lankan businesses gain scale, technology and entry into vast regional markets.

Sri Lanka can serve as a stepping stone for Indian companies – especially SMEs that are looking to scale internationally and become global exporters.

By setting up here, Indian companies can test and expand their global competitiveness in a lower risk environment, access bilateral and multilateral trade agreements, and build capabilities in international compliance, marketing and logistics.

In essence, the island will offer a soft landing into world markets.

STATES AND SMEs Another underleveraged channel is Indian states and their SMEs. From Tamil Nadu’s vehicle belt and Gujarat’s chemical hub to Kerala’s IT parks, India’s economic growth story is becoming increasingly decentralised.

Sri Lanka must identify ways to build direct state to state, SME to SME and cluster to cluster linkages with India, for trade, digital services and innovation.

Chambers of commerce and trade platforms have a pivotal role in this exercise. Sri Lanka must move beyond elite level diplomacy to real matchmaking in shared technology parks, co-manufacturing ventures and joint R&D platforms.

FTA AND FDI To attract the next wave of FDIs, Sri Lanka must speak the language of regional integration, trust building and sectoral readiness.

If our value proposition is grounded in location with sector strength and reform credibility, the country can be a natural complement to India’s rise. The current free trade agreement with India must be advanced after years of discussion.

Sri Lanka can also be a gateway for Southeast Asian economies that are looking to enter the region and use the island as a base. Countries such as Thailand have outward FDIs ranging from US$ 7 billion to about 17 billion dollars annually in a good year, and are increasingly looking at markets in Africa and Asia.

Given Sri Lanka’s FTA with Thailand, the government should try and attract some of this outward FDIs.

The government needs to convert the value of our strategic location into real investment, export growth and long-term economic resilience so that Sri Lanka can sustainably refinance its debt beyond 2028.