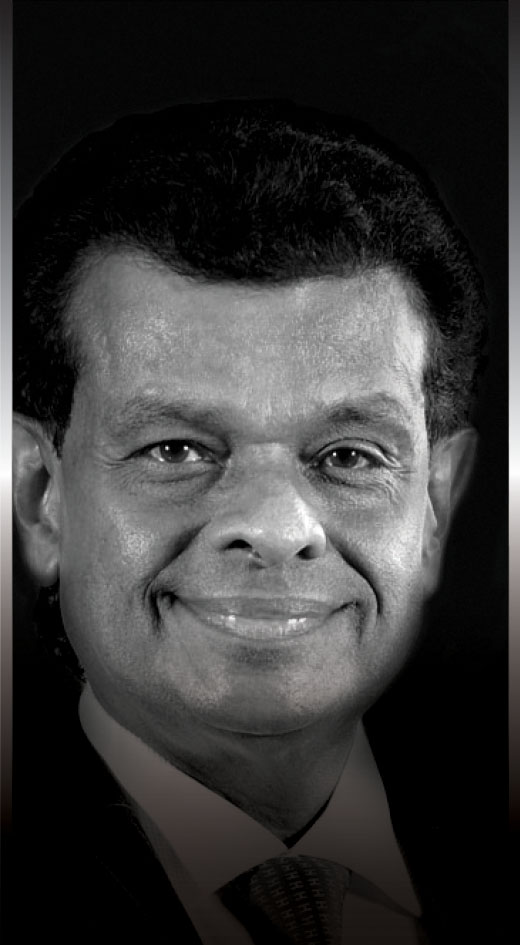

Deputy Chairman

Managing Director

Aitken Spence

Managing Director

Aitken Spence

The big picture

The pros of the 2022 interim budget are the proposal to increase income tax rates, and the re-introduction of withholding tax (WHT) on interest and dividends, and PAYE tax, as these enhance tax collection.

Mandatory registration of all citizens above 18 for an income tax file is a good proposal since it would bring self-employed and other private business owners into the tax net, provided there’s a solid tax administration system to ensure compliance.

However, with the steep increase in tax rates and reduction of slabs, it is the private sector’s middle management employees who will be severely affected by the additional tax burden.

They’re already burdened with the high cost of essential goods, and this could provide a further impetus for the brain drain that’s already commenced of young professionals and those practising other vocations.

With regard to the social security contribution levy (SSCL) of 2.5 percent on revenue – which has been introduced to replace the nation building tax (NBT) that was abolished in 2019 – and the increase in value added tax (VAT) from eight percent in 2021 to 15 percent, the loss of revenue from NBT is likely to be adequately compensated.

The SSCL would have a cascading effect on prices since set offs against inputs aren’t permitted – this will increase the cost of goods and services further.

Other pros are the public sector reforms (e.g. reduction of the retirement age to 60 years), the restructure of state owned enterprises (SOEs), establishment of a State Owned Restructuring Unit, and the introduction of a new Central Bank Act to insulate it from politicisation.

Removal of tax holidays

Foreign and local investors are more concerned about the ease of doing business than with being offered attractive tax holidays for investments.

Unrealistic lease rentals charged on government owned lands required for large projects, the bureaucratic red tape to obtain various licences and approvals for investments, long delays and other negative practices being adopted by public institutions to grant approvals are deterrents to any genuine investor.

A double deduction of capital allowances on investments in plant, machinery and technological assets would be more beneficial for large-scale investments than tax holidays, which are granted for a limited period and cannot be made use of when a project is in its startup and initial growth phase.

Furthermore, there should be transparency in granting Strategic Investment Project Status to large-scale infrastructure projects. Some of these projects are not awarded through a transparent bidding process; and they’re granted a host of concessions with tax holidays being extended almost for the lifetime of the project.

Unless the government provides a conducive and transparent landscape for investment, its ambitious target of achieving foreign direct investments (FDIs) will not be realised. Furthermore, local companies will also be compelled to move out of the country to set up operations and for future investment, which will be detrimental to the country.

It is the private sector’s middle management employees who will be severely affected by the additional tax burden