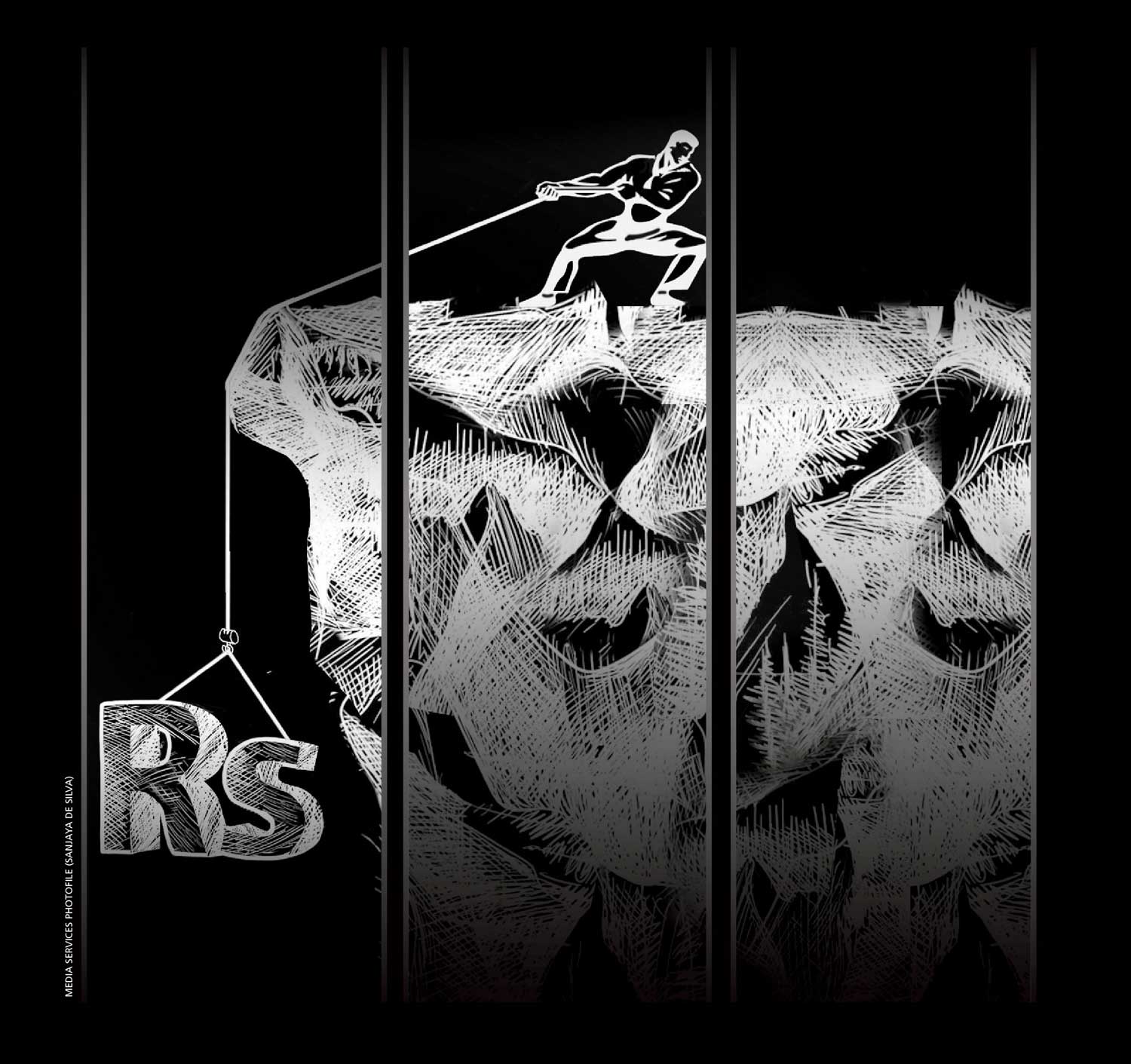

INTERIM BUDGET 2022 AND BUDGET 2023

SETTING THE STAGE

FOR AN ECONOMIC REBOOT

As socioeconomic headwinds buffet many of the world’s economies including ours, there are some aspects of Sri Lanka’s fiscal policies and financial practices that require serious consideration – by each and every citizen, and business.

It’s a time for action; a time to take responsibility for the contribution we must make for the privilege of our ‘Sri Lankan-ness.’

In last month’s edition of LMD, Nihal Fonseka – an eminent banker of yesteryear and incumbent member of the Monetary Board of the Central Bank of Sri Lanka – pointed out that “many Sri Lankans are obsessed with not paying tax at all or paying far less than they should. Sometimes, they even boast about how they got out of paying their tax dues through various ruses and by using loopholes.”

The World Bank has reported that Sri Lanka’s tax-GDP ratio had dropped over the years – to as low as eight percent at the end of last year. And Fonseka observed that “less than 300,000 individual tax files (other than PAYE) among a population of 22 million shows the sorry state of tax collection and compliance.”

Finance Minister and President Ranil Wickremesinghe’s 2022 Interim Budget aims to almost double the tax-GDP ratio to 15 percent by 2025 and introduce compulsory tax registration for all residents above 18, regardless of their annual income and tax-free thresholds.

He also proposed to reduce public sector debt from around 110 percent of GDP at the end of 2021 to no more than 100 percent in the medium term and restructure state owned enterprises (SOEs), assisted by a separate agency that would be established for this purpose.

The general lack of accountability of SOEs for the allocation and use of revenues from taxation, and an aspersion that much of it is wasted or stolen, has long been a justification by many citizens for tax evasion.

Meanwhile, the measures outlined in the interim budget should go some distance towards ameliorating these reservations and encouraging better engagement with tax policies – although their implementation will be key.

Targets presented in the 2022 Interim Budget for government revenue and debt reduction are the cornerstone of an agenda that seeks to address the worst economic crises the country has faced since independence.

It’s hoped these measures will provide an effective foundation from which to launch a trajectory of desperately needed economic recovery. We must remember that the IMF does not lend to countries whose debt is deemed unsustainable.

Indeed, a long hard road lies ahead…

As the Governor of the Central Bank of Sri Lanka Dr. Nandalal Weerasinghe has cautioned, Sri Lanka will not have a second chance to reset its macroeconomic trajectory if the crucial IMF programme along with the debt sustainability initiative is compromised: “We are not out of the woods yet, though we’re managing painfully. The transition will be a difficult period.”

Thankfully, it seems there may yet be a trail of breadcrumbs to follow, and a helping hand now and then. Good faith and confidence in our island nation are the needs of the hour – as is a spirit of progress out of the current predicament

It is with these thoughts that we look forward to the 2023 Budget presentation in November.

– LMD

Targets presented in the 2022 Interim Budget for government revenue and debt reduction are the cornerstone of an agenda that seeks to address the worst economic crises the country has faced since independence

Gihan Cooray

Deputy Chairperson

Group Finance Director

John Keells Holdings

The big picture

The fiscal measures proposed in the interim budget are necessary to rebuild Sri Lanka’s macroeconomic fundamentals – they’re long overdue to systematically overcome the current economic crisis.

The plethora of progressive reforms including enhancing the independence of the Central Bank of Sri Lanka and SOE reforms – to name a few – are encouraging, together with the steps taken to remove subsidies on power, energy and other utilities, which is a significant step towards reducing the budgetary burden.

The key success factor will be the implementation of these reforms, which has been a challenge for successive governments. The extensive list of reforms may pose challenges for their implementation – particularly given the multitude of reforms and bandwidth required to execute them. A more targeted list will increase the likelihood of successful implementation of meaningful reforms.

The revenue measures listed in the interim budget lack adequate clarity in terms of the practicality and reality of achieving such targets.

While revenue enhancing measures are imperative, there could have been more focus on controlling expenditure as well, which is required to bridge the deficit; and as importantly, from a messaging perspective.

Removal of tax holidays

In the long term, the removal of tax holidays on new projects is a step in the right direction. From an investor perspective, tax holidays are not the foremost of requirements and taxes may not be a substantial expense item since taxes are in any case levied on profits.

Investors seek consistency in economic, fiscal and tax policies together with many other aspects of the ease of doing business. Typically, tax holidays have prevailed in Sri Lanka as a sweetener for investors to compensate for the lack of other fundamental requirements such as economic and policy consistency, and the ease of doing business.

Therefore, while the removal of tax holidays is acceptable, there has to be a concerted effort to reduce the inefficiencies in our system, and ensure stable and consistent policies to attract investors. This needs to be pursued as a matter of priority.

The key success factor will be the implementation of these reforms, which has been a challenge for successive governments

Hiran Cooray

Chairman Jetwing Symphony

Tourism industry

With regard to the takeaways from the interim budget for the tourism industry, our team is of the opinion that there are no significant takeaways for tourism.

2023 budget expectations

As the tourism industry is projected to generate much needed foreign currency, out of which 90 percent would remain in Sri Lanka, and considering the importance of this to the economy – our expectations of Budget 2023 to be presented in November are to maximise foreign currency earnings – and tourism should be categorised as an export industry.

Our team is of the opinion that there are no significant takeaways for tourism

Dr. Parakrama Dissanayake

Deputy Chairman

Managing Director

Aitken Spence

The big picture

The pros of the 2022 interim budget are the proposal to increase income tax rates, and the re-introduction of withholding tax (WHT) on interest and dividends, and PAYE tax, as these enhance tax collection.

Mandatory registration of all citizens above 18 for an income tax file is a good proposal since it would bring self-employed and other private business owners into the tax net, provided there’s a solid tax administration system to ensure compliance.

However, with the steep increase in tax rates and reduction of slabs, it is the private sector’s middle management employees who will be severely affected by the additional tax burden.

They’re already burdened with the high cost of essential goods, and this could provide a further impetus for the brain drain that’s already commenced of young professionals and those practising other vocations.

With regard to the social security contribution levy (SSCL) of 2.5 percent on revenue – which has been introduced to replace the nation building tax (NBT) that was abolished in 2019 – and the increase in value added tax (VAT) from eight percent in 2021 to 15 percent, the loss of revenue from NBT is likely to be adequately compensated.

The SSCL would have a cascading effect on prices since set offs against inputs aren’t permitted – this will increase the cost of goods and services further.

Other pros are the public sector reforms (e.g. reduction of the retirement age to 60 years), the restructure of state owned enterprises (SOEs), establishment of a State Owned Restructuring Unit, and the introduction of a new Central Bank Act to insulate it from politicisation.

Removal of tax holidays

Foreign and local investors are more concerned about the ease of doing business than with being offered attractive tax holidays for investments.

Unrealistic lease rentals charged on government owned lands required for large projects, the bureaucratic red tape to obtain various licences and approvals for investments, long delays and other negative practices being adopted by public institutions to grant approvals are deterrents to any genuine investor.

A double deduction of capital allowances on investments in plant, machinery and technological assets would be more beneficial for large-scale investments than tax holidays, which are granted for a limited period and cannot be made use of when a project is in its startup and initial growth phase.

Furthermore, there should be transparency in granting Strategic Investment Project Status to large-scale infrastructure projects. Some of these projects are not awarded through a transparent bidding process; and they’re granted a host of concessions with tax holidays being extended almost for the lifetime of the project.

Unless the government provides a conducive and transparent landscape for investment, its ambitious target of achieving foreign direct investments (FDIs) will not be realised. Furthermore, local companies will also be compelled to move out of the country to set up operations and for future investment, which will be detrimental to the country.

It is the private sector’s middle management employees who will be severely affected by the additional tax burden

Shanil Fernando

Managing Director

Sysco LABS Sri Lanka

IT industry

The budget comes at a volatile time for the country and its economy. It’s a short-term revenue fix with increased taxation, which understandably, the government needs to pursue at this time.

However, there are many aspects the budget has to balance in terms of economic recovery without constricting industries and sectors such as IT, which are crucial forex earners and necessary for future socioeconomic growth.

At present, the IT sector is impacted by the loss of talent to other countries due to the prevailing socioeconomic environment. This is in addition to disruptions to operations caused by inconsistent electricity and fuel supplies, and so on.

The import bans further compound these problems by making it difficult and costlier for companies to access the technology imports that are needed for business continuity. Together with the increase in different components of taxation, these factors combine to reduce Sri Lanka’s desirability as a tech hub – for both the IT workforce and international clients.

If left unremedied, this will result in a migration of clients to more stable and viable sourcing locations – leading to a decrease in forex revenue. The interim budget does not offer adequate solutions to the issues that impact the IT sector’s performance and sustainability.

2023 budget expectations

The 2023 budget must address the public sector’s high expenditure. The private sector is the nation’s engine of growth but imposing high taxes on it and using that revenue to prop up inefficient state owned enterprises (SOEs) is not the way forward.

Most SOEs must be privatised or at a minimum, be restructured and listed on the stock exchange – so that they can be run and scrutinised like any private company. We must change our welfare mentality and minimise the negative impact of unproductive SOEs on the national economy.

I expect the November budget to deliver a framework that empowers export sectors as they’re key to economic revival This applies to the IT sector especially, because our core export is knowledge and therefore, we are neither capital intensive nor import dependent – so our value added per employee is higher than in most other industries.

The 2023 budget should allocate funds and announce measures to significantly improve socioeconomic conditions to curtail migration, and reduce the talent attrition rates that currently affect different industries.

It should address short-term challenges while also making provision for a midterm recovery and long-term socioeconomic growth. I expect the focus to be on further developing the IT sector. Budget 2023 should protect and promote the sector because it’s vital for the country vis-à-vis the PESTEL framework.

Overall, I think the budget must prioritise sustainable revenue generation and management, as well as socioeconomic stability, while safeguarding forex generators such as the IT sector. It has to introduce favourable measures for business continuity so we can emerge from this crisis faster and stronger.

At present, the IT sector is impacted by the loss of talent to other countries due to the prevailing socioeconomic environment

N. R. Gajendran

Senior Partner

GAJMA & CO

Income tax revisions

The people have been taken by utter surprise by multiple catastrophes primarily caused by accumulated imbecile decisions, which have left them reeling under legislated and unlegislated taxes.

Additional levies in the form of the value added tax (VAT), the social security contribution (SSCL) and income tax have mounted almost instantly. Unlegislated taxes arising from the precipitous depreciation of the Sri Lankan Rupee, and unprecedented demand and supply mismatches, have led to skyrocketing prices of goods and services.

For example, if a person earned an income of Rs. 100,000 prior to the crises, and if he or she used it all for consumption (and if he or she wasn’t liable to income tax), after paying VAT of eight percent, the person would have 92,000 rupees for consumption. If he or she was liable to pay income tax at the highest marginal rate of 18 percent, they would have Rs. 74,000 for consumption, based on a rough calculation.

From October this year, the same person with an income of Rs. 100,000 will have about 80,000 rupees for consumption after 15 percent VAT and SSCL of 2.5 percent cascaded to five percent. This Rs. 80,000 will be halved to Rs. 40,000 because of the depreciation of the rupee of around 100 percent against the US Dollar – from Rs. 180 to 360 rupees.

Furthermore, due to the demand and supply mismatches, prices have at least doubled for most goods and services. Therefore, the Rs. 40,000 will be halved further to 20,000 rupees. Consider the predicament of a non-income tax payer who had a real disposable income of Rs. 92,000 for consumption being brought down to 20,000 rupees!

In the case of an income tax payer at the highest marginal rate of 32 percent, which may increase further, he or she will have a depleted disposable income of Rs. 12,000 – compared to 74,000 rupees before the crises.

No wonder every citizen at his or her level of standard of living often finds that the relevant goods or services have become unaffordable; and even if cheaper substandard substitutes are available, that they too are unaffordable.

So it’s not surprising that the masses at the lowest strata of society are skipping meals regularly.

Certainly, Sri Lankans should not be in such a position as this is a resplendent island. Accordingly, the so-called leaders who made decisions about the lives and livelihoods of the people are answerable and accountable, and should be brought to book.

2023 budget expectations

Solving the foreign debt overhang with IMF assistance together with ensuring that the national budget is efficient is unquestionably of the utmost priority. There can be direct and indirect subtle impositions by the IMF, which we will have to oblige to obtain the Extended Fund Facility (EFF).

As a result, further imposition of tax – including capital taxes in the form of a wealth tax – may be in the offing. This is evident from the Value Added Tax (VAT) Bill issued on 27 September, which has brought down the tax-free threshold proposed earlier of Rs. 120 million per annum to 80 million rupees with effect from 1 October.

So there’ll be more to come in the 2023 budget.

Nevertheless, policy makers shouldn’t be blinded by mere revenue enhancements; they have a greater responsibility to ensure that tax and fiscal policies don’t drive businesses and investors away.

However, expenditure based incentives and relief should be granted to ensure that businesses and investments are attractive. This will certainly not offend the International Monetary Fund; it may even be encouraged by the UN agency.

Expenditure based relief in the form of double deductions should be continued for investments, and research and development endeavours. In addition, expenditure based on other business value drivers in the form of food security, storage and distribution, training and retraining, brand building, renewable energy and so on should be recognised, and deductions be available for income tax purposes.

Certainly, the 2023 budget should focus on introducing legislation to make corruption and malpractice impossible; and the tax base should be widened by netting in conspicuous evaders who go free with immunity and impunity.

No wonder every citizen at his or her level of standard of living often finds that the relevant goods or services have become unaffordable

Manil Jayesinghe

Country Managing Partner

Ernst & Young Investment Consultants

Public sector debt

To assess whether a reduction from 110 percent to 100 percent of GDP is possible, we need to first look at what our public sector debt is used for. According to revised estimates in the 2022 interim budget, debt is used for ever increasing public expenditure, which consists primarily of interest payments on debt, salaries and pensions, and subsidies.

If debt is to be reduced by such a percentage, one of two things should happen: either public expenditure should reduce substantially so that future borrowings can be reduced to meet this target; or government income should increase substantially so that the expenditure could be funded by such income – and existing debt can be settled.

Alternatively, a combination of both should take place – i.e. a moderate reduction in expenditure and a moderate increase in income.

Based on the interim budget, the expected income has been revised below the original estimate for the year and budgeted expenditure has been increased substantially compared to the original expenditure for the year.

In this context it’s difficult to believe that public sector debt can be reduced in the medium term as such a target requires robust steps to be taken immediately to bridge the gap between income and expenditure.

Tax registration

The proposal to register residents over 18 years has been introduced to increase government revenue. However, we need to assess how many 18-year-olds have any income at all – the point being that revenue can easily be increased by applying the existing law to those who have income.

Registering every person above 18 for tax does not mean it’ll result in increased income. It will however, definitely lead to an increase in administrative costs to register and maintain so many files.

The government should look at applying existing laws to assess whether each and every person who has income is paying the appropriate amount of tax.

Assessing a person’s income is not difficult. Basic auditing techniques – and an analysis of straightforward information such as bank deposits, large transactions, real estate ownership, vehicle registrations, credit card spending, loans, foreign travel, supermarket expenses, salary, interest and dividend income could be some effective areas to commence an audit to assess if those who have income are filing a return, and paying their taxes dues.

Information on all of the above is easily accessible to the revenue officials. To assist with compliance, those entering into any of the above transactions could be required to file a return and obtain tax clearance to ensure they have paid the appropriate taxes.

For example, prior to acquiring a vehicle or property, travelling abroad or obtaining a credit card, a person could be required to open a tax file and receive clearance. In this way, we could first target those who have income – rather than all and sundry.

It’s important to also focus on nonresidents as the budget proposal only refers to residents being registered. There are many nonresidents who earn income in Sri Lanka that’s taxable in accordance with existing laws who aren’t being taxed. To ensure that this is monitored, work visas should only be issued and renewed if a tax file is also opened, and tax clearance obtained.

Tax evasion

Unfortunately, there were no progressive proposals in the interim budget to address tax evasion and this reflects the lack of attention to this area. Based on tax revenue to GDP and the number of those paying taxes it’s evident that a large part of the income earning population isn’t paying their fair share.

This has resulted in tax rates increasing to compensate for the taxes unpaid by evaders and their advisors. As such, it’s imperative that appropriate proposals are introduced in consultation with professionals and revenue officials to consider the most appropriate methods to be used to deter tax evasion.

Robust training of revenue officials in audit techniques and access to data of other institutions, as well as analytical tools and technology, should be used to maximise tax collections. In terms of revenue collection, one could argue that this is the lowest hanging fruit as the money is already in the hands of the evader, which only needs to be taxed.

Strengthening the investigations unit of the revenue authority, and providing appropriate key performance indicators linked to incentives to tax officers, could help motivate taxing evaders and increase revenue.

Stronger implementation of penal provisions to fine tax evaders and take necessary legal action against them could be publicised and implemented to deter tax evasion – including aiding and abetting evasion, by employees and advisors.

In this way, a more compliant tax paying nation could be encouraged. But one needs to be careful in implementing these measures as they should not be used as tools to harass taxpayers who are compliant.

It’s difficult to believe that public sector debt can be reduced in the medium term

Dilanka Jinadasa

Group CEO

Hela Apparel Holdings

Apparel industry and exports

The interim budget marks an important step towards restoring Sri Lanka’s macroeconomic stability, which is critical for all industries including exporters. We welcome the government’s renewed focus on export-orientated growth – particularly through greater integration with regional and global value chains.

This will help Sri Lanka to boost productivity and support a structural transformation of the economy. It’s also supported by greater attention being placed on the National Export Strategy (NES), a blueprint unveiled in 2018 to increase exports, enhanced regional cooperation and job creation.

The strategy sets out specific priority actions to modernise regulatory systems for improved efficiency, increase opportunities in regional and global trade, and address potential competitive constraints.

In fact, the last key takeaway is that ‘high trade barriers will be phased out in the form of para-tariffs.’ This will be done in conjunction with a Trade Adjustment Programme to support industries and workers who are adversely affected by such tariff liberalisation.

Though unstated, this might also involve gradually lifting the current import restrictions. The import restrictions, which were brought forward to reduce pressure on limited reserves, have been a major setback to several economic sectors in the country.

2023 budget expectations

While navigating Sri Lanka through the current economic challenges should remain the focus of the Budget 2023, it will also offer an important opportunity to make further progress on key structural changes the economy requires.

In addition to continued fiscal consolidation measures, we expect to see further details on plans for areas such as the restructuring of state owned enterprises (SOEs) and trade liberalisation.

The apparel industry has maintained its position as a major exporter, and demonstrated extraordinary resilience despite unparalleled domestic turbulence and unstable global market conditions, along with the rising cost of raw materials and logistics.

While restoring Sri Lanka’s macroeconomic stability will remain important for the industry’s continued success, such structural reforms to the economy will be critical to ensuring its ongoing global competitiveness.

The interim budget marks an important step towards restoring Sri Lanka’s macroeconomic stability

Reyaz Mihular

Chairman

Bairaha Farms

Public sector debt

The reduction of public sector debt from 110 percent of GDP to 100 percent is possible if the government follows through rigorously on its proposals to reduce public debt.

Restructuring of the three big state owned enterprises (SOEs) – namely the Ceylon Electricity Board (CEB), the Ceylon Petroleum Corporation (CPC), including CPSTL, and Sri Lankan Airlines – is critical to achieving this; and this will require political will to see it through.

In addition, other state owned businesses (SOBs) need to be divested as the government should not be in the ‘business of doing business.’ Instead, it should provide the right environment for business while ensuring that adequate regulations are in place to protect consumers of such products and services.

The current crisis has provided the right impetus for this to be done. No longer are people ready to accept inefficiencies that stem from these SOBs due to inherent nepotism and favouritism that has plagued these entities from their inception.

Of course, these measures must be accompanied by an effective safety net to protect those at the bottom of the pyramid and I see promising steps being taken in this direction.

Tax registration

I believe that the concept of mandatory registration of all residents over 18 for tax purposes has been borrowed from the US tax system, where you have to file a tax return each year even if it’s a ‘nil return.’

This requires everyone to make a declaration of their income and any false declaration carries with it the threat of a tax fraud prosecution. This will help widen the tax net. However, I have serious reservations on the ability of our tax system (RAMIS) to handle such a volume.

Even now, the system jams on or around the tax filing date! While upgrading the system, I’d suggest that we increase the threshold age for such filing to say 21 years as a start, as this is the probable employment threshold for us in Sri Lanka. Once we get through the teething issues, the bar could be reduced.

However, this must be accompanied by further simplification of the personal tax system to facilitate people to file their returns without too much complication and cost.

Tax evasion

Frankly, no, not enough is being done to address tax evasion. The pathetically low number of tax payers in the country is testimony to this.

It’s critical that the tax authorities take tangible measures to widen the net without harassing those who are already paying taxes. An effective Tax Payers Charter should be implemented to protect taxpayers from such harassment from a small number of unscrupulous officers. I must hasten to add that a large majority of them do not fall into this category.

A high level reconciliation of assets declared to income earned will help. Right now, too much time is wasted on going into little details and we can’t see the wood for the trees!

A better allocation of resources of the Inland Revenue Department (IRD) will realise better results.

State owned businesses (SOBs) need to be divested as the government should not be in the ‘business of doing business.’

Thimal Perera

Director

Chief Executive Officer

DFCC Bank

Banking sector

The 2022 Interim Budget is ambitious and presents challenges; however, if executed effectively, it ought to achieve its national objectives by resetting the system, and allowing the economy to stabilise and recover.

Overall, we believe the interim budget proposals are timely and prudent. The focus is clearly on shoring up government revenue to reduce the deficit. Regarding the impact of the proposals on the banking sector, we believe there are some incredibly positive developments.

The proposals to insulate the central bank’s monetary policy from politicisation and political influence is very welcome. Allotting 20 percent shareholding of certain government banks to depositors and staff will also help strengthen the capital position of these banks, and the rest of the sector, amidst a tightening monetary environment and rising non-performing loan (NPL) risks.

We’re also pleased to note the many fiscal and tax reforms, all of which are needed. This together with a strengthening of the social net, which appears to be occurring now, will at the very least orient the economy in the right direction towards sustainable growth and responsible government fiscal policy.

It’s also very encouraging to see reforms such as the proposed Public Finance Management Act, which is expected to introduce stronger fiscal rules and better insulation of the country’s fiscal trajectory, from myopic and politically motivated decision making.

These reforms should encourage and help draw the support of the IMF and other global creditors to enter into partnerships with Sri Lanka, without which a meaningful financial recovery and return to growth will be impossible.

2023 budget expectations

We expect that the budget for 2023 will be an extension, if not an expansion, of the interim budget proposals. And we genuinely hope that this present sense of prudency and forward thinking will persist, helping to strengthen government revenue and ensure a balanced budget.

However, as a side note, it is essential to remember the effects of the Laffer Curve when raising tax rates. We should not create a state where higher tax rates incentivise tax evasion and stifle the economy, leading to an overall reduction in tax collections and a return to fiscal and economic underperformance. Instead, we should pursue a more accessible and efficient tax collection system at rates that are not burdensome to an already burdened populace.

In addition, Budget 2023 needs to be consistent with the economic reforms programme and macroeconomic framework under the IMF programme.

The proposals to insulate the central bank’s monetary policy from politicisation and political influence is very welcome

Hasitha Premaratne

Chief Strategy Officer

Group Finance Director

Brandix Lanka

IMF impacts and taxation

This interim budget predominantly covered the bulk of arrangements that were set out in the staff level agreement (SLA) with the IMF – these proposals are by and large articulated in the budget.

The confirmation of the SLA was announced a few days after the interim budget was read in parliament, which means that the authorities had access to what was in the staff level agreement by the time the budget was read. The 2022 Interim Budget attempts to make a start on implementing some of the proposals in the SLA with a particular focus on the principles.

In the short term, tax increases are to be brought in and certain expenditure allocations are to be scrapped to address the fiscal deficit. It attempts to look at certain reforms to address loss making state enterprises to ensure that state coffers will not be pressurised to fund such losses; it’s a platform to get on with the proposals in the IMF staff level agreement.

So in that context, Budget 2023 shouldn’t introduce significant changes to tax rates and the regime that is spelled out in the interim budget, though it may probably elaborate on some of the provisions and look at how we need to take them forward to 2023.

Budget 2023 shouldn’t introduce significant changes to tax rates and the regime that is spelled out in the interim budget

Charmaine Tillekeratne

Partner and Tax Leader

Tax Services

PwC Sri Lanka

Tax registration

It’s pertinent to note that the proposal to register all residents over 18 covers only compulsory tax registration, irrespective of annual income and tax-free thresholds; it does not specifically indicate whether filing an income tax return would necessarily follow, irrespective of income and tax-free thresholds.

It would be interesting to know the exact intention of the policy makers behind this proposal. Is it merely to enforce a habit of tax compliance among the youth? Or is it intended to generate additional income?

If it’s the former, then a mere registration may suffice together with the condition that the registration number is a prerequisite for certain capital transactions such as buying and/or registering an asset, opening bank accounts, obtaining loans and so on. But the registration would not be productive if the authorities are not able to monitor the change in income status of the youth as they progress in life.

And if it’s the latter, everyone above 18 years would have to file a tax return, declaring not only their income but also assets and liabilities. This would no doubt be a herculean task on the part of the Inland Revenue Department (IRD) to facilitate such filings. Obviously, these filings cannot be done manually and would have to be obtained electronically.

The internal systems of the IRD may not be geared to implement this overnight. Further, the compulsory filings will only yield results if the data obtained is analysed and the next steps taken. The pertinent question here is whether the department has the required resources to do this – and whether the benefits outweigh the costs (i.e. the cost of upgrading the IRD systems, recruiting and training new staff, and so on.)

Finally, will the said compulsion actually force all individuals above 18 to register? If a person is below the tax-free threshold, which is proposed to be reduced to Rs. 1.8 million per annum, it’s unlikely that the said individuals will be entering into any significant transactions unless they’re supported by wealthy families and/or illegal activities.

This segment would presumably be a minority and in any event, there are other mechanisms to monitor such activity, which are already in place – albeit not properly implemented.

Therefore, it may not be practically feasible to implement this proposal in the immediate future; and even if it’s implemented, it may not yield any significant positive results.

It may not be practically feasible to implement this proposal in the immediate future

Dinesh Weerakkody

Chairman

Colombo Port City Economic Commission

Construction industry and 2023 budget expectations

Today, the country is reeling from the worst forex crisis triggered by conflicting money and exchange rate policies. Sri Lanka has been hit by high inflation and forex shortages, accompanied by trade and exchange controls.

As a country, we need a hard reset and to develop a strategy for sustained economic development.

We would need to consider the following: corporatise non-performing state owned enterprises (SOEs); widen the tax net; cut government expenditure and build public service capacity; increase foreign direct investments (FDIs); and increase the export of industrial manufacture to reach a value of US$ 20 billion (currently, total exports stand at 12 billion dollars).

International investors who are willing to participate in Sri Lanka’s recovery will want clear unambiguous answers on debt sustainability. To this end, much depends on what is strategised and offered to private investors who might wish to participate in such a recovery.

It’s now essential to implement a new economic model for responsible development, which will ensure support for export acceleration, new industries, innovation, digitalisation and talent development.

However, a ‘no care attitude’ from public institutions (like we have today, in the case of some entities) could delay the economic recovery. A lot will therefore depend on the experienced president taking very hard decisions.

International investors who are willing to participate in Sri Lanka’s recovery will want clear unambiguous answers on debt sustainability