APPAREL INDUSTRY

WEATHERING THE STORM

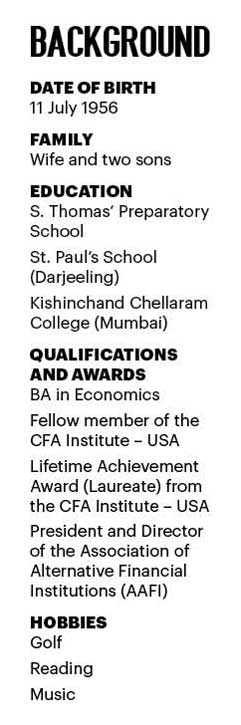

Representing the third generation in a line of entrepreneurs, Mahesh Hirdaramani has been a longtime contributor to Sri Lanka’s apparel industry in his roles at the Hirdaramani Group – and beyond.

He has served the group for over four decades, having joined the family business at the age of 21.

Appointed Chairman of the Hirdaramani Group in 2015, he has continued to play a role in its pioneering advances in recent years while preparing to hand over the reins of the business to the next generation.

In addition to his roles within the group, he has served the apparel industry as a former Deputy Chairman of the Joint Apparel Association Forum Sri Lanka (JAAF) and Council Member of the Employers’ Federation of Ceylon (EFC), where he represented the Manufacturing – Garments and Textiles segment.

In this exclusive interview with LMD, Hirdaramani outlines his views on the apparel industry’s role in the local economy, and sheds light on the obstacles it has faced in recent years and near-term challenges that must be addressed to ensure Sri Lanka’s competitiveness – including the need to focus on sustainability as an investment.

Furthermore, he discusses the sensitivities impacting Sri Lanka’s image on the global stage and his outlook for the nation’s prospects in prevailing environment.

– LMD

“The apparel industry plays an extremely important role in Sri Lanka’s economy – we must ensure that it continues to grow exports and provide employment opportunities”

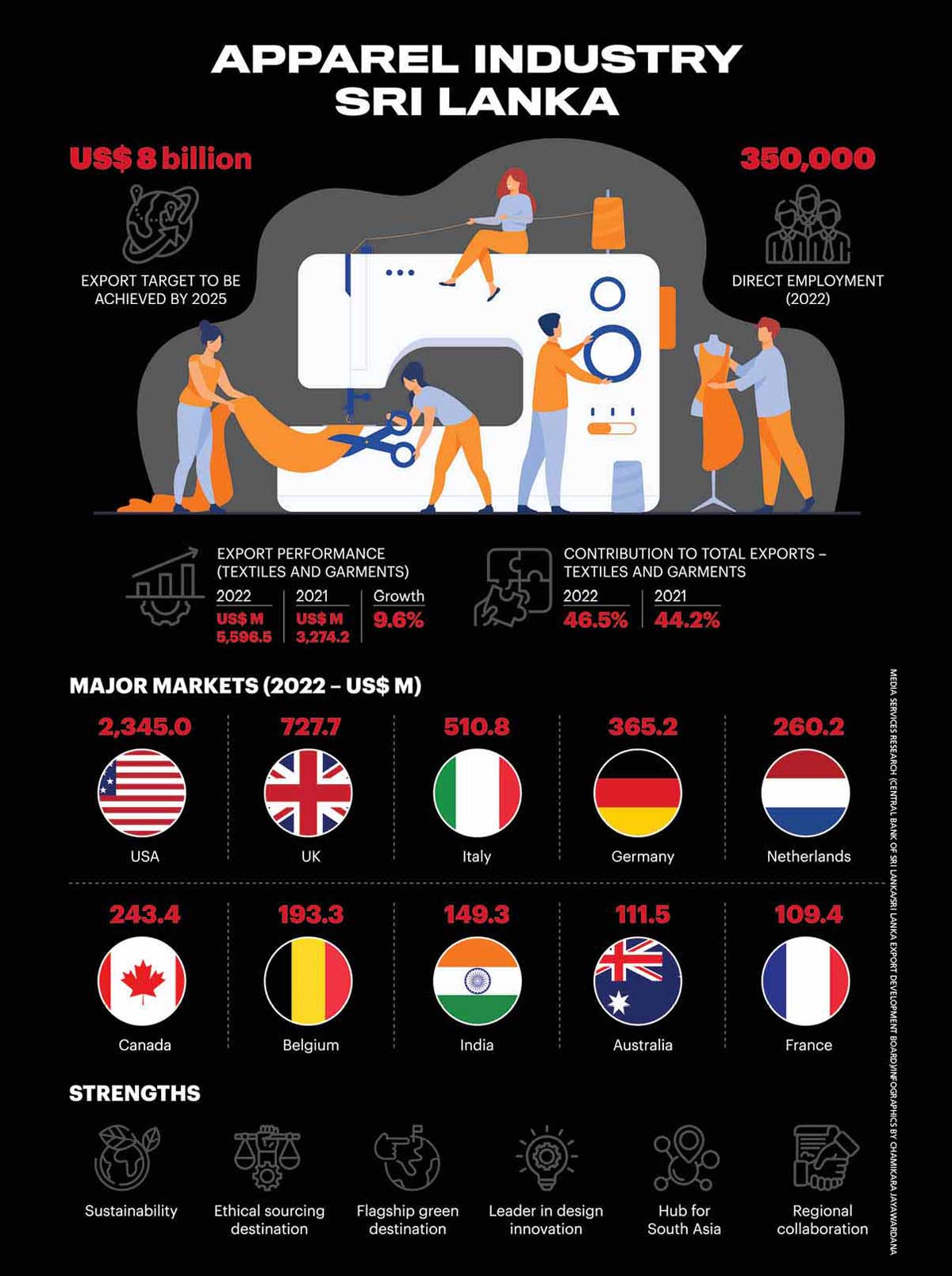

Q: Given the importance of the apparel industry, which accounted for nearly US$ 6 billion of Sri Lanka’s export revenue last year and employs more than 350,000 people working in some 300 factories across the island – what measures should its players take to ensure that it maintains its place among the nation’s export mainstays?

A: The apparel industry plays an extremely important role in Sri Lanka’s economy – we must ensure that it continues to grow exports and provide employment opportunities.

To do so, we need to ensure operational excellence and on time delivery to our customers; maintain high quality standards in production; localise supply chains as much as possible to improve overall lead times; be competitive and consistent in pricing; be leaders in compliance and sustainability; and continue to innovate with design, material innovation, manufacturing automation and digitalisation.

We also need to position Sri Lanka differently to our large-scale competitors. And we must be able to produce profitably for more premium brands with smaller order volumes, different retail models and higher quality standards. Manufacturers also need to look at new export market opportunities.

Q: The Export Development Board (EDB) has mooted an export revenue target of US$ 8 billion by 2025. How realistic is this in view of the global economic slowdown and the prospect of recessionary times in key markets in the West?

A: This goal is realistic in terms of the capability of the Sri Lankan industry and commitment of the large players. However, a lot will depend on the global economic situation.

We expect a recessionary environment this year with a reduction in overall apparel export revenue compared to last year. Global consumers have less discretionary income due to high inflation and other geopolitical challenges.

Yet, we believe that there is potential for a strong rebound next year as inflation comes under control and global central banks begin reducing interest rates. This will help improve sales, and possibly boost Sri Lanka’s export revenue in 2024 and the following year, making US$ 7-8 billion in revenue in 2025 more realistic.

“It is extremely important for apparel and textile manufacturers, and brands, to monitor their environmental impact and do whatever is possible to reduce it”

Q: How is the energy crisis affecting the industry in the context of the power cuts implemented over the last year or so? Likewise, what are the challenges of transporting goods and workers, given the fuel shortage and quota system?

A: Most companies will be affected by high new tariff rates and power cuts. To mitigate these factors, we have set up rooftop solar and invested in renewable power projects.

Q: Your group has invested heavily in the solar sector. Could you elaborate on your forward strategy and also the cost factor – not only for investors but consumers as well?

A: We have one of the largest solar roof installations in the country across eight of our factory rooftops. We generate 11.38 megawatts through this installation.

Our group strongly believes in renewable energy – we have rooftop solar installations and have also invested in other renewable energy projects with our ownership of WindForce.

Q: And how would you measure the return on investing in eco-friendly factories such as Mihila and steps being taken by the global apparel industry to go green?

A: There are both tangible and intangible benefits to investing in eco-friendly factories. We see better financial returns from lower energy consumption, less water usage and more lean factory premises overall.

By controlling our usage of raw materials and tracking waste diligently, we’re able to maintain our zero waste to landfill policy. It is clear that the apparel and fashion industry is one of the biggest polluters mainly due to the huge amount of water used, and the discarding of excess garments and materials that end up in landfills.

We feel it is extremely important for apparel and textile manufacturers, and brands, to monitor their environmental impact and do whatever is possible to reduce it.

Q: How have the global economic headwinds and war in Ukraine impacted the local apparel industry? And what do you believe will be the near-term challenges that need to be countenanced?

A: The global economic headwinds and war in Ukraine have likely had a negative impact on the local apparel industry. And the slowdown of the global economy has led to a reduction in demand for clothing, which has impacted exports from Sri Lanka.

Additionally, the conflict in Ukraine has disrupted supply chains, making it more difficult and expensive to import raw materials, and export finished products. This has resulted in higher costs for manufacturers and decreased competitiveness in the global market.

“We believe that there is potential for a strong rebound next year as inflation comes under control and global central banks begin reducing interest rates”

The near-term challenges include increased competition from other low-cost producers such as Bangladesh and Vietnam, which have preferential trade agreements with Europe. Africa has the same with Europe and the US, and this could mean less market share for Sri Lanka.

Volatility in raw material prices – particularly cotton and polyester – may result in increased production costs and decreased margins. And uncertainty in the global economy may reduce the demand for clothing, leading to lower exports from Sri Lanka.

“Growth in emerging markets such as India and China present opportunities for the apparel industry to reach new customers – and tap into the growing demand for clothing”

Q: What disruptions have challenged the apparel industry in the last three years? And have there been any changes that are advantageous to the business models of groups such as yours?

A: The apparel industry has faced several disruptions in the last three years – including the COVID-19 pandemic. It has had a significant impact on the apparel industry, disrupting global supply chains, reducing demand for clothing and forcing many retailers to close temporarily.

The shift towards online retail has accelerated in recent years, leading to changes in the way clothing is manufactured, distributed and sold.

There has been an increased focus on sustainability in the apparel industry with consumers demanding more environmentally-friendly and ethically produced clothing.

Technological advancements such as automation and 3D printing are changing the way clothing is produced, and affecting the traditional manufacturing model. This could result in reduced production costs, increased efficiency and improved product quality.

“There has been an increased focus on sustainability in the apparel industry with consumers demanding more environmentally-friendly and ethically produced clothing”

Other changes that are advantageous include an increased focus on sustainability, and a shift towards more environmentally-friendly and ethically produced clothing. This could lead to new business opportunities and increased demand for sustainable products.

The growth of online retail has opened new channels for reaching customers and selling clothing, potentially reducing costs and increasing efficiency for manufacturers and retailers. And the rise of direct-to-consumer sales, where brands sell directly to customers without intermediaries, could result in increased profitability and greater control over the sales process.

Growth in emerging markets such as India and China present opportunities for the apparel industry to reach new customers – and tap into the growing demand for clothing.

Q: Sri Lanka’s national brand value and country image have been under the microscope especially in the last 12 months or so. Is there hope on the horizon for a turnaround – and if so, what are the main sensitivities or barriers to a reversal of this trend?

A: Sri Lanka’s national brand value and country image have certainly faced challenges in recent years but there is hope for a turnaround.

However, there are several sensitivities and barriers that need to be addressed in order to achieve a reversal of this trend.

Improving perceptions of political stability will be critical to restoring confidence in Sri Lanka as a destination for investment and tourism. Strengthening the business environment – including reducing red tape and improving infrastructure – will help attract investment and boost the economy.

“We hope Sri Lanka will have political, financial and economic stability in 2023”

Addressing environmental concerns such as deforestation and pollution will be important to improving Sri Lanka’s image as a responsible and sustainable tourist destination.

Overall, addressing these sensitivities and barriers will require sustained effort and a commitment from the government, business community and civil society in Sri Lanka.

Q: Drawing on your considerable experience, what have been the most useful lessons learned in preserving the viability of a business in the light of demands for consideration of the triple bottom line – and demonstrating sustainability not only of the business but also its supply chains?

A: Holding on to labour during difficult times, ensuring talent is retained in the country and creating job security is vital for businesses.

During the pandemic, we had to increase the holding time for goods to overcome supply chain issues. Now that it has been resolved, we’re going back to being as lean as possible.

It’s also important to be flexible and agile in perceiving problems and solutions. Agility, sustainability and compliance must be treated as integral parts of a business, and not as add-ons. Sustainability and compliance are not expenses for a company; instead, they’re long-term investments – in fact, they help the business to reduce costs in the long term.

Q: And finally, what are your hopes and concerns for the rest of this year, in view of the local and global economic and socio-political landscapes? How do you perceive Sri Lanka’s medium-term prospects in the context of the economic and forex crises, business confidence and foreign investment?

A: We hope Sri Lanka will have political, financial and economic stability in 2023. In respect of the global situation, it is hoped that the war between Russia and Ukraine will end, and some sanity will prevail in the world.

It’s believed that our foreign reserves will improve and the rupee will appreciate slightly.

There isn’t much hope for foreign investment this year. But if we can prove that we’re stable, we may see larger investments in Sri Lanka in the next few years in both the tourism and manufacturing industries.

“Brain drain in Sri Lanka is an ongoing crisis and must be dealt with urgently”