Since sustainability is hard to gauge and harder to compare across organisations, an attempt is being made to measure how a business conducts its sustainability journey against set criteria. This process is called ‘sustainability rating’ or ‘ESG rating.’

Since sustainability is hard to gauge and harder to compare across organisations, an attempt is being made to measure how a business conducts its sustainability journey against set criteria. This process is called ‘sustainability rating’ or ‘ESG rating.’

These ratings are generally done by agencies using specific indicators to determine organisational performance in relation to sustainability.

RATINGS TO THE FORE

Standardised rating methods are necessary – Kiran Dhanapala

Ratings usually cover multiple dimensions including carbon emissions, labour practices, supply chain details, board diversity, how the community engages with a business and corporate governance. Most rating agencies use publicly available information.

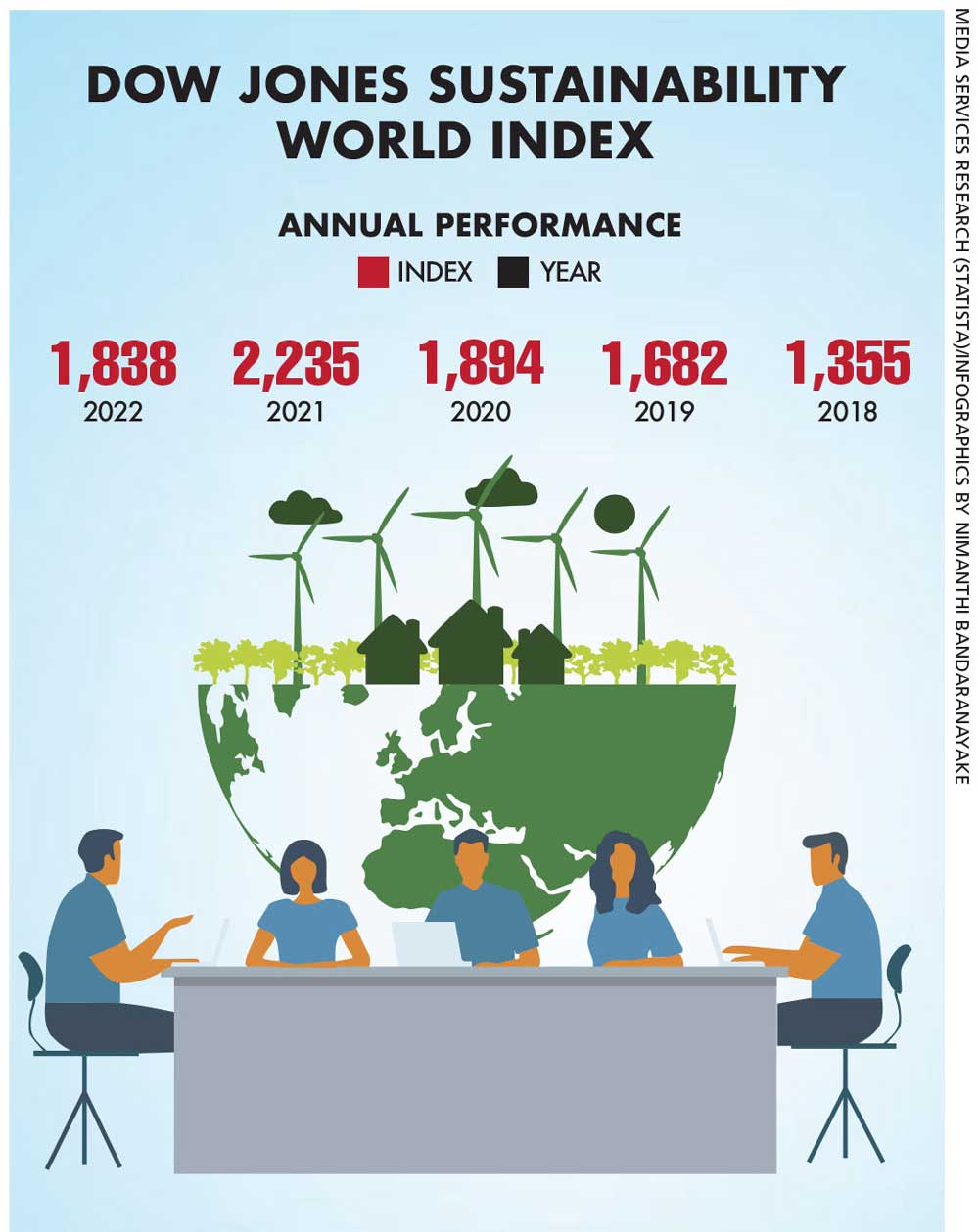

A sustainability rating may use different frameworks including the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), Dow Jones Sustainability World Index (DJSI) and so on.

And rating agencies include Sustainalytics and MSCI among others.

They can also use sustainability criteria as part of an overall corporate ratings methodology as Fitch does. Agencies use different methodologies to form their final sustainability ratings and these aren’t perfectly standardised to enable absolute comparability.

These agencies will use corporate disclosures in the public domain to rate businesses with scores – usually based on a scale of 1 to 100.

Sustainability ratings can help organisations gain a better sense of how they are progressing, improve their sustainability practices and benchmark progress against competitors. It’s also an easy way to communicate a concept with multiple dimensions to stakeholders.

A sustainability rating is particularly significant in helping investors and customers decide if they wish to be involved with an organisation. It aids the transparency of an entity’s sustainability efforts and is viewed positively as a good governance practice.

Independent agency ratings are very useful for businesses – and the benefits include a better reputation among customers and competitors, improved access to capital and markets, and stronger competitiveness.

It’s important to complete the work and then pursue ratings since a poor rating can be an expensive mistake. But it can also identify areas for improvement. Ratings can be a check along the path of sustainability, which helps a business improve and fine-tune itself.

Investors are increasingly using sustainability to evaluate businesses they wish to invest in. A rating makes the evaluation process easier and quicker, and signals good corporate governance. Scores can also indicate areas that merit further scrutiny for potential risks or untapped opportunities.

Corporate board diversity and skills are being increasingly scrutinised under the governance aspect of sustainability. In the past, directors weren’t educated on sustainability criteria. Fluency in sustainability however – as well as environmental, social and governance (ESG) – is now expected since disclosure is becoming mandatory. Boards need to understand and track their corporate sustainability ratings and processes, as part of their fiduciary duty and oversight responsibility.

As regulatory pressures increase, greater emphasis is being placed on sustainability disclosure and this may have more value than ratings. Further global sustainability standards will also need new guidelines and frameworks. Many changes and moves towards strengthening standardisation can be expected in the future.

Given the serious and complex impact of climate change, organisations need to understand their specific climate risks including disruptions and future opportunities. Boards also need to track these global trends, which are creating new regulatory frameworks.

Some argue that ESG ratings are insufficient for conveying relevant climate-related investor information. They claim that climate specific ratings should include organisational carbon footprints and climate risks among others, and be presented in an easy to understand score.

ESG ratings have different methodologies and constructs, which dilute various aspects and make them lose their specificity. Investors weight the environmental, social and governance aspects that come under the ESG framework differently.

Research highlights climate ratings as part of corporate performance metrics – and businesses with favourable ratings often enjoy a substantial increase in investments in their shares.

Positive climatic ratings are also believed to facilitate more climate savvy asset allocations in financial markets and can boost investment in more climate friendly shares by over 20 percent compared to the control scenario.

While ESG ratings are useful, and play a key role in leveraging more sustainable investment and transparent corporate governance, both reporting and ratings need to be standardised.

Given that it’s the key issue of this decade, there’s a push for climate to merit its own rating with greater specificity than ESG.

This content is available for subscribers only.