BUSINESS SENTIMENT

From upbeat growth forecasts and IMF bouquets, to strengthening reserves and a substantial US tariff reduction, the past month has been positive for economic developments here at home.

The economy is seemingly on course for a rebound with some forecasts suggesting that national output will surpass pre-pandemic levels by next year.

BUSINESS CONFIDENCE STEADIES

The barometer of biz confidence finds a footing but the outlook remains guarded

A recent Bloomberg Economics report expects the recovery to continue through this year and beyond, fuelled by domestic momentum despite potential external trade headwinds.

This optimism comes as the International Monetary Fund acknowledged the country’s steady economic progress ahead of the fifth review under its Extended Fund Facility (EFF).

Praising Sri Lanka’s reform agenda for delivering commendable outcomes, the IMF highlighted significant improvements in key economic indicators. Reflecting this progress, official reserves rose by one percent to US$ 6.14 billion in July, up from 6.08 billion dollars in June.

Adding to the positive momentum on the trade front, US President Donald Trump signed an executive order reducing import tariffs on Sri Lankan goods to 20 percent – a sharp reduction from the 44 percent imposed in April. And, there have been reports that further negotiations are underway to bring the levy down yet again.

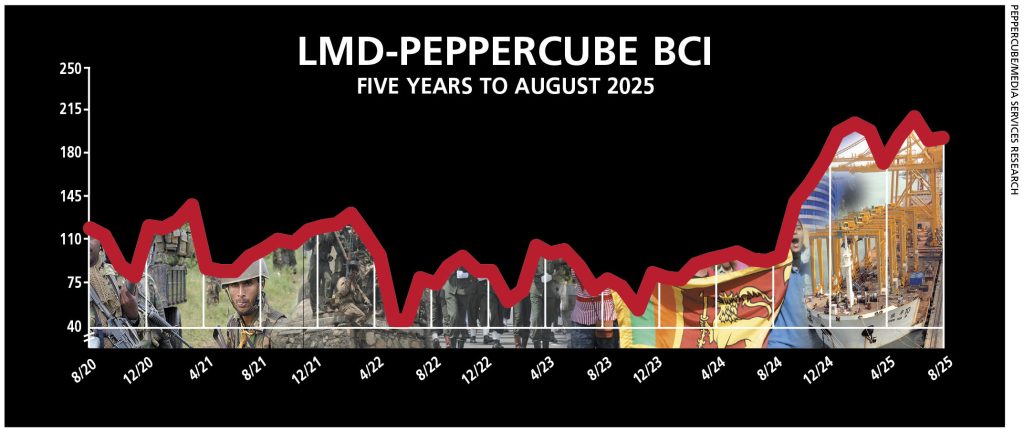

THE INDEX The LMD-PEPPERCUBE Business Confidence Index (BCI) edged up in August, rising by two basis points to 192 from 190 in July.

While still relatively high, the trajectory over recent months – a surge to June’s all-time high of 210, followed by a sharp drop and now a slight uptick – suggests that sentiment in corporate circles may have stabilised.

The index continues to outpace key benchmarks, standing 68 points above its historic median of 124 and 15 notches higher than the 12 month average of 177. In stark contrast, the BCI stood at only 94 in August last year, underscoring the notable recovery in business confidence over the past 12 months.

PepperCube Consultants attributes the latest BCI outcome to stabilising sentiment, following July’s steep decline, driven largely by a marked fall in negative perceptions surrounding the economy and a more optimistic long-term sales outlook compared to the previous month.

PROJECTIONS While June’s record high was short-lived, the swing in the pendulum came as no surprise. As anticipated, business confidence wavered – although the latest index score could be a signal that it may have stabilised to some degree.

On the world stage, the implementation of Trump’s sweeping new tariffs marks another chapter of uncertainty that has left businesses across the globe on edge, bracing for potential supply chain disruptions and spiralling import costs.

Locally, the outlook remains challenging. Political instability, high-profile dismissals and arrests, coupled with persistently elevated consumer prices, point to mounting inflationary pressures.

Against this backdrop, we maintain our view that June’s record setting climb is unsustainable – but whether or not it will head south is impossible to say.