BUSINESS SENTIMENT

CONFIDENCE PENDULUM SWINGS AGAIN

The barometer’s record high loses momentum as pre-budget caution weighs on sentiment

The beginning of November saw the presentation of Budget 2026, which largely mirrored the previous year’s proposals. While the budget did not introduce any major reforms, the president assured that Sri Lanka is on track to regain the economic output lost during the 2022 crisis.

According to him, macroeconomic stability has been restored and investor confidence regained.

Meanwhile, the World Bank forecasts economic growth of 4.6 percent in 2025 and 3.5 percent next year, reflecting a moderate but sustained recovery.

And in its latest Sri Lanka development update titled Better Spending for All, the World Bank notes that while the economy has shown solid signs of recovery, the rebound remains incomplete with output still below pre-crisis levels and poverty rates persistently high.

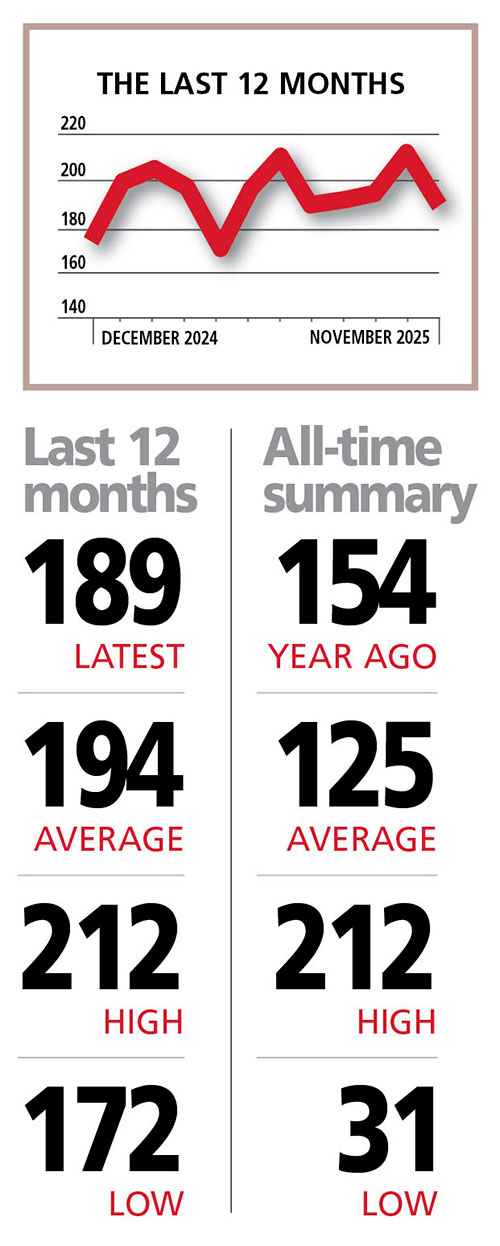

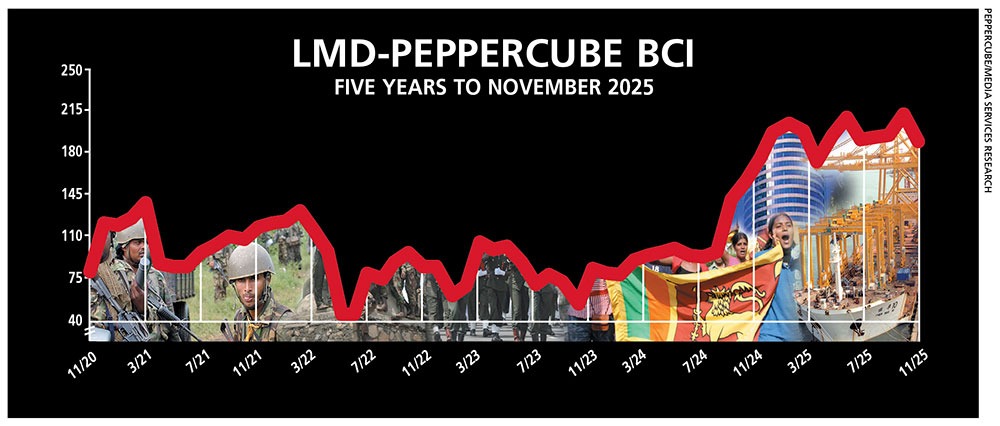

THE INDEX The LMD-PEPPERCUBE Business Confidence Index (BCI) tumbled by 23 basis points from its record high of 212 in October, falling to 189 in November.

As for key benchmarks, the index now stands 64 points above its historic median of 125 and 17 notches higher than the gauge’s lowest point in the last 12 months (172) – and it is five points shy of the 12 month average of 194.

For context, the BCI registered a modest 154 in November last year.

According to PepperCube Consultants, the BCI’s downgrade reflects a wave of uncertainty and apprehension within the business community in the lead up to the budget.

It notes that while overall optimism remains intact, sentiment has shifted towards greater caution – particularly regarding long-term economic and sales prospects.

And it cautions that sustaining confidence will depend on the implementation of targeted policies focussed on human capital development, operational efficiency and a clear plan to address broader socioeconomic challenges.

PROJECTIONS The erosion of confidence following yet another short-lived record high raises questions about the depth of the resurgence in sentiment in the last 12 months. The recent surge in biz confidence appears unsustainable with the barometer expected to fluctuate like a seesaw in the months ahead.

In fact, the International Monetary Fund’s World Economic Outlook (WEO) survey released in October echoes this uncertainty, noting that while the short-term growth momentum persists, the global environment remains volatile.

What’s more, the World Economic Forum (WEF) has cautioned that the international order should brace itself for three possible financial bubbles – viz. crypto, AI and debt markets – even as global hostilities appear to have eased for the time being.

Here at home, budget related anxiety and the recent spate of gang related violence, sensationally labelled with flashy names, have turned attention away from where the economy is heading.

Against this backdrop, as predicted in this column in recent months, November’s decline in confidence is likely to set the tone for the next six to 12 months.

That said, it may well be that the budget verdict rings a positive tone next month, so we could see more volatility in the BCI in the near term.