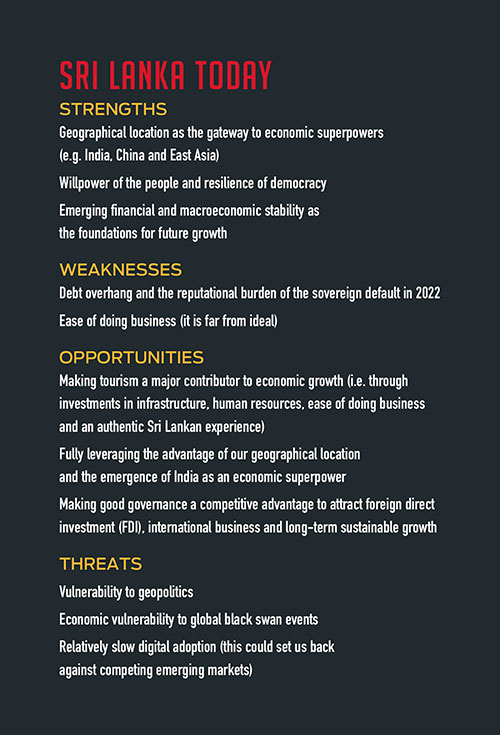

LMD DECEMBER 2025 COVER STORY

We see this as much more than an acquisition of business lines – it’s an infusion of talent and experience

STRATEGIC LEAP

LMD’s exclusive interview with Sherin Cader and Hemantha Gunetilleke

ABOUT SHERIN

EDUCATION AND QUALIFICATIONS

Studied at St. Paul’s Girls’ School

Fellow member of the Chartered Institute of Management Accountants (CIMA)

Fellow member of the Association of Chartered Certified Accountants (ACCA)

Chartered Global Management Accountant (CGMA)

SAP certified in Management & Financial Accounting

ABOUT HEMANTHA

EDUCATION AND QUALIFICATIONS

Studied at Royal College

BSc Management Science from Warwick Business School (University of Warwick) – UK

Associate member of the Chartered Institute of Bankers (ACIB) – UK

BSc Financial Services from the University of Manchester – UK

Advanced management programme at the Harvard Business School in Boston – USA

This acquisition includes HSBC’s premium customer base, credit cards, and personal loan and deposit accounts – a portfolio of some 200,000 clients

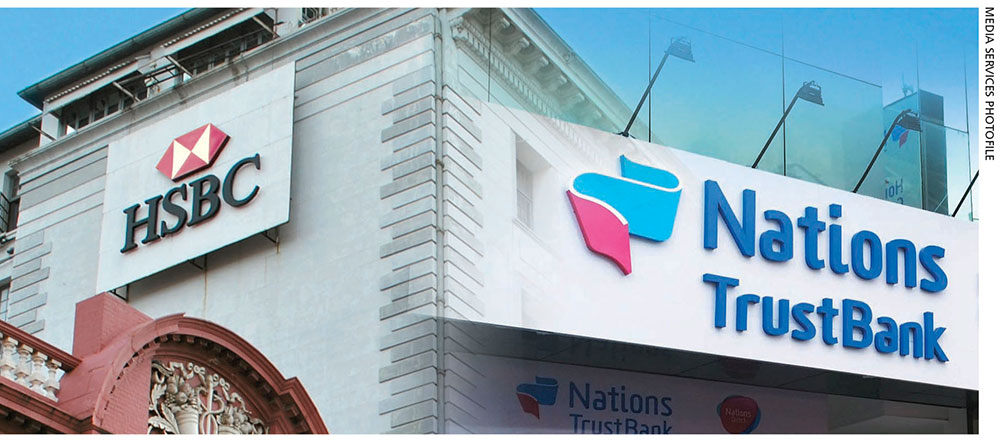

In what is poised to be a defining moment in Sri Lanka’s financial services landscape, Nations Trust Bank (NTB) recently announced the signing of a binding sale and purchase agreement to acquire the retail banking operations of Hongkong and Shanghai Banking Corporation (HSBC) in Sri Lanka.

The significance of this landmark transaction goes far beyond its scale; it marks the confidence of a domestic banking sector that is ready to lead from the front. For a nation on the mend from an unprecedented economic crisis, the deal sends a powerful message: homegrown institutions such as NTB are setting the pace.

This acquisition includes HSBC’s premium customer base, credit cards, and personal loan and deposit accounts – a portfolio of some 200,000 clients.

And what perhaps makes this acquisition notable is that NTB will fund the transaction entirely through its internal reserves – a rare feat, which underscores its financial acumen.

At the forefront of this strategic leap are Nations Trust Bank’s Chairperson Sherin Cader – a seasoned finance professional with decades of experience within the John Keells Holdings (JKH) ecosystem – and Director and CEO Hemantha Gunetilleke, who is a career banker with a global track record.

Together, their stewardship signals a confident future forward shift.

The acquisition of HSBC’s retail operations signals continuity. And NTB says it is committed to retaining HSBC’s retail staff to ensure a smooth transition.

While some view the exit of yet another multinational financial institution’s retail operations from our shores with a degree of trepidation, others have praised it as a bold and forward-thinking decision that reflects a sense of quiet confidence.

So as multinational giants reevaluate their regional strategies, banking institutions such as Nations Trust Bank are stepping up to fill the vacuum – and they’re doing so with intent.

Sri Lanka’s banks are seemingly ready – not merely to compete but lead as well.

The acquisition of American Express Bank’s local operations in 2003, and securing the licence to issue and acquire American Express credit cards, proved to be pivotal milestones that reshaped the bank’s growth trajectory

Q: Nations Trust Bank (NTB) entering into a binding sale and purchase agreement with HSBC to acquire its Sri Lanka retail banking business is one of the largest such transactions in recent years. What was the strategic rationale behind this decision – and why do you believe it’s a transformative step for your bank?

A: NTB is a relatively young institution – just over 25 years old; but in that time, the bank has firmly established itself as a high growth banking institution.

Today, Nations Trust Bank ranks fourth among private sector commercial banks in terms of profitability and has consistently recorded the highest return on equity (ROE) in the banking sector with the last several quarters recording an ROE of over 20 percent.

From its inception, NTB’s growth has been fuelled by a combination of strategic acquisitions and strong organic expansion. The bank was formed in 1999 when John Keells Holdings (JKH) and Central Finance acquired the banking licence of the former Overseas Trust Bank. In 2001, Nations Trust Bank went on to acquire Deutsche Bank’s retail banking franchise, further expanding its footprint.

The acquisition of American Express Bank’s local operations in 2003, and securing the licence to issue and acquire American Express credit cards, proved to be pivotal milestones that reshaped the bank’s growth trajectory. This has positioned NTB as the largest credit card issuer in the Sri Lanka today.

In 2006, Nations Trust Bank strengthened its portfolio further by acquiring Mercantile Leasing Limited (MLL), which added a leasing arm to its business. Today, the bank is among the leading players in the banking sector for leasing.

These strategic acquisitions, complemented by sustained organic growth over the past decade, have been key to NTB’s success.

Against this backdrop, the proposed acquisition of HSBC’s retail portfolio marks another transformative milestone in NTB’s journey. The opportunity emerged at the right time and the bank moved decisively to secure it.

Nations Trust Bank has prudently maintained strong capital ratios in anticipation of opportunities such as this. This acquisition provides the scale, reach and momentum to compete on a broader front, reinforcing its position as a high performing, high growth financial institution.

Q: Why was this the right time to pursue such an acquisition – both from the bank’s perspective, and in terms of the broader economic and financial services environment in Sri Lanka?

A: NTB’s financial position has strengthened considerably over the past four to five years. We have consistently built profit reserves and maintained a capital adequacy ratio of around 20 percent – well above regulatory requirements.

This has effectively created a buffer that enables us to pursue growth opportunities such as this, without raising additional Tier 1 capital.

Even after accounting for the acquisition cost of approximately Rs. 18 billion, our capital adequacy ratio will remain well above minimum regulatory requirements. In terms of liquidity, the bank is in a position to finance the acquisition without any external borrowings

We are entering this new phase of growth from a position of strength. The timing of this acquisition aligns perfectly with both our internal readiness and the improving macroeconomic landscape. We have continuously maintained strong capital and liquidity ratios, underpinned by a robust governance, risk and compliance framework. And we’re confident that this is the right time for the bank to take this step – and from a macroeconomic standpoint, the timing is opportune.

Sri Lanka is at a point of transitioning from an economic recovery phase to a growth oriented trajectory, characterised by improving business sentiment and steadily increasing confidence supported by positive GDP growth, reduced inflation and improved reserves. The country’s macroeconomic fundamentals are in a considerably stronger position than they were a few years ago.

The country’s macroeconomic fundamentals are in a considerably stronger position than they were a few years ago

Interest rates remain low, encouraging borrowing, and driving economic activity and credit expansion. Inflation is well below expectations and steadily moving towards the expected target of five percent. Overall, we are confident about the upward trajectory of the economy, which is effectively resetting.

The challenges of the sovereign default have been addressed effectively, macroeconomic fundamentals are sound, early signs of policy consistency are emerging and we’re witnessing clear signs of recovery among our customers.

Meanwhile, the financial services industry has shown remarkable resilience – and the banking sector has emerged stronger from recent challenges.

A transaction of this scale is a significant development in the financial services industry; it reflects not only the resilience of the banking sector but also the strength and capabilities of Nations Trust Bank.

Q: HSBC has been part of Sri Lanka’s financial services landscape for 133 years and is widely associated with benchmarking global banking. What does this development mean for the country’s aspirations of strengthening its position as a regional financial hub? And how do you view its impact on investor confidence?

A: What we’re witnessing reflects a broader shift across Asia over the past 10-15 years where domestic banks have come of age.

Traditionally, the region’s banking landscape was dominated by large global players. However, in recent years, local and regional banks have become increasingly competitive.

In our view, this transition represents a positive development; it highlights that local banks are now well-equipped to acquire, integrate and enhance such portfolios – both technologically and operationally.

The ability of a domestic institution to take over and elevate a business previously managed by a global bank signals a new level of maturity in the industry. We see it as a sign of progress – a moment that reinforces the confidence, capability and resilience of Sri Lanka’s domestic banking sector.

Q: Were there any concerns or risks you identified when pursuing this transaction – and how have you planned to mitigate them?

A: As with any mergers and acquisitions (M&A) transaction in the financial services industry, there are inherent risks – mainly around integration, governance and compliance. These are common to transactions of this nature from a global perspective as well.

With a strong governance framework and a proven track record in managing complex integrations, we are confident in our ability to successfully mitigate such risks.

The necessary systems, processes and people are already in place to ensure a smooth transition, adhering to data transfer protocols and regulations. From a project management standpoint, it is a large-scale integration programme that is well-coordinated.

At NTB, a cross functional team including senior members is dedicated full-time to the project, supported by globally recognised firms advising on best practices and processes. This is very much a joint transition, not a handover or takeover in isolation.

Both institutions are fully aligned in ensuring the project’s success, making the transition completely seamless for customers.

While it may sound like a complex transition, this is not unprecedented. For us, it represents a landmark project in which we are investing our full commitment, expertise and energy. This is about partnership and precision – working together to ensure that the transition is managed smoothly, securely and successfully for all stakeholders.

The ability of a domestic institution to take over and elevate a business previously managed by a global bank signals a new level of maturity in the industry

Q: What can HSBC customers expect from Nations Trust Bank’s retail banking proposition? And what can they look forward to?

A: The bank is committed to delivering a seamless transition for customers with uninterrupted service and the continued maintenance of excellent service standards.

For us, service quality has always been a defining strength. When the bank was first established, we entered an already competitive market. To stand out, we focussed on challenging convention and service excellence became our core differentiator. It remains deeply ingrained in our DNA to this day.

Since its inception, NTB’s retail banking business has positioned itself as a premium service institution, catering to the affluent and mass affluent segments. This makes for a perfect match with HSBC’s high net worth premier clientele and their mass affluent segment.

We have served these segments for over two decades through Nations Trust Private Banking, supported by a dedicated team and a network of over 90 branches, including our flagship Private Banking Centre in Cinnamon Gardens.

Nations Trust Bank’s private banking and Inner Circle propositions cater to this very demographic, offering bespoke financial solutions and privileges across our network.

The credit card business is another area of strong synergy.

We count over two decades of experience through our long-standing partnership with American Express as well as a strong offering with Mastercard.

With this acquisition, we will expand our card offering to Visa, covering a full suite of credit card options to ensure incoming customers enjoy equally strong value propositions complete with attractive rewards, benefits and service standards.

Digital experience is another strong focus area. Today, over 90 percent of our transactions are processed through digital channels, reflecting customer preferences. We have invested heavily in building secure, intuitive and high performing digital platforms to deliver a frictionless user experience.

Continuity of service is a top priority too.

We will offer employment to HSBC’s staff who currently service the retail banking customer base so that clients can continue interacting with the same trusted professionals. This will ensure that service quality and familiarity remain intact, during and after the customer transition to NTB.

Q: What measures have been put in place to ensure a smooth and uninterrupted service to customers – particularly with regard to their accounts, credit cards, loans etc.?

A: From a customer’s perspective, the transition will be entirely seamless. All HSBC customers will continue to be served by their existing relationship managers and branches, and their products, services and access to banking channels will remain unchanged until the final handover date.

A planned product transition will be implemented during the integration period. To keep clients informed about what to do and expect, Nations Trust Bank and HSBC will jointly implement a communications plan that provides clarity on how their accounts, credit cards, loans etc. will be transitioned – and what steps will need to be taken before and after the handover, once regulatory approval is received.

Both NTB and HSBC have collaborated to design a process that ensures continuity and minimises disruption for customers.

Digital experience is another strong focus area. Today, over 90 percent of our transactions are processed through digital channels, reflecting customer preferences

Q: So how does this transition impact customer’s when it comes to international transactions?

A: The short answer is that there will be no major impact.

For individual customers, outward international transactions generally occur in two ways: through credit cards or via permitted foreign remittances such as tuition fees or living expenses for students overseas. The underlying mechanisms for these transactions remain unchanged.

Credit card transactions are driven by global payment schemes – Visa, Mastercard or American Express – which facilitate settlements between the local issuing bank and overseas merchant. Irrespective of the issuing bank, international payments are processed seamlessly both locally and internationally through these card schemes.

NTB already maintains robust correspondent banking relationships with leading global banks, allowing it to process international payments efficiently and securely. For inward remittances and other international transactions, the bank offers regulated accounts to facilitate permitted transactions.

All such transactions will continue to operate within the local regulatory framework, irrespective of the banking partner.

Sri Lanka’s banking system has demonstrated remarkable strength through an unprecedented period

Q: As you have affirmed, this deal also involves absorbing HSBC’s retail banking staff. How do you plan to integrate them into Nations Trust Bank’s culture while ensuring a smooth transition?

A: This transaction involves the acquisition of an entire retail business – and in the services sector, people are a vital part of that. Staff form the backbone of customer experience, which is why we place immense value on welcoming the entire retail banking team that currently serves HSBC’s customers.

We are confident that this transition will be both seamless and mutually enriching. Although we’re a relatively young bank, our culture has been built on a diverse mix of talent. Some of our colleagues have been with us since inception while others have joined us from leading local and international banks, as well from other industries.

Over time, this blend of experience and perspective has created what we proudly call the ‘nations culture’ – one that is collaborative, inclusive and performance driven.

Our evolution as a bank is a story of integration: from our origins through the acquisitions of Deutsche Bank’s retail operations, American Express and Mercantile Leasing, we’ve successfully brought together different institutional cultures, and created a unified and cohesive organisation – one that’s focussed on performance and service excellence.

Many of our senior leaders including members of the top management team joined the bank through previous acquisitions; and they have not only integrated successfully but thrived, growing into key leadership roles. That personifies our culture: it’s merit based, open and designed to help people reach their full potential.

Ultimately, we see this as much more than an acquisition of business lines – it’s an infusion of talent and experience. We’re excited to integrate these colleagues into the Nations Trust family, and continue building on our shared commitment to excellence in service and culture.

Q: And last but not least, what do you believe this consolidation signals about the strength, stability and resilience of Sri Lanka’s banking sector?

A: Sri Lanka’s banking system has demonstrated remarkable strength through an unprecedented period. The recent crisis was one of the most challenging in our history – not only within our careers but in the broader context of the country’s financial evolution.

What’s particularly noteworthy is that while Sri Lanka experienced a sovereign default and foreign exchange crisis, we didn’t face a banking crisis. That’s quite rare globally; and it speaks volumes about the discipline, governance and prudence of the local banking sector.

The resilience of the banking sector has been recognised internationally – and despite the sovereign stress, the banking system remained stable and functional.

Throughout that period, banks played a crucial role in supporting both individuals and businesses. The financial services industry collectively provided multiple rounds of moratoriums, offering borrowers the breathing space they needed at a time when liquidity pressures were immense.

It wasn’t easy – because while banks deferred loan repayments, they had an obligation to honour deposits and interest payments. Balancing those two sides required careful liquidity management and strong capital buffers.

Today, the sector remains well capitalised and liquid, which reflects the soundness of its fundamentals.

From our perspective, this acquisition underscores the strength of both Nations Trust Bank and the wider financial services industry. This is one of the largest M&A transactions in Sri Lanka’s financial services sphere to date; and importantly, it is being entirely funded internally – i.e. without the need for new capital or debt financing.

Looking ahead, this could very well pave the way for more consolidation within the financial services industry. The sector has proven its resilience – and transactions such as this show that Sri Lankan banks are in a position of strength to lead the next phase of growth and transformation.