THE ECONOMY

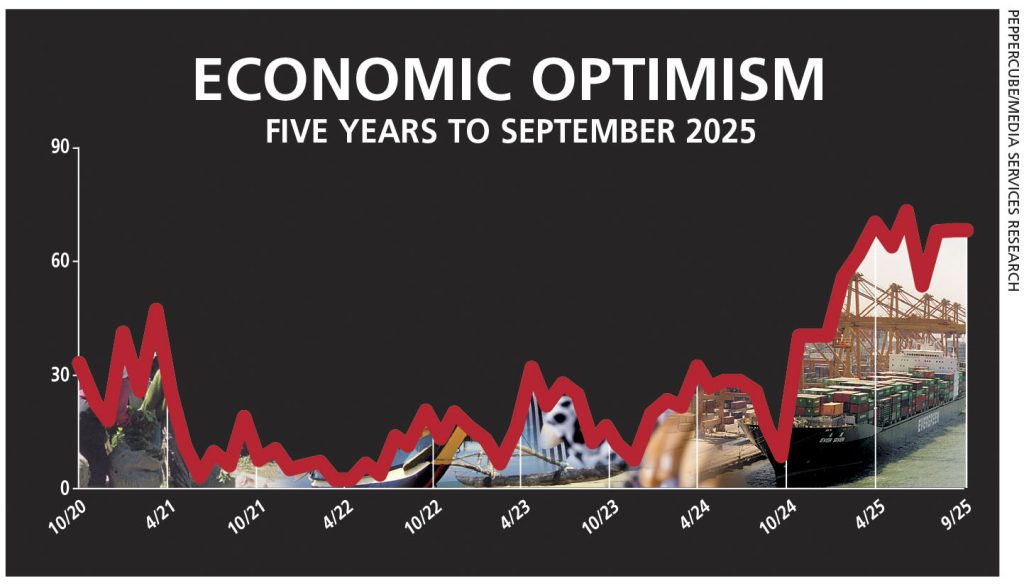

Concerns raised by the business community in August spilled over into September with overall sentiment showing little sign of improvement– still on edge, albeit cautiously optimistic, as mixed signals from underlying indicators cloud the outlook.

THE ECONOMY The latest LMD-PEPPERCUBE Business Confidence Index (BCI) survey, conducted in the first week of September, doesn’t portend an uptick in optimism about the economy.

SENTIMENT REMAINS STATIC

How corporates perceive the economy remains cautiously optimistic – at best

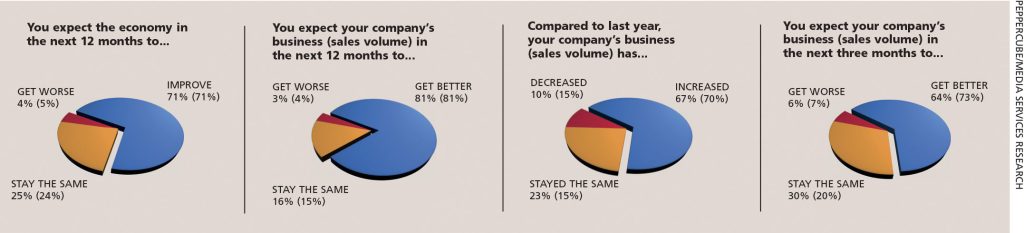

A notable 71 percent of respondents still believe the economy will ‘improve’ over the next 12 months – unchanged from August. And a quarter (25%) expect the economy to ‘stay the same’ – up one point from the previous month – while only four percent anticipate it will ‘get worse’ (down 1% from August).

SALES VOLUMES Expectations about sales volumes remained broadly unchanged from August: eighty-one percent of polled executives expect an improvement in their sales volumes over the next 12 months.

And 16 percent of executives polled by PepperCube Consultants believe their sales numbers will ‘stay the same,’ which is up one point from the previous month. Only three of the 100 respondents surveyed expect volumes to ‘get worse’ – a one point decline compared to August.

However, the proportion reporting an ‘increase’ in sales volumes compared to the previous month dipped marginally to 67 percent (from 70% in August).

Additionally, 23 percent say their volumes ‘stayed the same,’ reflecting an eight point spike from the preceding month (15%) while only 10 percent report a decline – that’s a five point drop from the 15 percent recorded a month ago.

Looking ahead, expectations of higher sales volumes over the next three months eased further with 64 percent of respondents projecting an increase – that’s a notable nine point fall from 73 percent in August.

Thirty percent of the sample population believe their sales volumes will ‘stay the same’ (up 10% from the previous month) and six percent anticipate their numbers will ‘get worse’ over the next three months, reflecting a decrease of one percentage point.

INVESTMENT CLIMATE Confidence in the investment climate improved in September with 12 percent viewing the outlook as ‘very good’ – up sharply from August’s two percent.

Those viewing the future as ‘good’ also rose – up seven percentage points to a third (33%). In contrast, 49 percent believe the investment outlook is ‘fair,’ reflecting a 10 percentage point decrease from 59 percent in August.

Meanwhile, the share of poll participants who rate the investment climate as being ‘poor’ or ‘very poor’ fell to six percent (down from 13% in the preceding month).

EMPLOYMENT PROSPECTS Thirty-six percent of businesses say they plan to ‘increase’ staff numbers, which is five points lower than in August.

In the meantime, 58 percent disclose that they intend to maintain the status quo, reflecting a six point rise. And only six percent may consider downsizing in the next six months, suggesting a stabilising yet fluctuating employment outlook.