BUSINESS SENTIMENT

From encouraging economic reports to more high profile arrests and evacuations – set against a backdrop of violence erupting across the region and beyond – the past month has seen a mixed bag of developments.

The economy is showing signs of resilience as it charts a seemingly steady path to recovery with GDP growth projections for this year ranging from 3.1 to 4.5 percent, according to multiple sources.

BUSINESS CONFIDENCE EDGES UP

The barometer of biz confidence crawls up although the outlook remains cautious

Even so, the Central Bank of Sri Lanka has cautioned that weaker external demand and an uncertain global geo economic environment could weigh on near to medium-term prospects.

Reinforcing this sense of cautious optimism, Central Bank Governor Dr. Nandalal Weerasinghe has reiterated Sri Lanka’s ambition to achieve four to five percent growth in the medium to long term – surpassing the IMF’s baseline requirement of three percent to ensure debt sustainability.

The World Bank echoes this assessment in its ‘Sri Lanka Public Finance Review: Towards a Balanced Fiscal Adjustment,’ commending the country’s remarkable progress towards economic stabilisation.

According to the review, the turnaround has been underpinned by decisive revenue measures, including the reversal of past policy missteps and higher taxation on a previously narrow base.

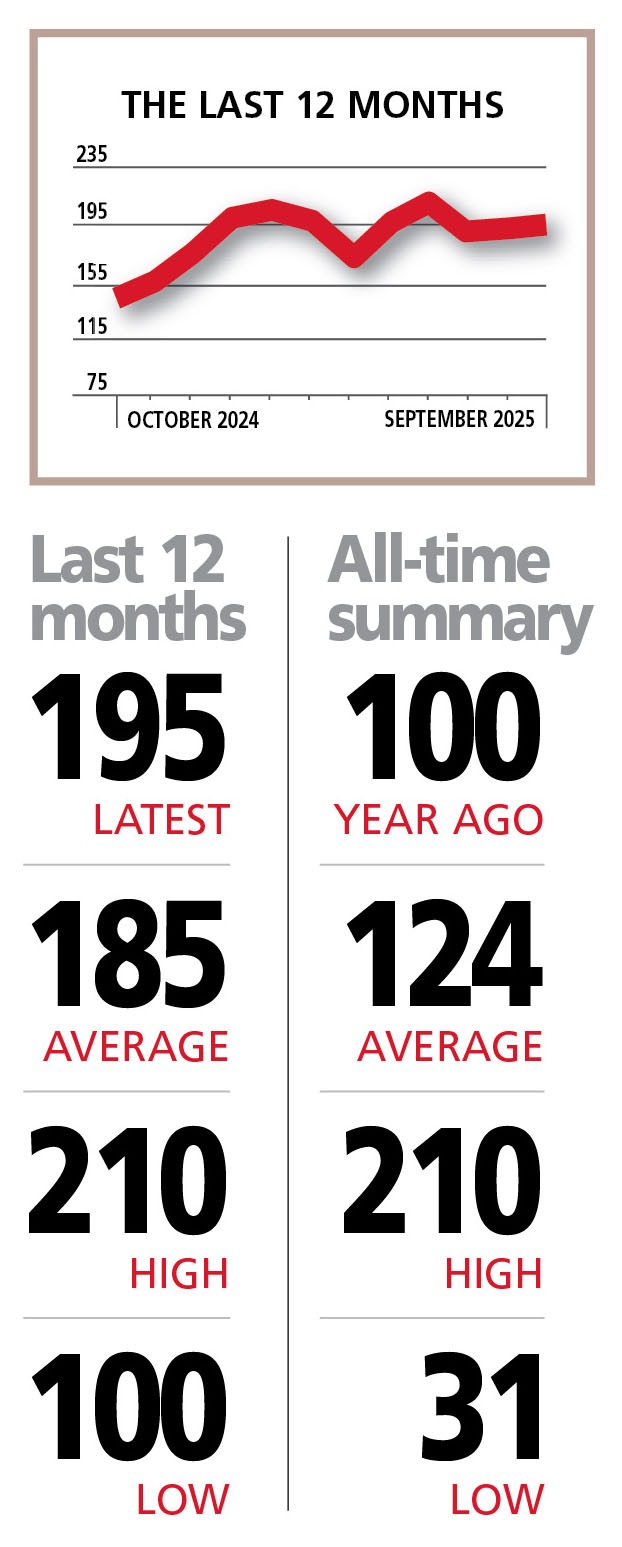

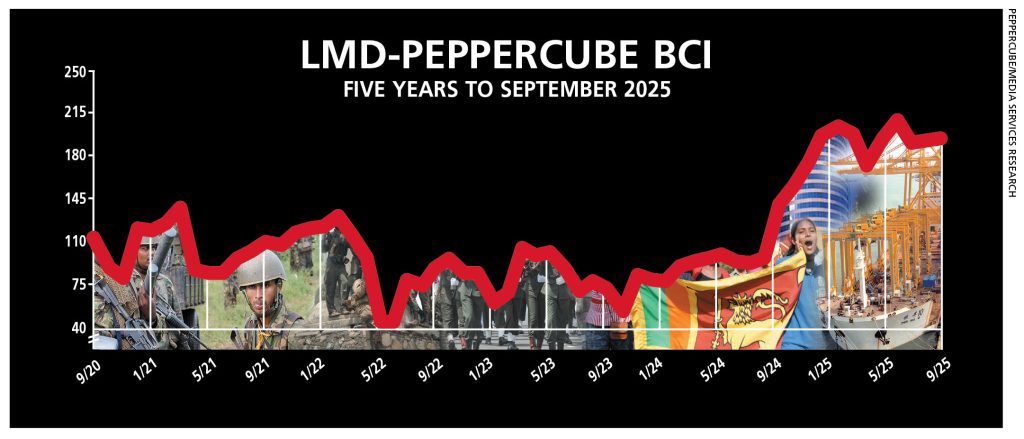

THE INDEX The LMD-PEPPERCUBE Business Confidence Index (BCI) edged up in September, rising by three basis points to 195 – from 192 in August.

Although confidence remains relatively high, recent movements paint a mixed picture – from June’s all-time high of 210, to a sharp decline and now a modest uptick for the second consecutive month. This trend suggests that sentiment in corporate circles may have stabilised.

The index continues to outperform key benchmarks, standing 71 points above its historic median of 124 and 10 points higher than the 12 month average of 185. In stark contrast, the BCI registered only 100 in September last year, underscoring the recovery in corporate sentiment over the past 12 months.

According to PepperCube Consultants, the latest BCI result reflects renewed optimism within the business community, fuelled by stronger sales and easing economic pessimism.

However, it notes that challenges persist with concerns centred on high taxes and the broader national economy.

PROJECTIONS June’s record high proved short-lived and the subsequent dip in confidence came as little surprise. As anticipated, sentiment has wavered – although the latest consecutive gains suggest the index may have reached some measure of stability.

Globally however, ongoing conflicts and widespread unrest threaten to derail progress, keeping businesses on edge as they brace for potential supply chain disruptions and higher prices.

At home, the outlook remains equally testing. Political uncertainty, a spate of high profile dismissals and arrests, and persistently high consumer prices continue to signal mounting inflationary pressures.

In the light of the above, June’s peak looks increasingly unsustainable – and whether the index will hold steady remains an open question.