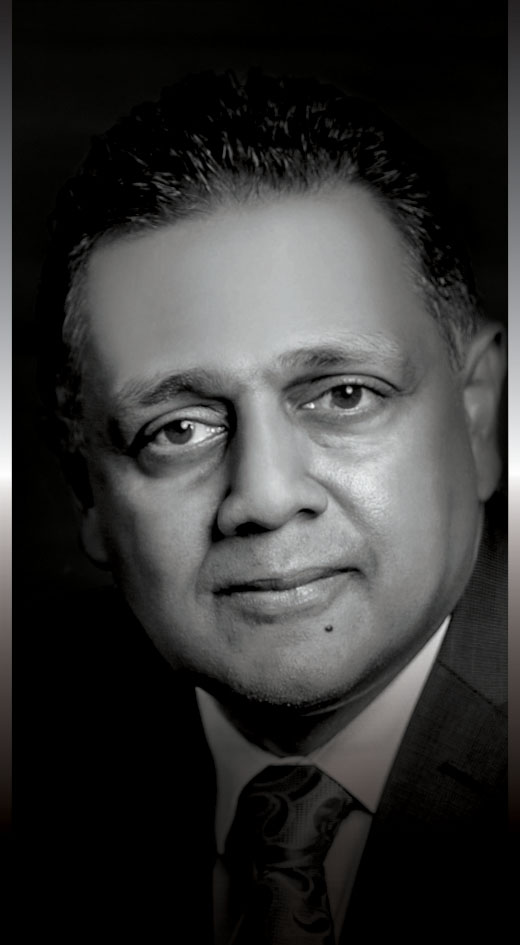

Thimal Perera

Director

Chief Executive Officer

DFCC Bank

Chief Executive Officer

DFCC Bank

Banking sector

The 2022 Interim Budget is ambitious and presents challenges; however, if executed effectively, it ought to achieve its national objectives by resetting the system, and allowing the economy to stabilise and recover.

Overall, we believe the interim budget proposals are timely and prudent. The focus is clearly on shoring up government revenue to reduce the deficit. Regarding the impact of the proposals on the banking sector, we believe there are some incredibly positive developments.

The proposals to insulate the central bank’s monetary policy from politicisation and political influence is very welcome. Allotting 20 percent shareholding of certain government banks to depositors and staff will also help strengthen the capital position of these banks, and the rest of the sector, amidst a tightening monetary environment and rising non-performing loan (NPL) risks.

We’re also pleased to note the many fiscal and tax reforms, all of which are needed. This together with a strengthening of the social net, which appears to be occurring now, will at the very least orient the economy in the right direction towards sustainable growth and responsible government fiscal policy.

It’s also very encouraging to see reforms such as the proposed Public Finance Management Act, which is expected to introduce stronger fiscal rules and better insulation of the country’s fiscal trajectory, from myopic and politically motivated decision making.

These reforms should encourage and help draw the support of the IMF and other global creditors to enter into partnerships with Sri Lanka, without which a meaningful financial recovery and return to growth will be impossible.

2023 budget expectations

We expect that the budget for 2023 will be an extension, if not an expansion, of the interim budget proposals. And we genuinely hope that this present sense of prudency and forward thinking will persist, helping to strengthen government revenue and ensure a balanced budget.

However, as a side note, it is essential to remember the effects of the Laffer Curve when raising tax rates. We should not create a state where higher tax rates incentivise tax evasion and stifle the economy, leading to an overall reduction in tax collections and a return to fiscal and economic underperformance. Instead, we should pursue a more accessible and efficient tax collection system at rates that are not burdensome to an already burdened populace.

In addition, Budget 2023 needs to be consistent with the economic reforms programme and macroeconomic framework under the IMF programme.

The proposals to insulate the central bank’s monetary policy from politicisation and political influence is very welcome