FINANCIAL SERVICES INDUSTRY

BANKING MAKEOVER

Compiled by Yamini Sequeira

THE WHEELS OF FORTUNE

Ransith Karunaratne weighs the pros and cons of the financial services industry

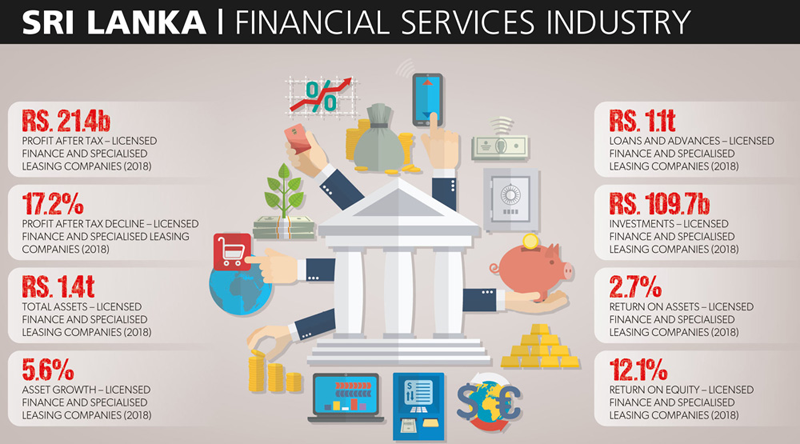

Having enjoyed consistent year on year growth for almost a decade, the financial services industry slowed down considerably in 2018 and 2019. And as Ransith Karunaratne states, “there is a direct correlation between the macroeconomy and financial services, and the slowdown in economic activity has adversely impacted the industry.”

He attributes the downtrend to lower margins and volumes. This in turn has led to lower incomes and a higher level of nonperforming loans (NPLs); and together with taxation, the erosion of profitability is evident.

MOUNTING COMPETITION The financial services industry faces stiff competition due to a surfeit of players in what is a limited marketplace, which has been aggravated by the banks offering products that were previously the domain of finance companies. It follows that margins have come under pressure.

Economic volatility, a drop in volumes across all sectors, lower cash circulation and shrinking disposable incomes have caused NPLs to soar.

However, Karunaratne maintains that “based on their past experiences, most investors are now knowledgeable enough to differentiate between stable and unstable financial institutions. Finance companies that are properly capitalised and profitable, with solid product portfolios and good governance structures, will continue to attract more investors and grow.”

The regulatory framework must be periodically evaluated and adjusted to manage risk, he asserts. Stringent monitoring by the Central Bank of Sri Lanka (CBSL) is required to ensure compliance across the board.

Karunaratne notes: “Progressively increasing capital requirements, the introduction of Basel III and moving to SLFRS 9 are positive steps to strengthen the industry.”

TECHNOLOGY DRIVE The industry is evolving rapidly and this is supported by new technology. Finance companies must ensure they move to digital platforms (with quicker processing and delivery times) and greater customer convenience (with offerings such as mobile connectivity, digital banking, payment gateways, e-wallets, and credit and ATM cards).

Developments in business and artificial intelligence (BI and AI respectively) will offer higher quality information on customer and business trends, for better segmentation of clients and improved decision making, Karunaratne opines.

RISING INDEBTEDNESS Microcredit was touted as the next growth frontier but in the recent past, this segment has been affected by rising NPLs. Some finance companies have overexposed themselves, and are taking corrective steps by consolidating and rationalising their portfolios.

Karunaratne perceives a growing spirit of entrepreneurship but laments “the lack of knowledge in and experience of business and financial management of micro-borrowers, which has led to individuals borrowing from multiple entities and utilising these funds for their day-to-day expenses – rather than establishing, improving and expanding their businesses.”

Irresponsible political statements concerning the SME sector have also influenced nonpayments. A Microfinance Act has been introduced by the CBSL to regulate and streamline the industry, the results of which are yet to be witnessed, Karunaratne states.

Vehicle financing has been a driving force of the industry. However, the product has come under intense pressure with the Central Bank attempting to reduce forex outflows on the import of new motor vehicles through loan-to-value (LTV) ratios and the introduction of new taxes.

Meanwhile, stiff competition for vehicle financing among banks and finance companies has triggered the introduction of new and innovative lending products to the market.

RENEWED MINDSET Karunaratne believes that sales personnel in the industry must be equipped with the right skills and training to deal with diverse customer requirements.

The former should have an in-depth knowledge of products to meet specific customers’ financial needs, enhanced credit appraisal and investigative skills, and report writing and narrative excellence. A fair knowledge of current economic and industry trends, and the resulting impacts, is also required.

Structured programmes must be introduced to educate entrepreneurs and SMEs on basic financial management of their respective businesses (e.g. cash flows, profitability, business continuity and so on), Karunaratne suggests.

He asserts: “Mergers and acquisitions will occur in the financial services industry to comply with the CBSL’s new core capital requirements. This will result in the emergence of a smaller number of stronger, larger and more resilient companies – which will strengthen the industry as a whole.”

However, this process will pose challenges due to diverse business cultures, product portfolios, operational processes and systems, and possible redundancies.

On the future prospects of the industry, he comments: “Historically, the financial services industry has been cyclical, mirroring and facilitating economic activity. The current economic growth of 3.3 percent – the lowest in the SAARC region – has taken its toll on the industry.”

LONG ‘TO DO’ LIST Karunaratne’s wish list for the industry includes consistent monetary policy to facilitate investments through foreign direct investments (FDI) and access to equity; a rationalised number of players consisting of stronger companies that are capitalised satisfactorily; good governance; an improved range of products; enhanced BI and AI for effective decision making; stronger legal initiatives and regulator assistance to expedite recovery from wilful defaulters; and better education on basic financial management for entrepreneurs and the SME sector.

As for the future of the nation, Karunaratne posits: “Sri Lanka has had many opportunities since gaining independence to become a major regional player. It’s a tragedy that it has continuously failed to live up to its potential due to party politics and personal agendas.”

He elaborates: “We are blessed with a unique geographical location, rich cultural heritage, geographical diversity, natural resources and agricultural exports, as well as versatile and intelligent human capital. What we need is a visionary leadership team, backed by the people’s mandate and a 20 year strategic plan, to harness these resources.”

“The outcome of this will be an export oriented economy that is stable; higher GDP and per capita income; and improved infrastructure, transportation, healthcare, education, information technology and so on, so that the diverse citizens of Sri Lanka can live and coexist in peace and harmony,” Karunaratne surmises.

He adds: “The difference between developed nations and developing countries such as Sri Lanka isn’t about heritage or the availability of natural resources but the attitude of the people, moulded for many years by education and culture.”

“Ethics, integrity, responsibility, punctuality, respect for the law, love of work, efforts to save and invest, and the will to be productive will propel the country into the future. Citizens of Sri Lanka should strive to cultivate these traits to elevate the nation to its true potential,” he concludes.

The interviewee is a Director and the Chief Executive Officer of UB Finance Company