EXTERNAL ECONOMY

SURPLUS AMID A SLUMP

Shiran Fernando takes stock of prospects for the external economy in the near term

Sri Lanka registered a current account surplus in the first quarter of this year. This was the first time in over a decade that the country realised a quarterly surplus, according to Central Bank of Sri Lanka (CBSL) Governor Deshamanya Dr. Indrajit Coomaraswamy. The current account recorded a surplus of US$ 423 million in the first quarter of 2019 compared to a deficit of 587 million dollars in the corresponding period of the previous year.

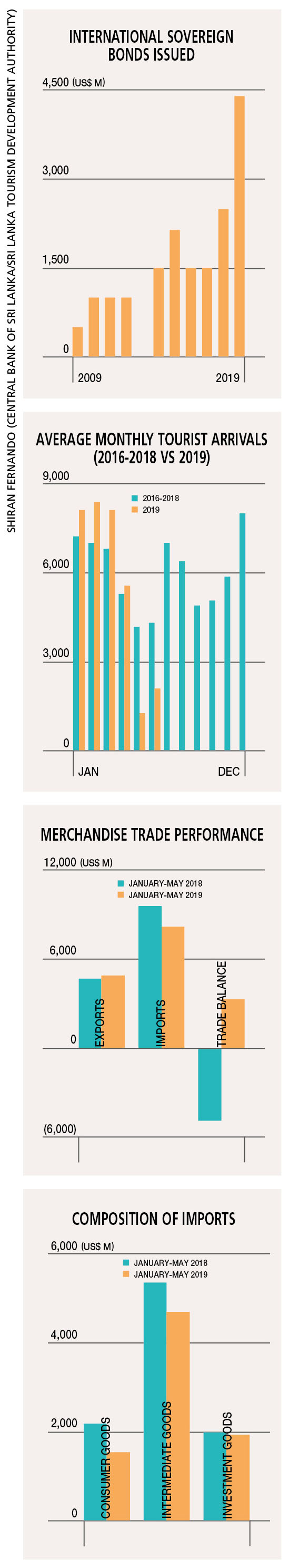

IMPORT DOWNTREND Imports declined by 15 percent in the first five months of 2019 – in absolute terms, this amounts to a contraction of around US$ 1.4 billion. A near 30 percent drop in the importation of consumer goods led by a slump in vehicle imports has been attributed to this decline. Other headline import items – viz. intermediate and investment goods – also slumped during the period (by 12% and 3% respectively).

An overall slowdown in imports is reflected in lacklustre economic growth, as well as a decline in private sector credit growth to 9.4 percent by May from 15 percent at the beginning of 2019.

EXPORT EXPANSION While the above-mentioned current account surplus was generated in large part due to a slowdown in imports, exports are growing at healthy mid-single digit levels.

Headlined by an increase in apparel, rubber products and seafood exports, the first five months of the year witnessed export growth of 4.4 percent. Provisional data released by the Ministry of Development Strategies and International Trade indicate that both merchandise and service exports recorded an 11.4 percent year on year hike in the first half of 2019.

TOURISM RECOVERY In the first two months following the Easter Sunday terrorist attacks, tourism earnings experienced a sharp slowdown as expected. However, daily arrivals increased to around 4,000 by mid-July compared to 1,260 arrivals a day in May.

The impact of tourist advisories being rescinded by many countries contributed in no small measure to this turnaround.

While the 4,000 arrivals a day figure remains below the daily average of 7,030 for July from 2016 to 2018, a steady rise in the next few months would augur well for the peak tourist season towards the end of the year.

Therefore, the 30 percent dip in arrivals initially expected by the tourism ministry for this year could in fact ameliorate to a decline of around 25 percent compared to the 2018 arrivals figure. This could translate into a reduction of about 1.1 billion dollars in Sri Lanka’s income from tourism.

Moreover, in the light of discounts being offered by hotels, resorts and other related establishments to attract tourists, earnings could come under pressure.

The drop in tourism earnings is covered to a large extent by the contraction in import expenditure, which means that the current account will be unaffected this year. Nevertheless, a caveat in this regard is that the current trends continue and there is no observable adverse impact from the presidential election at the end of 2019.

SOVEREIGN BONDS Taking a cue from global market conditions that bear an appetite for emerging market debt such as that of Sri Lanka, CBSL was able to re-enter the international sovereign bond market on behalf of the government. In June, the Central Bank raised US$ 2 billion following the 2.4 billion dollars raised in March.

With the Active Liability Management Act in place, CBSL is able to borrow ahead for the next fiscal year, thereby reducing the impact of a bunching up of foreign debt maturities that existed this year and in relation to 2020.

The US$ 4.4 billion dollars raised by the Central Bank represents its highest in a single year so far – the previous high was last year when 2.5 billion dollars was raised in a single offering.

According to the CBSL’s Governor, Sri Lanka had settled close to 70 percent of its US$ 5.4 billion in foreign debt repayments due in 2019 by July. Amid high borrowings this year by way of sovereign bonds, Coomaraswamy explains that a buffer has been created to settle a portion of the debt maturing in 2020 as well.

This is considered crucial on two fronts: it’s difficult to predict how global financial markets will swing and whether they will be receptive to further borrowings from emerging markets such as Sri Lanka; and more importantly, it will provide the necessary buffer in Sri Lanka’s reserves to settle debt when the country heads into the election cycle.

While near-term stability is a positive from a balance of payments perspective, it also highlights a slowdown in economic growth, which needs to be at a higher trajectory for the country to be in line with its debt refinancing and development priorities.