GROWTH PROSPECTS

REBOUNDING ECONOMY?

Zulfath Saheed assesses the prospects for growth despite systemic shocks

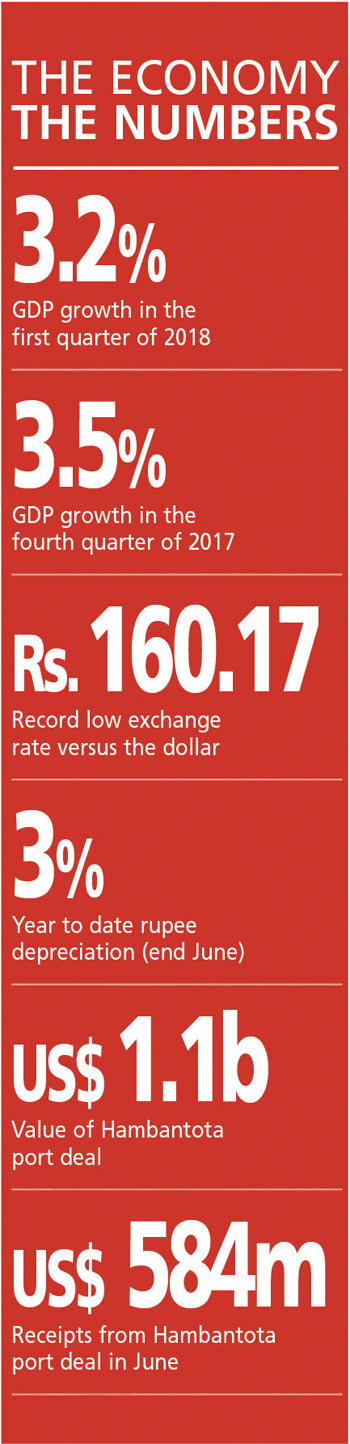

The Sri Lankan economy accelerated by 3.2 percent year on year in the first quarter of 2018, which is slightly lower than the 3.5 percent year on year growth in the previous three months. This is according to official data with analysts citing political uncertainty and a weaker currency for the economic slowdown.

Growth in the fourth quarter of 2017 was revised upwards by the Department of Census and Statistics although initially reported at 3.2 percent year on year. Full year growth for 2017 was also upgraded to 3.3 percent (from 3.1% year on year) but remained at the lowest level since the economy contracted in 2001. This growth was muted by tight economic policies and an agriculture sector afflicted by drought and floods.

Nevertheless, the IMF forecasts economic growth to rebound to four percent this year while the Central Bank of Sri Lanka (CBSL) projects an acceleration of between four and 4.5 percent.

Nevertheless, the IMF forecasts economic growth to rebound to four percent this year while the Central Bank of Sri Lanka (CBSL) projects an acceleration of between four and 4.5 percent.

MONETARY POLICY Tight fiscal and monetary policies, and currency depreciation, were key factors restraining growth in the first quarter.

The Central Bank decided to cut the key lending rate by 25 basis points in April to bolster the economy. In June, the Sri Lankan Rupee was hovering near a record low on dollar demand from importers with exporters largely choosing to remain on the sidelines in anticipation of further depreciation.

DOLLAR DILEMMA Since mid-April, the strengthening US Dollar has led to major currency depreciation, as well as a decline in foreign exchange reserves of many emerging and frontier market nations. This has increased credit risks for those with massive external funding needs, according to a report by Moody’s Investors Service.

The report titled ‘Sovereigns – Global: US Dollar appreciation raises credit risk for sovereigns with large external funding needs’ considers the external exposure of 40 emerging and frontier market sovereigns with some of the highest levels of external debt either in US Dollar terms or with respect to the size of their economies.

It identifies Sri Lanka alongside Argentina, Ghana, Mongolia, Pakistan, Turkey and Zambia as being among the most vulnerable to a stronger greenback. Meanwhile Chile, Colombia, Indonesia and Malaysia are also exposed, according to Moody’s, although financial and institutional buffers reduce their near-term vulnerability.

COUNTRY REVIEW Moody’s Global Managing Director of the Sovereign Risk Group Alastair Wilson observes that “countries with large current account deficits, high external debt repayments and substantial foreign currency government debt are most exposed to the impact of a stronger US Dollar.”

“To the extent that these currency fluctuations reflect capital outflows or significantly lower external inflows, they are credit negative for sovereigns with large external funding needs,” he adds.

PAST EXPOSURE Emerging markets that have been historically prone to large shocks to external financing conditions are ceteris paribus deemed to be more likely to experience shocks in the present – unless past shocks led to adjustments that reduced their reliance on external funding.

In 2014 for instance, Hungary, Malaysia, Mongolia and Russia experienced particularly large shocks to their external financing conditions. Since then, Angola, Kenya, Indonesia and Sri Lanka have experienced relatively large shocks. Of these, Kenya, Mongolia, Sri Lanka and Zambia continue to be extremely vulnerable, indicating high structural barriers to reduce the reliance on external financing.

Brazil, China, India, Mexico and Russia are recognised as being among the least vulnerable to tightening external financing conditions due to their low reliance on external capital inflows.

Moody’s points out that sustained and severe shocks to external financing conditions can have credit implications – particularly when they result in a substantial further erosion of financial buffers, raise liquidity risks and/or take fiscal metrics along a more unfavourable path than previously expected.

RECENT DEVELOPMENTS At the end of June, the Sri Lankan Rupee remained steady amid slim dollar demand on the part of importers with banks matching the sale of the greenback by exporters and inward remittances, as observed by market dealers.

A week later, the rupee closed at 159.20/35 a dollar on 6 July, compared to the previous day’s close of 158.90/159.10. On 20 June, the spot rupee hit an all-time low of 160.17 to the dollar while so far this year, it has fallen by approximately three percent.

The downward pressure on the rupee indicates an easing following the receipt of US$ 584 million from China Merchants Port Holdings on 21 June, which came as part of a 1.1 billion dollar deal to operate Sri Lanka’s deep-sea port in Hambantota.

Under the deal, Sri Lanka received another 292 million dollars in December as well as 97 million dollars in January.