MONETARY POLICY

FED RATE HIKE TAKES CENTRE STAGE

Samantha Amerasinghe recounts the outcomes of the recent central bankers’ meeting

All eyes were on the annual central bankers’ meeting, at Jackson Hole – from 26 to 28 August – for any signal of the US Federal Reserve’s (the Fed’s) thinking ahead of its Federal Open Market Committee (FOMC) meeting, on 20 and 21 September, when it decided to leave the interest rate unchanged.

All eyes were on the annual central bankers’ meeting, at Jackson Hole – from 26 to 28 August – for any signal of the US Federal Reserve’s (the Fed’s) thinking ahead of its Federal Open Market Committee (FOMC) meeting, on 20 and 21 September, when it decided to leave the interest rate unchanged.

Given the divergence of opinion of the Fed’s policymakers leading up to the conference, Fed Chair Janet Yellen’s speech at Jackson Hole was closely watched, for the likely timing of the next Fed rate rise.

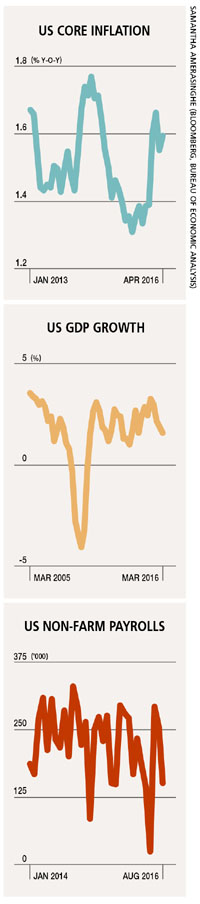

Firm jobs growth in recent months – and an expected return of inflation to the Fed’s two percent target in the next two years – has strengthened the case for a rate hike, ahead of the US presidential election on 8 November. Consumer spending has been encouraging, and personal income and savings have increased.

The core of the FOMC leadership (Yellen, Stanley Fischer, William C. Dudley and John Williams) expressed renewed confidence in the resilience of the US economy. Despite this, Yellen fell short of providing a hint of timing on the next interest rate hike, maintaining that any increase would remain data-dependent.

Policymakers remain divided on how soon the Fed should act, given the risks lurking overseas and sub-par inflation in the US.

Longer-term issues such as the ability of central banks to fight recession also dominated the Jackson Hole conference. Yellen entered the debate about the long-run neutral rate of interest – the r-star (r*) – which provides an important reference point for monetary policy.

When an economy is at full strength, central banks desire a ‘neutral’ or natural rate that keeps inflation steady. But when the economy is overheating, a rate above neutral is best, while a rate below works for a weak economy.

Expectations of a low future federal funds rate are partially a function of the decline in the long-run neutral rate. The FOMC’s current forecast for this rate is roughly three percent, but Yellen hinted that this may fall to as low as two percent. She even stated that “by some calculations, the real neutral rate is currently close to zero.”

The Fed was successful in containing inflation at much lower rates in the 1970s and 1980s, but cynics argue that it has failed to halt the collapse of inflation expectations in recent times. San Francisco Fed President Williams argued that one possible strategy would be to raise its two percent inflation target, to combat the next downturn. In contrast, Yellen’s stance has been rather dovish.

She maintained that the rate-hiking cycle would be gradual, and was confident that the Fed is capable of fighting a downturn, even at low rates. More Quantitative Easing (QE) remains in the ‘policy toolkit,’ if needed, along with the option to explore a wider range of assets than mere US Treasuries and mortgage-backed securities.

She maintained that the rate-hiking cycle would be gradual, and was confident that the Fed is capable of fighting a downturn, even at low rates. More Quantitative Easing (QE) remains in the ‘policy toolkit,’ if needed, along with the option to explore a wider range of assets than mere US Treasuries and mortgage-backed securities.

Yellen said that additional tools, such as negative rates and raising the FOMC’s two percent inflation objective, were not being actively considered. So there will likely be no increase in the inflation target – which is good news for both interest rate and emerging market volatility.

Persistently sluggish US productivity has also caught the attention of the Fed, and is moving up on its list of concerns. Sluggish productivity suggests that GDP growth may remain at low levels, and the theoretical neutral rate (an implicit benchmark for the monetary policy stance) may be lower than previously thought.

Productivity fell by 0.4 percent year-on-year in the second quarter of this year, and has averaged only 0.5 percent since 2011. This compares with an average productivity growth of 2.2 percent between 1987 and 2007. Productivity growth is a key driver of economic growth, and is the main determinant of living standards.

During the 1990s, output per hour surged, in part because companies invested heavily in new technology and machinery.

Many economists assumed that technology would continue to fuel rapid productivity growth. But it has failed, for reasons economists still don’t fully understand. In the US, productivity per worker has risen by 47 percent since 1991 – but it would be up by about 73 percent, if the 1987-2007 growth rate had continued.

So the key message is that the Fed – supported by solid labour market data, with US non-farm payrolls averaging a healthy clip of 232,000 new jobs over the last three months – believes its scenario of a rate hike in the second half of 2016 remains very much in play; it’s only a question of when.

However, a rate hike in the second half of 2016 has less than a 50 percent chance, despite the Fed’s ongoing tightening bias. It seems to be in no rush to tighten rates, and the data bar is unlikely to be cleared, with August non-farm payrolls being disappointing.

The Fed has a definite pretext to stall the next rate hike, on the basis of weaker than expected employment growth in August. But robust gains in non-farm payrolls in the rest of the year should be sufficient to push the Fed to raise interest rates in December.