LMD 100 (2014/15)

CORRECTION

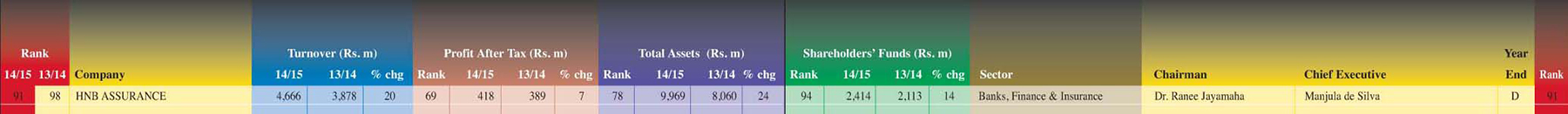

In compiling our rankings for financial year 2014/15, we have inadvertently used the net premium of HNB Assurance, instead of its gross premium, in the primary ranking of turnover. As a result, HNB Assurance was not ranked in the LMD 100 this year. Had we used the company’s gross premium, HNB Assurance would have been placed at No. 91 in the rankings. We regret the omission.

The following is an extract of the main schedule in the special edition, which includes the LMD 100 companies’ turnover, with information pertaining to HNB Assurance.

FINANCIAL PROFILE

FOREWORD

BIZ CONTOURS

Jump-starting the corporate spirit

More than five years since the guns fell silent in Sri Lanka, 2015 marked yet another paradigm shift in the country’s history, with a newly elected president and coalition government coming into power through what’s been deemed as largely free and fair polls.

More than five years since the guns fell silent in Sri Lanka, 2015 marked yet another paradigm shift in the country’s history, with a newly elected president and coalition government coming into power through what’s been deemed as largely free and fair polls.

The crux of the twin election campaigns lay on instilling the spirit of good governance in an island so entrenched in corrupt practices that Transparency International’s Corruption Perceptions Index places Sri Lanka in 85th place, from among 175 nations.

Thus was born a programme of weeding out the corrupt from the highest echelons of power, although some have voiced criticism over such efforts deliberately targeting members of the former regime, and others pointing to allegedly corrupt individuals being protected by the current Administration.

Having already put in place the so-called ‘100-day programme,’ the Government sought to introduce amendments to fiscal policy, through proposals set out in an Interim Budget for 2015 – which, for the most part, drew wide criticism from the corporate community, on account of the draconian measures – such as one-off retrospective taxes – which were enacted only recently.

Following the August general elections, the Government came under pressure to outline its focal points for economic policy, which corporates and investors would need to take cognisance of in setting out plans for the year ahead. Prime Minister Ranil Wickremesinghe’s November economic policy statement was, therefore, broadly endorsed by the business community.

The Ceylon Chamber of Commerce (CCC), for instance, welcomed the PM’s policy announcement, stating that “large and persistent budget deficits have continued to be a source of macroeconomic instability in Sri Lanka for many decades, and the Chamber welcomes moves to bring down the budget deficit to 3.5 percent by 2020.”

However, the CCC cautioned against compromising on important public investments in social infrastructure, in efforts to substantially cut the deficit, noting that “the focus should be on ensuring efficiency of public spending and raising tax revenues in a way that does not hurt growth as well as equity. The indication that the Super Gains Tax, and similar retrospective and business-unfriendly taxes, will not continue in the future is encouraging, as such taxes hurt entrepreneurship and provide a negative signal to investors.”

It also welcomed proposed changes to the export policy and promotion regime, including the creation of a new International Trade Agency, which “will be critical in aggressively pushing Sri Lankan exports into current and new markets abroad,” along with moves to manage the Employees’ Trust Fund (ETF) and Employees Provident Fund (EPF) independently by the Central Bank of Sri Lanka.

The Government’s economic policy statement drew on next-generation reforms to accelerate and sustain economic growth; however, it is equally important that the necessary legislative and administrative processes are introduced, to fully implement the reform agenda, for which the Government will require the cooperation of the business community – in particular, the large corporates, many of which take their rightful place in the LMD 100 this year.

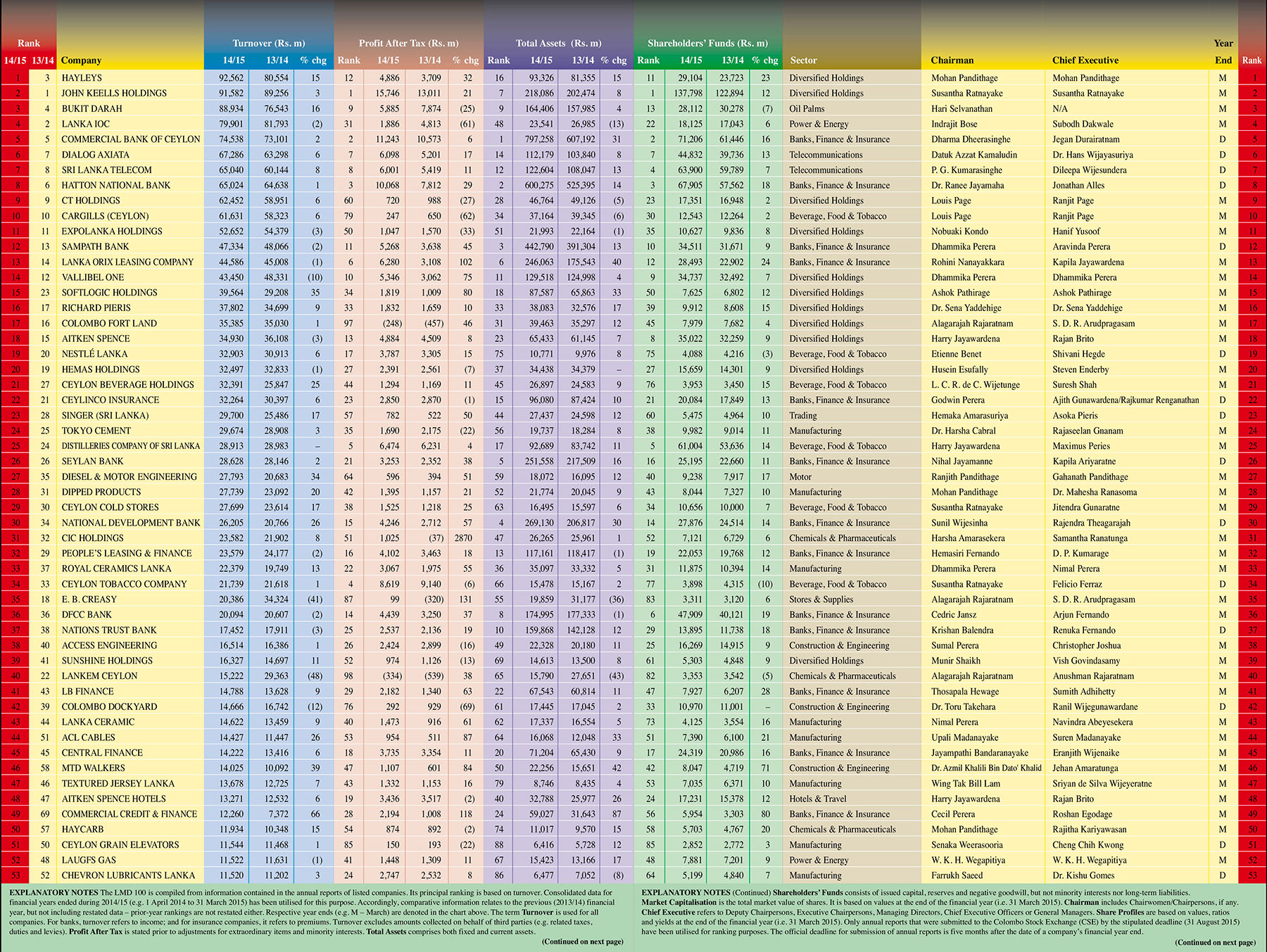

In the latest edition of the LMD 100, thanks to a turnover of over Rs. 92.5 billion in 2014/15, it is Hayleys that makes its mark at the summit of Sri Lanka’s premier listed company rankings. As we predicted in last year’s edition of the LMD 100, the top four corporates in 2013/14 were “gearing up for a tight race next year,” so much so that we expected “a photo finish for the grand prize!”

As it turns out, John Keells Holdings (JKH) has been replaced at the top by virtue of a difference in annual turnover of less than one billion rupees; but it retains the No. 1 spot for profitability, with a Profit After Tax (PAT) of Rs. 15.7 billion for financial year 2014/15.

In addition, at the 2014/15 financial year end (31 March 2015), JKH claimed a market capitalisation of nearly Rs. 199 billion, preserving its title as the most valuable company on the Colombo Stock Exchange. Meanwhile, Ceylon Tobacco Company followed closely behind, with a market cap of just over 187 billion rupees.

Fourteen of the top 50 listed corporations reported lower earnings in financial year 2014/15 – that’s double the number in 2013/14. But in the latest rankings, there were only two loss-makers among the 50 leaders, versus the previous year’s count of four, while a notable 33 companies (versus 22, in 2013/14) reported double-digit or higher profit upside.

The latest LMD 100 also includes 60 corporates that recorded an annual turnover in excess of 10 billion rupees, along with 11 entities that enjoyed post-tax profits of over five billion rupees.

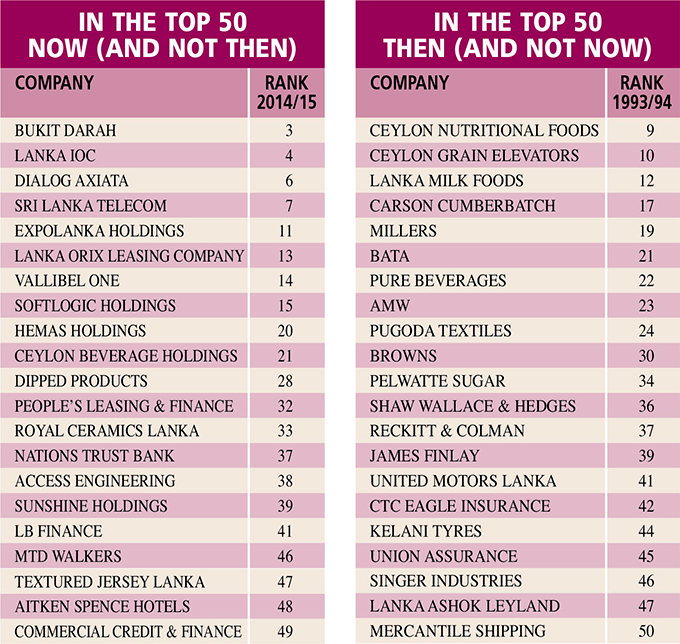

Turning the clock back to when the pioneering rankings were first published in 1993/94 (that was when the LMD 100’s predecessor – The LMD 50 – was compiled for the first time), the corporate heavyweights consisted of 21 entities that do not feature in the latest edition of leading listed companies in Sri Lanka.

Meanwhile, there are an equal number of corporations that were not in contention at the time of the rankings’ inception, including the likes of Bukit Darah, Lanka IOC, Dialog Axiata and Sri Lanka Telecom, all of which feature on the 2014/15 Leaderboard.

Combined turnover of the 50 leading listed entities has increased by five percent in the latest rankings, while their aggregate bottom lines grew by a more impressive 15 percent. In 1993/94, revenue rose by 20 percent year-on-year, whereas profits expanded by a mammoth 60 percent.

The total asset base of the 50 leaders also grew by a healthy 15 percent during 2014/15, alongside a 12 percent appreciation in shareholders’ funds – albeit at a much slower pace than achieved two decades ago.

As things stand, the proposals outlined in Budget 2016 will, to a great extent, determine the future course of action by the island’s leading listed entities. The January edition of LMD will break the news on where post-budget business confidence lies, with activities on the bourse since 20 November providing an early indication of how the investor community is viewing what the Finance Minister has called a ‘revolutionary budget.’

– LMD/Media Services