INFLATION OUTLOOK

PRICE OF OIL IS KEY

Shiran Fernando examines the impact of recent trends in inflation and interest rates on Sri Lanka’s economic recovery

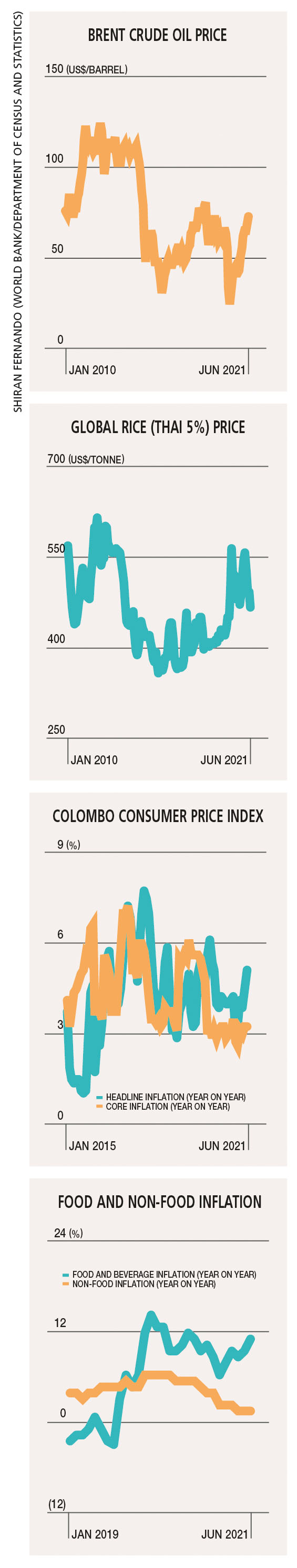

Sri Lanka has maintained an inflation rate under double digit levels for more than a decade. Inflation has not been a concern in recent years with the rate being under six percent since 2018 – with the exception of February last year.

However, recent changes in fuel prices, the increase in the price of food items, and impact of post-pandemic recovery externally and locally have caused concern regarding the future direction of inflation.

However, recent changes in fuel prices, the increase in the price of food items, and impact of post-pandemic recovery externally and locally have caused concern regarding the future direction of inflation.

RECENT MOVEMENTS Inflation rose to 5.2 percent year on year in June – the highest level since March last year. But this is within the Central Bank of Sri Lanka’s (CBSL) target of between four and six percent.

The recent rise has been driven by an increase in food prices with June recording a year on year growth of 11.3 percent. Meanwhile, the transport subcategory rose by 1.3 percent month on month during this period owing to the revision of fuel prices. Near-term pressure on headline inflation could continue given that there are supply concerns regarding essential food items, which have led to an increase in the price of vegetables, fish and rice among other items.

A policy change in the form of switching to organic fertilisers for cultivation could cause operational problems in the coming months in terms of churning out the same level of production to keep supplies in check.

A policy change in the form of switching to organic fertilisers for cultivation could cause operational problems in the coming months in terms of churning out the same level of production to keep supplies in check.

Furthermore, revised fuel prices could result in upward revisions of the price of other related goods and services. Other potential utility price hikes – such as for gas – are also a cause for concern in the context of headline inflation remaining at an elevated level.

GLOBAL INFLATION Across the world, inflation has been rising with the post-pandemic economic recovery in most countries being fuelled by their vaccination roll out, and substantial fiscal and monetary stimulus measures.

Inflation in OECD countries rose sharply in April to its highest level since 2008 when the global economy was in the throes of the global financial crisis. The main driver has been an increase in food and energy prices.

The 38 countries that comprise the OECD constitute about 60 percent of the global economy. Looking at some specific countries, inflation in the US rose to 4.2 percent in April (from 2.6% in the previous month) while the UK saw inflation reach 2.1 percent in May, which is the highest level in almost two years.

According to the basket of commodities that the World Bank tracks, prices rose further in the first quarter of this year and have exceeded pre-pandemic levels. Certain commodities such as copper were 50 percent higher in March compared to the end of 2019.

WORLD INTEREST RATES Certain economists believe the rise in inflation to be a temporary phenomenon in response to supply chain disruptions, resulting higher prices of raw materials, commodities and shipping – which in turn has led to higher prices for goods.

They say that the income and wage price cycle has yet to gain momentum to sustain the rise in inflation.

Therefore, the movement in commodity prices and inflation in the second half of this year will play a crucial role in driving expectations for interest rates.

In response to the spike in inflation, job growth and overall demand, the US Federal Reserve has said it may raise interest rates in 2023, which will be much earlier than previously expected.

Other central banks are signalling the same and emerging market economies could also head in this direction.

COMMODITY WATCH At the time of going to press, global oil prices have risen beyond pre-pandemic levels.

The recovery in prices observed over the last six to eight months has been driven by demand with the economic recovery in key markets, as well as supply limitations through production cuts by OPEC and its partners.

Meanwhile, some forecasters expect oil prices to rise above US$ 100 a barrel if the economic recovery continues and oil supplies are held at current levels.

Oil prices could edge downwards if new variants of the COVID-19 virus cause major outbreaks globally. This could drag demand for oil, which has been positive so far.

The other factor relates to oil supplies, and if OPEC and partners increase production. This could ease the oil price spiral.

ECONOMIC IMPLICATIONS Global developments related to higher inflation and potentially interest rates pose cause for concern as the domestic recovery takes root. Higher import prices on essential food items coupled with a weaker Sri Lankan Rupee could increase domestic prices further.

Furthermore, an increase in global interest rates may warrant similar hikes at the domestic level so as to keep pace with emerging world trends. This will be aggravated if the increase in domestic inflation persists and exceeds the range of four to six percent.

The key will be the movement in the price of oil, which affects exchange rates and inflation.

The movement in commodity prices and inflation in the second half of this year will play a crucial role in driving expectations for interest rates