INFLATION OUTLOOK

FOCUS ON INFLATION UPTICK

Shiran Fernando wonders whether the recent spike in inflation is a cause for concern

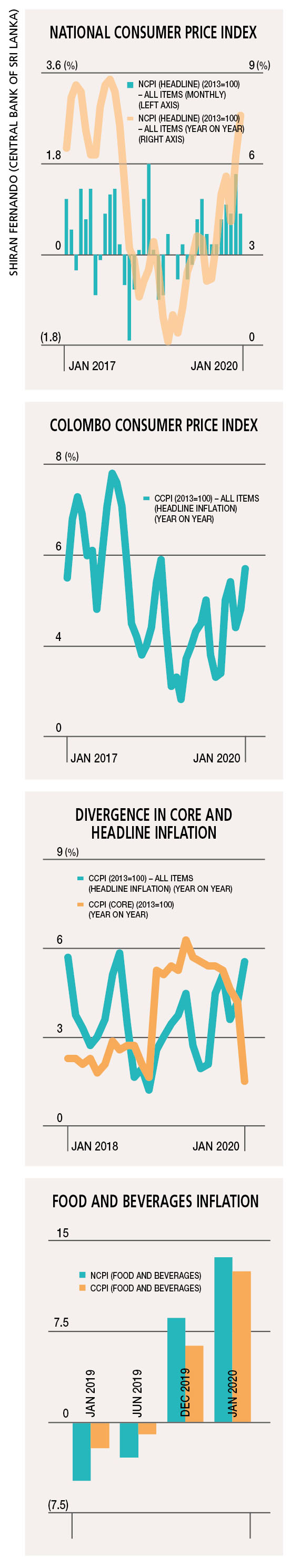

Headline inflation – as measured by changes in the National Consumer Price Index (NCPI) – grew to 7.6 percent in January, its highest level since December 2017. Meanwhile, the Colombo Consumer Price Index (CCPI) recorded its highest level since August 2018 whereas inflation was in the range of three percent a mere six to seven months ago.

So would rising inflation be a concern moving forward; or is it more of a temporary uptick that will ease off as the year goes by?

MAJOR DRIVERS The increase in consumer price indices was mainly driven by the food category with food and nonalcoholic beverages constituting 28 percent and 44 percent of the CCPI and NCPI respectively.

Notably, the weightage for food in the inflation basket highlights the sensitivity of overall consumer price indices to changes in food prices particularly at a national level – i.e. in the NCPI.

In both the NCPI and CCPI, food and beverages witnessed double digit growth (on a year on year basis) in January. Similar to the highs in the overall consumer price indices, the last time the year on year growth was in double digits for the food and beverage category was towards the end of 2017.

Higher food and beverage inflation was seen in September 2019 in terms of the CCPI and NCPI. The recent spikes – in December 2019 and January 2020 – was attributed to price increases recorded as a result of a supply shortage on the back of adverse weather conditions towards the end of last year.

For example, the NCPI rose in January due to an increase in the price of vegetables, coconut, red onions and fresh fish.

MONETARY REVIEW The Central Bank of Sri Lanka (CBSL), in its first monthly monetary policy review for 2020, considered the rise in inflation to be a short-term fluctuation – its near-term forecast being for inflation to hover below five percent this year. Inflation is expected to stabilise between four and six percent thereafter.

A notable point from the review statement is that the Monetary Board anticipates a readiness to respond to any buildup of demand driven price pressures. This is significant given that both fiscal and monetary policy – courtesy of the Ministry of Finance and CBSL respectively – have been geared towards stimulating aggregate demand and growth.

Higher demand stemming from stimulus measures such as revised tax rates, debt moratoriums and lower interest rates could spur growth led by consumption rather than investment. If the former does take place, the upward trend in inflation is likely to continue.

CBSL has highlighted that it is ready to respond primarily in terms of monetary policy. However, a change in the present monetary policy stance would not have an impact that immediately quells aggregate demand should it cause a spike in inflation.

DIVERGENCE CONCERNS Core inflation is a measure of underlying inflationary or demand pressures in the economy. Compared to headline inflation, it does not consider prices of volatile items such as food, energy and transport, which are subject to monthly changes as a result of external factors.

Between October 2018 and December the following year, core inflation of the CCPI was higher than headline inflation as reported in the media. In 2019, when annual average headline inflation was 4.3 percent, core inflation stood at 5.5 percent.

A similar trend is observed vis-à-vis the national index as well although with a shorter duration in which core inflation was higher than its headline counterpart. While headline inflation in the NCPI was 3.5 percent in 2019 on average, core inflation registered 5.5 percent. This indicates a divergence between the two reported figures.

There was a reversal of this trend in January when core inflation dropped to below headline inflation for both consumer price indices. This was a result of base effects (given the higher growth in January 2019) although there was a notable monthly increase in both the NCPI and CCPI.

The lower base impact of 2019 may mean that core inflation remains below headline inflation this year. Going forward, the concern would be if core inflation continues to grow on a monthly basis.

INFLATION CONTROLS While the food supply will remain integral to driving the future direction of inflation, certain factors may ease inflationary concerns.

For example, given the sense of uncertainty resulting from COVID-19, many forecasters are revising their outlook for global growth and oil demand. Therefore, the Brent oil price declined from US$ 66 a barrel at the beginning of 2020 to 55 dollars a barrel by the first week of March.

If the impact of declining global oil prices is passed on to consumers, major items in the inflation basket such as transportation would lead to lower inflation in the near term.