GLOBAL SURVEY

FINANCIAL REPORTING TODAY

Courtesy Ernst & Young

DELIVERY OF FINANCIAL INFORMATION

CFOs must develop the finance function to meet board and stakeholder needs

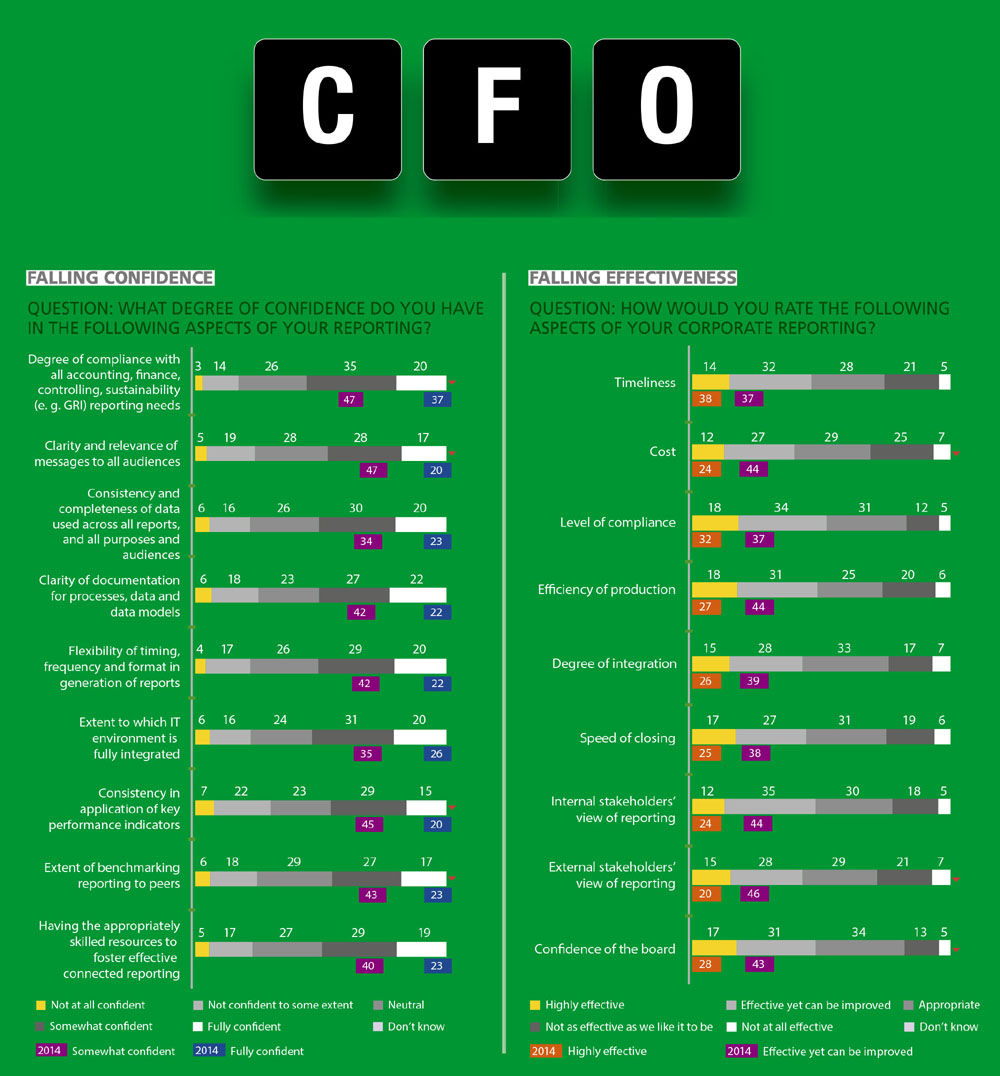

Today, the environments in which organisations operate are both complex and demanding. A survey conducted by Ernst & Young reveals that CFOs and the finance function are finding it difficult to keep pace with the demands of financial reporting. As a result, finance teams are stretched and confidence in financial reporting has declined.

SURVEY REACH Among the 1,000 respondents to the global survey were group, divisional and regional financial controllers from the Americas, the Asia-Pacific, Europe, the Middle East, India, Japan and Africa.

So what are the complexities that affect the finance function of an organisation?

With the versatile growth of businesses, the number of operational entities that exist in an organisation has increased, leading to the proliferation of reporting systems. Achieving consistency in financial reporting is therefore, a difficult task.

KEY INDICATORS Some stark indicators of this situation include a high number of legal entities or business units, conducting business in different jurisdictions and the number of systems (ERPs, Excel and other sources) being used to prepare financial statements.

While the financial reporting function is being severely challenged, the information needs of various stakeholders have intensified. The survey reveals that over the last three years, audit committees and boards have greatly increased the attention they pay to financial reporting while CEOs and executive teams aren’t far behind.

However, the ability of the finance function to deliver quality information based on existing systems, processes and staff strength has strained the relationship between the CFO and board. Only 20 percent of survey respondents say they have an excellent relationship with the audit committee.

QUALITY INFORMATION The foundation of the relationship of a CFO and the board is built on the quality of the information that’s provided to the directors. Quality information contains the right info at the right time, which requires the finance function to understand the requirements of the board, its direction and strategies.

A starting point would be to undertake a survey on the attributes of financial reporting such as the adequacy and timeliness of financial information, and the changes the board would like to see.

In their assessment of the confidence they have in financial reporting, the survey highlights that CFOs are far from satisfied.

Many of the survey respondents view technology and big data as a way out for this predicament. Advanced technologies make it possible for finance functions to extract significant reporting insights from increasing volumes of data. They will be able to collect and analyse corporate data from across myriad functions and geographies, transforming the efficiency of corporate reporting.

Some of the obstacles to delivering quality information are as follows: lack of integration between IT systems; difficulties in accessing data; poor quality data; existence of several reporting systems; lack of automation across systems; and inconsistency in data and dated IT systems.

The journey to achieve the perfect financial reporting system is not unachievable. Organisations must have a clear framework for their reporting to boards and other stakeholders, and the systems and processes that generate such financial reports should be adapted to such needs. This would involve the identification of critical gaps in an organisation for reporting, for both people and processes.

END OBJECTIVE It is in terms of the end objective that the gaps need to be identified. For the project to be successful, the right people and processes (governance framework) need to be established. Likewise, the support of senior management is paramount.

The project may require the overhaul of some of the competencies in the finance division – such as IT infrastructure, regulatory and governance knowledge, business analysis, technical accounting skills, risk management, data analytics, and process and legal knowledge.

SOFTER SKILLS While the aforesaid technical skills are important, such a transformation will not be successful without the capabilities of personnel with softer relationship management skills. This may severely strain the training and development budgets of companies.

With this in mind, organisations may need to look outside for the right level of recruitment to supplement the team.

Trust and confidence are lasting attributes of a CFO. They cannot be compromised. To maintain the essence of a successful CFO, he or she must build confidence. Three imperatives that cannot be overlooked in this journey would be to build strong trusted relationships with the board and other key stakeholders, adopt innovative technologies and sophisticated data tools to develop strategic insights, and develop the right mix of capabilities for the finance function.

– Compiled by Hiranthi Fonseka