ECONOMIC OUTLOOK

DRIVERS OF A RECOVERY

Shiran Fernando explains what is needed for a turnaround in the national economy

In June, Sri Lanka recorded its first trade surplus since August 2002. While this seems to be a positive development given the island’s economic woes, the question is whether it can be sustained...

If the country is able to manage by using its export earnings to pay for imports, this could assist in financing essential items. However, a slowdown on the trade side will result in an overall contraction in economic activity too.

Let’s examine trade trends and other data that point to a potential recovery of the economy.

For this situation to eventuate, three factors will need to prevail. The trade deficit is simply the export of merchandise goods (tea, rubber, apparel and so on) minus import expenditure (on fuel, raw materials, consumption items and investments goods among others). So a key aspect is the movement of exports in addition to fuel and non-fuel imports.

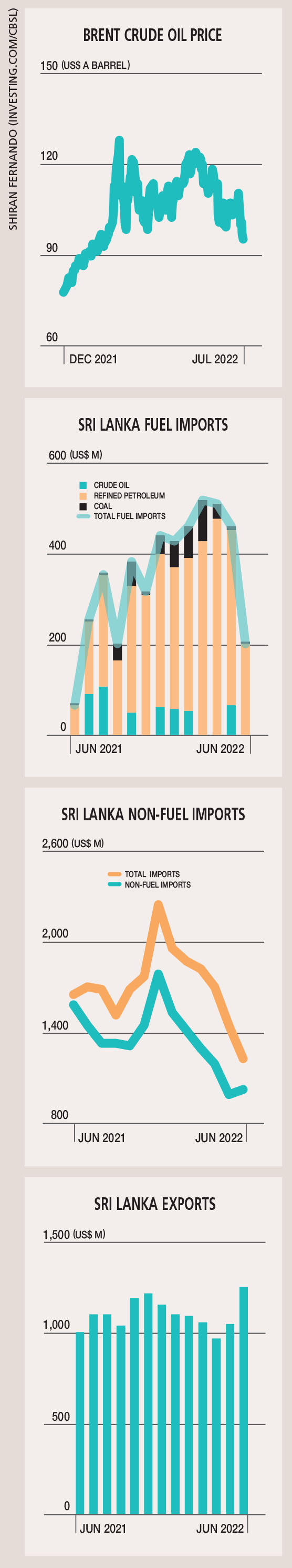

The first factor will be if Sri Lanka can maintain its export momentum – with the first half recording a growth of 14 percent and June registering an upswing of 24 percent compared to a year ago.

Key drivers of export growth have been apparel, seafood and petroleum products. Apparel in particular has grown by 20 percent but this growth momentum could stall if the economies of the US and EU member states, which are vital apparel markets, slow down.

We may see exports continuing along this trend, and slowing down towards the end of the year and in the first half of 2023. Beyond the external factors, the confidence of export buyers will need to be maintained to ensure that they continue to order from Sri Lanka. So stability on the social and political fronts is critical for driving economic equilibrium.

The second factor will be how much fuel would be imported in the latter half of 2022. Due to the Indian credit line, we were able to import much of our fuel requirement during March-May period.

When the credit line ended however, Sri Lanka had to resort to utilising its depleted reserves and purchasing dollars from the banking system to finance fuel imports. This was evident in July and early August.

In June, Sri Lanka imported only US$ 200 million worth of fuel, which was less than half of what it had brought into the country in the past few months. As a result, the nation was able to reduce its overall imports to 1.2 billion dollars – compared to between US$ 1.4 and 1.8 billion recorded in the early part of this year.

The movement in global oil prices will help determine the country’s fuel import bill as well. Oil prices have been hovering above US$ 100 a barrel for most of 2022 while reaching close to 135 dollars in March, following the onset of the Russia-Ukraine conflict.

Due to concerns about a slowdown of the global economy and an improvement in oil supply however, crude prices have eased since the end of June; and in recent weeks, Brent has fallen to below US$ 100 a barrel.

If fears of a global slowdown persist, oil prices could fall further – providing some respite for Sri Lanka. The island could then manage oil imports at between 250 to 300 million dollars a month. Otherwise, the current fuel rationing system may have to continue for the foreseeable future – unless the country secures substantial levels of bridging finance.

A final factor is the non-fuel import component that’s been falling since February and has continuously declined. This slowdown can be sustained in particular with a reprioritisation in the financing of essential imports.

The import of consumables and investment goods fell by 20 percent and 14 percent respectively in the first half of 2022. This trend is likely to continue – although expenditure on intermediate goods will be sustained, given the need for raw materials to meet export orders and other domestic production.

Beyond the export of goods, service exports will also play a crucial role. According to the Export Development Board (EDB), the export of services grew by 46 percent to US$ 1.3 billion in the first half of 2022.

Service exports comprise ICT/BPM, construction and financial services, as well as transport and logistics.

This growth would need to be sustained, and could play a part in financing imports and improving Sri Lanka’s reserves.

Other inflows such as remittances and earnings from tourism will also be key elements in the second half of 2022. In the first half, remittances fell by US$ 1.7 billion (52%) and tourism earnings lost the momentum it gained in the first three months of this year.

During this period, 280,334 tourists arrived in the country – but that figure fell sharply to 126,043 between April and June. An improvement of even 20-30 percent in tourism and remittances will help bolster the dollar liquidity position and provide some confidence that an economic recovery is on the horizon.

Leave a comment