MACROECONOMIC OUTLOOK

ECONOMIC BALANCING ACT

Shiran Fernando evaluates Sri Lanka’s economybin 2018 and what it means for future trajectory

Looking back at some of the key data points to come out of 2018 produces quite a mixed bag as this commentary will explain; it underscores the need for consistent policy and an improved domestic operating environment.

FOREIGN INVESTMENT Despite the difficult operating environment, foreign direct investment (FDI) inflows continued to witness a positive trend last year.

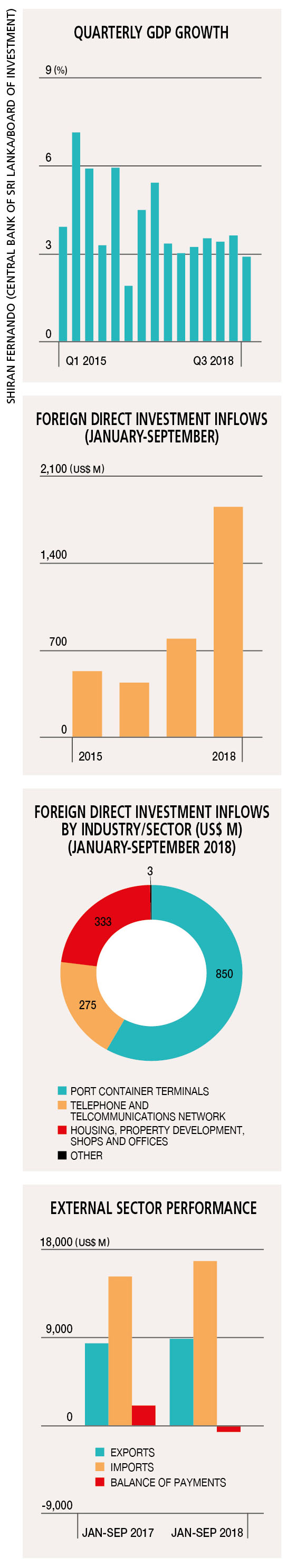

According to data released by the Board of Investment (BOI) of Sri Lanka, FDI inflows grew to US$ 1,856 million in the first nine months of 2018 from 796 million dollars in the corresponding period of 2017. This is impressive as it represents the highest value on record for a full year, which was in 2017 (US$ 1,710 million).

MAJOR DRIVERS If one were to delve deeper to ascertain what drove these inflows, it becomes clear that this was mainly due to the infrastructure sector, which recorded an inflow of US$ 1,416 million – accounting for around 76 percent of total FDI inflows – during the period.

The infrastructure sector also witnessed sharp growth in inflows as FDIs rose to US$ 1,416 million from 347 million dollars in 2017. If we were to be more specific as to what the key driver of infrastructure inflows was, close to 58 percent came from inflows to port container terminals. This was due to transfers related to the Hambantota Port terminal.

UPS AND DOWNS While the infrastructure sector witnessed substantial growth, the manufacturing industry saw inflows decline by 27 percent during the first three quarters of 2018 relative to 2017. The other two sectors witnessed below par growth as well with agriculture growing by only 0.4 percent and services accelerating by seven percent during this time.

This demonstrates that although the headline FDI inflow was positive and recorded healthy growth, the underlying drivers were once again led by more infrastructure related flows – and this isn’t sustainable in the longer term.

FDI inflows need to increase in sectors such as manufacturing to have a positive impact on economic growth and create more jobs.

TAPERING GROWTH GDP growth slowed to 2.9 percent in the third quarter of last year, which reflects a slowdown to a two-year low and is far below expectations. It also reflects a slowdown compared to the 3.6 percent growth recorded in the second quarter of 2018.

This brought growth for the first nine months of 2018 to 3.2 percent. It will be interesting to see how the fourth quarter performs if 2018 GDP is expected to be above the full year number for 2017 (i.e. 3.3%).

However, these expectations are far below the four plus percent expectation that existed at the beginning of 2018. Weak growth in the industry sector and the slower than expected increase in the services sector undermined overall GDP growth.

EXTERNAL TRADE The balance of payments (BoP) position at the end of the first nine months of 2018 turned to a deficit of US$ 650 million owing to outflows in the financial account and an expanding trade deficit.

Export growth (5.6%) was outpaced by higher imports (10.4%) in the first three quarters of 2018. Higher imports of fuel, private vehicles and other consumer products contributed to this.

The growth in exports was steady last year with five of the first nine months recording more than one billion dollars in earnings. From an overall growth perspective however, there was a noticeable slowdown. In the full year 2017, exports grew by 10.2 percent while the first nine months of 2018 witnessed growth of only 5.6 percent.

TOURISM EARNINGS The positive has been on the tourism front with healthy cumulative growth in the first 11 months of 2018 – both in terms of earnings as well as arrivals. But it remains to be seen if the recent political uncertainty will have a more prolonged impact on tourism.

OTHER INDICATORS Worker remittance inflows – although representing a substantial portion of Sri Lanka’s current account – declined by 1.5 percent in the first nine months of 2018.

The BoP position is cause for concern given that reserves have been volatile, coupled with a high level of outflows from the local bond market.

Receding oil prices will be beneficial in terms of the fuel import bill but that could be short-lived if prices climb back up to 70-80 dollars a barrel. The global financial environment will also need to be favourable for Sri Lanka to be able to raise debt on favourable terms.

WHAT NEXT? Growth, FDI inflows and the external sector are all indicators of how the economy is performing, and is expected to perform.

The policies of the government on the way forward, its reforms agenda and political certainty will be needed to take growth back to a four percent plus trajectory. This will naturally lead to a more sustainable level of FDI inflows and a positive BoP.