DIGITAL MONEY

ALL-NEW CRYPTOCURRENCY

Taamara de Silva tosses the Libra coin from Facebook for potential benefits

So can ‘stablecoins’ dominate the token economy?

Facebook stunned the world when it announced the launch of its own cryptocurrency – Libra. Expected to be used for global payments, according to its white paper released in June, Libra’s mission is to “enable a simple global currency and financial infrastructure that empowers billions of people.”

With perfectly serviceable online payment services such as Apple Pay, Square, WePay and many more that are available, why does the world need Libra?

We will find out very soon that this initiative is game changing for many reasons.

Research estimates that around two billion people do not have bank accounts despite the surge in financial inclusion. Yet, of this unbanked adult population, two-thirds own a mobile phone.

In a bid to tap this unbanked population, Facebook intends to leverage its 2.4 billion strong user base, which is distributed across a suite of social platforms – including Facebook Messenger, WhatsApp and Instagram – to encourage large-scale adoption of a new currency, pushing it to mainstream acceptance.

By comparison, only 2.5 million people own bitcoins.

Even though blockchain is hyped as a technology that will revolutionise the financial services industry, high volatility and a lack of mass adoption of cryptocurrencies have resulted in widespread scepticism. Slow transaction speeds and a lack of standardisation have also threatened to restrict growth.

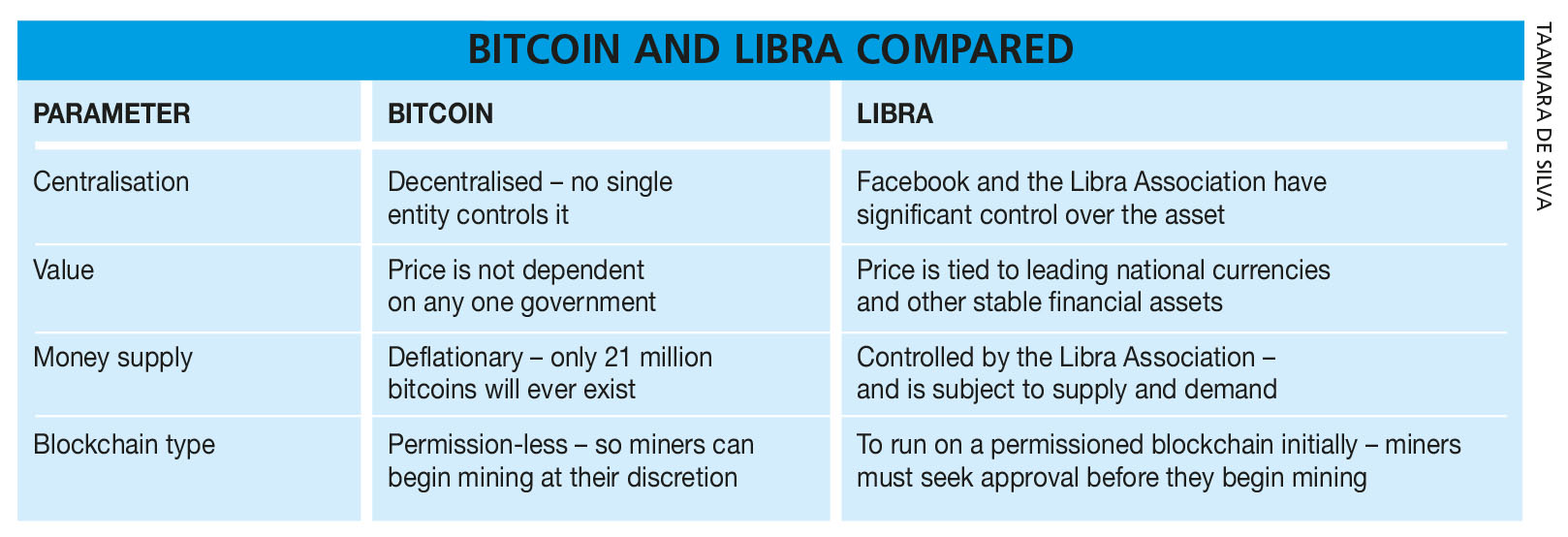

How is Libra different from the leader bitcoin and other blockchain currencies?

Libra has unique components that make it stand out from the pack. For example, it is built on a secure, scalable and reliable blockchain. It’s also a stablecoin backed by a reserve of assets such as bank deposits and government securities. And most importantly, it is governed by the independent Libra Association.

Why did Facebook choose a stablecoin structure? And how does it work?

A sound currency should fulfil the following roles: be a medium of exchange, unit of account and store of value. However, while cryptocurrencies do a great job serving as a medium of exchange, they fail miserably as units of account and stores of value. If you own something that is extremely volatile, would you trust it as a store of value? The answer is most likely ‘no’ – for good reason!

From a basic blockchain perspective, Bitcoin is completely decentralised with a large number of nodes operating across the world. It’s also ‘permission-less,’ which means that anyone with the hardware and technical knowledge can begin mining. The core issue with this from a payment perspective is that it takes a considerable amount of time to validate a transaction.

On the other hand, Libra does more or less the opposite. It’s based on a relatively centralised blockchain that is governed by the Libra Association so that transactions are fast and scalable.

Libra payments will be peer-to-peer, which means that neither a bank account nor credit card will be required. This makes the digital coin ideal not only for those seeking to bypass banks and avoid high transfer fees but also millions of people around the world who don’t have access to traditional banks or financial services.

Cryptocurrencies have enjoyed a more rapid adoption rate in economies with troubled currencies and this is another aspect that may favour Libra advocates.

While the project looks promising, it also has its fair share of challenges. The burning question is how comfortable will the financial system and governments be in passing regulation, and enabling and accepting the Libra project?

In addition, we cannot disregard the harmful potential that it may have as a vehicle for money laundering, a threat to global financial stability and myriad instances of data privacy abuse. This may have far-reaching consequences – especially for us, as consumers – and could possibly even strip nations of control over their economies by privatising the money supply.

Overall and in summing up, Libra probably has the best shot at success compared to the tokens available in the market, to introduce the greater part of the world to a financial system that can help eliminate poverty and provide people with alternatives to the broken fiat currencies they’re forced to use today.

Libra is expected to be launched in the latter half of this year. If successful, it will disrupt existing power structures that control the world’s financial system. It must be said however, that the solution must not transfer this newly acquired power from governments to corporations; but rather, directly to the people.

We can only hope for global adoption that is fair and equitable – one that does not herald modern technological colonialism.

Leave a comment