COVER STORY

EXCLUSIVE

STATE OF THE STATE

Dr. Razeen Sally presents a no-holds-barred account of the state of the nation and its present-day economy

Dr. Razeen Sally is no stranger to the Sri Lankan developmental status quo, most recently voicing concern about the path taken by the powers that be in their bid to steer the nation’s economy in the right direction.

Dr. Razeen Sally is no stranger to the Sri Lankan developmental status quo, most recently voicing concern about the path taken by the powers that be in their bid to steer the nation’s economy in the right direction.

At a forum in December, the Associate Professor of the National University of Singapore (NUS) outlined potential scenarios for the Sri Lankan economy in which he warned against a relapse into a ‘Big Man’ illiberal democracy, a statist economy, ethnic strife and servitude to China.

Sally advocated a takeoff into a stable liberal democracy, sustainable and broadly shared economic growth, ethnic reconciliation and balanced international relations.

LMD’s exclusive interview with the highly regarded economist delves deeper into the island’s political economy to appraise progress on the promised good governance (aka yahapalanaya), where it stands in engineering economic prosperity and establishing social recognition for Sri Lankans.

In relation to the corporate sector, he argues in favour of and points to the necessary mechanisms for improving the conditions that are currently available to do business in Sri Lanka. The Chairman of the Institute of Policy Studies of Sri Lanka (IPS) also emphasises the need for substantial reform of the nation’s state sector.

The global context is also very much in focus given the ripples created by the Brexit vote and the new occupant of the White House, as well as their potential impact on the open economy in countries such as ours.

As a prominent member of the diaspora community, Sally also calls for greater positive engagement vis-à-vis reaching out to the many Sri Lankans residing overseas who are willing to give back to their country of origin.

– LMD

Q: What is your take on Sri Lanka’s progress in terms of good governance since January 2015 – and are your expectations being met?

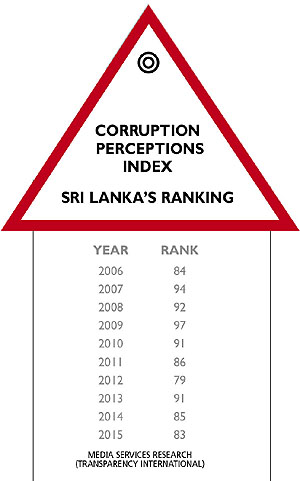

A: It is disappointing but not surprising. Abuses of power and corruption are not as bad as they were under the Rajapaksas. There is less fear and self-censorship, and more openness and criticism. There is less arbitrary power and more rule of law.

But the quality of governance is back to where it was before the Rajapaksas – i.e. pretty bad.

Corruption, nepotism, rampant populism, marginalisation of competent professionals and misinformed decision-making are still the norm. The crux of the problem is that the political class remains essentially the same; it shuts out younger and better talent, and prevents the emergence of sound institutions. The same is true in business.

Q: Is the country making headway in achieving ethnic reconciliation, in your view? If so, what are the positives?

A: The right symbolic overtures have been made to the minorities since the change of government. There’s less overt and crude Sinhalese-Buddhist supremacism.

But tangible changes for lasting ethnic reconciliation – land restitution, investigation and redress for human rights abuses, demilitarisation and devolution as part of a new constitutional settlement – have yet to be achieved.

The domestic politics of all this is daunting: every government must pay heed to the Sinhalese-Buddhist heartland whose chauvinist core is so easily whipped up. Sri Lanka’s ethnic mix is still a tinderbox.

Q: And are Sri Lankans by and large guaranteed an equal share of the economic pie?

A: No, and it is foolhardy to aim for ‘equal shares.’ That is a collectivist atavism and an open sesame for unlimited state intervention. That Sri Lanka has had for 60 years; its result is an entrenched crony-capitalist or crony-socialist oligarchy – ‘insiders’ who exclude ‘outsiders.’

The answer is less – but better – government and more individual freedom, especially economic freedom to liberate the animal spirits and entrepreneurship of ordinary Sri Lankans.

Outcomes will inevitably be unequal but probably less unequal than they are now. But the main thing is that much more wealth will be generated for the many and not the few; ‘outsiders’ will be able to create their own wealth, gain a much larger share of a pie that is expanding rapidly, and lead to better lives for their families and communities.

Q: What are the most urgent priorities for the macroeconomic scenario? And what is your assessment of the likely impact of events such as Brexit and the installation of Donald Trump as President of the United States?

Q: What are the most urgent priorities for the macroeconomic scenario? And what is your assessment of the likely impact of events such as Brexit and the installation of Donald Trump as President of the United States?

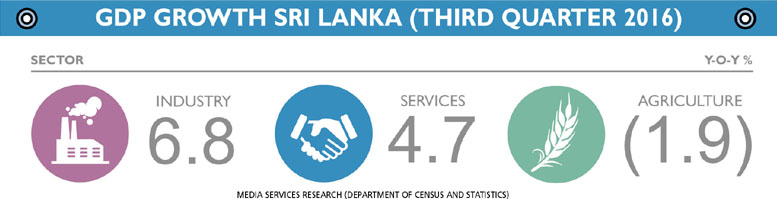

A: Fiscal clean-up is paramount. The tax system must be simplified with fewer exemptions to both increase revenue and create incentives for wealth creation. Out-of-control populist expenditure must be reined in. Monetary policy should aim for price stability and the exchange rate should be market-led.

But the key remains more stable public finances without which there will never be macroeconomic stability. So far, this government’s record has been as bad as its predecessor’s.

Brexit on its own has minimal impact given that the UK economy is not that large as a share of the global economy.

But the United States is different and Donald Trump’s election signals some major policy changes.

US fiscal stimulus combined with higher Fed interest rates will probably cause the US Dollar to appreciate further as well as raise interest rates in emerging markets. That is going to make Sri Lanka – with its reliance on foreign commercial borrowings to fund public debt – more vulnerable with added downward pressure on the rupee.

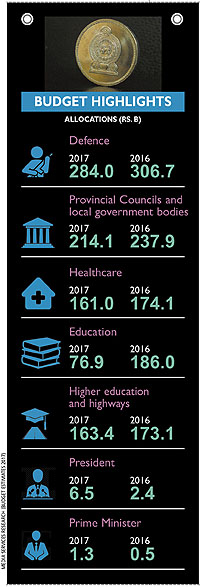

Q: How do you view Budget 2017 in the context of the nation, and its people and businesses?

A: Better than the last two budgets. On paper, it does some of the right things. But this is only rectifying mistakes from previous budgets, and falls in line with the International Monetary Fund (IMF) conditions for the Extended Fund Facility. So I would not give too much credit for this to the government.

But it is still premature to pronounce definitively for success or failure lies in implementation. As ever, that remains a big question mark.

Q: In your view, are the following sectors receiving the attention, concessions and resources they need given the government’s economic policy brief late last year – exports, education and healthcare?

Q: In your view, are the following sectors receiving the attention, concessions and resources they need given the government’s economic policy brief late last year – exports, education and healthcare?

A: Education and healthcare have long been squeezed by runaway spending on the military, public sector salaries, infrastructure and debt servicing. Structural reorientation of public finances is vital to devote adequate resources to education and healthcare.

But the more important issue, in my view, is this: these sectors will never improve without changing their basic structures and incentives.

Public sector and trade union domination is a recipe for continued bad service that makes the poor suffer most.

There should be a much larger role for choice and competition in education and healthcare.

As for exports, they continue to decline. Sri Lanka needs to reverse a 15-year decline in exports, imports and foreign investment. Trade, foreign direct investment (FDI) and private-sector investment should drive growth.

The government mouths the right words but so far has done nothing. Sri Lanka needs a new pro-market trade policy with major liberalisation of trade and FDI. This government does not have an overarching trade policy and neither does it have a coherent overall economic strategy. As a poor substitute, it has myriad ad hoc policy measures that contradict each other, make matters worse or don’t make much difference.

Q: In an interview aired on the TV programme Benchmark in November, you called for “a different kind of tax system that is essentially about having consumption and direct taxes on personal and corporate incomes that are simple and straightforward, and with as few exemptions as possible.” And you said the state should “undertake significant and comprehensive tax reforms to rescue the system from collapse.” Could you elaborate on these views?

A: The best tax systems in the world have only a few rates, low rates, and few exemptions for both corporate and personal income. They are simple to use and administer, leave few incentives for corruption, generate adequate revenue and spur wealth creation. Singapore, Hong Kong, Georgia and Estonia are role models.

Sri Lanka should head in that direction, however gradually. But that requires institutional checks on politicians to prevent them doing silly things. When is that ever going to happen in Sri Lanka?

Q: In your opinion, is it fair that the people and businesses are being asked to pay higher taxes when there’s so much waste in public expenditure – and when very little has been done to revive loss-making state utilities? How do you think this imbalance can be redressed? Can it be redressed?

Q: In your opinion, is it fair that the people and businesses are being asked to pay higher taxes when there’s so much waste in public expenditure – and when very little has been done to revive loss-making state utilities? How do you think this imbalance can be redressed? Can it be redressed?

A: Fair or unfair, the government’s short-term macroeconomic priority must be to increase revenue to 15-20 percent of GDP. Adjustments to expenditure are politically more difficult and will take longer than implementing tax changes. And that is even more the case with state-owned enterprises (SOEs).

But reform in these areas must begin too. Otherwise, Sri Lanka will drift towards being a higher tax and higher spending nation with a still bloated, leeching public sector. But is this government – and are Sri Lanka’s politicians – capable of and willing to implement these reforms? I am not optimistic.

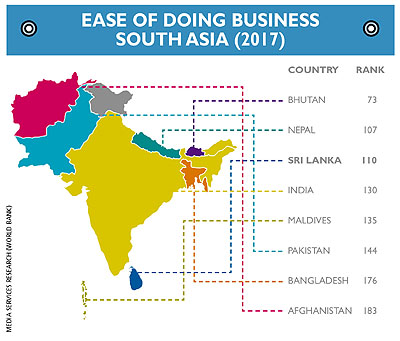

Q: Is the business climate in the country conducive to doing business, particularly for foreign investors?

A: No, and it has become worse as Sri Lanka’s deteriorating ranking in the World Bank’s Doing Business Index indicates. The convoluted, dilatory approvals process and having to go through multiple agencies are at the heart of the problem. Access to land is another especially for large-scale foreign investors. The Board of Investment (BOI) has never been a successful one-stop shop.

The solutions are simple: reducing the number of approvals and agencies responsible, and the time taken for approvals, implementing online procedures, and making them transparent and automatic. They’ve been implemented successfully elsewhere. Again, this government talks the right language but does not seem capable of action.

Q: Are you satisfied with the monetary policy stance being adopted by the Central Bank of Sri Lanka (CBSL)?

Q: Are you satisfied with the monetary policy stance being adopted by the Central Bank of Sri Lanka (CBSL)?

A: Not until the appointment of Dr. Indrajit Coomaraswamy. And I applaud what he has done. He has tried to depoliticise the Central Bank, focus it on clear monetary goals and clean up its regulation, not least the primary bond market.

Goodness knows Sri Lanka needs institutions with restored credibility that are run by clean, competent professionals who know what they’re talking about. That should start with the CBSL.

It worries me that government politicians who do not know what they are talking about and have ugly ulterior motives have tried to undermine the Governor of the Central Bank and eat away at its authority.

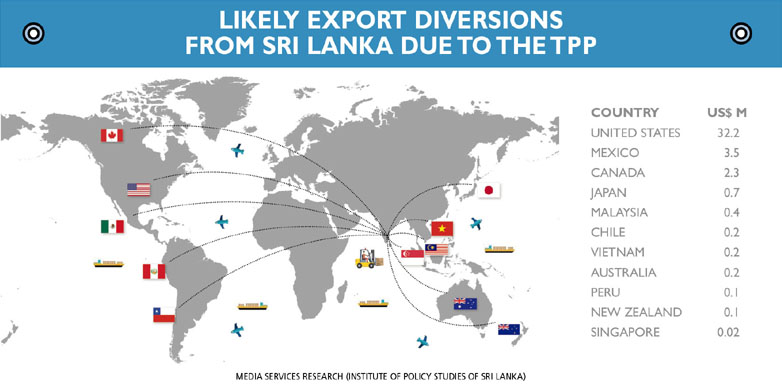

Q: How do you view Sri Lanka’s intentions to be a part of the Trans-Pacific Partnership (TPP)?

A: The TPP is dead; or at least will be dormant for a few years. That is sad, for – warts and all – it could have liberalised trade considerably and cemented the US’ engagement in Asia.

But trade policy is turning more protectionist and the signs coming out of the Trump camp are very worrying. So the question is redundant. Sri Lanka first needs national, unilateral trade liberalising reforms. And to support that, it could negotiate sensible free-trade agreements (FTAs). But the better, stronger agreements are with non-Asian partners.

It might be possible to negotiate a bilateral FTA with the US but we will first need to see what comes out of the first months of the new US administration.

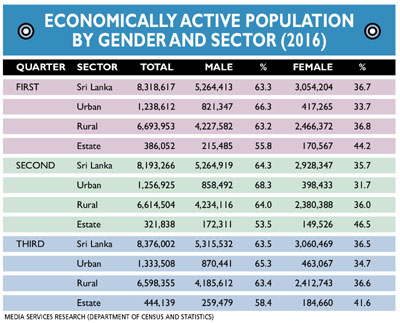

Q: Do you believe that Sri Lanka’s workforce is geared to meet current and future economic realities?

A: No. It requires structural – i.e. long-term – reforms to education and vocational training, and these should have more private sector participation for choice and competition.

Q: What key steps must be taken to reduce or stop corruption in Sri Lanka? Is it too late? Has the rot spread too far?

A: Yes, it is rotten but repair and recovery are still possible.

Political reforms so far such as independent commissions for public service appointments and the reforms proposed might improve matters, but I suspect not by much. That is because they do not change the underlying economic incentives.

The key is economic reform: to limit government to a smaller sphere and take it out of the lives of ordinary Sri Lankans. That will eliminate most, though obviously not all, incentives for corruption.

The key is economic reform: to limit government to a smaller sphere and take it out of the lives of ordinary Sri Lankans. That will eliminate most, though obviously not all, incentives for corruption.

Legal deterrents on corruption are important but without congruent economic incentives they mean little or nothing.

Q: How is the country faring in maintaining the rule of law?

A: Better after the defeat of the Rajapaksas, better than many other developing countries, not bad by South Asian standards but pretty bad by East Asian standards and even worse by Western standards.

Sri Lanka still has a ‘rule of man’ culture – getting things done through political connections and often by breaking the law with a superficial veneer of the rule of law.

Q: In your opinion, is there a need for reforming the local civil service?

A: Yes, absolutely. It’s been degraded for over half a century especially since the 1970s, and reached rock-bottom under the Rajapaksas. Sri Lanka needs a much smaller, less politicised, meritocratic and better-paid civil service.

But how can civil service reform be implemented politically? That would be as difficult as downsizing and privatising SOEs. Reforms outside the state, especially its inner sanctum, are easier but even they have barely begun.

Q: How can Sri Lanka reach out to members of the diaspora such as yourself to contribute to the country’s development?

A: By beginning serious economic reform – that would be the best incentive. Specific measures would also help: a diaspora passport with rights to residency and work in Sri Lanka, a fast track to citizenship, BOI targeting of diaspora investment and an annual diaspora convention.

DR. RAZEEN SALLY

DATE OF BIRTH

27 January 1965

FAMILY

Sri Lankan Muslim father and British mother

EDUCATION

S. Thomas’ College

Seven other schools in Sri Lanka and the UK

London School of Economics (LSE)

HOBBIES

Serious reading (literature, history, biographies and social sciences)

Serious travel (particularly in Asia)

Swimming

Hiking

ADMIRES

Adam Smith

David Hume

Ronald Reagan

Baroness Margaret Thatcher

The Buddha

ROLE MODELS

“Anyone who performs a task excellently – mindfully – with a solid inner core and for the service of others, without show, and with humility and sacrifice. These are rare individuals but I know a few and rate them above all others especially myself. And I prefer not to name them.”

SRI LANKA TODAY

STRENGTH

Huge potential

WEAKNESS

Never achieving its potential – a fatal complacency

OPPORTUNITY

Economic takeoff through liberalisation and globalisation

THREAT

Backsliding to economic stagnation, big man politics and ethnic conflict

THE PRIVATE SECTOR

STRENGTH

A lot of talent

WEAKNESS

A politically well-connected rent-seeking oligarchy

that shuts out competition and talent

OPPORTUNITY

To open out to the world and link up with global supply chains to raise productivity and standards (which is good for firms, their workers and above all consumers)

THREAT

Stagnation through suppressed competition (this could mean Sri Lanka would continue to be inward-looking – a backwater)

THE STATE SECTOR

STRENGTHS

None

WEAKNESSES

Where does one start? Politicisation, overstaffing, underwork, terrible service, arrogance, incompetence, taxpayer bailouts and crowding out competition – the list is endless

OPPORTUNITIES

Only with downsizing and privatisation (corporatisation and part privatisation of commercially viable firms could be intermediary steps; but privatisation and competition are the only ultimate solutions to eliminating politics from these institutions)

THREATS

Blocking by politicians, unions and other cronies

MODEL NATIONS

Australia, New Zealand, Singapore, Hong Kong, Estonia, Georgia, Costa Rica, Chile and Mauritius – “For their political and macroeconomic stability, ease of doing business and openness to the world economy; in sum, for good governance and simple, transparent regulation.”

Leave a comment