COVER STORY

EXCLUSIVE

THE STATE OF BUSINESS

Kapila Jayawardena assesses the state of business in the context of the COVID-19 pandemic – and outlines priorities to drive Sri Lanka’s economic recovery and attract investments to the country

Counting more than two decades in the financial services industry, Kapila Jayawardena’s experience encompasses investment banking, banking opeations, audit, relationship management, corporate finance, corporate banking and treasury management.

Appointed as the Group Managing Director and CEO of LOLC Holdings in 2007, he also serves on the boards of several of the conglomerate’s susidiaries.

A fellow member of the Institute of Bankers of Sri Lanka (IBSL) and associate member of the Institute of Cost and Executive Accountants in the UK (ICEA), he was previously the Country Head and CEO for Sri Lanka and the Maldives of a global bank.

Over the years, Jayawardena has contributed to industry reforms and development as Chairman of the Sri Lanka Banks’ Association (SLBA), and a member of the Financial Sector Reforms Committee and Finance Sector and Capital Markets Cluster of the National Council of Economic Development (NCED).

Additionally, he has served as President of the American Chamber of Commerce Sri Lanka (AmCham Sri Lanka), as well as a member of the inaugral Sovereign Ratings Team for Sri Lanka and board member of the United States-Sri Lanka Fulbright Commission (US-SLFC).

Commenting on the outlook for Sri Lanka’s economy in the 2019/20 edition of the LMD 100 – which was released in March this year – Jayawardena noted that “history indicates that the period after every recession is followed by massive growth,” anticipating growth stimulated by people beginning to travel, “which will have a positive impact on related industries.”

Some six months later, in this exclusive interview with LMD, he assesses the state of business in Sri Lanka and highlights the main concerns that need to be addressed in the nation’s pursuit of a sustained economic recovery, as well as the corporate sector’s role in building the country’s resilience to external shocks.

– LMD

Q How do you view the present state of business in Sri Lanka given the impact of the COVID-19 pandemic since early last year?

A Over the last year, a major slowdown has been witnessed in economies across the world with very few exceptions.

If you take Asian countries with large populations that play a significant role in the global supply chain – such as China, India, Bangladesh and Indonesia – their economies were severely disrupted by the pandemic. China’s economy was the first to recover but India and Indonesia are still struggling.

As for Sri Lanka, with its relatively small population as an island nation – and given that it has one of the best healthcare systems in the world – I strongly believe it will emerge from this crisis much sooner than some peer group countries. The nation’s high literacy rate means people understand the risks of not being careful.

As for Sri Lanka, with its relatively small population as an island nation – and given that it has one of the best healthcare systems in the world – I strongly believe it will emerge from this crisis much sooner than some peer group countries. The nation’s high literacy rate means people understand the risks of not being careful.

The pandemic has had a catastrophic impact on the tourism industry such that hotels, restaurants and related businesses are bleeding, and experiencing cash flow issues; most are running at a loss while some have been compelled to retrench staff.

All these economic challenges have snowballed into a major socioeconomic problem for the country – about 1.5 million people in the leisure sector have been severely impacted as a result of the pandemic.

During periods of total lockdown, the services sector – which accounts for around 40 percent of the economy – was also affected. SMEs especially have been hard hit.

However, it is heartening to see some of the profit and loss numbers reported by non-banking financial institutions (NBFIs) and the banking sector – it seems that a fairly speedy recovery can be expected than we envisaged previously.

While the agriculture and fisheries sectors were less affected, the industrial sector has also managed to keep its head above water by operating throughout the year. For example, the apparel industry continued production even at the height of the pandemic as it was granted the necessary security clearances.

Apart from the impact on business, the pandemic has had a devastating effect on education over the past so many months. It is imperative to open schools as soon as possible for the new academic year while adhering to safety protocols.

The present accelerated vaccination drive infuses greater confidence in a more rapid economic recovery. However, the over-30 population should be vaccinated based on government targets along with the 18-30 age group. I believe this is what the business world is banking on.

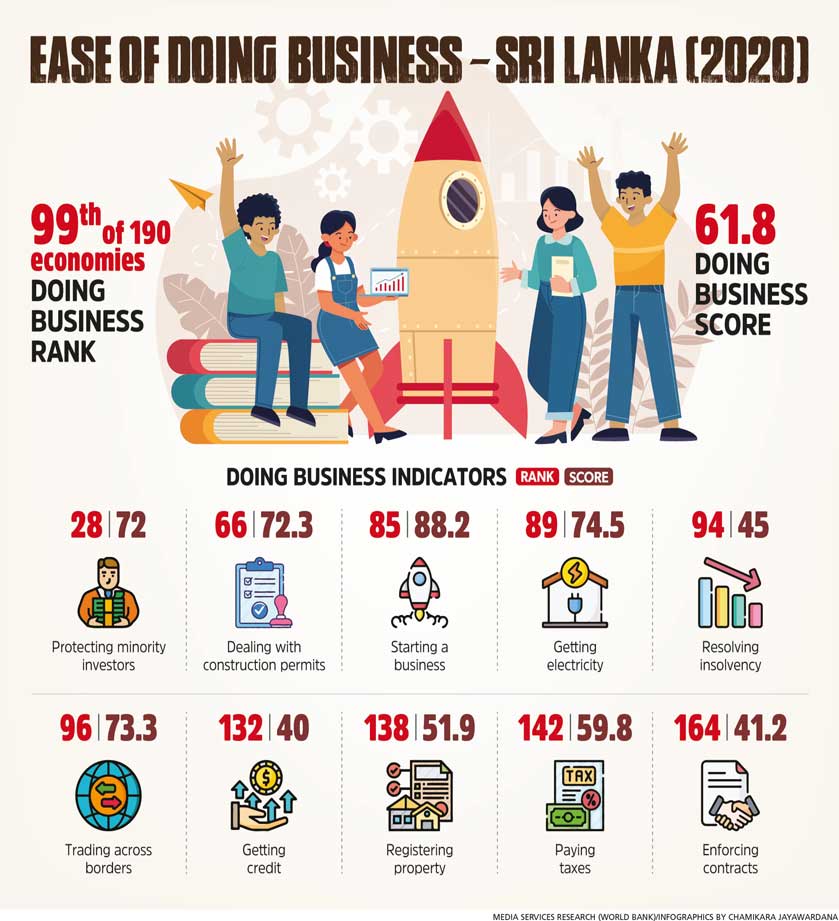

Q What do you consider to be the main barriers to doing business in the country at this time?

A The main barrier to expansion in Sri Lanka is the lack of scale. With its fairly small population, the country doesn’t have the advantage of economies of scale. In fact, that was one reason why LOLC Holdings forayed into overseas markets.

Yet another barrier is the time taken to obtain approvals and licences, to register and commence business – be it a foreign entity or local investor.

Yet another barrier is the time taken to obtain approvals and licences, to register and commence business – be it a foreign entity or local investor.

The other major hurdle is the prevailing tax environment, which is complicated and hard to navigate.

Having said that, I am pleased to see that successive administrations have been working on addressing these challenges and a fair degree of progress has taken place – especially in the digitalisation of government procedures and practices, which is benefitting investors. It’s one of the positives that have come out of the pandemic.

Q How has the financial services industry performed over the last 12-18 months? And what is your take of its prospects going forward – including the key sensitivities?

A Following a slump last year, the financial services industry has set out on the path to recovery, and we are seeing fairly healthy first quarter numbers from banks and the NBFI sector in the 2021/22 financial year.

As long as the country doesn’t encounter another economic crisis that could impact the corporate and SME sectors, one remains hopeful that industry will deliver a fairly positive performance in the current financial year.

As long as the country doesn’t encounter another economic crisis that could impact the corporate and SME sectors, one remains hopeful that industry will deliver a fairly positive performance in the current financial year.

One of the key sensitivities is non-performing loans (NPLs) because people are liquidity strapped in the leisure and industrial sectors with no access to finance despite the low interest rate environment. Meanwhile, financial service institutions and banks have also become very risk averse.

There is excess liquidity in the banking sector with the average amounting to more than Rs. 100 billion over the last 12 months. Between December and January, excess liquidity in the banking system exceeded 200 billion rupees.

However, banks are reluctant to lend because of pandemic related stressors. In this context, borrowers’ liquidity will be a key sensitivity.

Q In a nutshell, what are the salient features of LOLC Holdings’ recent performance and record profits – and could you cite three factors that have bolstered the group’s bottom line?

A The key factors are diversification and knowing when to divest. Fifteen years ago, LOLC was merely a leasing company; today, it is positioned as one of the largest conglomerates in the country.

For the group, diversification means not only diversifying within the country but across borders to minimise risks. Maintaining a presence in 10-20 countries limits the sovereign risk rather than being present in one or two countries where an entity is completely exposed to their risks.

By the end of this year, LOLC will be present in 15-20 countries, mainly in the realm of financial services, strengthening its position as one of largest players in microfinance on a global scale.

The group expanded its footprint in leisure and trading through the acquisition of Browns, and later entered the plantations sector here in Sri Lanka and then in Sierra Leone – where it owns a sugar plantation. It has also established a presence in the leisure sector in the Maldives and Mauritius.

One of the main reasons for LOLC’s record profitability in financial year 2020/21 was our divestment in Cambodia. We sold one of the group’s two financial institutions in that country to the largest bank in South Korea – KB Kookmin Bank.

The secret to LOLC’s success is not only investing but divesting at the right time. Overall, the group has recorded strong growth in the first half of 2021 in all the countries it operates in.

Q And what is your assessment of the performance of the other sectors in which your group has been engaged during this period – and what’s your take of the future?

A I’m very optimistic that in the post-pandemic landscape, the leisure sector will bounce back once the country opens for tourists.

A I’m very optimistic that in the post-pandemic landscape, the leisure sector will bounce back once the country opens for tourists.

The vaccination drive is progressing reasonably well and once more restrictions are lifted, it will make travel one of the largest businesses locally and globally as there seems to be a great deal of pent-up demand.

Global demand for goods and services is also expected to increase, which will benefit Sri Lanka’s exports of industrial and financial services. Leisure, financial services and the industrial sectors will be the first to gain.

Q In your opinion, what are the main concerns the corporate sector needs to address to drive a sustained economic recovery in the prevailing macro environment?

A The corporate sector is urgently in need of a long-term economic strategy to invest more in the economy. To this end, the Ministry of Finance should put forward the government’s five year plan for an economic recovery in the post-pandemic era.

A The corporate sector is urgently in need of a long-term economic strategy to invest more in the economy. To this end, the Ministry of Finance should put forward the government’s five year plan for an economic recovery in the post-pandemic era.

This crisis has also shed light on the fact that without technology, there will be no future. It is encouraging to note that in many instances, Sri Lankans have begun adopting technology – especially in smaller towns and villages, where people are accessing online education and e-commerce.

The pandemic has truly helped Sri Lanka focus on the importance of technology and the need to supercharge digitalisation.

In addition, I believe that exporters are looking to the government to establish a dynamic strategy to grow Sri Lanka’s exports.

Furthermore, amid the pandemic, the work ethic has been disrupted for over a year; to this end, getting people back to work is very important. In the months ahead, CEOs and corporate leaders will have to focus on motivating people to return to their offices, to work smart and use the appropriate technology.

Finally, the corporate sector should take measures to ensure the sustainability of its operations, as well as push for a sustainable recovery of the economy and businesses in general.

Q How are factors such as policy inconsistencies impacting the broader economy at this juncture?

A Policy inconsistencies continue to dog the investment climate; and in the past, with every change of administration, policies too have been reversed. The government should establish a five year plan and policy strategy to accelerate the country’s economic recovery post-COVID.

Before investing, investors consider several factors.

Firstly, would their businesses be safe here? Sri Lanka probably scores well on this point because the war has ended, there is peace and security, and the island does not suffer major natural disasters regularly.

Moreover, the Colombo International Financial City (CIFC a.k.a. Port City) development, which is underway, will infuse confidence among investors and prove to be a magnet for foreign direct investments (FDI).

For the country to realise its potential however, policy inconsistency must be eliminated because that is the second factor an investor would consider. Is this a country where it is conducive to do business? The answer should be a resounding ‘yes!’ where Sri Lanka is concerned.

Lastly, Sri Lanka also needs to address the scale factor and improve the depth of the economy to attract large-scale investors.

Q In what ways can Sri Lanka’s economy build resilience to external shocks – and what is the role of the nation’s leading corporates in propping up such efforts?

Q In what ways can Sri Lanka’s economy build resilience to external shocks – and what is the role of the nation’s leading corporates in propping up such efforts?

A One way to achieve economic resilience is by building our reserves because when they run low, vulnerability increases. Bangladesh, which was a very vulnerable economy, now has reserves of around US$ 42 billion.

Remittances from migrant workers too have played a critical role in our nation’s cash flows. In 2019, this group remitted 6.7 billion dollars to Sri Lanka. This increased to US$ 7.1 billion the following year. In the first half of 2021, the country recorded worker remittances of three billion dollars.

To put this in context, the total value of exports was US$ 10.1 billion last year – workers’ remittances were equal to 70 percent of this. As such, this is another resource that needs to be nurtured.

We need to look at increasing the share of qualified professionals in the migrant labour force instead of this trend being a brain drain where they look to migrate.

In addition, a national strategy needs to be in place to increase exports while transforming Sri Lanka into a strong investment destination and popular tourism destination.

Moreover, projects like CIFC must be leveraged to attract investors – they could be the solution to mitigating some of the economic challenges faced by the country.

The role of the nation’s leading corporates is to work closely with the government, and ensure the latter implements and executes national policies. Companies in turn should ensure they increase value additions to maximise revenue for the country’s and their own benefit.

The role of the nation’s leading corporates is to work closely with the government, and ensure the latter implements and executes national policies. Companies in turn should ensure they increase value additions to maximise revenue for the country’s and their own benefit.

The prosperity of corporates and the nation is intertwined – it is the only route to achieve sustainable growth.

Q What is your take of the nation’s prevailing monetary policy stance? Does the low interest rate regime continue to be conducive to business?

A As a country, Sri Lanka is accustomed to high interest rates, having seen them in the double digits for decades. The rationale behind reducing interest rates at the time was perhaps to stimulate investment and growth; but unfortunately, the COVID-19 outbreak spread immediately thereafter.

Although potential investors have enjoyed a very long window of opportunity with single digit interest rates, nobody could really take advantage of it because of hardships brought about by the pandemic.

Although potential investors have enjoyed a very long window of opportunity with single digit interest rates, nobody could really take advantage of it because of hardships brought about by the pandemic.

The regulator should sustain the low interest environment until such time that there are clear signals the pandemic is behind us as it will also bring some stability to the exchange rate.

The downside of a low interest regime is that fixed income earners – such as retired people – are affected as their earnings from deposits are lower. However, the government is subsidising this segment of the population as otherwise, it could lead to social issues.

Q And what are the implications of Sri Lanka’s ballooning trade deficit for business and the wider economy? What solutions are there to avert a crisis?

A Sri Lanka’s trade deficit is under severe pressure and the situation has to be closely monitored. We cannot afford a sustained deficit since it could erode the nation’s reserves. This should be the foremost concern for the government while ensuring exports are facilitated and the dependence on imports reduces.

In terms of sovereign ratings, Sri Lanka has some inherent strengths that rating agencies are unable to consider because they have to work on the basis of statistics alone.

But what’s most important is that Sri Lanka has maintained an unblemished track record of debt repayments and honouring debt commitments, which should be one of the most important considerations for investors and multilateral finance institutions.

Q Do you view import restrictions and capital controls as suitable strategies to improve the country’s trade balance?

A Import restrictions are inevitable as a recourse for many economies to combat the present economic downturn but it is a temporary solution. Sri Lanka needs to resolve its cash flow situation so that import controls can be relaxed in the near future.

Q The Sri Lankan Rupee has depreciated by more than six percent against the US Dollar so far this year. Where do you see it heading in the next six months or so – and what are the sensitivities?

A The fact that the rupee is under pressure is not a secret – this is mainly due to the challenges we have discussed here.

Given the widening trade gap and low reserves, the Central Bank of Sri Lanka’s capacity to maintain the value of the currency is limited.

The rupee will find its own level soon. However, the unfolding situation needs to be watched closely as it could increase public debt in rupee terms because most government borrowings are in foreign currency.

Q With Sri Lanka’s foreign reserves falling to US$ 4 billion at the end of May, are concerns about its debt servicing ability warranted, in your view?

Q With Sri Lanka’s foreign reserves falling to US$ 4 billion at the end of May, are concerns about its debt servicing ability warranted, in your view?

A This government has a long-term strategy for funding and managing some apparent short-term stressors. In the post-pandemic environment, if strong GDP growth can be stimulated, the situation could certainly be brought under control.

Q What role can ongoing and planned developments such as the Port City play, in boosting Sri Lanka’s economic recovery and driving growth?

A CIFC is a real ace in the hands of the country – but it has to be marketed properly. It should be positioned as a centre of excellence for South Asia such that investors will be comfortable investing in it. Thus far, the proposed project is encouraging.

Leave a comment