COVER STORY

THE BUSINESS OF IMPORTS AND EXPORTS

BEYOND SURVIVAL MODE

Despite JAT being a relatively young brand, the Founder and Managing Director of JAT Holdings Aelian Gunawardene has imbued a corporate ethos that’s gained him kudos for the energy and innovation of his leadership.

Despite JAT being a relatively young brand, the Founder and Managing Director of JAT Holdings Aelian Gunawardene has imbued a corporate ethos that’s gained him kudos for the energy and innovation of his leadership.

Since its inception in 1993, he has steered the JAT Holdings brand, which represents multifaceted spectrums within the furnishing and finishing sectors.

In this exclusive interview, Gunawardene shares his perceptions and experiential expertise on what propels the success of his group in these turbulent times. And he imparts insights into better ways in which to countenance the socioeconomic headwinds that will storm awhile yet.

He has played a pivotal role in transforming his business from a local enterprise to an international conglomerate; and his forthright stewardship has been recognised by the award of a Moody’s ICRA rating of ‘A+ (Stable)’ outlook for five consecutive years.

Gunawardene also weighs in on improvements that could strengthen the national economy, and suggests commercially savvy perspectives to encourage better business outcomes that would serve both enterprises and the community.

A strong advocate of the triple bottom line approach to doing business, he shares his corporate’s approach to ensuring that people and planet are served while in the pursuit of healthy profit margins.

From a strategic perspective, it would be prudent to focus on stringent debt management by cutting credit periods

Q: Drawing on your considerable experience, what have been the most useful lessons learned in preserving the viability of a business in the light of demands for consideration of the triple bottom line – and demonstrating sustainability not only of the business but also of supply chains?

A: Genuinely focussing on the triple bottom line of people, planet and profit is what has kept us growing steadily for 30 years.

We especially focussed on the people aspect of the triple bottom line. This includes our employees and painters, who when times have been really tough, have required protection. Throughout the last three years, it has been necessary to pay attention to their livelihoods and the wellbeing of their families, even while facing external shocks such as the Easter Sunday attacks, the COVID-19 pandemic and a severe economic downturn.

For instance, programmes were initiated to help painters finish work undertaken but which remained incomplete due to the pandemic. To improve marketability and upskilling, the company introduced and paid for National Vocational Qualifications (NVQ) Level 3 together with the National Apprentice and Industrial Training Authority of Sri Lanka (NAITA).

We also increased the loyalty points programme so that painters could be compensated. And at the same time, we introduced a unique low interest loan scheme in collaboration with HDFC Bank. It was important to ensure that all jobs were secure but also that there would be no loss of pay.

Additionally, the company paid annual increments and bonuses as has been the norm; it even offered a special allowance of an additional 17 percent to countenance inflation.

Naturally, decisions such as these come at a cost, which could affect the bottom line. However, our results have shown increased profitability in keeping with the company’s forecasts since our team has worked harder.

The same principle has stood the test of time with the ‘green planet’ aspect of our business as well.

At the time the company introduced water-based wood coatings to Sri Lanka – which are environmentally friendly with no volatile organic compounds (VOC) – in competition with solvent-based products that existed in the market, it had to allocate a substantial budget to promote the products and educate consumers.

It was important to think beyond profitability. And today, these water-based coatings are a leading seller and flagship brand.

Sustainability in supply chains is equally important, and a great testament to a corporate’s investment in the supply chain would be that even during times of continuous external shocks, inventories can be effectively maintained.

Q: What guidance could you offer businesses in reviewing their operating models to maintain profitability as well as sustain themselves, in light of fuel price fluctuations, levies on imports, export challenges and the diminishing demand for goods due to spiralling costs?

A: Proactive measures need to be taken in terms of the company’s operations.

Firstly, one would need to diagnose change in the cost economics from the raw materials stage to the final customer point and find ways in which to innovate around the components of all operating costs.

In this way, a company could gear its strategy to the long-term changes in the industry’s cost economics.

From a strategic perspective, it would be prudent to focus on stringent debt management by cutting credit periods. This could be of tremendous benefit to the company in maintaining a positive cash balance.

On the operational side, it could be useful to consider restructuring the value chain wherever possible by introducing alternative sources of raw materials, backward integration of certain lines to bring in cost reductions and substituting the distribution network model in selected areas for dealer models.

Mechanisms such as these could help negate part of the spiralling cost increases, which could ultimately result in the company’s ability to pass on the benefit to end consumers while maintaining budgeted profitability.

Q: How have global economic headwinds and the war in Ukraine impacted the import-export trade; and what do you believe will be near-term challenges that need to be countenanced?

A: From a trade perspective, the biggest consequence of the war in Ukraine has been the sanctions on Russia and increased cost of three main commodities – energy, food and metal – which is having an effect on the entire international supply chain and markets.

These sanctions have also disrupted land, sea and air transport routes via Ukraine and Russia, resulting in rerouting, which directly impacts freight rates.

Furthermore, the increase in the import cost of fuel, food and fertiliser could lead to food insecurity and debt distress in developing countries, making it almost impossible to import their domestic requirements.

Several companies that exported heavily to Russia are suffering due to the sanctions imposed, which have made payments to and from that country difficult. Tourism has also been affected due to sanctions placed on Russian banks and credit cards.

As a consequence of the above, the near-term challenges may be unforeseen tariffs, restrictions on the importation of certain categories of goods, controlled foreign travel, increased taxes, stringent local laws and so on.

Q: In November, there was a furore in the media with the Governor of the Central Bank of Sri Lanka asking exporters “to come clean on conversions.” What are your thoughts on the challenges facing exporters in light of the developments facing the nation and the economic agenda required to align the country with the IMF’s proposals?

A: Exporters are competing with the world and not within Sri Lanka – antagonising exporters will only drive them to set up elsewhere.

I firmly believe this is a chicken and egg situation where the government should create an environment in which the export sector can thrive. Exporters will then want to do everything to develop the export environment, which will result in higher conversions.

Inconsistent policies set out by the Central Bank of Sri Lanka and Ministry of Finance have caused Sri Lanka to forgo a large chunk of its export income. Previously, when taxation on exports was zero or nominal, most export companies operated from Sri Lanka and paid dividend taxes on these incomes.

However, since the imposition of high taxes on exports, companies are opting to set up in countries that have negligible or zero tax. And so the government of Sri Lanka loses the opportunity to tax dividends or has far less forex remitted to the country.

Q: What ground realities have businesses experienced as a result of the import restrictions imposed last year? And what measures have importers had to take to overcome them and maintain profitability?

Q: What ground realities have businesses experienced as a result of the import restrictions imposed last year? And what measures have importers had to take to overcome them and maintain profitability?

A: The outbreak of COVID-19 in 2020 created a standstill in tourism and halted export operations, which triggered an acute shortage of foreign exchange. These, together with domestic fiscal mismanagement, have compelled the imposition of import restrictions.

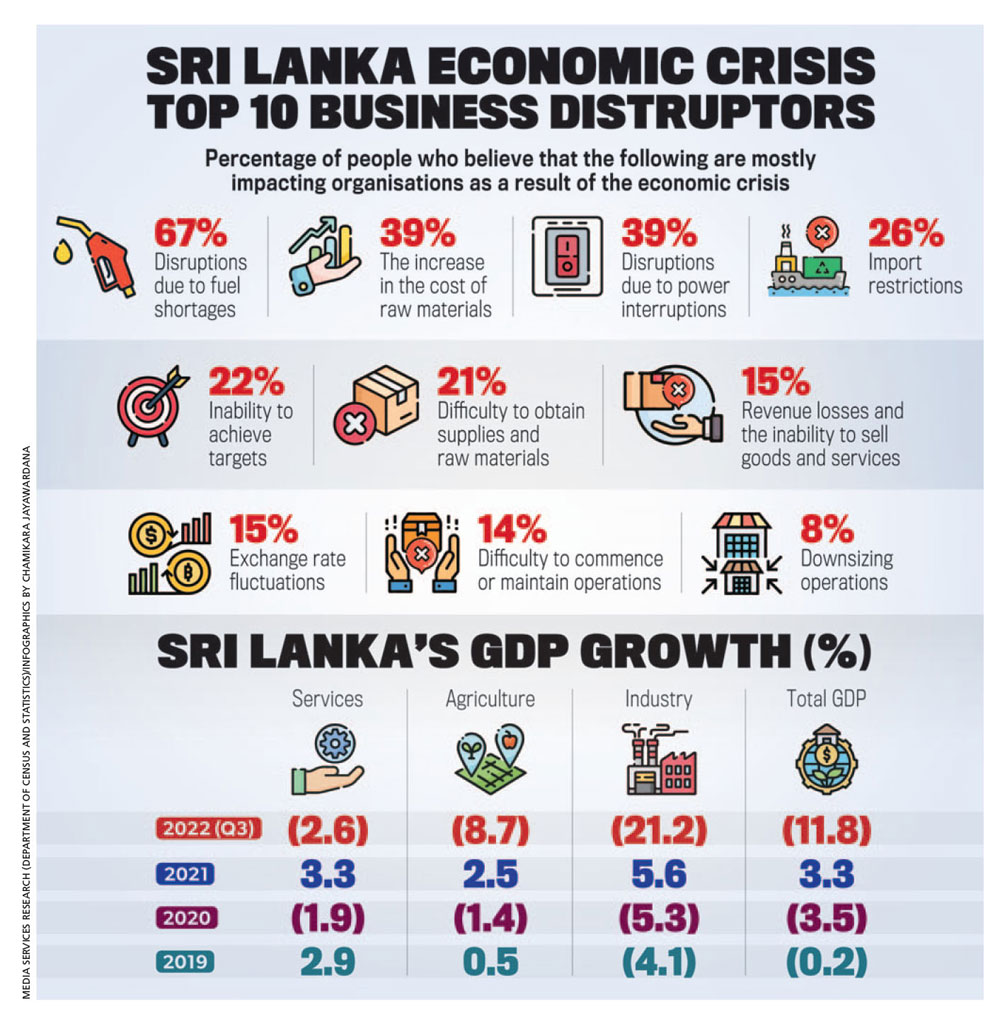

Naturally, this has caused a dip in the growth of the economy due to business expansion being restricted to set boundaries. Businesses have been adversely affected due to curtailed operations and low profitability, compelling certain organisations to cut down or retrench staff, creating an increase in unemployment.

Due to the above, some importers have moved their operations overseas while others have shifted to alternative products to trade so as to sustain profitability in a fragile marketplace.

Q: You were determined to build a global brand but what is your take on international perceptions of Sri Lanka in the context of taking a local brand overseas?

A: The perception of Sri Lanka internationally is very poor. Most international companies do not feel comfortable dealing with Sri Lankan banks after the Central Bank declared bankruptcy and defaulted on its debt.

In most cases, it is impossible to transfer forex into foreign markets if a company wishes to set up operations overseas. This makes our task even more difficult in building a Sri Lankan brand internationally.

Q: Your take on Sri Lanka’s nation brand value and image is…?

Q: Your take on Sri Lanka’s nation brand value and image is…?

A: Sri Lanka has faced several economic challenges. As a way out, the country has to take clear steps to build, enhance and manage its reputation globally but we would first need to establish consistent national policies.

As a nation, we need a greater focus on innovation. We must encourage entrepreneurship in knowledge based industries, which are vital for economic recovery.

Branding could be pursued in clusters, highlighting different approaches.

For instance, export branding could focus on and develop ‘country of origin’ products such as apparel, tea, coconut-based products, graphite, and minerals such as ilmenite; and generic ‘nation branding’ with the capacity to attract tourism and hospitality opportunities, and foreign direct investments (FDIs).

Q: How will the vicious cycle of the forex crisis play out, in your opinion? And what can be done to increase our reserves or build trust, or look for new and innovative approaches as we progress in the new year?

A: It is very important for Sri Lanka to negotiate with its large creditors to restructure its debt and thereafter, sign the IMF agreement to regain investor confidence.

It is believed that companies and institutions from several countries including Japan will start reinvesting in Sri Lanka thereafter. However, the inconsistent policy framework by the government does not help encourage FDIs.

With regard to inconsistent policies, an example would be the statement on 17 November 2020 – in Budget 2021 presented by the Minister of Finance – that gains and profits of companies listed on the Colombo Stock Exchange (CSE) between 1 January and 31 December 2021 would be taxed at a rate of 14 percent for three years of assessment, commencing 1 April 2022 (i.e. 2022/23 to 2024/25).

This was thereafter enacted as law in terms of Section 51(4)(c) of the Inland Revenue (Amendment) Act No. 10 of 2021.

Encouraged by this statutory scheme, which was the declared policy of the then government, 14 companies including ours listed their shares on the CSE during calendar year 2021 with a total subscription of Rs. 12,713,442,117. All these initial public offerings (IPOs) were oversubscribed.

The listing of 14 companies (at 30 September 2022, the number of companies listed on the CSE was 294) during the COVID-19 pandemic was viewed as a milestone and an achievement of government policy encouraging the capital market.

However, the Inland Revenue Amendment Bill now tabled in parliament limits the 14 percent tax rate only to the period from 1 April to 30 September 2022 – a mere six months – as opposed to the originally declared term of three years.

Would this not invariably erode investor confidence and create a ground reality of being unable to make any investment decisions based on any budget proposals of any Sri Lankan government?

Would this not invariably erode investor confidence and create a ground reality of being unable to make any investment decisions based on any budget proposals of any Sri Lankan government?

Such an outcome would have devastating consequences on the economy, in addition to unfairly impairing and imperilling businesses. Such arbitrary and short-sighted legislation would set a wholly undesirable precedent, the effects of which would be further detrimental to the economy.

To increase reserves, perhaps the following should be considered: a reintroduction of tax incentive schemes for new business operations to encourage foreign investments; a placement of export related businesses at a lower or tax free rate to encourage exports; and the creation of entertainment hubs to cater to tourism, utilising natural resources available on the coastline and in the hill country.

Additionally, encouraging export oriented entrepreneurs by offering concessionary borrowing rates, grants or providing state land for business operations – and facilitating the mining and export of minerals such as graphite, ilmenite and phosphate – could also help boost reserves.

Q: It would seem that corporates on foreign soil pivoted to countenance and mitigate the dire consequences of multiple crises brought on by the pandemic more efficiently than ours. Could you share some of the measures you put in place to ameliorate the negative impacts of the last few years?

A: A step the company took by establishing a manufacturing plant in another country to cater to that overseas market was one that helped us face the negative impacts. Given the results, we’re looking at replicating this model in other potential markets as well.

The company also expanded into other technology-based product categories in collaboration with foreign partners to counteract the possible downturn in profits earned in Sri Lanka due to import restrictions and recoup any losses in terms of foreign currency dividends in the future.

I would also moot venturing into other regions to increase product footprints, as well as investing in R&D focussed on new product development and cost reduction, for potential local and export markets.

Q: What disruptions have you encountered in the construction industry, which perhaps have worked to the advantage of your business model? How viable are these new innovations – and how can they be leveraged optimally?

A: Restrictions on imported furniture has compelled the local market and condominium developers to opt for wooden and wood-based furniture, which has resulted in an increased demand for wood coatings.

To act on other prospective opportunities created however, the lack of consistency in government policy makes one insecure about investing heavily in other potential sectors. We have also leveraged value for money solutions and value engineered options.

Q: Given the problems that the construction industry is facing, what is the medium-term outlook for the paints sector in this country?

A: Apart from the economic and political crises in Sri Lanka, the construction industry has been severely affected by the high cost of construction materials, extremely high interest rates, the stalling of government projects, non-payment of outstanding invoices to large contractors by the state, and the shortage of cement and other construction materials.

However, Sri Lanka’s construction industry is expected to register a growth of 5.5 percent from 2023 to 2026, supported by investments in transport, housing and renewable energy projects, coupled with government policies to promote manufacturing and exports.

If this is achieved, the outlook for the paint sector may seem encouraging. The one benefit it has is that even though there’s a slowdown of new projects, refinishing of existing properties continues to take place.

Q: What are your ‘anticipated possibilities’ for 2023, in view of the local and global economic and socio-political landscapes? And what are your hopes for Sri Lanka in the context of the economic crisis, business confidence, FDI and country image?

A: Both globally and locally, there could be a recession; but the outlook could look more stable in terms of external shocks. The economic crisis could ease with an IMF bailout in the first or second quarter of this year.

With regard to business confidence, FDI and the country image, the political landscape will play a deciding role – and consistent government policies should come in wherever possible to help build this image.

Leave a comment