THE LITMUS TEST

CORPORATE RECORD-BREAKERS

Sri Lanka’s leading business houses set new benchmarks for performance despite a plethora of looming challenges

The latest LMD 100 for financial year 2016/17 illustrates the resilience and potential of Sri Lanka’s most prominent listed companies with some laying claim to record results. Of course, there were others who failed to live up to expectations so the big picture continues to be that of a mixed bag of results.

As the unique LMD-Nielsen Business Confidence Index (BCI) has shown over the last 12 months or so, corporate sentiment has also been volatile although the gauge has by and large remained in the doldrums. Recent months in particular have seen a tapering of sentiment, possibly as a result of the prospect of Budget 2018 related pronouncements although the immediate aftermath of the 9 November proposals produced a surge.

LEADERBOARD The LMD 100 is helmed by a livewire in Sri Lanka’s corporate sphere, surpassing another highly regarded diversified conglomerate that assumed prime position back in 2015/16. Banking and finance entities, as well representatives from the telecommunications and retail domains, also make their presence felt on the LMD 100 Leaderboard for financial year 2016/17.

John Keells Holdings (JKH) was ranked No. 1 in as many as eight of the first 10 years of The LMD 50 (the pioneering precursor to the LMD 100), only to be surpassed by Sri Lanka Telecom (SLT) – a partnership between the Government of Sri Lanka and Malaysian telecom giant Maxis, which went public in 2003.

SLT in turn helmed the rankings for four consecutive years before surrendering its place at the top of the ladder to a petro giant from neighbouring India: Lanka IOC (LIOC) was The LMD 50’s numero uno until 2009/10 with its reign lasting three years.

And Hayleys, which was runner-up to JKH in many of the early years – and pipped the latter to the winning post in 1995/96 and 1996/97 – also raced ahead of SLT and LIOC in 2010/11 to occupy the podium’s second place.

Turning to the latest rankings, Hayleys takes the No. 1 spot while JKH relinquishes the crown to sit in second place. Hatton National Bank (HNB) catapults its way to third place and is followed by Commercial Bank of Ceylon (ComBank). Lanka ORIX Leasing Company (LOLC) rounds off the top five of the LMD 100’s latest edition.

Dialog Axiata (No. 6), CT Holdings (in seventh place) and Cargills (Ceylon) (No. 8) make up the remainder of the Leaderboard, alongside Lanka IOC and SLT who are ranked ninth and 10th respectively.

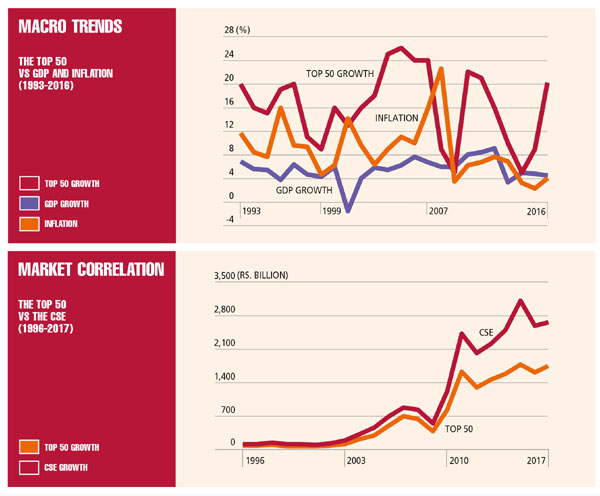

REVENUE STREAMS Aggregate revenue of the island’s 100 largest quoted companies amounted to Rs. 2,786 billion in 2016/17, which reflects an annual growth of 13 percent. In the period under review, the official rate of inflation stood at four percent so the LMD 100’s combined top line reflects healthy upside. In the preceding financial year, the cumulative turnover of LMD 100 companies improved by eight percent amid an inflation rate of 2.2 percent.

As many as 44 (versus 35 in the prior year) LMD 100 entities registered an annual turnover of more than 20 billion rupees. Moreover, the two highest ranked corporates (Hayleys and JKH) broke an LMD 100 record by surpassing the Rs. 100 billion mark in financial year 2016/17 for the first time in listed company history.

When it comes to revenue growth, Aitken Spence comes out on top with a 77 percent year on year uptick in turnover (to Rs. 45 billion). Three other entities – Union Bank, DFCC Bank and Nations Trust Bank – reported a top line improvement in excess of 50 percent in 2016/17.

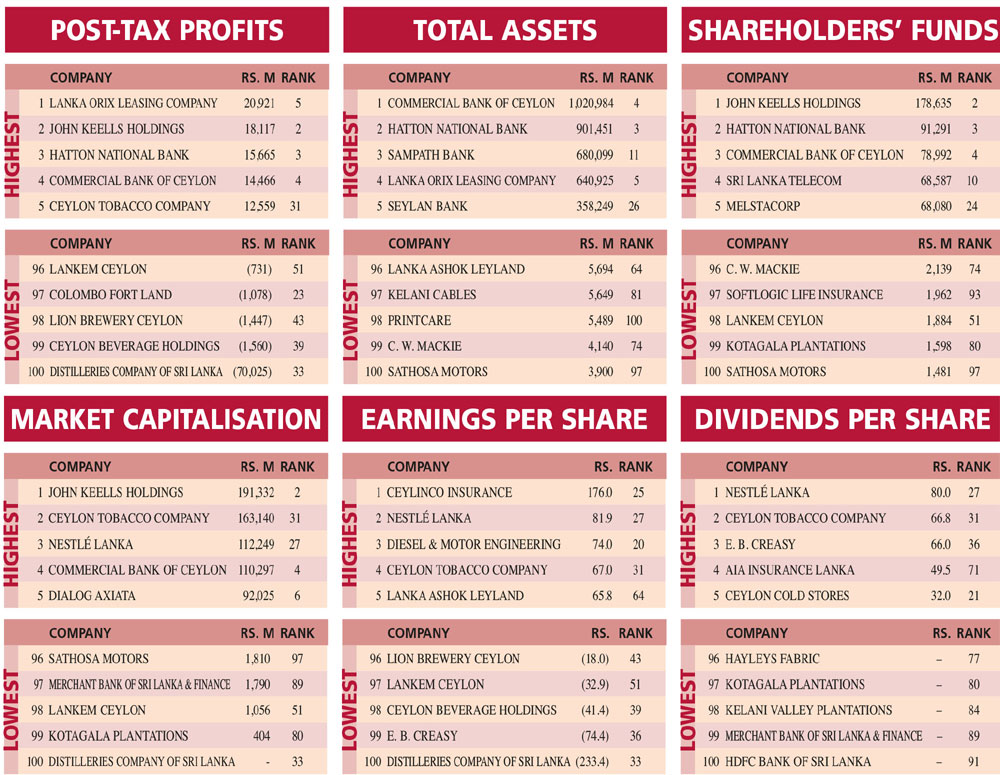

BOTTOM LINES On the face of it, at Rs. 187 billion, the 2016/17 cumulative post-tax profit of the LMD 100 declined by 13 percent compared to the previous year. But numbers can be deceptive at times and in this instance, a massive restructuring loss of 70 billion rupees reported by Distilleries Company of Sri Lanka (DCSL) distorts the combined bottom line – meaning that without it, the LMD 100 reflects a robust performance vis-à-vis profitability with an effective increment over the prior year of almost 20 percent.

As for more landmarks, the after-tax profit of LOLC, JKH, HNB, ComBank and Ceylon Tobacco Company (CTC) crossed the Rs. 10 billion in financial year 2016/17.

Ten (versus a dozen in the preceding year) of Sri Lanka’s LMD 100 companies ended financial year 2016/17 in the red – viz. Kelani Valley Plantations, Colombo Dockyard, Kotagala Plantations, E. B. Creasy, LAUGFS Gas, Lankem Ceylon, Colombo Fort Land, Lion Brewery Ceylon, Ceylon Beverage Holdings and DCSL.

And among the movers and shakers are Browns Capital (profit after tax up by 930%), Merchant Bank of Sri Lanka & Finance (505%) and Browns Group (402%) who lead the way from among the largest listed entities in the island.

TAXATION On average, an LMD 100 entity turned in 955 million rupees in taxes for 2016/17, which represents an annual hike of 10 percent from the previous year’s tax bill of Rs. 866 million.

The Leaderboard accounts for nearly a third of the combined taxes of the LMD 100 in 2016/17 as the top 10’s payout increased by 25 percent (versus 20% in 2015/16) to over 30 billion rupees.

As has been the case in the past as well, CTC forked out the heftiest contribution to government coffers during the period on account of a tax charge of Rs. 8.7 billion.

ASSET VALUES The largest listed entities in Sri Lanka enjoyed a 16 percent appreciation in total assets from the previous year, which is broadly in line with the uplift in asset values recorded in both 2015/16 and 2014/15.

The financial services industry continues to hold sway in the LMD 100’s asset related rankings as the banks, finance and insurance sector represents two-thirds of the combined portfolio of assets of the premier listed entities in Sri Lanka.

ComBank is at the forefront with Rs. 1,021 billion in assets at 31 December 2016, followed by fellow private sector banking giants HNB (Rs. 901 billion) and Sampath Bank (Rs. 680 billion).

On the other hand, LOLC is ahead of the pack for highest percentage gain in asset values among the top 100 – its total assets of 641 billion rupees reflect a 69 percent appreciation from the end of the preceding year.

Ceylon Hospitals is next in line, on the back of a 48 percent uplift in asset values. And Piramal Glass Ceylon and Aitken Spence Hotel Holdings join the party by virtue of a 36 percent expansion in their assets in 2016/17.

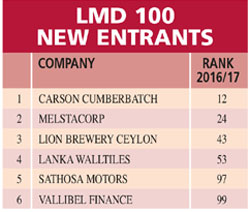

MOVERS AND SHAKERS By virtue of a change in our methodology in regard to subsidiary companies, Carson Cumberbatch made the most notable progress by entering the rankings at No. 12, and so did Melstacorp (24) and Lion Brewery Ceylon (43). As for those who climbed up the ladder from their positions last year, Aitken Spence (up 12 places) takes pride of place followed by a trio of movers by six rungs – viz. HNB, LOLC and Nations Trust Bank.

In total, 15 (versus 22 in financial year 2015/16) of the island’s largest corporate entities climbed higher up the LMD 100’s top 50.

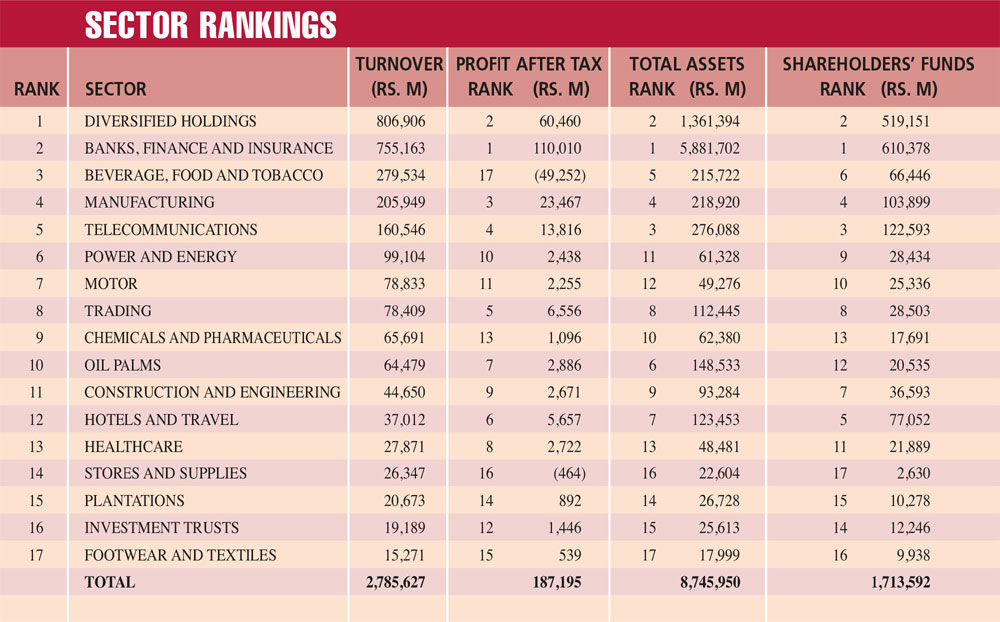

SECTOR RANKINGS The diversified holdings sector reigns supreme amongst the leading listed companies in Sri Lanka with its cumulative turnover representing 29 percent of the LMD 100’s combined income during the period under review.

Banks, finance and insurance prove to be the second largest player in the LMD 100 with an aggregate income in excess of 755 billion rupees and a share of 27 percent of cumulative turnover in the 12 month period. The sector also accounts for 59 percent of profits and 36 percent of shareholders’ funds in 2016/17.

INVESTOR YARDSTICKS JKH leads the way with a market capitalisation of Rs. 191 billion at 31 March 2017 and is followed by CTC, which registered a market cap of 163 billion rupees at the end of financial year 2016/17. Nestlé Lanka and ComBank were the only other entities to record a market capitalisation of more than 100 billion rupees.

The LMD 100’s combined market capitalisation increased by one percent (to Rs. 2,066 billion) between 1 April 2016 and 31 March 2017.

Bettering its tally in the preceding financial year, 10 of the island’s 100 leading listed corporates maintained an equity value in excess of 50 billion rupees at the end of 2016/17. The top five (JKH, CTC, Nestlé, ComBank and Dialog) accounted for almost a third of the LMD 100’s combined market cap.

THE FUTURE The Sri Lankan economic milieu appears to be changing by the day with uncertainty permeating the sociopolitical spectrum of concerns ranging from higher education conundrums and barriers in the way of constitutional reform, to attracting quality local and foreign investments on a large scale.

Earlier in the year, steps were taken by the administration to develop the Hambantota Port as a public private partnership (PPP), which the Ceylon Chamber of Commerce (CCC) – arguably the largest and most influential corporate body in the island – referred to as “an important step towards the goal of positioning Sri Lanka as a full service maritime hub nation.”

A statement issued by the CCC notes that “in addition to the much needed boost to the country’s foreign reserves, the reported scale and size of the investment is expected to generate meaningful foreign direct investment (FDI) in port related activities as well as businesses around the port.”

Meanwhile, in an economic policy statement issued in October that covered debt management, growth rates and exports for the three years ahead, Prime Minister Ranil Wickremesinghe acknowledged that “the challenge faced by us today is to sustain what we have built and strengthening the economy. This task has two prongs. The first is to stabilise the economy, creating a country free of debt for our future generations; the second is to expand the economy, giving all Sri Lankans the chance for prosperity.”

On the state of international affairs, there appears to be guarded optimism about the global economy. For instance, the IMF’s World Economic Outlook (WEO) published in October asserts that “the global upswing in economic activity is strengthening.”

“Broad based upward revisions in the euro area, Japan, emerging Asia, emerging Europe and Russia more than offset downward revisions for the United States and the United Kingdom. But the recovery is not complete; while the baseline outlook is strengthening, growth remains weak in many countries and inflation is below target in most advanced economies,” the IMF reports.

Moreover, growing geopolitical tensions threaten to keep the world economy on edge with the emerging cold war between the US and North Korea – precipitated by the strongmen who lead the two nations – hogging the headlines in recent times.

Key markets for Sri Lankan goods and services in Europe and West Asia are also under the spotlight amid growing discontent and major policy undertakings in their respective economies.

The bottom line therefore, is that the corporate outlook may not be as rosy as businesses would like it to be, which means that Sri Lanka’s leading listed entities will have to work doubly hard to sustain the overall growth momentum it achieved in financial year 2016/17.