CAPITAL MARKETS

INVESTMENT HORIZON

Compiled by Yamini Sequeira

SWEETENERS FOR INVESTORS

Dilshan Wirasekara discusses ways to facilitate the growth of capital markets

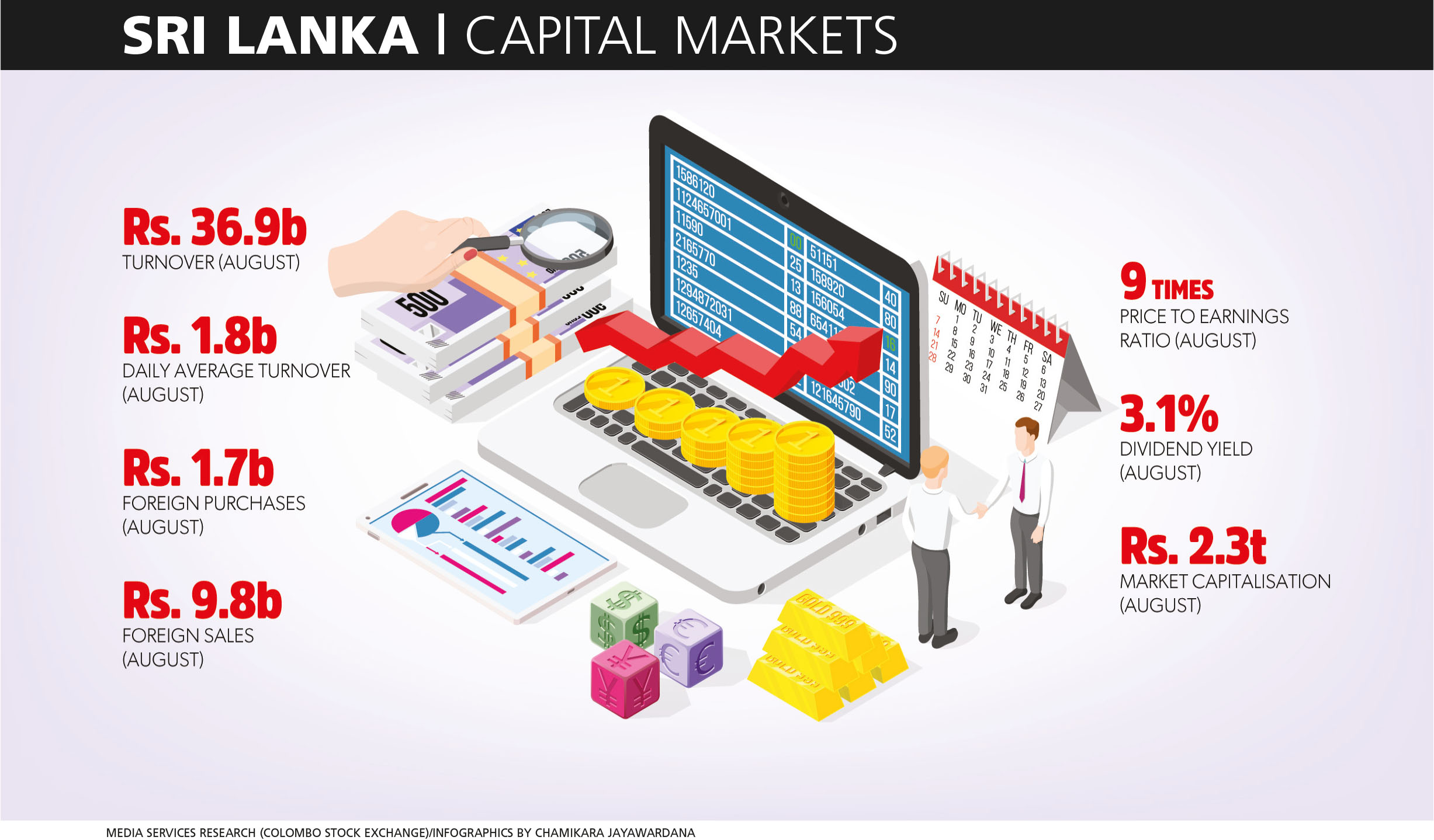

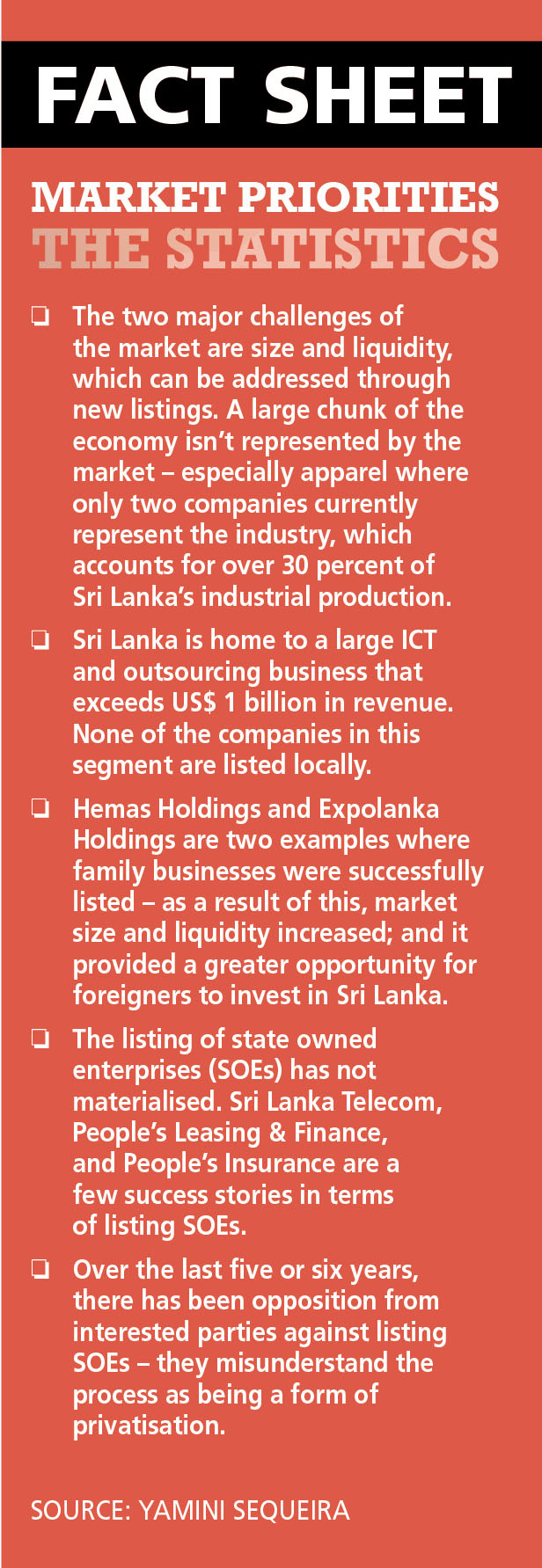

Sri Lanka’s capital markets do not adequately reflect its economy and have been underperforming for a considerable period. Today, the market capitalisation of the Colombo Stock Exchange (CSE), which was US$ 25 billion and represented 30 percent of the country’s GDP at the end of 2014, is down to 13 billion dollars and 15 percent of GDP.

The country’s economy has witnessed a gradual slowdown, causing concern and resulting in an accelerated rise in debt. A lack of policy certainty and constant changes to the tax regime have further complicated matters.

Global uncertainty over the last few years has been another factor negatively impacting emerging markets. Thereby, Sri Lanka has witnessed continued outflows as most foreign participants shift towards safe havens around the world.

DETECTING ROADBLOCKS Dilshan Wirasekara explains: “Counters being undervalued presents a good opportunity for investors considering medium to long-term horizons.”

He adds: “Additionally, the requirement to modernise the market with an accelerated digitalisation process is a long felt need. As a result, the market has not kept pace with most of its regional peers.”

Moreover, the high debt burden is another roadblock for Sri Lanka, adding further woes to volatility in both exchange rates and interest rates during periods of high foreign debt payments, he notes.

Wirasekara continues: “Over-regulation is also a cause for concern as there needs to be a balance between development and regulation. If market regulation takes place ahead of market development, it is detrimental to the market and will result in low confidence for investors moving into alternative classes of investment.”

Market development in Sri Lanka has not taken place over the last 15 years, rendering the market unattractive to more sophisticated investors. However, steps taken to reform regulatory policy through the introduction of the new SEC Act, dissemination of information, implementation of controls and surveillance, along with creating ease of access, investor awareness and education, are expected to greatly change this trajectory.

THE RIGHT DIRECTION Expressing his regulatory concerns, Wirasekara comments: “The role of the regulator is crucial in making the market more attractive for stakeholders through market development and investor education.”

He adds that “digitalisation is an extremely important element to increase the ease of opening and operating any type of investment account, increasing access for retail investors. Introducing new products is another important step that’s long overdue.”

“More recently however, we have observed a much more proactive approach by the regulator. With the support of the regulator, we have already witnessed the introduction of REITs to the market. The introduction of the new CSE mobile app also enables seamless account opening, information sharing and trading to take place,” he asserts.

Over the past few years, several cases of allegations against market manipulators have been taken up by the regulator. A number of inquiries were held covering complaints and allegations against market manipulation with necessary action being implemented to punish wrongdoers.

Wirasekara remarks that “the new SEC Act will further strengthen the regulator in carrying out surveillance and taking prompt action against those who violate these rules. Furthermore, the Securities and Exchange Commission (SEC) together with the CSE is taking action to educate investors, which must begin at an early age.”

SLUGGISH MARKETS Touching on primary and secondary markets, he believes that on the debt side, primary market activity has been quite stable over the years although a slight slowdown was observed after tax incentives were removed a few years back. However, Wirasekara feels that the primary equity market is virtually dead right now with very few new listings and no large equity IPOs being recorded over the last couple of years. Secondary market activity also died down in the last five years until the market closure of March due to COVID-19.

“Following the steep decline in interest rates in the wake of COVID-19, market activity surged at a record pace, registering strong market returns over the four months from May. Extremely low valuations supported by the lower interest rate environment have been the main catalyst,” Wirasekara affirms.

However, the primary market space remains slow amid present low valuations. Undervalued market conditions have made it unattractive for business owners to raise funds in the equity market. Market valuations must increase substantially to attract new listings on the stock market.

Wirasekara maintains that “pension funds should also consider a more diversified portfolio rather than government securities. Currently, pension funds have a rather short-term mindset. Even in their government securities portfolios, the investment mindset is short term. Pension funds must consider more long-term investment horizons. In such a situation, the equity market becomes a more viable option,”

He notes that most pension fund portfolios at present have an equity allocation of only five percent and this allocation needs to change. The prevailing low valuations also justify entering today, whereby a potential upside over the medium term could be realised to the benefit of funds and their members.

RETAIL INVESTORS As for encouraging retail investors, the digitalisation of the account opening process is a major initiative taken by the regulator in collaboration with the CSE to encourage more retail activity.

In addition, education is one of the main tools to encourage retail investors. The lack of financial literacy is a major obstacle to promote equity markets. One of the best ways to bridge the knowledge gap is through unit trusts.

Unit trusts could be used as a vehicle for retail investors to enter a variety of financial investments such as equity, fixed income, government securities or a mixed portfolio, without taking on the direct risks, having accurate assessments and guidance from professional asset managers.

A low interest rate outlook is another key element for a booming equity market. If interest rates are high and volatile, it is difficult for investors to invest long term. A low interest rate environment promotes the equity market as a viable alternative investment option, Wirasekara maintains.

In conclusion, he says: “New products that already exist in other equity markets should be introduced here. This will facilitate the growth and expansion of the local market into a vibrant and attractive opportunity.”